Good morning, it's Paul here with the last report for this week.

Today's report is now finished.

Yesterday was a bit of a rush, because I had to write the usual SCVR here, and then go into the City for a meeting with the management of Intercede (LON:IGP) . Sod's Law being what it is, I was actually invited to two meetings, both at 1pm in the City - the Intercede one, and another with Sosandar. Both of these companies are key positions in my personal portfolio. So I had to chose which one to go to. Given that I'd already spoken to SOS management earlier this week, and know the company very well, then the time seemed better spent getting to know IGP a little better.

Intercede (LON:IGP) meeting

(at the time of writing, I hold a long position in this share)

This is a small software company, which specialises in cyber-security (digital identities) which replace passwords, ensuring that only authorised users can get access to computer systems for large organisations.

I've written about it loads of times here in the last 5 years, mainly negatively in 2015 and 2016, then turning positive more recently, at the potential for a turnaround under new management. Here's the archive of articles.

The exciting part is the client base, which includes US Federal agencies, and 5 out of the world's top 6 aerospace companies. Plus major banks, and others. It's the client list that makes this stand out. In the past, it didn't seem to gain traction, in terms of growth.

New management has slimmed down the costs, so that it's now operating around breakeven, and is cashflow positive. The existing client base is very sticky, and has recurring/repeat business. So new management has stabilised the business.

I reviewed its latest interim results here, on Monday this week.

This is clearly subjective, but it seemed to me that the tone felt a bit more upbeat than at my last meeting in June 2019. In the past, the discussion was all about stabilising the business, cutting costs, etc. This time, it was more positive, about the sales pipeline, and what the company is doing to attempt to win new business.

5% revenue growth in H1 was a bit disappointing, but hopefully that can accelerate in the future.

We had a couple of amusing moments in the meeting, e.g. a couple of times the lights in the meeting room (at FinnCap) suddenly switched off. Nobody knew why, but the CEO continued the briefing without skipping a beat. Also, he seems good at multi-tasking - e.g. whilst talking to an investor on the conference call machine, he noticed that my pen wasn't working, so handed me a new pen (and some sandwiches) while he was talking. Then, as I struggled to work out how the pen worked, the CEO noticed, and calmly said, "Paul you have to take off the little yellow clip", then immediately carried on talking into the phone to the other investor.

We all had a good laugh at the fact that I was there trying to understand & review their business, but had just failed to work out how to operate a pen! You had to be there, but it was good fun.

Oh, one other point. The CEO seemed a bit miffed about comments from private investors that IGP wasn't innovating any more. He said (in a non-aggressive way) that any investors are welcome to call him, if they want to discuss product innovation, or any other aspect of the business. He's happy to explain the facts to anyone interested.

I cannot predict the future, but my feeling is that there's a good chance that IGP might develop well under the newish management, in the next few years. Time will tell. I want to buy some more for my SIPP, when funds are available (which they are not at the moment).

Obviously the current round of meetings in the City are going well, as the share price has been rising nicely this week. Although it should be noted that this share is extremely illiquid, and the price moves on tiny volumes, so really the short term share price is artificial - as you cannot buy or sell in any size most of the time. My broker told me there are backed-up buyers, but no sellers in the market right now. Shares like this often go to sleep in between trading updates & results, and drift back down. I bought most of mine in summer 2018, and generally like to give things at least 2-3 years to gestate. So far, so good.

Should we meet management?

This is a really good question. I know plenty of investor friends who steadfastly refuse to meet, or talk to management, because they've been hood-winked so many times by unscrupulous management that have lied to them. Let's face it, AIM is full of dodgy companies, with dodgy management, and plenty of city advisers who are happy to lie through their teeth (explicitly, or by omission), in order to earn fat fees.

I've been doing small cap investing for over 20 years, and like everyone else, have developed my own approach, and am still learning. As things stand now, my approach tends to be;

1) I'm very selective about meeting management. It takes up a lot of time to meet a company, travel, preparing beforehand, and thinking about it afterwards. It roughly halves the available time in the day. Also it's quite intense & stressful, so I don't waste mine or their time, unless I find the company genuinely interesting.

2) I never slag off any company I meet. That's just rude. If I think the company is rubbish, then I won't meet them in the first place. If advisers have invited me to meet a company, then I'll always be polite, put on a suit, prepare beforehand, and ask some sensible questions. To a certain extent you have to "play the game" in the City - otherwise you won't get invited to any future meetings.

3) It's important to try to keep some distance - in order to be as objective as you can. We're not there in a meeting to make friends. We're there to find out more about the company. I try to be positive, and supportive towards management/companies that I think are good - but that does carry a risk, that you can end up finding it difficult to detach, and sell up, if things go wrong. Experience has taught me that more hard-nosed investors, who unceremoniously ditch shares when things go wrong, are usually more successful than people like me, who tend to give management the benefit of the doubt.

4) Overall, I think that small caps investing is very much about backing great management. Hence, I do want to meet management of all my main holdings. What are the key traits I look for?

a) Intelligent fanatics - i.e. entrepreneurs who live & breath the business. Not showmen, or financial engineers. They should be able to instantly & fully answer any question about their business

b) Ideally plenty of skin in the game (big personal shareholding). OR a burning desire to prove themselves

c) Prior experience & success in a similar sphere - or even failure, if they've learned the key lessons from previous mistakes

d) Honesty/Humanity - admitting mistakes, and showing some human traits, not a fake image.

5) Most importantly - if something doesn't feel right, about management, then don't back them. That's your subconscious telling you that something is wrong.

What do subscribers think? I'd be interested to hear your thoughts on this issue.

Reach (LON:RCH)

Share price: 92.5p (up c.11% today, at 11:21)

No. shares: 299.3m

Market cap: £276.9m

Reach plc is today issuing a trading update for the 52 weeks ending 29 December 2019, covering the period from 1 July to 29 November 2019 ('the period').

This update comes across quite well. Being a newspaper group (formerly known as Trinity Mirror), both circulation & advertising revenues are in long term decline.

What's interesting about today's update, is that the rate of decline has improved somewhat;

On a like-for-like basis, revenue during the five months ended 24 November 2019 fell by 4.4%, an improvement on the 6.6% like-for-like decline in the comparable period in 2018.

Within like-for-like revenue, Print(2) fell by 7.3% and Digital(2) grew by 14.0%, with the prior year comparable period showing a fall of 8.2% and an increase of 9.3% respectively.

Also note that the digital revenues are rising, but not enough to offset falling print revenues.

Cash - it is expected to be in a net cash position at the year end. These businesses remain amazingly cash generative.

There's a gigantic pension scheme to consider. As discussed earlier this week, low bond yields mean that pension deficits are growing again in some cases.

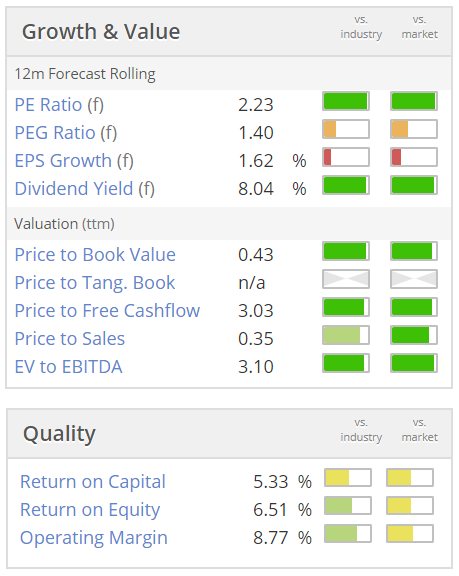

Valuation - it's not often we see a PER of 2!

Full year outlook for FY 12/2019;

The Board remains confident that the full-year performance will meet its expectations.

My opinion - we've discussed this share here for years now. In that time, the group has done a lot better than many people thought. It's paid down all of the previously large debt. It's also managed to keep funding the pension scheme, and pay decent divis on top. Rather impressive for a supposedly dying business.

I can't make my mind up on this one, so have to say I'm neutral.

There's an announcement from Daily Mail and General Trust P L C (LON:DMGT) that it has bought the "i" newspaper from what's left of Johnston Press. Reach says today that it is no longer in active discussions to buy any JP assets.

Redde (LON:REDD)

Northgate (LON:NTG)

Have announced an all-share merger. That's an interesting development.

NTG's share price is down 7% today, and REDD is up 2%.

Both are nicely cash generative businesses, paying large (huge in the case of REDD) dividends. Both are valued at high single-digit PERs. So it looks quite a sensible fit in terms of numbers.

I wonder whether this means that no-fault accident customers will be running round in light vans in future, instead of courtesy cars?!

Northgate has also issued its interim results today. There's not much point in me reviewing those, as the combined business will be well above my upper limit on market caps. The highlight look a little lacklustre, with adjusted EPS down 5% on last year.

Aggregated Micro Power Holdings (LON:AMPH)

More corporate activity - there's a recommended 90p cash takeover bid, a 32% premium to last night's close. This values the company at £63.1m

There's a lot of value around in small caps right now, in my opinion. It's good to see some bidding activity, as that might help generate a bit more interest in the many bombed-out UK small caps out there.

I'll leave it there for today, and this week. There were a couple of other things which I looked at, including what looks like a profit warning from Benchmark Holdings (LON:BMK) (down 11% today). I've never understood that business, and looking at the figures, I cannot understand why its market cap is still so high. Particularly as it is heavily indebted.

Interims from Aortech International (LON:AOR) also failed to interest me, and the market cap is too small anyway.

Signing off, hope everyone enjoys the weekend.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.