Good morning, it's Paul here with Friday's SCVR.

Estimated timings - I've got to stay in most of the afternoon for the electrician, so will keep typing away here until about mid-afternoon. Today's report is now finished.

Apologies for the site outages. The data centre fell over today, apparently.

US markets , Fed, inflation target - US markets hit new highs again yesterday, driven by a change in policy from the Fed. I listened to Powell's speech, and instead of his usual gloomy assessment about the economy (which usually drives markets down temporarily), he announced a change in inflation targeting policy.

Instead of targeting the specific figure of 2% inflation (which always struck me as odd), the Fed will now target an average 2% inflation rate over the long term. This means inflation will be allowed to overshoot 2%, if it had previously undershot.

This seems positive for markets, because it defers the possibility of interest rates rising to combat inflation. Did anyone actually think interest rates would rise? I think it's becoming increasingly clear that we are in a new world of permanently near-zero interest rates. Governments have too much debt to even consider raising interest rates meaningfully, because the cost of rolling over maturing debt would then become too expensive, and force them to cut spending elsewhere and/or raise taxes, which is electorally unacceptable.

What struck me about Powell's speech, is that he seems to have a certainty that the Fed is and can, control inflation, through its various policy measures. Where is the evidence for this? I think the internet, and globalisation, are the reasons that we've had low inflation for almost 3 decades. It's probably had little, if anything to do with central bank policy. Loose money should have stimulated inflation, but it hasn't. Instead, it's just driven up asset prices. Therefore, stepping out of the way, and just letting the economy do what it wants, is probably quite sensible at the moment.

Understanding conventional economics is actually a hindrance at the moment. The people making money from the stock market seem to be the least knowledgeable. Just buy a fancy tech stock, and watch it go up almost every day, and ignore valuation completely! We've been wasting our time doing analysis of fundamentals.

It feels increasingly like 1998-2000. Markets this exuberant never end well. That said, the big tech stocks of today are vastly superior to the ones that went crazy in 1998-2000, a lot of which was speculative rubbish.

On the bull side of things, if interest rates are going to stay at near zero forever, then many shares are probably still cheap, because a PER of 20 is an earnings yield of 5%, which is very attractive when you can't get a decent return on cash or safe bonds.

If inflation does rise in future (which it might do, if import tariffs and re-shoring drive up prices), then we're likely to see the mother of all bear markets, both in bonds (rising yields, falling capital values), and shares (which should fall when inflation & interest rates rise).

The danger I see is that if inflation does start to take hold again, at some point in the future (no idea if, or when), then if the Fed lets it rise to say 3-4% with no action taken, there's a danger inflation could then become self-fuelling.

We saw this in the 1970s. Two oil price shocks initially triggered high inflation, but it then became ingrained, as workers forced employers to award big pay rises in order to protect their standard of living. Therefore everything kept going up in price, as employers were forced to raise their selling prices in order to cover their increased costs.

Once inflation of say 10-20% is ingrained, everyone then begins anticipating further price rises, and taking pre-emptive action, thus fuelling a further acceleration in inflation. Governments are forced to raise taxes, borrow, and print money, as the public sector wage bill spirals upwards, fuelling more inflation, and slowing the economy.

The only way the Thatcher Govt was able to bring inflation back under control, was by allowing a severe recession to occur, to stifle demand, and raising interest rates sky high in the early 1980s - they didn't have any choice, as the Gilts market had dried up - for several months the Govt couldn't sell any new Gilts, there were no buyers [source: Charles Moore authorised biography of Thatcher].

I saw my grandparents life savings all but disappear in the 1970s and early 1980s, as inflation rapidly eroded the purchasing power of cash, and they were forced to dip into their savings, as the purchasing power of their pensions seemed to fall each year.

Therefore, the Fed is dicing with danger with this new policy. We might yet see the inflation genie escape from the bottle, and once it's out, getting it back in is extremely difficult.

These are probably worries for another day though. For now, the Fed has just lit the blue touch paper yet again, by effectively removing the risk of higher interest rates for the foreseeable future. That sounds very bullish for shares, for now anyway.

How much higher can things go? Your guess is as good as mine. There's little doubt now though, that we're in a bubble, in some parts of the market anyway. Irrational exuberance (e.g. the Tesla cult) is becoming more widespread in the States. I've never known the US markets shrug off so much bad news. They tend to drag our market in their wake, so it looks like there could be more upside to come, for the time being. Who knows what the trigger could be, to see markets correct to more sensible valuations? As we've seen in all exuberant markets in the past, sooner or later everything comes tumbling back to earth. Hence in my view, a big market correction is now only a question of when, not if.

.

Works Co Uk (LON:WRKS)

Share price: 22p

No. shares: 62.5m

Market cap: £13.8m

(I'm long)

TheWorks.co.uk plc the multi-channel value retailer of gifts, arts, crafts, toys, books and stationery, announces today its preliminary results for the 52 weeks ended 26 April 2020 (the "Period" or "FY20").

I'll keep this brief, as the market cap is so small. These results came out yesterday, here are my notes on the key figures;

- FY 04/2020 adj EBITDA (a proxy for underlying cashflow in retail sector, before interest, tax & maintenance capex of course) looks quite good, at £10.8m (LY: £13.9m)

- Estimated profit impact of covid in March-April of £3m

- Large non-cash impairment charge of £19.5m, to write down goodwill and store fixed assets - doesn't really matter to me

- Adj basic EPS 3.0p vs 9.2p LY - not bad in the circumstances, in my view - at least it's still profitable on an underlying basis

- 37 new store openings, total now 534. Probably wishing they hadn't done this now - expect far fewer new store openings in future (although probably on cracking deals with landlords in future)

- Liquidity - £7.5m loan secured through CLBILS, and RCF extended to Sept 2022, so funding looks OK to me, and debt level modest & safe (since Govt guarantee, bank unlikely to get the jitters)

- Uncertainty = no guidance given - but see the going concern note for various scenarios.

.

Going Concern note - these are very enlightening, and I have to thank auditors generally for making companies include some very useful information in them. It's always worth doing a CTRL+F search of every results statement, searching for the term "Going concern", because that throws up these notes, which are easy to otherwise miss. Actually, I think the most important information in the RNS is in this going concern section!

WRKS outlines its base case, and reasonable worst case scenarios. Results are;

Under the Base Case scenario, the Group expects to have sufficient financial resources to continue to be viable and the Going Concern basis of preparation of the financial statements is appropriate.

Under the reasonable worst case scenario, things are tight, but manageable, "albeit with limited headroom". But more positively;

Actual trading results since the beginning of the FY21 financial year have been better than factored into the Base Case and RWC assumptions.

Overall then, this looks like things are financially tight, but no insolvency risk for the time being.

Longer term, I think the group might need to restructure, and raise more equity.

The going concern note ends with a material uncertainty conclusion, clearly this is a worry;

In light of this level of uncertainty over the duration and severity of any disruption, there are scenarios under which the Group could breach its EBITDA covenant, which represents a material uncertainty that may cast significant doubt on the Group's and the Company's ability to continue as a going concern.

Current trading - it says;

Sales from the online channel, during lockdown, and store sales since the end of lockdown, have been better than the Board's initial expectations. Despite this, there remains uncertainty, for example, over how long social distancing measures will be required to be in place and the possible effects on the level of consumer demand.

Peak trading at Xmas this year is very important;

The group's ability to meet the EBITDA covenant is heavily influenced by trading during the peak months of November and December.

Business rates relief is a huge benefit (so what happens if/when it ends?);

The Group will also benefit from approximately £13m of business rates relief between the beginning of lockdown and the end of FY21.

Furlough support from the taxpayer was £8m, again hugely significant.

Current trading (continued) - this does look encouraging, considering High Street footfall has been well down on prior year after re-opening;

LFL sales, 10 weeks after re-opening, to 23 August 2020: UP 0.7% - that's actually really good!

Most recent trading, LFL down "high single digits". This implies a burst of sales after re-opening, but settling down at a lower level now. Note that ATV (average transaction value) is up, but number of transactions is down. So fewer people spending, but basket size is larger.

In the circumstances, I think that's OK for now. The business rates holiday effectively funds a shortfall in sales of c.5-10% by my rough workings.

Online sales - no figures given, so this may or may not be significant. Obviously rose a lot during lockdown (over 3x LY), and is still running at 2x LY, even after stores re-opened.

Balance sheet - still solvent, but huge lease liabilities. That's not a problem if stores are trading profitably, but there must be a long tail of loss-making stores, given that the overall total is only very modest profitability.

My opinion - after going through the figures, this is riskier than I previously thought.

Judging by the large number of CVAs and pre-pack admins being undertaken at the moment by retailers & hospitality companies, I think this route is probably the only long-term option for WRKS too. It needs a step change in reduced property costs, and to jettison all those leases, some of which are bound to be uncompetitive now. Turnover rents are becoming the new normal for restructured companies, and companies which don't restructure in this way will basically be operating for the benefit of landlords in future. Where's the attraction in that, from our point of view as investors?

The good news is that the company is securely financed for the rest of this year, so no immediate panic. If it trades well over Xmas, then things could be looking up next year.

The product range strikes me as quite good, and good value, and I often make impulse purchases of books or greetings cards when passing by. The focus on kids & art/crafts is probably being boosted by schools being closed. A lot hinges on covid, second wave or not, etc.

This looks a fairly marginal business in the good times, so probably doesn't have much of a long term future in its current guise. On reflection, I think buying this share was probably a mistake. In future, I might sell into any rally (if there is one) later this year or early next year.

I'd like to maintain a toehold though, because if it announces a restructuring, and exits the leases, then I would want to buy more (something that Quiz (LON:QUIZ) did - I hold - which resets the cost base to a much lower level, and hence a decently profitable business should then emerge).

.

.

Tandem (LON:TND)

Share price: 385p (up 3% today, at 11:59)

No. shares: 5.03m

Market cap: £19.4m

Trading Update & Investor Meeting

The Board of Tandem Group plc (AIM: TND), designers, developers, distributors and retailers of sports, leisure and mobility equipment, announces a trading update and details for the forthcoming investor meeting.

H1 profits are up on last year;

As previously reported it has been a strong year for bicycles and outdoor products. Despite the reduction in FOB business, turnover and profit before and after tax for the 6 months to 30 June 2020 are expected to be ahead of the prior year.

Isn't it annoying when companies use jargon & abbreviations that they are familiar with, but others may not be? I remember from a former life importing from the Far East, that FOB means "Free On Board", but what is the significance of that in this context? Ideally, it's best not to use jargon/abbreviations, but if companies must do, then please provide an explanation in a footnote.

Other points;

- Supply chain under pressure - due to strong global demand for bikes, increased lead times

- Cautious buying from national chains

- Revenues fell below LY over the summer - lack of orders & limited supply

- Margins strong, and lower overheads

- "Difficult to confidently forecast" outcome for FY 12/2020 results

That all sounds a bit mixed.

Rather than suffering the vagaries of retailers, it sounds like Tandem should concentrate on selling direct to end customers via the web. Thus bagging both the distributor, and the retailer margins. It has lots of websites - here - so I'd be much more interested in this share, if it prioritised own website sales, and got in some digital markets wizards to aggressively grow that side of the business.

I bought a semi-circular parasol from its website, which is a terrific product. Checking its website here, out of 60 parasols, 56 are out of stock. Dear oh dear. Clearly they need a proper sort out of the eCommerce part of the business.

Both Graham and I have written previously about Tandem, so for more detail on the numbers, here is our archive of commentary.

Investor meeting - as previously announced in June.

This is a major breakthrough, as several investors have told me that, in the past, the company seemed at best off-hand, and at worst openly hostile towards its shareholders. There seems to have been a big shift in attitude, with the company now actively encouraging shareholder engagement, which is wonderful to see, well done to everyone involved.

Investor meeting

The Company announces that an investor meeting will be held at the Company's Birmingham offices on 22 September 2020 at 10am.

The day will include a presentation of the interim financial results, which will be released that morning, and strategy followed by a tour of showrooms where various products sold by the Group will be on display. There will also be an opportunity for investors to ask questions to the Board.

More detail on how to sign up for this - see the RNS.

As it's a slow day for news, let's have some fun by looking again at the outgoing Chairman, Mervyn Keene making a complete fool of himself in his outgoing remarks, in this corker of an RNS from Feb 2020. Just for your amusement, here is part of what he said again;

When I was appointed Non-Executive Chairman the share price was 110.5p. Today as I announce my intention to step down the price is 205p per share. Despite this, it is disappointing that internet posters, who often hide behind absurd pseudonyms, continue to type inaccurate statements and offensive remarks. There are an irritating few of these keyboard warriors who have no commercial experience but think that they could run the Group better.

If they're using an absurd pseudonym, then how come he knows they don't have any commercial experience? I can just imagine the broker saying to him, we really can't put this out, it's a very bad idea. No, I insist, I want to tell these keyboard warriors just what I think of them! Something like that probably happened, I guess, and it's amusing to imagine it.

The share price has nearly doubled again, since he announced his resignation, in a much shorter time than it previously took to double.

Should a listed company Chairman really be publishing stuff like that in an RNS? I very much doubt that shareholders miss Mr Keene.

I don't have any particular view on Tandem, so am neutral. I've held it in the past, but missed the big recent rise, so am not interested in chasing it now. It's got freehold property, but also a pension deficit, remember. If the eCommerce side of the business really started to fly, then I would take an interest here.

.

.

Macfarlane (LON:MACF)

Share price: 92.6p

No. shares: 157.8m

Market cap: £146.1m

This is a packaging manufacturing & distribution company, headquartered in Glasgow. Its website says it’s the UK’s largest.

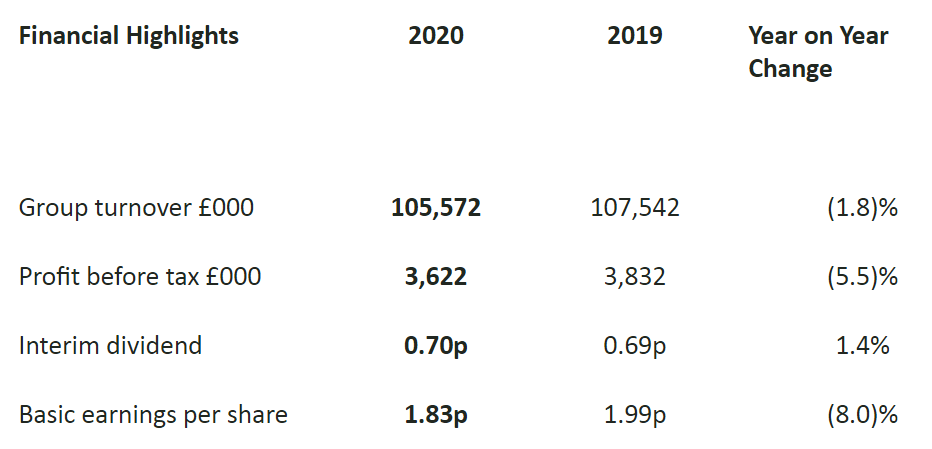

Considering we’ve been through such a turbulent period, these financial highlights look remarkably resilient, I’m impressed. Although the narrative mentions several acquisitions, and I can’t find the split of organic & acquired growth.

A good mix of customer sectors has helped (e.g. automotive down, eCommerce up).

.

.

No benefit from Govt support schemes, as these have since been repaid (I’m not saying anything!)

Net debt – interesting comments here, and great disclosure that the unusually low net debt at 30 June is explained;

Net bank debt at 30 June 2020 was £0.8m, £11.9m below its 31 December 2019 level of £12.7m. The improved cash position has been achieved through active management of working capital and reductions in the cost base. The net debt of £0.8m has benefited by £5.4m from the various government support and deferral programmes, all of which we have repaid since 30 June 2020.

The Group is operating well within its existing bank facility of £30.0m. We expect to pay an estimated £0.8m in deferred consideration, in the second half of 2020, relating to the acquisition of Ecopac in 2019 .

Dividends – previously the 2019 final divi was held back. Now resuming divis, paying a 0.7p interim divi.

Outlook – uncertainty mentioned, as practically all companies are saying at the moment, but this sounds reassuring;

Our future performance is largely dependent on our own efforts to grow sales, increase efficiencies and bring high quality acquisitions into the Group. Whilst we have experienced significant challenges from the Covid-19 pandemic and there are still uncertainties ahead, our strategy and business model have proved resilient and robust. We expect to deliver a solid sales and profit performance in 2020 and are well positioned to benefit as the economy recovers.

Looking at last year’s figures, it seems as if there might be an H2 bias to profitability.

It’s seen steadily rising EPS in recent years. 2020 could see a small step back maybe, but I would say c.6p looks about the right level to base valuation on. Hence at a PER of just over 15, it looks priced about right.

Balance sheet – looks OK overall. NTAV is only £9.7m, not brilliant, but not a concern either due to reliable profits generated over a very tough period. Therefore I can’t imagine the bank would have any worries about its exposure to MACF.

Cashflow statement – note the large depreciation charge. When that’s added back, the business looks highly cash generative both this year and last year. Remember that it repaid Govt support measures after 30 June 2020, so net debt will have risen post period end. Not a problem, I’m just flagging it.

Going concern – there’s just a short note to say everything is fine. Generally speaking, the longer the going concern note, the more of a concern it is!

Pension scheme – although the accounting deficit is small, the cashflow statement shows what seem to be deficit recovery payments of about £3m p.a., if I’m reading that correctly. In which case, the pension scheme is quite a significant thing. Remember that deficit recovery payments are real cash going out, which could otherwise have been paid out as dividends. So the valuation might need to come down, to take into account this long term liability. Especially as low interest rates make the liabilities grow in how they are accounted for. I’m flagging this as something for people to investigate yourselves, if you’re thinking of buying the shares, because it’s material to the valuation of the shares.

My opinion – this look a good business. Shares look priced about right, hence it doesn’t really interest me as a potential investment. There’s always going to be competition in supplying packaging, which limits growth and margins. Still, it seems well managed, and could continue growing by acquisition. If smaller competitors can be picked up the cheap, and efficiencies/cost savings made, then it might make a nice acquisition-based investment, maybe? It would be interesting to meet management, or see them present online.

Towards the end of a bull market, fairly staid companies like this can get very cheap, as the money is sucked into high growth, tech companies – exactly what happened in 1998-2000. Hence I don’t particularly want to pay a PER of 15 for a company with only modest growth prospects, as it could get cheaper.

Note the sideways chart trend over the last 3 years, and consistently very strong StockRank;

.

.

All done for today, and the week! I hope you enjoy the long weekend.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.