Good morning from Paul. We have Graham here today too, despite it being a Friday, to help cover some of the backlog items from yesterday, thanks Graham!

Cohort (LON:CHRT) - CEO interview

This niche defence group impressed me with its recent results - record profits and order book, strong balance sheet with net cash, and a reasonable valuation. So I reached out to invite the CEO to let me interview him over the phone. As usual, I select only companies that I think are interesting, and GREEN on our traffic lights here, and it's completely independent, as I don't charge any fees.

Anyway, here it is - Paul Scott interviews Cohort CEO Andy Thomis, 28 July 2023.

Let me know what you think in the reader comments here, as quite a bit of work goes into preparing these, so it's good to know whether people find them worthwhile (or not).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

I've (Paul) got to prepare for my next CEO interview with Cohort (LON:CHRT) this afternoon, so unfortunately we're not making that much of an impact on the backlog items, sorry about that -

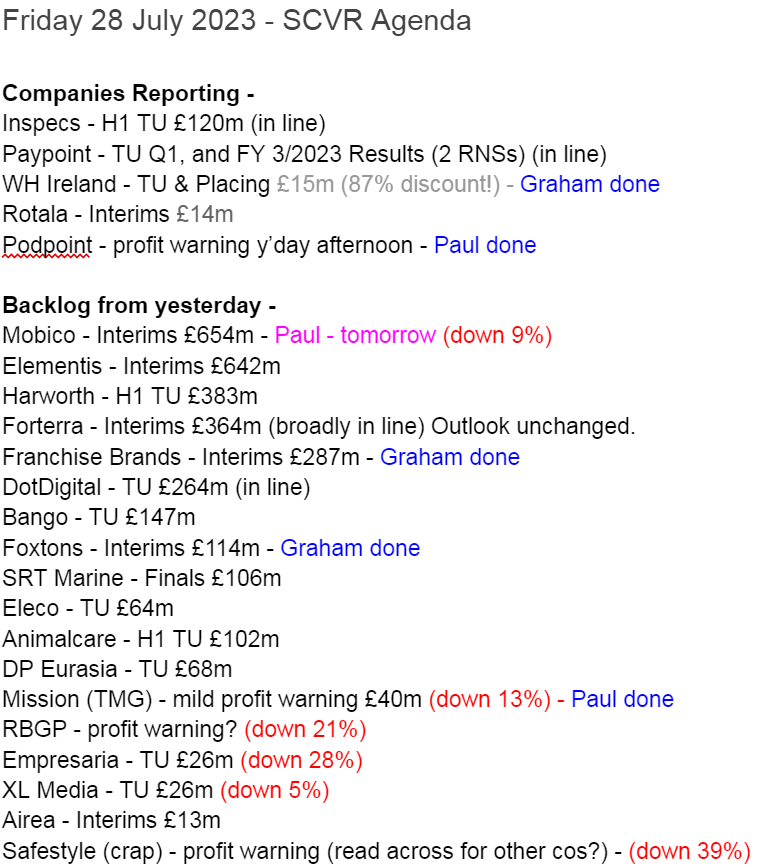

Summaries of main sections below

Franchise Brands (LON:FRAN) down 5% yday to 140p (£271m) - Interim Results - Graham - AMBER

The outlook is at least in line with expectations at this company which offers a range of van-based services internationally through its franchisees. Results are complicated by acquisitions, including a very large one this year (£200m+). Worth keeping an eye on this.

WH Ireland (LON:WHI) down 60% today to 8.9p (£6m before a placing) - Trading Update and Proposed Placing - Graham - AMBER

I remain neutral as it fixes its balance sheet with an emergency placing, shortly before it would have needed an orderly wind down. There are few signs that this company is being run for its shareholders but hopefully it can ensure its survival for the medium-term now.

Foxtons (LON:FOXT) 38.6p (£116m) - Interim Report - Graham - GREEN

Trading is in line with expectations at Foxtons as it shows both revenue and profit growth despite adverse conditions in the London property market. With recurring revenue from lettings keeping it in the black, I’m happy to give this stock the thumbs up at this stage.

Paul’s Section:

Profit warning special

Yesterday we had 5 minnows warn on profit, as follows, taken from yesterday's agenda -

Mission (TMG) - mild profit warning (down 13%)

RBGP - profit warning (down 21%)

Empresaria - TU £26m (down 28%)

XL Media - TU £26m (down 5%)

PodPoint - PW in the afternoon.

I’ll have a quick look at each, to see if there are any bargains or any avoids. These may not interest you, but I want to get facts/views into the archive, so that if anyone is temped to buy them, they can first check our analysis. If that helps people avoid a lousy investment (or find a bargain occasionally), then it's worth doing!

Mission (LON:TMG)

42p (£38m) - Trading Update (mild profit warning) - Paul - AMBER/RED

MISSION Group plc (AIM: TMG), creator of Work That CountsTM, comprising a group of digital marketing and communications Agencies delivering real, sustainable growth for its Clients, is pleased to issue a trading update for the six months ended 30 June 2023 ("the period" or "H1").

The point of difference with TMG is that it’s an acquisitive group, buying marketing/PR agencies that are not London-centric. History has been a bit mixed, I’ve followed this for many years. It got into balance sheet/debt trouble and looked precarious for several years, but remedied that, and has been a fairly decent dividend payer. So it’s a reasonably decent company I think, which might be worth putting on our watchlists as a medium-term cyclical recovery candidate. Obviously marketing companies usually see a downturn in business, often quite serious, when the economy goes into recession. That’s because marketing budgets are a quick & easy way to slash overheads for the customers, when times are hard.

Accounting adjustments at TMG are extensive, and sometimes questionable.

Yesterday’s update says -

H1 revenue £42.0m (up 12% on H1 LY), helped by notable new client wins.

“Headline” PBT in H1 is £1.0m, down 44% on H1 LY £1.8m - it blames higher interest rates.

Surely profit should be up, not down, when revenue is up 12%? It blames margin mix, esp from US tech cos.

H2 weighting to profits is usual, which I’ve confirmed on Stockopedia’s handy half-yearly results table here.

Full year guidance -

Whilst the Group remains on track to meet full-year guidance, profitability is likely to be at the lower end of the Board's expectations, with profit before tax expected to exceed that of 2022 (£7.8m).

That’s not too shabby at all, given tough macro. Although I’d suggest that the risk of another profit warning in the more important H2 looks quite high to me. For that reason I’d be reluctant to get involved at this stage.

Outlook -

"Despite the more challenging trading environment, it is pleasing to see double-digit revenue growth and continued strong Client retention and acquisition. The investments made across the Group in recent years underpin a robust performance for the period.

"We enter H2 with a degree of caution linked to the wider economic backdrop but with the tailwind of notable Client wins and an encouraging pipeline of new business opportunities, which reinforce the Board's confidence in the long-term outlook for the Group."

Paul’s opinion - I wouldn’t dismiss TMG out of hand. If you’re fishing in this sector right now, then you’re obviously looking for bargains, but must have a stomach strong enough to hold through any profit warnings (high risk of those happening, I’d say). The worst thing is to buy now, hoping it won’t warn on profit, then sell in despair when it does.

Given its history of doing too many debt-fuelled acquisitions, then getting into trouble in recessions, I would pay particular attention to the balance sheet and debt, before considering risking any money here. Looking at its last balance sheet, risk is too high for me, as it has too much bank debt, plus some acquisition-related liabilities. NTAV was negative £(9)m at Dec 2022, so I think that rules it out for me at this stage, but I’ll keep an eye on it as a possible punt once the macro backdrop is improving.

On reflection, I think with a weak, overly indebted balance sheet, and operating in a cyclical sector, I'll have to lean towards a slightly negative stance, so AMBER/RED, to reflect the higher risk.

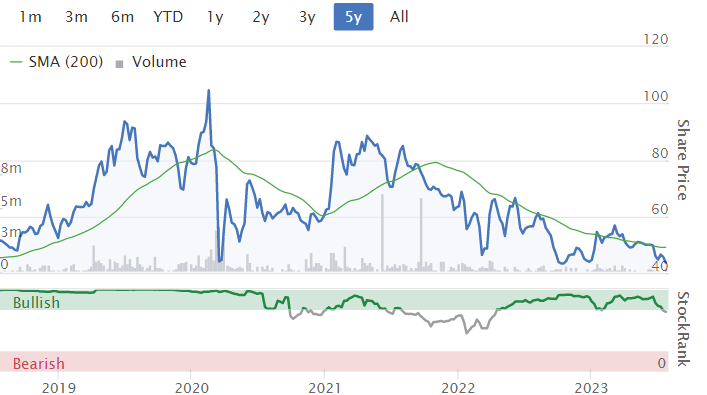

As the 5-year chart below shows, it's not created any sustainable shareholder value, being back down where it was in later 2018. There have been some divis along the way though. I wouldn't rely on the forecast 7.3% dividend yield, given its weak, indebted balance sheet, those divis are not really affordable in my view, during tough macro uncertainty.

Pod Point group (LON:PODP)

30p (£47m) - Updated Guidance (profit warning) - Paul - RED

I’ve sounded the alarm on this EV charging point installer before, because it simply is not a viable business - that’s glaringly obvious from the previous results. My first review of it here in Nov 2022 concluded that it looked a lousy investment. It took a while for the market to realise this too, but the share price has really been tanking since the inexplicable 100p high in May 2023, we’re over two-thirds down from that now, at 30p.

The founder was ousted recently, and his cash-burning strategy has left a big headache for new management. Their update yesterday was a profit warning, saying -

Revenues of £60m expected in FY 12/2023 (StockReport shows consensus of £83.4m)

EBITDA loss of £17m! (not a typo)

Net cash of £58.8m - above the market cap, but don’t get excited, as it’s ripping through that cash, and no doubt will also incur hefty restructuring costs too. Cash was £74m at Dec 2022.

Paul’s opinion - just awful. EDF still owns 54%, so the logical thing would be for it to re-absorb PODP at some point, or just let it go bust once the cash has all gone. As it’s in EDF’s interests to have more EV charging points installed, then I see a potential conflict of interest here.

Can new management at PODP restructure the company so that it might be able to generate profits? I doubt it personally. Most of its business is one-off domestic installations for EVs, on peoples’ driveways. There’s no money in that, so why bother? Other larger installations mean PODP spending on capex up-front, so further depleting its cash pile.

As things stand, I think this is a completely hopeless situation. Something has to change radically, otherwise the share price is just likely to keep tracking the cash pile downwards, with the occasional rally along the way providing selling opportunities. The institutions are high & dry, but there’s no excuse for private investors holding on. Better to throw them out, even if it means taking a haircut, or resign yourself to ongoing losses.

This was another of 2021's awful IPOs. Were fund managers' brains fried by covid, I wonder?!

Graham’s Section:

Franchise Brands (LON:FRAN)

Share price: 140p (-5% yesterday)

Market cap: £271m

This is the company whose 12% shareholder, Nigel Wray, must be hoping will turn into the next Domino’s Pizza.

The Executive Chairman at FRAN, Stephen Hemsley, is also a 12% shareholder here. He spent 21 years at Domino’s and took it “from private ownership to a market capitalisation of almost £1.5bn”.

Both Franchise Brands and Domino’s are based on the franchise model, a business structure that we talk about regularly here at the SCVR.

Let’s briefly review these interim results from Franchise Brands:

System sales (i.e. sales by franchisees to customers) +81% to £146m

Revenue for FRAN +57% to £70m

Adjusted PBT +45% to £8.6m

Net debt £79m (it previously had a net cash position)

The situation here is complicated by acquisitions. As we discussed in April, FRAN spent over £200m on a deal to buy Pirtek. The company borrowed £110m and raised £110m in new equity at 180p.

This means that we really need like-for-like numbers for FRAN, as they are more meaningful than the total numbers. Today’s report doesn’t give me an overall like-for-like growth number, but it does give the following information:

Filta International: Like-for-like system sales up 16%

Filta UK: like-for-like growth of 5%

Kemac Plumbing: Like-for-like sales up 11%

Outlook:

The outlook for the remainder of the year is positive and we anticipate full year performance to be at least in line with expectations.

The deleveraging profile is ahead of schedule and we fully expect the acquisition facilities to be repaid within 5 years.

Graham’s view

I’ve previously been neutral on this one and I’m inclined to stay that way today, although I must admit that the declining share price is starting to get me interested:

The share price is back at a level first reached in early 2020, while revenues are profits are reaching new heights:

However, are these “real” profits? Today’s income statement shows less than £1m of statutory profits, although it’s closer to £4m if you are willing to add back in the non-recurring items. Adjusted EBITDA looks unrealistic to me at £12m.

On balance, I’m still neutral. However, there are certain people you shouldn’t bet against and I do think that Nigel Wray might be one of those people. I would be tempted to own a handful of these shares just on the off chance that it turns out to be the second coming of Domino’s.

WH Ireland (LON:WHI)

Share price: 8.9p (-60%)

Market cap: £6m

This has temporarily fallen below our market cap cut-off limit but I thought it was worth commenting on:

The Company announces it is carrying out a conditional placing to raise approximately £5.0 million, before expenses, by way of the issue of new ordinary shares in the capital of the Company (the "Placing") to certain existing shareholders and other investors at a price of 3 pence per share (the "Placing Price").

The Placing Price represents a discount of approximately 86.67 per cent. to the Closing Price of 22.5 pence per Ordinary Share on 27 July 2023, being the latest practicable business day prior to the publication of this Announcement.

A deeply discounted placing is a disaster for the value of a company’s existing shares, and a discount of 86.7% is about as bad as it gets.

To raise £5m at 3p per share, the company will need to print 167 million new shares. There are only 65 million shares currently outstanding, so that’s dilution of over 250%.

Or in other words, the existing shares will represent less than 30% of the company, after the placing.

Why the desperation to sell shares at this level?

The company lets us know that they’ve made a £1.1m loss in Q1 (April to June), and they believe that they will remain loss-making “until at least November 2023”.

And then things get really serious:

In recent weeks… the Company has been in discussion with the FCA… in order to ensure that, in the absence of the injection of further capital pursuant to the Placing, the Company could deliver a solvent wind down for the Group, if required, in line with the Company's solvent wind down plan ("SWDP")...

On the basis of the adverse current and forecast trading and resultant losses, without further funding pursuant to the Placing, the SWDP would be required to be implemented on 31 July 2023.

In other words: without this placing, it is highly likely they have reached the end of the road.

That explains the desperation to raise funds.

As for why the placing is at such a discount? It’s simply a matter of supply and demand. In discussions with potential investors, they must have found that nobody wanted to refinance them at 22p. At 3p, there was some interest.

Here are the top existing shareholders:

Top shareholder TFG have indicated they will put in between £2m and £2.5m, so they will remain the top shareholder.

Irony: the broker for the placing is none other than WH Ireland. I suppose they will at least save on some of the costs associated with raising money!

Graham’s view

Firstly, I’m relieved to see that I took a neutral stance on this one in April. I’ve been bullish on many financial stocks, including small brokers and boutique investment banks, for the past year. But WH Ireland’s history of losses kept me cautious. I said “it seems to offer a decent service to its wealth management clients, but it hasn’t done enough over the years to suggest that its stock is worth buying.”

Today’s news puts a new spin on things, and not in a good way. It shows that management drove the company right to the cliff edge, where they were just a few days away from winding down.

They will now reduce headcount and seek to cut costs, but does that mean the stock is worth backing at the current level? I would say no. At around 9p per share, that implies a new market cap of £21m (with 232 million new shares after the placing). This is superficially too cheap for a company with total AUM of nearly £2 billion, but the company hasn’t paid a dividend since 2015 and the track record of profitability is spotty to say the least!

So I’m not convinced that this outfit is being run for the benefit of its shareholders, and today’s 87% discounted placing would appear to confirm that. I’ll stay neutral on the basis that I wouldn’t want to short it after it fixes its balance sheet, and it could be a takeover target. But I wouldn’t want to buy it either.

Foxtons (LON:FOXT)

Share price: 38.6p

Market cap: £116m

Let’s check in on this estate agency business. The highlights table is promising:

Note the small difference between adjusted operating profit and actual PBT: I love to see it!

London property sales remain very difficult, but Foxtons’ success in lettings offsets this.

CEO comment:

Our continued focus on growing non-cyclical and recurring revenues is working and has enabled us to deliver strong revenue and profit growth despite a challenging sales market and investing in recruiting more fee earners.

In the first half of the year we cemented our position as London's largest Lettings and Sales estate agency brand. We not only had the largest market share of instruction volumes in London, but we also grew instruction market share quicker than any of our competitors as recently implemented operational upgrades yielded significant gains.

Organic growth in non-cyclical lettings revenue was 14%. Lettings revenue almost hit £50m.

Sales revenue was down 16% to £17m. As indicated above by the CEO, the company maintains that it grew market share despite this.

Outlook - trading is in line with expectations. In sales, volumes are up as deals in the under-offer pipeline are completed, but new enquiries are lower (thought to be due to rising mortgage rates). So it’s a mixed outlook for H2 in sales.

Net debt is £2m and is not at a level that worries me. The company has access to a £20m RCF.

Interim dividend is unchanged at 0.2p.

My view

I feel obliged to take a positive stance on this stock today, something I’ve resisted doing before. In April, I described Foxtons as a turnaround stock that “might” succeed. The share price hasn’t budged since then but the turnaround is materialising, and it’s doing this despite interest rate rises in an overall very tough property market.

The exciting prospect is that if the company can generate this level of profitability when the sales market is in the doldrums, what might it do when London property sales are booming again?

It’s a different business these days, compared to what it was before. It now has a very substantial and stable revenue stream from lettings, combined with an option to generate large profits from sales, when conditions allow.

So I’ve seen enough here to give it the green light at this valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.