Good morning from Paul! I'm ready for the weekend, after a really busy week here writing the SCVRs whilst Graham's sunning himself in the Med!

Right, all done for today and the week! Have a super weekend.

It's the last trading day for AIM companies to report their FY 12/2023 accounts before shares are suspended, so there's some dross on the companies reporting list today.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

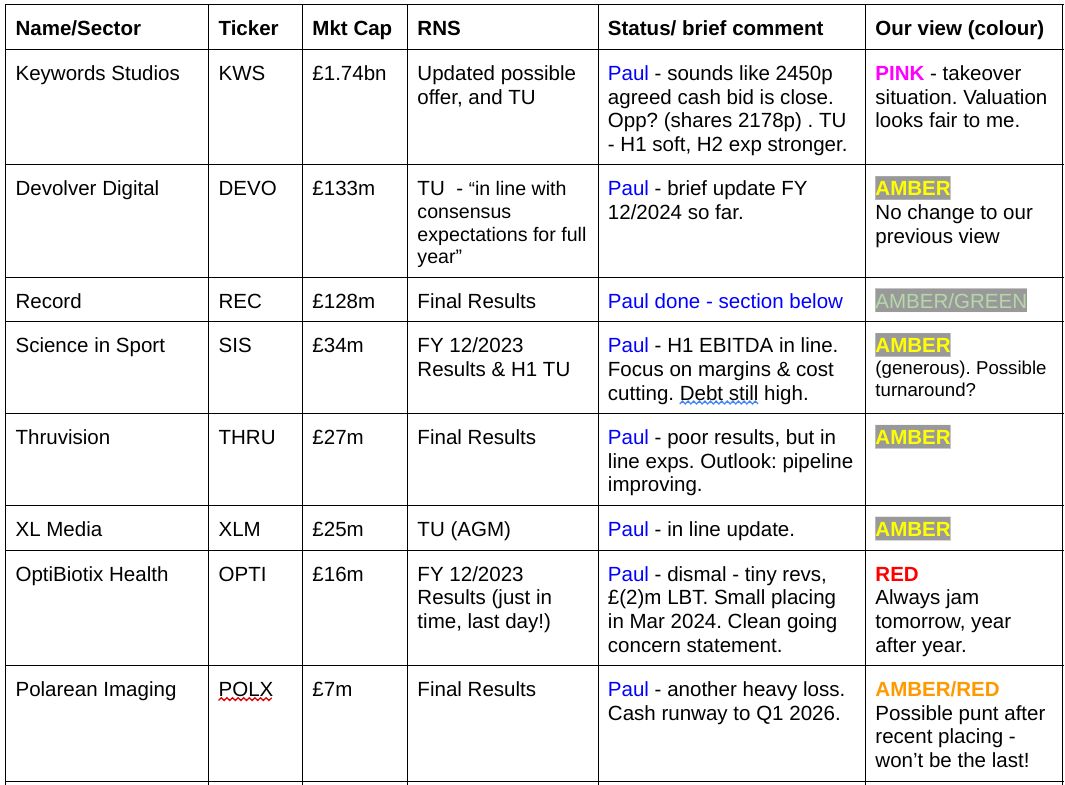

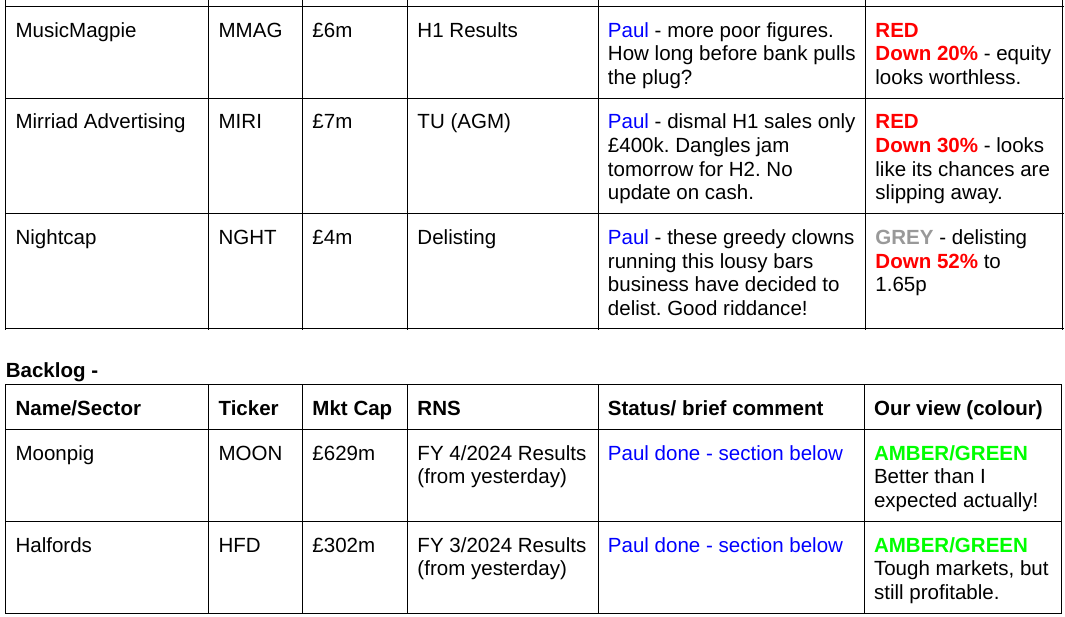

Companies Reporting

Summaries

Halfords (LON:HFD) - 138p (£302m) - FY 3/2024 Results - Paul - AMBER/GREEN

Trading continues to be subdued, but in tough macro I'm quite impressed HFD has remained profitable and paying divis. Finances look fine, with negligible net debt and ample liquidity. Could it attract private equity bidding interest? I wouldn't be surprised. On balance, I think there could be good cyclical upside here, but have no idea on timing.

Moonpig (LON:MOON) - up 15% y’day to 183p (£629m) - FY 4/2024 Results - Paul - AMBER/GREEN

I like these results (out yesterday). It's demonstrated very strong cashflow, which has taken a big chunk out of the previously worrying net debt. A positive outlook, and valuation that now looks quite reasonable to me, means I'm happy to move it up a notch from amber, to AMBER/GREEN.

Record (LON:REC) - down 1% to 64p (£128m) - FY 3/2024 Results - Paul - AMBER/GREEN

Results look OK, and the main attraction of a big dividend yield (now 7.2%) is maintained. However, outlook comments sound a bit cautious, and with talk of the medium-term, it sounds as if any upside on the shares might require patience. So I've shifted down a notch to a still positive AMBER/GREEN.

Halfords (LON:HFD)

138p (£302m) - FY 3/2024 Results - Paul - AMBER/GREEN

I’ve been keeping half an eye on HFD shares, as it looks cheap, and a good potential cyclical (no pun intended) turnaround.

Its results didn’t come up on my usual sweep of the RNS, I think they use a different news service. So I’ll come back to it now.

Three headlines make interesting points -

Strong revenue growth of +7.9%, with underlying profit before tax of £36.1m

Good strategic progress; market share gains helping to offset significant external headwinds

Strategically important Services business now represents more than half of Group revenue

As you can see below, HFD has been struggling for a while, with a downward trend in broker forecasts reflecting that. Probably due to tough macro, but also the pandemic cycling boom probably pulled forward demand, which for long-life products like bikes, means we’re now seeing reduced demand. Who knows what normal will look like, as we've been in permanent crisis for over 4 years now.

Although it is an important point that HFD has been growing through diversification into buying & rebranding car repair/servicing/MoT businesses. That strikes me as a good sector to consolidate, being very fragmented, and capable of improvement through centralising websites, marketing, etc.

It blames the following areas for weak performance -

“Business performance has, however, been impacted by continuing declines in the Consumer Tyres and Cycling markets, and in consumer demand for big ticket purchases… drivers continue to delay the replacement of unsafe tyres. In a recent survey of 6,000 tyres at Gatwick, Manchester and Edinburgh airports, we found that one in four vehicles had tyres that were dangerously worn or damaged.”

Reading the summary points, this actually seems quite reassuring to me -

Dividends total 8p gives a lovely yield of 5.8%, and that could have scope to rise, if we’re at or near the low point of the earnings cycle, perhaps?

Low margins - adj PBT of £43.1m is only 2.5% of the £1,697m revenues. Does this indicate a fundamentally poor business, or could it be an opportunity to see operationally geared upside (with gross margin 48.5%) in a consumer recovery? Or both maybe?!

Adj EPS is down 14% to 15.1p, that’s a PER of 9.1x - cheap, if we’re at bottom of the cycle earnings, but we don’t currently know if that’s true or not.

However it then goes on to say that a reduced adj EPS of 12.7p (PER 10.9x) is more accurate and comparable to forecasts, which includes costs of running (since disposed of) tyre supply operations, which will now be outsourced, hence I presume the costs will increase in future correspondingly. The StockReport shows broker consensus of 12.1p, so actual looks to be a beat.

Outlook - CEO comments make me cringe by using the meaningless, infuriating and seemingly now ubiquitous phrase “profitable growth” -

“While the short-term outlook remains challenging, we continue to build a unique, digitally-enabled, omni-channel business, which is well positioned for profitable growth”.

This longer outlook section below sounds like a business that’s hunkering down to endure continuing tough conditions. Also it’s interesting to see the mention of sea freight costs rising, and the effect quantified -

“Trading since the start of FY25 has continued to be soft, impacted by low consumer confidence around big ticket, discretionary purchases, and poor spring weather, which has reduced store footfall and affected sales of both cycling and staycation products. Whilst we continue to expect market share gains in the year ahead, based on what we are currently seeing we now expect market volumes to decline in FY25 in cycling and consumer tyres, and to remain broadly flat in motoring servicing and retail motoring products.

Inflation remains a material headwind, particularly driven by the 10% increase in the national minimum wage. More recently we have seen very significant increases in sea freight rates, with spot rates more than doubling since the start of our financial year. Whilst we continue to successfully secure rates well below market spot rates, we now forecast freight costs to be £4-7m higher than we anticipated at the start of the year.

Against this backdrop, we continue to focus on optimising the platform we have built, and controlling what we can. As such, we plan for proportionately fewer resources to be allocated to strategic transformation, as set out in more detail at the end of the Strategic and Operational review.

We do not expect these headwinds to persist in the long term. Consumer price inflation is easing and our core markets are expected to improve in the mid-term. We remain confident that the financial targets announced at the April 2023 CMD are achievable assuming markets ultimately recover as forecast, albeit this will take longer than we envisaged last year.

We remain very confident in the Group’s strategy, as we build a stronger and more resilient platform for the future and continue to take market share.”

I was hoping to see signs of economic recovery by now, so it’s disappointing to have lots of companies saying there isn’t yet much of a sign of recovery. Trouble is, we don’t really know if that’s due to macro factors, or that competitors are taking away business from each company? Our house expert on the cycling sector, PlanetX, has been telling us for a while in the reader comments that selling bikes has been tough for a while, with a glut of supply due to over-production and over-ordering in the pandemic boom. Maybe he can update us with the latest market conditions, and when things might normalise?

Balance sheet - looks healthy. NTAV is modest at £70m, but being a retailer, it’s mainly supported by trade creditors, hence there’s not much need for equity on the balance sheet. Nice position to be in, where suppliers effectively fund your business, interest-free! Many retailers operate like this, and if stock turn is managed well, you can often sell the product for cash to end customers, before you’ve paid the supplier.

With negligible net debt (excl leases) and a bank facility of £180m to April 2028 (option to extend to 2029), liquidity seems ample, and safe.

So no issues here to fear dilution or insolvency.

Cashflow statement - is large and complicated, with the lease entries in particular making a nonsense of things, with supposed cash generation of £178m, but further down there are (property) lease costs of £93m.

Capex was £46m, just over halved on last year. This includes £23.7m of intangible assets, so I’d like to know if that’s IT spend, which it looks like.

Share repurchases cost £10.2m, plus divis cost £21.7m. Given the balance sheet includes hardly any net debt, these shareholder returns look fairly safe, providing trading doesn’t deteriorate any further. The risk is that future divis might come under strain if it moves into losses in future. But for the time being the yield seems safe, but is subject to flexibility under HFD’s dividend policy.

Paul’s opinion - I still like HFD as a potential cyclical recovery share. I’m encouraged that, despite difficult market conditions, it’s still profitable and financially sound - there’s ample liquidity, and negligible net debt, so this looks a fairly safe bet.

There was bid talk a while back, and I suspect this could attract bidding interest from private equity, which is a nice reason to own this share.

On the downside, conditions still sound difficult, with as yet no sign of a consumer recovery.

On balance I think I’m leaning slightly positively in my assessment of risk:reward, taking into account that it’s still profitable, even in very tough macro, and has weathered multiple macro storms (pandemic, energy crisis, cost of living squeeze, higher wages/energy/freight costs, etc) and still remained profitable and cash generative. There must be less competition too, as independents either close down or get bought by Mike Ashley!

Halfords is a very recognisable brand too. I often buy products like oil or brake fluid there, as they’re too heavy to be ordered online at a reasonable delivery price. Although I do worry that they over-charge for smaller items, and must suffer a lot of pilferage from customers and staff (if you can find any in store!).

Leases are relatively short, and flexible, so it should be able to run down the cost of occupancy as sites come up for renewal.

With a perhaps 1-2 year view, it’s possible that HFD might be starting to report improved demand and profits, which I imagine could see its shares recover, with possibly 50-100% upside on the current share price if performance does improve? So yes, I quite like it, but don’t know when the low point for earnings will be, there could be further downside before a recovery, who knows?

Moonpig (LON:MOON)

Up 15% y’day to 183p (£629m) - FY 4/2024 Results - Paul - AMBER/GREEN

Nice prompt reporting here, I do think that UK companies should generally have quicker reporting cycle.

Revenue and profit growth underpinned by technology and innovation

From the options above, my preferred profit measure is adj PBT (where adjs are reasonable). This is up a modest 5%, not bad I suppose, in a macro situation which has been tough for discretionary consumer spending. It sounds like a one-off benefit was gained this year from some experiences vouchers sold in the pandemic having expired without being used.

That’s a good PBT margin of 17.1%, demonstrating a business with decent pricing power.

“Adjusted profit before taxation of £58.2m (FY23: £55.4m) reflecting stronger trading offset in part by higher interest charges and the amortisation of technology platform investments.”

Debt - my previous concerns with Moonpig was that it overpaid for a poor acquisition, and ruined its balance sheet. That seems to be getting repaired now - eg

“ Net leverage improved to 1.31x at 30 April 2024, from 1.99x at 30 April 2023. Given our strong cash generation, there is potential for a similar reduction in net leverage in FY25. To maintain an efficient capital structure, our target is to operate with net leverage of approximately 1.0x over the medium term, with flexibility to move beyond this as business needs require.

We will continue to prioritise investment to drive the execution of our growth strategy. With our consistent strong operating cash generation and the progress being made with deleveraging, we will also have the financial flexibility to consider returning excess capital to shareholders."

Balance sheet - still looks very weak to me, but this is a capital-light business model. NAV has improved from £(33.7)m last year, to scraping into the black at £3.8m. But that last figure includes £204m of intangible assets (mostly goodwill and similar). So NTAV is a dismal £(200)m, with this balance sheet hole being mostly filled with £118m borrowings. Net debt excl leases was £109m, down a very impressive £39m from last year. To put that another way, to reach net cash neutral position, would take about 3 more years of retaining all cashflow generated.

You could argue that a business as cash generative as this could happily support c.£100m net debt, but that’s not cheap any more (finance costs are a walloping £20m pa), and it’s the reason why there are currently no divis.

Overall though, I’m happy to say that it’s moved from an alarming balance sheet weakness, to an acceptable level of balance sheet weakness where I don’t think there’s any risk of needing to do a placing any more.

Management talks about doing more acquisitions. Let’s hope they don’t, as there’s no evidence they know what they’re doing on that front, and made a bad decision in the past. A decent, cash generative business making bad/overpriced acquisitions squanders shareholder value in my view.

Also bear in mind MOON was a cynical, overpriced IPO during the pandemic, and is still way below that price -

Outlook - sounds pretty good, I have to say -

“Trading since the start of the year has been in line with our expectations with both new and existing customer orders in growth. In the context of the current macroeconomic environment, we expect FY25 revenue growth (after adjusting for temporarily higher breakage on experience vouchers in FY24) at a mid to high single digit percentage rate, underpinned by growth in orders at the Moonpig brand.

Our business is well positioned to deliver sustained growth in revenue, profit and free cash flow, driven by our continued focus on data and technology. With respect to the medium-term, we are targeting double digit percentage annual revenue growth, an Adjusted EBITDA margin rate of approximately 25% to 26% and growth in Adjusted earnings per share at a mid-teens percentage rate.”

The Moonpig Plus subscription scheme has exceeded our expectations, passing the milestone of half a million members within one year. Our investments in new AI technologies are delivering an increasingly personalised experience for our customers. As the clear online leader in greetings cards, Moonpig Group is well positioned to benefit from the long-term structural market shift to online."

Valuation - apparently 8 brokers cover MOON, but none of them let us see their notes! The Stockopedia chart of broker consensus does show a slight tick up in forecasts for FY 4/2025 and FY 4/2026, as you can see -

What PER should we put these forecasts on? I’d say given the more perky outlook comments about future growth, a PER of say 15-20 is justifiable. This is a quality, cash generative business I’d say, and the balance sheet weakness is no longer a deal-breaker for me, since it has demonstrated very good debt reduction this year.

That gets me to (based on 12.3p current year forecast) a share price of 185p to 246p. The current price is 183p, so that shows some potential upside in my view.

Paul’s opinion - I’m much happier with these numbers than last time. Good progress has been made in debt reduction, emphasising that this is a nicely cash generative business. Let’s just hope management don’t repeat the previous mistake of overpaying for a dubious acquisition, and taking on too much debt to fund it.

It’s market leader in online greetings & presents, with a very well known brand, which in itself creates a barrier not to entry, but to scaling up (massive marketing spend over years is required, and that’s a sticky sort-of-asset, since people remember jingles for many years, even decades, if they’re catchy)

My view has been steadily improving as the facts & figures improve - we always look at each company with fresh eyes. So amber/red last autumn became amber the last time I looked on 14/3/2024.

Putting together the big reduction in net debt this time, and a perky outlook, combined with valuation which I think could have further upside, I feel the correct view to take now is up another notch, to AMBER/GREEN.

I like the sound of its subscription service, and might have to look into that. Despite having birthdays recurring on my calendar, I still frequently forget to send cards in time, so automating it completely does sound a nice idea. Ecards have never taken off, and remain just a curiosity in limbo. You can't beat receiving a physical card through the door, especially if it comes with a bottle of wine.

Record (LON:REC)

Down 1% to 64p (£128m) - FY 3/2024 Results - Paul - AMBER/GREEN

Record plc, the specialist currency and asset manager, today announces its audited results for the year ended 31 March 2024 ("FY-24").

The share price remains in the doldrums, despite this quite upbeat-sounding headline -

“Positive net inflows take AUM to a record high”

I’ve viewed REC shares positively, GREEN, three times so far this calendar year. Although I’m the first to admit that I’m certainly not an expert in this field, so maybe I’ve missed something? What appeals to me is its niche activities, a step change upwards in EPS throughout the pandemic, good cashflows, and generous dividend yield, with an OK balance sheet.

It’s not a forex/payments company, it’s more a specialist fund manager.

To save me typing, here’s the highlights table - which I’d say looks OK, considering the share price has been bombed out for a while -

Outlook - sounds a bit defensive, with not much sign of profit growth (NB not "profitable growth" thank goodness!) -

I don’t really understand why profits are flat, given that AuM are hitting new highs?

Dividends - total 4.6p, a yield of an attractive 7.2%

Balance sheet - looks healthy, with £29m NTAV, almost all liquid assets.

Paul’s opinion - I’ve not read all the detailed commentary, so this review is just a quick skim of the numbers. This share remains moderately attractive to me, with the main attraction being a lovely dividend yield.

Outlook comments talk a lot about the medium-term, strategy, etc. So it’s giving the impression of being a little bit under pressure, but still producing decent profits, just not any further profit growth.

Maybe I should moderate a little, from green to AMBER/GREEN, just because it has the look of something that’s more likely to tread water, rather than deliver stunning growth. Although getting paid 7.2% pa to sit and wait, is far from shabby.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.