Good morning!

Of interest today are:

- Boohoo.Com (LON:BOO) - trading update

- Park (LON:PKG) - final results

- Motorpoint (LON:MOTR) - final results

- Ted Baker (LON:TED) - trading update

- Air Partner (LON:AIR) - final results

- Frontier Developments (LON:FDEV) - trading update

Sorry for the slow start this morning!

I'm updating the above list in response to reader requests and as I figure out which stories I want to prioritise.

Boohoo.Com (LON:BOO)

- Share price: 213.25p (-3%)

- No. of shares: 1149.5 million

- Market cap: £2,450 million

This online fast-fashion retailer is an honorary small-cap, as many in this community have been watching it since it was a tiddler (relatively speaking).

The shares have been back on another great run since last April, up 50% since then.

We are firmly in the middle of the range created over the past year:

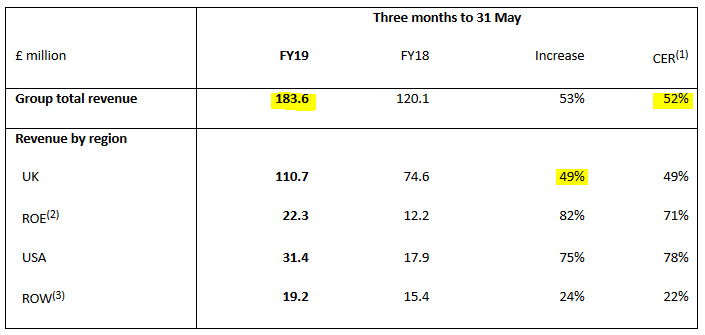

The sales table for Q1 shows a great set of percentages:

Growth in the core boohoo brand has slowed to 10% at constant exchange rates (CER). (For context, last year, the boohoo brand reported sales up 44% at CER.)

So the main growth driver has been PLT, whose revenues have surged again by almost 160% to £79 million.

I wonder if PLT has been stealing some of the growth that boohoo might otherwise have experienced? Although not serving exactly the same markets, they are each providing dresses and tops to 16-24 year old girls at a similarly cheap price point.

PLT remains 33% owned by the Kamani family. Perhaps there was some selling this morning out of disappointment that growth had been so heavily weighted toward PLT, which has this large minority shareholding, rather than toward the boohoo brand?

Nasty Gal also performed well, revenues up 150% to £7 million.

Outlook statement: trading has been in line with expectations.

For the full year, we continue to expect group revenue growth to be 35% to 40% with adjusted EBITDA margin between 9% to 10%. All other guidance for the current financial year and our medium term guidance to deliver sales growth of at least 25% per annum and 10% EBITDA margin are unchanged.

My view

Congratulations to all the long-term holders in this one.

My own view is that this is likely to be fully-priced. Many people have said that before, and been wrong. I've probably said it before, too.

The company is re-iterating guidance for sales growth to cool to 25% per annum in the medium term. That's a very fine growth rate, and deserves a premium rating. But it's no longer a truly extraordinary growth rate.

I think the share price settling into a range over the past year reflects the fact that sales growth is set to cool (indeed, it looks to have already cooled as far as the boohoo brand is concerned).

The company's target of £3 billion in net sales is going be several years away at the least (sales in the year to February 2018: £580 million), with lots of infrastructure spending required.

At the target 10% EBITDA margin, that would generate £300 million in EBITDA. So today's market cap is at an 8x multiple of the planned EBITDA several years away.

I do think that this valuation is sufficiently large, even for a very high-performing company. with a decent chance of achieving its targets. To expect really strong investment returns from the current price, I think you have to expect sales to keep growing indefinitely and indeed to stretch well beyond £3 billion.

That's certainly possible, and I may end up looking back at this report in a few years feeling rather silly, but indefinite sales growth at this company is not something I'd feel comfortable betting on. The best way to figure it out would be to build a financial model, e.g. 10 years out, and test it with a range of assumptions.

Personally, my preference is to invest in companies where the brand is their moat (e.g. Burberry (LON:BRBY), my largest single position and one which you are probably sick of me mentioning!). I feel a bit less comfortable investing in companies who compete on price or whose logistics infrastructure is their competitive edge.

Such companies can be still be great investments, of course. But I do feel that their competitive edge is a bit less secure than a great brand.

Boohoo's competitive edge has been secured, as far as I can tell, through a combination of fantastic marketing, cheap sourcing and super distribution capabilities. These are great achievements. But I think we are all full up in terms of the valuation of these achievements, at this stage.

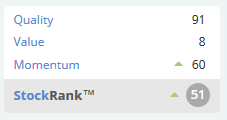

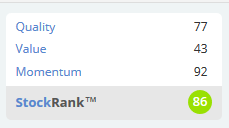

The Stocko algorithms agree:

Park (LON:PKG)

- Share price: 80.75p (unch.)

- No. of shares: 185.6 million

- Market cap: £150 million

(Please note that I own shares in PKG.)

Good solid results from Park, the UK's leading gift voucher and pre-paid card business.

This is a nice little financial stock which has been grinding out solid results year in and year out. Operating profit has increased every year since 2008.

It down have some vulnerability to weakness on the High Street and to consumer spending in general, and growth rates have typically been modest.

Billings (i.e. value of all vouchers, cards, etc.) are up 2% in FY 2018 to £413 million, translating to a 6.5% increase in operating profit to £11.6 million.

Interest income on the company's cash balances worsened slightly, so the increase in pre-tax profit is 4.1%, lower than the increase in operating profit.

Park would enjoy increased interest income were rates to increase - a very nice hedge, since so many companies would only see negative effects from higher rates.

The explanation for reduced interest income is as follows (and note the size of the average total cash balance):

Average total cash held by the Group, including cash held in trust during the year increased by over 6 per cent to £165m (2017 - £155m), however the yield achieved on this higher cash balance continued to decline in spite of the increase in base rates, due to deposits placed prior to this increase being reflected in bank deposit rates.

The peak cash balance during the year was £229 million.

Park has a new CEO as of February 2018, so it will be interesting to see what adjustments and changes he might make. We will also have a new FD as of August 2018.

The solid results allow for a modest increase in the dividend.

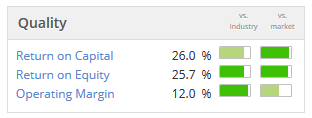

Conclusion - I'm happy to continue holding. In an investment world with so many speculative payment processors and silly "fintech" stocks, I'm pleased to have found such a nice payments business at a reasonable valuation:

I'd like to increase my stake, but will wait first to see if growth prospects might improve at all under the new management team.

Its main growth opportunities are in issuing its own pre-paid MasterCards (it secured the right to do this last year), and expanding its corporate digital rewards platform (which you can read about at this link). Hoping for more pleasant news and progress over the next year. Rising interest rates wouldn't hurt, either!

Motorpoint (LON:MOTR)

- Share price: 244.5p (-6%)

- No. of shares: 100 million

- Market cap: £244 million

The share price fall for this car retailer seems to be related to a broker downgrade, at at least according to Reuters.

The results themselves are excellent. Revenues are up 20.6% with the help of a new site in Sheffield and other sites maturing.

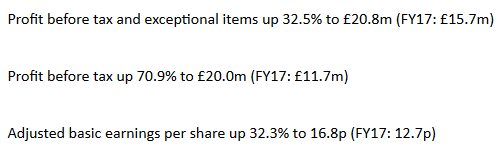

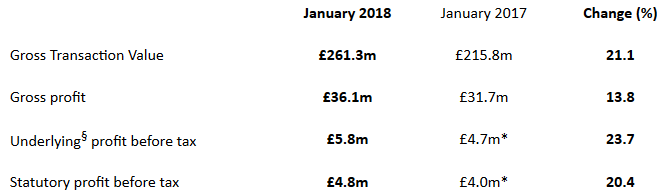

Profit growth is very exciting, too:

It continues to operate 12 sites, reiterating today that it "continue to evaluate" locations for its 13th site.

The strategy is to open at least one new site per year, and it is still on track to do that.

In contrast to site opening, sShareholder returns are steaming ahead. The full-year dividend is up significantly and this is on top of a £10 million share buyback.

I like this snippet:

Repeat customer levels have again surged to new highs, and now represent 26.2% of our total volume during the year. This is the most objective and reliable indication of ongoing customer satisfaction, and gives us great confidence in the relevance of our proposition.

Motorpoint runs open-air used car supermarkets of nearly-new cars. It's not a conventional car retails, so it's great to see repeat customers growing as a proportion of the total. A strong sign of customer acceptance.

Outlook

The outlook statement is really confident in every respect.

I would like to see a bit more disclosure in like-for-like sales and performance. It would be good to see a clear analysis of how the older estate is performing now, rather than only having the consolidated numbers including all of Motorpoint's locations.

The balance sheet is clean and simple. Like many other car retailers, the company uses bank stocking facilities to finance its inventories, but the balance sheet does have £26 million of equity (as of March 2018) and this is entirely tangible, with limited fixed capital (PPE).

Overall, it's a nice results statements and I think I'd continue to hold this, if I had a position, regardless of broker downgrades.

As Paul has noted before, Motorpoint shares are more expensive than your average car retailer. This is a consequence of its differentiated business model and the market share growth which this is producing. That sounds fair enough to me.

Ted Baker (LON:TED)

- Share price: 2400p

- No. of shares: 44.5 million

- Market cap: £1,068 million

These shares were down as low as 2275p this morning, but have since recovered.

Sales growth from this global fashion brand was just a touch lower than some analyst estimates.

Revenues increased 4.2% (7.5% at CER) over the course of 19 weeks from January to June. External conditions remain "challenging".

Retail sales may be suffering. E-commerce sales grew 33.6%, but total retail sales, including e-commerce, only grew by 0.7%. This is despite a 5.7% increase in average retail square footage.

So I think this raises a question mark or two over performance. The long-term performance is terrific, though, and management remain confident about the brand's long-term development. So I think I need to get this stock on my watchlist, especially given how it has de-rated over the past couple of years.

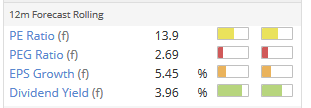

These plotted lines tell the story. EPS has been going up in a straight line, but the valuation has been drifting lower:

The StockRanks aren't too impressed, except when it comes to Quality:

Air Partner (LON:AIR)

- Share price: 112.5p (+12%)

- No. of shares: 52 million

- Market cap: £59 million

Some of you have been following the situation at this aviation services company very closely.

An accounting issue was revealed in April, and the subsequent review means that results for the year ending January 2018 could not be released on time (within four months).

The shares were duly suspended on 31 May, but are back trading today.

We were treated to three RNS statements last night:

- Completion of Accounting Review

- Full year results for year ended 31 January 2018

- Annual Report and Notice of AGM 2018

The accounting review concludes that someone within the organisation, prior to February 2018, was responsible for creating false records. The company's previous CFO resigned in April, so we can conclude that he is not to blame.

There was no theft and no customer or supplier was impacted. Indeed:

The Review concluded that there was no conceivable pattern or logic to the manifestation of the Accounting Issue and no clear motivation or evidence of personal gain.

One imagines that there was some personal gain to be had, even if it's not immediately obvious what it might have been.

The effect of the falsehood was to wrongly increase net assets by £4.4 million (gross) or £4.0 million (net of tax).

It's not possible to figure out where this amount has come from, or exactly when, so £3.5 million is being written off in a straight line manner from 2010 onward. That means an approx. £0.4 million reduction in net income per annum for eight years.

Having read this entire RNS, I'm satisfied that the company has dealt with the issue in the best possible way, and that the damage is not serious. Shareholders may form their own view.

In the company's words: "The issue has been contained, reviewed and resolved."

The full-year results are excellent, especially in the circumstances when management must have been terribly distracted:

The cost of dealing with the issue are not reflected in the above. FY 2019 will include £1.3 million of costs directly related to the issue. No big deal.

I haven't got the time to familiarise myself with the company in any further detail today but I would view the completion of accounting review in this manner as having turned out to be almost the best-case scenario!

Frontier Developments (LON:FDEV)

- Share price: 1697.5p (+5%)

- No. of shares: 38.7 million

- Market cap: £657 million

Trading Update and Jurassic World Evolution Launch

It's an important trading update from this video game developer and publisher.

Checking our previous notes, the release of Jurassic World Evolution (JWE) was seen as critical to performance in the current financial year (ending May 2019).

From the results statement last September:

We anticipate that the next step-up in our financial performance will be delivered by the launch of Jurassic World Evolution in summer 2018.

This game has been launched today as planned.

We also have a positive result from the company's first two franchises, and therefore a profit upgrade for the previous financial year:

... the Board expects to report financial results for FY18 ahead of market expectations, with revenue of approximately £34 million and operating profit (as calculated under IFRS) of approximately £2 million.

I imagine that the company includes the reference to IFRS above because its own view of underlying profitability is likely to be a little different to the accounting standards. The company's EBITDA, before allowing for those costs which have been sent to the balance sheet and depreciated, will be closer to £8 million, rather than the £2 million IFRS operating profit.

The forecasts I can see for revenue (e.g. on Stocko) predicted a figure of £31.1 million for FY 2018. So the £34 million result is a meaningful increase of almost 9% on top of that.

I can also see a forecast for EBIT of £1.4 million. So I think the £2 million operating profit result is also a substantial beat.

So why are the shares only up by 5%? I imagine that's because most of the value in the stock is based on forward-looking JWE predictions, and won't be swayed by the pre-existing two franchises having done a bit better than expected.

Another reason might be that huge things are already expected from FDEV in the current financial year. Sales are supposed to almost double to £62 million, and net income is supposed to increase to c. £13 - £14 million.

I like the video games space, I admire FDEV as a company, and I think shareholders in FDEV could do really well in the long run. But I do retain a very strong preference at current share prices for richly diversified alternatives trading at less aggressive valuations, such as Activision Blizzard (US:ATVI).

All done for now. If Friday is quiet, I will come back to cover one or two that I didn't get around to today (specifically B.P. Marsh & Partners (LON:BPM) and iomart (LON:IOM) ).

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.