Good morning!

Today we have:

- Judges Scientific (LON:JDG)

- Johnson Service (LON:JSG)

- Volvere (LON:VLE)

- SIG (LON:SHI)

Finished at 2.40pm.

Short political comment - I'm slightly alarmed by overnight news from America about riots and looting.

Everything in America tends to be bigger and louder, and that goes for civil unrest, too.

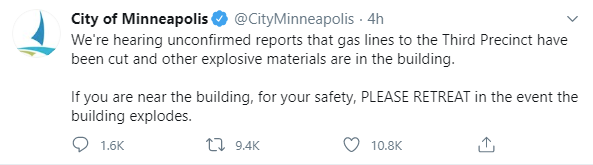

Check out this tweet from the verified Twitter account of the City of Minneapolis:

That police building has been abandoned by the authorities and set on fire by the protestors.

I've seen videos of protestors climbing on top of moving vehicles and emptying large department stores. There is unrest in Minneapolis, Denver and LA.

But I don't want to overstate the importance of these events.

I was living in London during the riots of 2011, and remember thinking how strange they were - but they ended soon enough, and weren't talked about much afterwards.

It's no coincidence that they happened in August - rioting is much less fun in the cold and rain.

The relevance to investors is that we are about to have a very noisy election season in the US, and I'd expect tensions to be high for the next few months. We can look forward to thousands of headlines about the Trump/Biden contest.

Most of these stories can be safely ignored by investors, but I wouldn't want to ignore them completely.

The extremely divided country is still a great place to invest, but politics will be an important theme this year. For example, President Trump has just signed an executive order to make it easier to sue social networks.

The monopolistic power of Big Tech (especially Twitter and Facebook, but others too) could be vulnerable.

I own shares in Alphabet and through Berkshire Hathaway, I also own Amazon and Apple.

Since the outcome of this year's election will play a big role in determining US tax policy, competition policy, trade policy, and (increasingly) monetary policy for the next four years, I think it's compulsory to keep half on eye on it.

Judges Scientific (LON:JDG)

- Share price: 4970p (+1.5%)

- No. of shares: 6.3 million

- Market cap: £310 million

Acquisition of Health Scientific Company Limited

Volvere is on my mind today - it's my top holding by a mile, and it has released final results.

But it's a very small company, and very illiquid. Something like Judges is more appropriate for a much larger group of investors.

I covered Judges during the height of the Covid-19 stock market crash, and described it as being "on sale" at the time. Its share price that day was £32.25p.

It's up over 50% since then - and I'm sure many of you will have participated in that rally.

It is no longer "on sale", at a P/E multiple in excess of 30x.

The reason for its high valuation is that it tends to earn very high returns on its investments (in scientific instrumentation businesses).

Today's acquisition appears in line with that track record.

Judges has bought "Heath Scientific Company Limited" which owns Thermal Hazard Technology Limited.

This company: "specialises in the design, manufacture and sale of instruments used to measure the thermal properties of lithium batteries and other reactive materials. Its main product, the Accelerating Rate Calorimeter, is a key tool to improve and verify the safety of lithium batteries and of other chemical reactions."

Sounds good - should be a growth area.

- £5.3 million purchase price, plus another £2 million in earn-outs.

- Heath earned PBT of £0.7 million in FY April 2019 (on revenues of £4.4 million)

- adjusted for non-recurring costs and for costs that will be eliminated by Judges, operating profit would have been almost £0.9 million.

- Net tangible assets of £1.9 million and cash of £0.8 million.

All of these numbers are more than a year old - I wonder if there was an improvement in FY 2020?

Based on the 2019 numbers, Judges is paying an enterprise value of £4.5 million (excluding the earn-out). So that's only 5 times operating profit.

Other key points:

Synergy - Judges expects a "constructive interaction" between Heath and its first investment, Fire Testing Technology. Both companies make "calorimeters", and use similar underlying science.

Retirement - I think this is a common feature of the Judges strategy. It enables founders of small scientific businesses to retire. Heath's MD, a co-founder of the business, will retire. He will be replaced on Heath's Board by his son.

Self-funded earn-out - Judges will have to pay £2 million to the sellers, if Heath earns adjusted EBIT of £1.2 million in FY April 2020 or in calendar year 2020.

But if Heath does that, and its profits convert to cash, then it will probably have around £2 million on its own balance sheet anyway. So it will be able to fund the earn-out itself.

Debt with (hopefully) rapid payback - Judges tends to borrow to fund its acquisitions, and pay back those loans quickly. This is the process by which it produces incredible value for its own equity holders.

If it had simply raised equity to fund every deal, then it would not have been the stunning success for its shareholders that it is.

The latest deal is being funded by a facility from Lloyds Bank. Hopefully it will not take too long to pay it back.

My view

It should be clear that I am positive on this news.

As stated before, the main question mark for shareholders at this point is whether the strategy can be scaled up to manage a much larger and wealthier group.

It's not a bad position to be in. Judges has been so successful that it is now arguably too wealthy to be able to deploy all of its cash flows using the original strategy. The special dividend paid last year was highly noteworthy in this regard.

Ultimately, my view on this is that I would back management, even if they have arguably more funds than they need.

I would much rather back management who have proven they are capable of allocating small amounts of capital extremely well, instead of backing management who lack any convincing track record at all (which let's be honest, is probably most management teams).

If David Cicurel finds that there aren't enough good deals coming his way, I expect him to propose even more of those juicy special dividends for Judges shareholders. That wouldn't be a terrible outcome, would it?

Johnson Service (LON:JSG)

- Share price: 124.12p (-13%)

- No. of shares: 370 million

- Market cap: £459 million

Proposed Placing to raise approximately £85 million

It has been a long three months since I mentioned this company's final results.

As a provider of table linen and napkins to the hotel, catering and hospitality industry, it is not ideally placed to weather these conditions.

As of early March, it said it had not seen any impact on trading. Then of course, the lockdowns began. On March 20th, it unsurprisingly announced that a slowdown had been seen.

Net debt was c. £88 million at year-end.

Placing - it wants to issue 74 million new shares at 115p each.

That's a fairly aggressive discount to last night's 143p close, though it's less aggressive if you look at the average price over the last two weeks (which is the perspective the company takes).

Raising £85 million would effectively wipe out the debt that it started the year with.

Trading update - "significant disruption".

In the Workwear division (garment rental, protective wear and laundry), revenues were slightly down year-on-year in Q1 and down 12% in April. Some indications of customers reopening in May.

As for the Hotel/Restaurant/Catering division, it has basically shut down. March revenues were down 27% and April down 97% (no surprise that economic data points to this being an awful depression, possibly the worst one ever).

May numbers are only "slightly ahead" of April's, meaning that they are still close to zero.

Management actions - huge cost cuts, no dividend, staff furloughed, tax payments deferred, etc.

Net debt - reduced to £85 million by the end of April, thanks to cash conservation measures. The total size of the bank facility is now £175 million, so there should be some headroom.

Covenants are relaxed until the end of next year.

Government Loan - JSG is eligible for £150 million under the Covid facilities.

Scenario Planning - JSG has modelled various scenarios, and thinks that peak net debt will occur in April 2021, at £110 million.

But in bear case scenarios, e.g. a slow recovery in hospitality and catering only starting in September, net debt would peak at £142 million.

In these scenarios, JSG would be forced to reduce stocks and cut its PPE spending even further, and would be reliant on the government's furlough scheme for longer.

Net debt of £140 million+ would clearly be uncomfortable if the bank facility is only for £175 million. The Government's Covid facility would be required to save the day.

My view

I think this Placing is a good idea for the company. Not doing it would risk leaving it in a very uncomfortable position over the summer/Autumn.

However, taking a longer view of JSG's progress, I must say that I think the overall cash flow picture leaves a lot to be desired.

Since 2008 (which was another year when it raised lots of equity), it has paid out c. £60 million in dividends, by my calculations.

Isn't it interesting that today's proposed equity raise is big enough to reverse all of those dividends?

The ROCE/ROE numbers here aren't bad, and those who invested in the depths of the 2007-2008 financial crisis have done very well, but the overall quality of the business is still somewhat questionable for me.

Volvere (LON:VLE)

- Share price: £14.50 (+5.5%)

- No. of shares: 1.8 million

- Market cap: £25 million

Please note that I have a long position in VLE.

As you may already know, I have an overly large position in this - 25% of my portfolio. Not exactly in tune with standard portfolio construction practices.

When I originally bought in, it was for less than 10%. But the price has nearly trebled, so here was are.

It's a turnaround investment vehicle, typically buying businesses out of administration. It then reinvigorates them, gives management a decent stake, and helps them to grow, before selling them on.

Results - for those who closely follow the company, I don't think these results contain much that is new.

The main points are:

- NAV per share now £13.85

- Net assets £25.4 million (excluding non-controlling interests), of which £19 million is cash.

- The only operating subsidiary which was left at the end of year, Shire Foods, grew revenue by 25% and PBT (before Volvere's charges) almost doubles to £1.4 million.

Volvere owns 80% of Shire (the rest of it was awarded to management), so its adjusted pre-tax profit that is attributable to Volvere is £1.1 million.

One of the key features of the Volvere strategy is incentivising management at subsidiaries, and I note that Shire paid a £500k dividend. Shire management will have received £100k of this.

Success in 2019 is explained as follows:

I am pleased with the growth achieved in 2019, which came principally from a deepening of relationships with existing customers, resulting in wider distribution and broader product ranges. Particularly encouraging was the growth in vegan product lines, where we believe we have developed flavours and textures that appeal to a wide consumer audience

Covid-19 impact - "too early to say" whether the sales uplift to supermarkets will be sustained and result in full-year growth.

Foodservice customers have been hammered, and they represented 12.5% of Shire's 2019 sales. Volvere expects them to return to normal when trading restrictions are ended.

Production and costs are affected by social distancing measures - "we are still achieving an encouraging level of output and, for the most part, meeting customer demand".

Indulgence Patisserie - a small acquisition made earlier this year. It is making progress, with more to do:

"...we have been working to improve customer and supplier relationships, increasing teamwork and investing in new systems - and whilst we have been encouraged on a number of fronts, there is still work to be done in making the business more efficient and reducing costs."

Strategy - this bit is interesting. Jonathan Lander said on April 21st that markets were experiencing "peak gloom". But it looks like Volvere is waiting for more fallout from this crisis, before it does another deal. It's not in a rush:

We are already seeing increased levels of distressed deal flow due to the COVID-19 pandemic. The length of the economic effects is uncertain, but I fear it is likely to extend well into 2021 and possibly beyond. The anticipated reductions in financial support from state schemes will probably trigger more hardship for individuals and companies.

We will do what we can to rescue those businesses which we believe viable, in all sectors and geographies, in accordance with our investment mandate, but with added focus on building a larger group of food businesses, leveraging our competencies in this area.

I think this is fairly clear, and sounds sensible.

Remember that Volvere's strategy typically involves buying out a bank loan for a company in administration.

But with the government support schemes currently in place, such as furlough and loans, many companies have avoided going into administration.

It makes sense to wait until some of these schemes are over, and only then to make a move.

My view

No change to my view here (what did you expect?!)

The share price is now at a small (5%) premium to NAV, but I don't think that's unfair. Remember that this vehicle has compounded wealth at an extraordinary rate for nearly 20 years now. A small premium for this sparkling track record hardly seems unreasonable.

If we deduct year-end cash from Volvere's market cap, we are left with an enterprise value of just £6.4 million.

With Shire earning (pre-tax) £1.1 million for Shire in 2019, the implied pre-tax earnings multiple is a mere 6x.

Some cash has been used to buy Indulgence, but I note that Volvere did not even pay a premium over book value in that deal. And there is clearly some potential for it to benefit from the association with Shire, as they are both in the business of manufacturing frozen food.

Happy to continue holding, then.

SIG (LON:SHI)

- Share price: 29.7p (+6%)

- No. of shares: 592 million

- Market cap: £176 million

This ticker has been blowing up my Twitter feed, and blowing up the message boards too, by the looks of things.

It's a mysterious thing - why do some companies capture the imagination? And why would SIG capture the imagination? It's "a leading supplier of specialist building products and solutions to trade customers".

One feature of the markets that will never change, is that people are attracted to high-risk shares.

The SIG balance sheet is broken, and they are trying to fix it:

Strengthening the capital structure for the long term:

Constructive discussions ongoing with lenders to reset covenants and agree other amendments to the Group's financing facilities

Intention to raise approximately £150m in new equity in the coming weeks

Good luck to the company. If you are holding the equity in this, one of your main sources of risk is that even if a fundraising occurs to save the company, it can be almost impossible to predict how much of it you'll be left owning.

In an unfavourable scenario, the percentage you are left with is tiny.

I hope that doesn't happen to the existing equity at SIG.

Calling it a day there, have a fantastic weekend everyone. Thanks for your comments as always.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.