Good morning! Paul & Jack here. Today's report is now finished.

End of week podcast - we've just recorded it, so should be up on Spotify shortly! Search for "The Small Cap Value Report" or use this link.

Agenda -

Paul's Section:

Dotdigital (LON:DOTD) - from yesterday. Despite an in line with exps update, the share price crashed 24%. I think the problem is - the shares ran way ahead of reality, and growth is now lacklustre. Costs are rising too. Doesn't deserve a premium rating in my view.

Empresaria (LON:EMR) (I hold) - another solid trading update from this eclectic group of staffing companies. PER of 10 looks reasonable, and an upbeat outlook.

Treatt (LON:TET) - a wordy AGM update, with no numbers. Seems reassuring. High valuation, so it could come under pressure in current sceptical markets. However, I do wonder if the broker forecasts could be set too low, given the new factory coming on stream? Nice company, but it's particularly difficult to assess whether the valuation is high, or not? Only time will tell.

Chill Brands (LON:CHLL) - a quick look at interim results, for this early-stage, heavily cash-burning startup. It needs to raise more cash, and the £26m market cap looks bonkers. So I wouldn't go near it, unless/until the business model has been proven.

Jack's section:

Renewi (LON:RWI) - another material upgrade here, supported by a strong recyclate price environment. The shares are quite modestly valued on a forecast PER of 10.4x but this depends on what a sustainable recyclate price level looks like. There are likely long term demand drivers here though, so it looks interesting.

Avon Protection (LON:AVON) - supply chain stabilising but revenues expected to be weighted to the second half of the year. Share buyback announced after a calamitous share price fall following the Body Armor acquisition and subsequent closure. Disastrous capital allocation. There is likely still a good business here, but management has very seriously blotted its copy book.

Paul's Preamble - UK Small Cap Valuations

Revolution Bars - I got sick of being stuck indoors yesterday afternoon, so took my laptop off to Bournemouth's branch of Revolution Bars (LON:RBG) (I hold) - which is a nice place to hang out after its recent refurbishment. Also, their free wifi is quicker than mine, and it saves me some electric, turning off my heaters at home for a few hours. It was the last day of their January promotion for half price main courses, so I tried more items on the menu, and once again was delighted with the quality - the food offering has drastically improved, and it's now better than my local Harvesters. That alone won't transform the performance of the company (profits are mainly made from late night trading on Fri & Sat), but I do think, over time, the greatly improved food offering should attract more people in for repeat business, once they realise it's a pleasant place to have lunchtime meetings, and do a bit of work on your laptop, whilst having a pleasant meal.

Why did I mention that? Partly to flag up that I see a proper turnaround underway at RBG - it's not just based on one site that I visit, but also on the overall menu, good app, sensible pricing, good offers, and that 19 bars are being refurbished this year (which will drive up LFL sales yet to be reported). The whole place has a real buzz about it, and the site manager Scott (who knows me now) came over for a chat, and introduced me to his area manager, Mark, who seemed very upbeat about the company. When I queried it, they confirmed what RBG said in a recent RNS, that the impact on trading from omicron in Dec 2021 is now benefiting trading in Jan 2022 - because some work parties are now being held, which were deferred rather than cancelled. Combine that with apparently the end of the pandemic from herd immunity brought about by vaccines + omicron getting everyone else (let's hope it doesn't come back yet again), then conditions look ideally set up for a bonanza. I quipped that if they can't make money in the next 6 months, they never will! Absolutely, they agreed. So I think things look set up for a beat against (very low) market expectations for RBG.

UK valuations - this is my main point. Whilst in Revs, I wrote up 2 more sections, which are below. One, on Dotdigital (LON:DOTD) demonstrated with a >20% share price fall, that "in line with expectations" is not enough, for a company that was rated on 40 times forward earnings.

So, is DOTD a bargain? It's halved in price from the peak about 5 months ago. Absolutely not, in my opinion. I think the share price ran way ahead of reality, and I can't justify a price above 90p (and that's being generous). DOTD closed down 24% yesterday at 135p - still too high, I reckon.

The problem is that, following the big tech correction in the US (far worse than it looks, because mega tech are cushioning the much heavier blows hitting more speculative tech), people are also questioning tech/speculative shares in the UK too. Not before time. Once the sheen of seemingly never ending upward momentum of a share price has gone, and the assumption that because it's tech, it's somehow intrinsically better than other companies. Throw off those prejudices, and what I see with DOTD is a company that's struggled to increase earnings over the last 3 years (when it should have had a bonanza from eCommerce growth). It also warned yesterday of rising costs due to a shortage of suitably qualified & experienced staff, who obviously now want pay rises - a problem for many companies, especially those in tech areas. Revenue growth has reduced to just 10% at DOTD, and as I've queried here before, more than all the revenue growth is coming from higher average spend per customer - which by deduction implies that customer churn must be greater than new customer wins. That sounds more like an underlying business barely running to stand still.

Therefore, the lofty valuation on DOTD now looks unjustified. Other people must have come to the same conclusion, hence the 24% drop in price yesterday, on top of previous falls.

Private investors have a massive advantage here - we can click a few buttons, and sell up. Institutions can't. Hence we should use that advantage, when something goes wrong, and is obviously over-valued. We can get out at the first sign of trouble - something I still haven't mastered, despite investing in small caps for >25 years! It's so difficult to break that emotional attachment to a share, particularly if you've held it for a long time. People who can ruthlessly cut shares that no longer justify a valuation, have a big advantage. Whereas most of us cling on, hoping for an improvement, and watch in dismay as things continue to deteriorate.

I think it's time to scrutinise our portfolios again, to make sure we don't have any ticking timebombs like that lying around. If you're holding shares that are on a high PER, you need to ask: are the growth rates sustainable, and strong enough to justify that? Revenue growth is all very well, but costs are rising a lot too - so revenue growth may not feed through fully to much profit growth. In which case, a PER of 30+ could be slashed by Mr Market.

Growth investors are particularly vulnerable at the moment. With even Tesla crashing down from its highs, and still many multiples of any rational valuation (great company, just clearly the wrong price!), growth/tech investors are running out of places to hide. So do be careful, if you find yourself sounding blase about high valuations on shares that you've maybe fallen in love with. Selling some or all of aggressively priced shares right now looks a sensible strategy, and we can always buy them back once the current valuation reset has run its course.

Dotdigital (LON:DOTD)

149p (down 17% at 15:17) - mkt cap £440m

This is for H1, ended 31 Dec 2021.

I wasn’t going to cover this update, as it’s just in line with expectations, but the share price has tumbled 17%, so thought I’d better check it out for a possible buy the dip? (edit: ended the day down 24%)

H1 revenue up 10% to £30.9m

Average revenue per customer is up much more, at 19%. That suggests quite a bit of customer churn (no figures provided), otherwise revenue would be up a lot more than 10%, so I can only conclude that new customer wins are not replacing customers lost - we’ve queried this issue here before actually.

H1 is said to be consistent with full year guidance.

Cash of £40.0m is about 9% of the market cap, clearly positive.

International sales growth has slowed to only 4%

Broker guidance (new updates available today) show adj EPS of 4.3p, which hasn’t risen much in 3 years. This makes the PER a pricey 35 times. I can’t see any reason why the rating would be so high, given that earnings growth has been modest in recent years.

Cost pressures (esp. salaries) are mentioned in the commentary.

My opinion - it seems to me this is a good example of a share which became very significantly over-valued, and now the hangover is underway, with valuation coming down to something more realistic.

Personally I don’t think the growth is impressive, and I reckon anything above a PER of 20 is probably too high. So 90p looks about right to me (20 times earnings, plus the cash pile). With the current price at 149p (half the peak level, 5 months ago), I don’t see this share as having any attractions from a value perspective, and the growth isn’t good enough to command a premium rating.

.

.

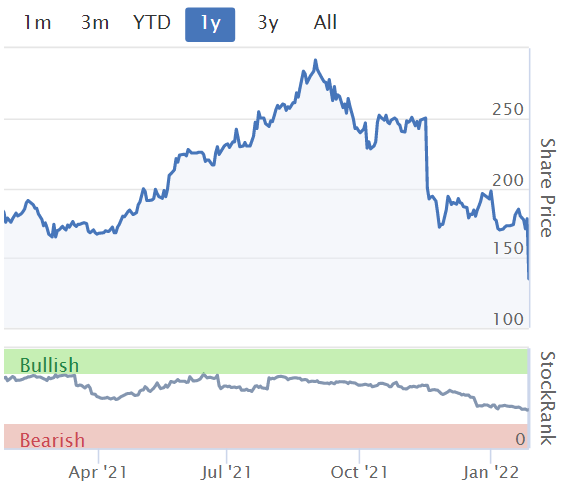

It's interesting how the StockRank system was flagging poor value, and negative momentum:

.

Empresaria (LON:EMR) (I hold)

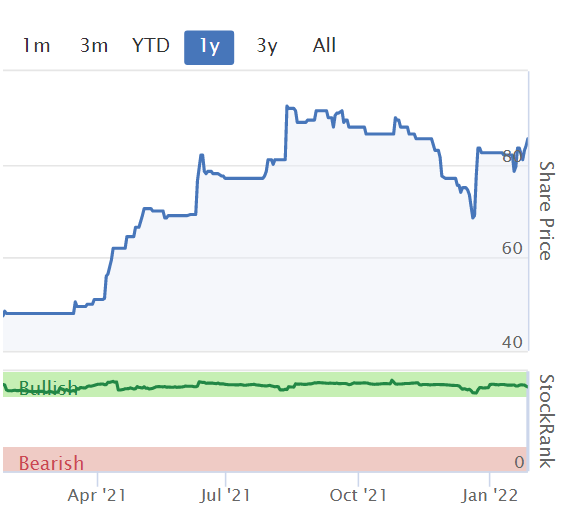

84.5p (up 2% at 15:35) - mkt cap £42m

This is a strange little mixture of geographically diverse staffing businesses.

It’s trading rather well - a series of upgrades during 2021, and it says now that actual 2021 results are “slightly ahead” of upwardly revised expectations.

Many thanks to Singers for updating its spreadsheet, they now forecast 8.5p adj EPS (fully diluted). That puts the share on a PER of 10 - not expensive.

Outlook for the start of 2022 sounds encouraging, and we could see profits rise further, as post pandemic recovery continues maybe? -

Going into 2022, we continue to experience favourable market conditions across parts of the Group. We are investing in growing our sales and recruitment teams in targeted markets to take advantage of market recoveries and to accelerate long-term growth.

The divi is only small, at 1.0p.

My opinion - what I like about EMR, is that it may not be the most glamorous business in the world, and heaven only knows why anyone thought it would be a good idea to buy this odd collection of far-flung subsidiaries. But it’s working! The group keeps beating market expectations, and seems to have not had any of the issues that caused Gattaca (LON:GATC) to crash. The way I look at things, I cannot rely on outlook or forecasts from GATC, but I do seem to be able to rely on these from EMR. That's what matters.

.

.

Treatt (LON:TET)

1,115p (Unchanged at 09:01) - market cap £668m

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, announces the following trading update ahead of its AGM to be held later today …

It’s one of those vague, general commentaries, with no figures in it -

Having reported record full year results for the year ended 30 September 2021, Treatt has made a good start to the new financial year, with the order book up strongly year-on-year. As previously indicated, against the backdrop of last year's unusually strong first half, we expect this year's profit before tax and exceptional items to revert to a more normal H2 weighting, reflecting the seasonality of beverage consumption in the Northern Hemisphere.

The business continues to grow across multiple categories reflecting our increasing investment in R&D and our relevance with prevalent consumer beverage trends, particularly the growing demand for healthier, natural products.

The move to the new UK headquarters is progressing as planned and will give us substantial extra capacity in coming years to grow with enhanced efficiency and an emphasis on sustainability. Our strategy to invest in our people and capabilities to support our growth journey, which we have announced previously, is also going well.

The Board therefore looks forward to the remainder of this financial year and beyond with confidence.

The reason why TET shares are on a premium rating (forward PER of 42.6) seems to be because of the expansion potential, both in sales and gross margins, from its new facilities which have been recently built, to replace an inefficient sprawl of existing sites. Hence investors are anticipating growth & better profits. That’s not particularly reflected in existing forecasts, which only show modest growth. So my concern is that the forecasts could be misleading, in being too low. It’s all very well to under-promise then over-deliver, but if investors are told only modest growth is expected, then we might avoid the shares thinking they’re over-priced.

If management only see modest profit improvement, then why did they embark on a large investment programme to expand & modernise the production facilities?

On balance then, I think it’s likely TET should beat existing forecasts next year.

As regards this year, I’m not keen on the H2 weighting stuff above. Whilst that might be perfectly reasonable, and not a sign of problems, it does mean that H1 results to Mar 2022 could look cosmetically poor, due to unusually strong prior year comparatives (H1 PBT was up 71% last year - now the tough comparative for this year's numbers to come). In buoyant markets, people tend to look through that type of thing, but if markets are bearish when H1 results come out in mid-May 2022, then it could trigger a lurch down. Although that would depend what the outlook comments are like, accompanying the figures.

Forecasts - I’m looking at a freely available update note from Edison. It forecasts 32.2p EPS for FY 9/2022, which is only up 7% on prior year. That doesn’t look a demanding forecast, so should be beaten, given the upbeat commentary today from TET about the order book being up strongly, and growth in multiple categories. Although not mentioned, costs will also be rising.

Another modest rise in forecast EPS to 34.3p for FY 9/2023 also looks like a soft target. If it can only grow earnings by 7% again, with all that new capacity coming on stream, then there’s something badly wrong!

I’d want to be valuing this share on say 40-50p EPS being more possible over the next couple of years. At 1,115p that would be a PER of 22-28 - still quite pricey, even if I bake in a large beat against forecast earnings.

My opinion - as mentioned in my preambles recently, and today, valuation matters again. Very high PER companies are being punished even if they perform in line, and slaughtered if growth expectations slow down.

Against that backdrop, I definitely don’t want to be buying any shares right now which already factor in strong growth, and still look quite pricey, which is how I see TET.

It’s a very nice company though, and I know there are enthusiastic long-term holders who look-through the high rating, and have been proven correct. I'm not convinced by the argument that European competitors are also very expensive.

TET has been transformed over the last 10 years, and has been a serious multi-bagger for shareholders. So there is a strong argument for just finding good companies, with good management, and holding them for the long-term, overlooking periods of apparently high valuation - because the best companies do readily grow into a high valuation.

It’s just that right now, that’s not the market’s zeitgeist at all, so holders with a low pain threshold could be in for a bumpy ride in the short term - which doesn’t matter, if you’re in for the long term. Sharp dips in price can be good buying opportunities in high quality companies.

If in doubt, I check what the StockRanks think - this is quite interesting. Expensive, but bear in mind those broker forecasts could be set artificially low maybe?

.

.

Stunning long-term chart below for TET. Also, note how it multi-bagged over a 12-month period in 2016-17, but then traded sideways for 3 years - suggesting the price does get ahead of itself after good news, then takes time to grow into the valuation. The wild card this time though, is the new production capacity coming on stream. If that goes well, who knows, it could power another leg up, possibly? That’s the most interesting aspect of this share, so I remain intrigued.

.

.

Chill Brands (LON:CHLL)

12.2p (down 8%, at 10:04) - mkt cap £26m

I had nothing good to say about this share when I reviewed its Q2 trading update here in Nov 2021, concluding that risk:reward looked terrible for investors.

Chill Brands Group plc is an international company focused on the development, production, and distribution of best-in-class hemp-derived CBD products, tobacco alternatives and other consumer packaged goods (CPG) products. The Company operates primarily in the US, where its products are distributed online and via some of the nation's most recognisable convenience retail outlets. The Group's strategy is anchored around lifestyle marketing that is designed to enhance the popularity of its products, channelling visitors to its landmark chill.com website.

H1 revenues £1.1m

H1 operating loss: £(2.5)m, including a £1.35m charge for share options (seriously!)

Balance sheet as at 30 Sept 2021 - note that £377k (current) + £567k (non-current) is owed to the company by a related party. How has that come about? What is the likelihood of the money actually being received by the company? This is very unusual, and a potential red flag.

Cash of £2,080k is sitting on the balance sheet, but that’s come from an equity fundraise of £5.7m during H1. This appears on the cashflow statement as a receipt, and it also can be worked out from the balance sheet, by calculating the increase in share capital compared with 6 months ago (add up share capital + share premium account), also equals £5.7m.

So the fact there’s only £2,080k cash left, so soon after raising £5.7m is another red flag - it looks as if the cash pile has been largely splurged, and I suspect the remaining £2m is probably following in hot pursuit!

Outlook - as the balance sheet shows, it’s clearly going to need to raise more cash from shareholders, and this is confirmed in the outlook comments today -

Chill is the combination of a powerful brand, a driven and experienced team, and products at the forefront of the world's fastest growing consumer category. As we look back on the first half of this financial year, we are also firmly focused on the future and making changes that will propel the Company on to greater success. Through persistent execution of marketing and sales strategies, Chill Brands will become an iconic brand synonymous with creating a "Chill State of Mind" - a mindset advanced by the freedom and choice offered to our customers through lifestyle marketing and innovative products.

This is the moment at which Chill Brands matures into a focused and fully operational CPG company with aspirations to join the ranks of the world's largest brands. In the coming weeks we will continue to build our model alongside an investment case that reaffirms the decisions of existing long-term holders and attracts new ones. We would like to take this opportunity to thank our shareholders for their ongoing support and restate our belief that Chill Brands has a bright and prosperous future ahead.

My opinion - very negative. The company clearly hasn’t got enough cash to build “an iconic brand”, which is hugely expensive.

So it needs to raise more cash - in a market that is now much less willing to fund speculative projects. Early stage companies which have to rely on repeated funding rounds whilst they try to establish themselves, are just not suited to the stock market.

Why on earth would you want to risk your money on this? It looks like the sort of speculative share that can do well in a roaring bull market, but gets severly punished in a bear market - as you can see - and it's still valued at about 10x what I reckon it's worth (close to zero). To be fair though, I haven't tried the product, and if it does make people more chilled, then that could be a good thing, providing they're not operating any machinery?

.

.

Jack’s section

Renewi (LON:RWI)

Share price: 672.34p (+2.33%)

Shares in issue: 80,054,224

Market cap: £538.2m

Q3 update for the three months to 31 December 2021

The Board today announces a further material upgrade to its expectations for the year ending 31 March 2022. Underlying EBIT is now expected to be at least €120m for the year (FY21: €73m).

The robust performance has been driven by continued high recyclate prices.

This positive pricing, driven by positive supply/demand dynamics, high commodity prices, and increasing demand for secondary materials, more than makes up for softening volumes in Covid-impacted areas such as hospitality and later cycle construction in the Commercial Waste Division.

Volumes in the Netherlands and Belgium in the third quarter were 91% and 93% of prior year respectively.

While labour markets have tightened but this has not materially impacted costs or operational effectiveness so far.

The Mineralz & Water Division performed in line with revised expectations. ATM's recovery has been delayed, as reported at the interims, we expect it will generate material additional earnings in the medium term as well.

In November 2021, the Dutch National Institute for Public Health and the Environment (RIVM) published a report on the environmental standards for secondary mineral products, such as thermally cleaned soil (TGG) and bottom ashes from incinerators. It concluded that legislation must be amended in order to provide better clarity.

This issue has weighed on the share price previously, so it’s good to see progress here.

The Specialities Division performed in line with expectations as well, helped by the recyclate prices and a strong performance at Coolrec.

Core net debt (excluding IFRS 16 lease liabilities) at 31 December 2021 was €301m, representing a reduction of €35m since 30 September 2021 and the leverage ratio has reduced to 1.52x from 1.82x at 30 September 2021. There is a fair amount of debt here, but it has been coming down once you account for capital leases.

Outlook - management is confident that recyclate prices will continue to be robust in Q4, hence today’s further material upgrade for the year to 31 March 2022. Recyclate prices are expected to contribute around €40m of additional EBIT.

So the short term looks positive, while the medium and longer term should deliver growth through the group’s ‘Innovation pipeline’, which is on track to deliver significant additional earnings over the next three years and beyond.

Conclusion

Renewi’s business activities appear well placed for future demand. It helps companies improve their sustainability credentials by recycling waste materials and turning them into secondary products, often to high specification for customers.

Given the potential drive we might see towards more of this type of activity, I wonder if the supply/demand dynamics that are pushing up prices might continue? The degree to which these pricing tailwinds are structural vs cyclical is important, and not something I have a firm view on yet. There are certainly longer term tailwinds, but then again Covid disruption could have impacted the market in various ways as well. Food for thought.

The group itself notes ‘positive structural growth drivers as the Dutch and Belgian regional governments progressively tax carbon emitters, incentivise recycling over incineration, and promote the use of secondary materials’.

You can see the company has disappointed the market in the past.

That big jump in shares in issue looks to be from a large acquisition, as it coincides with an equally large gap up in revenue. Tying it back to the share price chart above, perhaps there were some integration issues which have since been resolved. That plus the soil review and Covid wouldn’t have helped the share price.

Assuming something like that is the case, and those issues have been resolved, then Renewi could be a growth stock on a cheap valuation. It’s only trading at around 5x EBIT. The trading momentum, longer term outlook, and current price all suggest the stock could be worth a closer look in my opinion.

Avon Protection (LON:AVON)

Share price: 1,047p (-0.1%)

Shares in issue: 31,023,292

Market cap: £324.8m

AGM trading update and share buyback announcement

Trading has continued in line, with organic revenues in the first quarter ahead of the comparable prior year period. Supply chain disruptions continue but are now largely stable and the board is confident of achieving its expectations for the current financial year.

However, given continued longer order lead times, the group expects revenues to be weighted to the second half of the year.

Given recent developments here, this makes me wary. I’m of the impression that management might not have communicated as forthrightly with the market as it might have regarding the Body Armor debacle. Somehow, it’s still the same team in place.

Respiratory protection - further progress with the NATO Framework Contract. Additional orders have been received from the initial six customers, with Latvia becoming the seventh and conversations with other nations continuing.

The group’s MCM100 underwater rebreather has received an initial order from Belgium following a competitive tender, bringing the total number of countries purchasing this product to seven. The outcome of the U.S. Navy underwater rebreather tender process is currently expected to be announced in H2.

We anticipate follow-on orders under our long-term U.S. DOD contracts during the first half of the 2022 financial year and have good visibility of a wider pipeline of opportunities in the U.S. and globally for both military and first responder customers.

Head protection - Delivery of the existing first-generation Integrated Head Protection System (IHPS) helmet continues and preparations to submit helmets for the first article testing for the next-generation IHPS during Q2 of FY22.

We are actively pursuing a strong pipeline of opportunities in both the military and first responder markets for the F90 and Team Wendy EXFIL range of helmets.

Armor business - Detailed plans have been developed to complete the closure of the armor business in FY23.

Share buy back

We are launching a share buy back of up to £18.5 million ($25 million). As previously announced, the Board does not intend to initiate any major merger and acquisition activity in 2022 and given the strong financial position and expected cash generation, the purpose of this buy-back is to maximise the efficiency of the balance sheet for shareholders' benefit.

Conclusion

Is the company buying back stock because it’s cheap, or is it an attempt to appease irate shareholders who have just lost a lot of money after management botched a recent acquisition?

I would much rather see a full and frank post-mortem from management about just how this situation - an acquisition that goes on to be shut down just over a year later - came about and what lessons have been learned. Instead I’m getting the impression that the company would rather just move swiftly on from this episode of material value destruction.

Perhaps I’m being harsh, but capital preservation is priority number one and there is a serious question mark in that regard here, so I think it pays to be skeptical.

And then there is the ‘H2 weighting’ for revenue at a point when credibility is already stretched. I’m not convinced right now, and I’m not giving the benefit of the doubt, although I do suspect there is a good business somewhere beneath all this wreckage.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.