Good morning, it's Paul here with Friday's SCVR.

No preamble today, as I was too tired last night to put anything together. Let's see what the 7am RNS brings.

Police forces are apparently on a New Year's Eve footing for "Super Saturday" tomorrow's pubs opening day. It's obviously going to be carnage, and no doubt we'll have Priti Patel & other Govt ministers chastising us on Monday for the bad behaviour of a hooligan anti-social minority (about 20% of the UK population I would guess! And growing every year, it seems).

Estimated timings - should be mostly done by 1pm, but I want to cover a few stragglers left over from earlier this week, after lunch. So final finish time c.4pm.

Update at 17:56 - today's report is now finished.

Running through the list, there's hardly anything of interest today. Looking at the reader requests today;

.

Manolete Partners (LON:MANO)

546p (up 7% ) - mkt cap £237.8m

Final Results - I've not come across this company before. It floated in Dec 2018, and seems to be involved in litigation financing. Graham outsourced coverage of it to subscriber abtan who wrote an interesting piece on it here on 21 Nov 2019. Reading that piece, it's clear that this share is not of interest to me, and I'm not interested in ploughing through loads of details on individual cases in order to work out what the shares might be worth.

Having a quick skim of the results today FY 03/2020, the headline numbers look good - adjusted (for IPO costs) PBT up 40% to £9.5m.

Final divi doubled to 3p (a very low yield though). Outlook statements reads positively.

My main worry with this sector (as some readers have commented on below) is that short sellers attacked another, larger, litigation funding company, Burford Capital (LON:BUR) and the share price has never recovered - currently sitting at about 500p, still about 75% down from its peak. I remember listening to the conference call from Burford when it was fighting the shorting attack, and it struck me how many potential problems there are with estimating the outcomes of cases, realised/unrealised profits, selling fractions of cases just before the year end to establish a higher book value, etc. It sounded an absolute minefield. The more information Burford provided, the more questions it seemed to stimulate.

According to the StockReport, Burford seems to currently sit at a Price to Tang.Book of about 1, which seems a sensible valuation to me. The equivalent metric for Manolete is 7.2. The latest balance sheet as at 31 Mar 2020 only has net assets of £34.9m, a P/NTAV of a very high 6.8 times. Looking at the list of its RNSs, I don't see anything that suggests it has done a placing since the year end, so the balance sheet would still be similar now.

Clearly the business is being valued on a multiple of earnings, and net assets are largely being ignored. Whereas the short sellers smashed up that valuation basis for Burford, and hauled it down to a P/NTAV of only 1. What's to stop them doing the same thing with Manolete?

My opinion - good luck with it, but this is not a sector I would want to invest in, given what happened to Burford.

.

Another reader request was;

Cmc Markets (LON:CMCX)

CMC is doing very well at the moment, up another 17% today. That takes the market cap close to £1bn, well over my usual cut-off of around £400m-ish. Larger rival Ig Group (LON:IGG) has also been doing well this year - these companies thrive on market volatility., Although bear in mind when markets calm down, then client trading activity can be expected to reduce back down again. Also some clients will have blown up their accounts, so new ones might be needed to replace them.

That said, today's update is very strong indeed - Q1 TY is better than H1 LY! Also it says;

The Board is confident that, even in the event that more normalised client trading activity returns, with the strong underlying performance of the business, 2021 net operating income will exceed the upper end of current market consensus1.

There's a very helpful footnote (all companies should do this) saying;

1 As at 2 July 2020, the Group compiled Full Year 2021 consensus is as follows:

· Net operating income of £245.9 million, ranging from £239.1 million to £255.5 million

· Profit Before Tax of £85.2 million, ranging from £75.8 million to £93.5 million

My opinion - neutral. The price looks about right to me, on the basis that this could be an unusually profitable year, due to the exceptional circumstances. It's a good point to remember for next time there's a major market panic - when everything plunges, we should buy the spread betting companies, as they benefit from market turmoil.

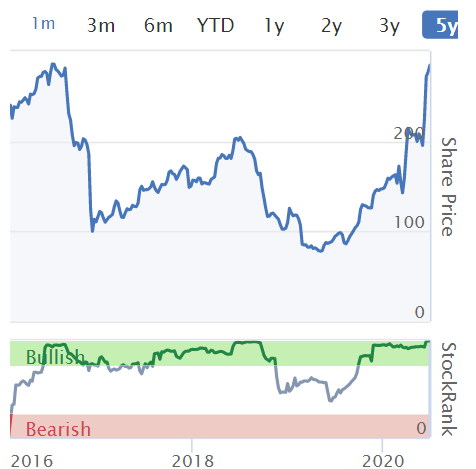

The 5-year chart below shows that it's only got back to where it started, with long periods of disappointment in between. Hence it's maybe worth bearing that in mind, before getting too excited about current strong trading? Every now and then regulatory issues surface with this sector, another point to bear in mind.

.

.

Numis (LON:NUM)

317p (up 2% today) - mkt cap £336m

Reports strong trading in Q3 (Apr, May, June 2020) - Q3 revenue "materially ahead" of Q1 & Q2.

Investment Banking benefited from an increase in capital markets transaction volumes which more than offset the decline in M&A deals and absence of IPOs. In addition average deal fees were significantly higher during the quarter as we completed capital raisings for some of our larger corporate clients such as ASOS, Beazley, Ocado, and Unite.

That's great, and I think we'll continue to see many more fundraisings this year, as companies repair their balance sheets, often under pressure from banks, who want to reduce their own risk. Although as the economy improves, then fundraising deals are likely to go back down again, in 2021 maybe? Hence IPOs and M&A will need to recover to replace the bonanza of fees from fundraisings.

Outlook comments are positive;

However, we currently have a good pipeline of transactions, and we expect revenue and profits for the second half will be ahead of the first half.

A general moan about old school brokers

Something really needs to be done about the profligate fees that brokers & various other advisers charge for fundraisings. It's money for old rope. Let's hope future financial reform sweeps away this cosy closed shop. What we need is a quicker, less complicated, and cheaper way for listed companies to raise fresh funding. The technology for quick, cheap, electronic fundraisings, has been around for 2 decades, but vested interests have successfully managed to stop any progress being made. I can feel a letter to Dominic Cummings coming on.

Numis produces excellent research on companies, but does its best to make sure that private investors don't get to see it. Whereas many other brokers make their research available on Research Tree, so there's no regulatory problem here at all.

Numis also seems to see it as their job to actively block private investors from having contact with companies, excluding them from company meetings, etc.. This is scandalous in my view, and needs to be challenged. The way I see it, if analysts are in any way guided by the company itself (e.g. chatting through & agreeing assumptions with the CFO), then it should be a requirement that such research is made widely available to everyone, not restricted to a select few important people - i.e. the broker's clients.

Peel Hunt & Shore Capital are a couple of other old school brokers that do the same thing. It's such a pity because Peel Hunt's research is fantastic. I really miss it, since circulation was tightened up after MiFiD I seem to recall.

The strength of these brokers is in their relationships with institutions, so they're good at raising money from the select few, whilst private investors often don't get a look in. When I meet companies, I always emphasise that they need a broker which sees the value of engaging with private investors. After all, we create the liquidity, and set the share price, with smaller caps.

.

Trakm8 Holdings (LON:TRAK)

21.1p (up 24% today) - mkt cap £10.6m

An impressive contract win announced today - 2 years minimum term, with a "major UK food retailer".

... utilises Trakm8's market leading algorithm to optimise home deliveries. There will be some initial customer funded engineering integration activity in advance of product going live later in the year.

No financial details are given.

I like the sound of this. One of my concerns with TRAK is that it seems low down the value chain, not making any profits from a sector where e.g. competitor Quartix Holdings (LON:QTX) produces fine profit margins & cashflows.

However, if TRAK's algorithm saves companies money by better planning routes for their lorries, then I can see that would be a valuable service.

Can someone explain why a Director was allowed to buy £50k-worth of shares just before this price sensitive news was announced? (see RNS yesterday, showing his purchases of shares on 30 June, and 1 July).

My opinion - TRAK has a very poor track record, and a lousy balance sheet with too much debt. Therefore it will need to do a significant placing at some stage, to fix the balance sheet. However, the market cap is now low, so if it does manage to get some excitement going again, with more contract wins, then that could boost the share price and allow it to do a fundraising without excessive dilution.

I'd like more information on the contract values, sales pipeline, etc. Otherwise it's just a complete punt.

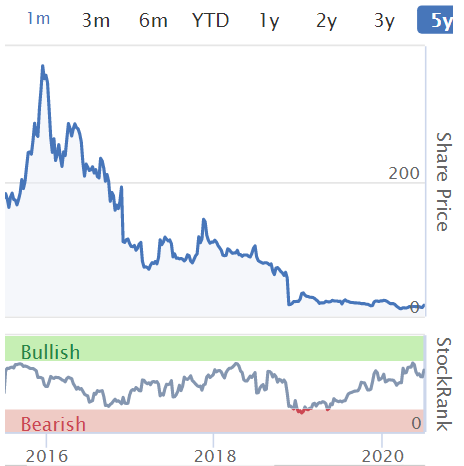

The 5-year chart shows just how bad things have been from the frothy highs when it seemed to be doing well. Could this provide an opportunity though, of a multibagger, if business starts doing well again? Unfortunately, my Tardis is out of service at the moment, so I'm not able to report from the future how things turned out!

.

.

Tasty (LON:TAST)

2.85p (unchanged) - mkt cap £4.0m

This is a chain of casual dining restaurants, mostly called Wildwood, but also some called DimT.

It's just issued an announcement, which I am reviewing because of the read-across to the wider sector.

Statement re: Redundancies - today it says;

Further to the Company's announcement on 26 June 2020 regarding the phased opening of a limited number of sites over the next few weeks, given the anticipated drop in footfall due to the continuing restrictions imposed as a result of COVID-19, the Board has come to the difficult decision that staff numbers need to be reduced accordingly.

Consequently, some 284 staff members (representing approximately 32 per cent. of the total workforce) have been made redundant across our restaurants and Head Office. Clearly, this decision has been very difficult for everyone involved and throughout this process our priority has been to support those that have been affected.

What a pity. However, I think this it the thin end of the wedge, given that the furlough scheme has really just deferred mass redundancies in the hospitality sector.

What isn't clear from Tasty's announcement above, is whether it is permanently closing any sites, or plans to re-open all of them, in time? So I'm pondering whether the sites that do re-open are going to be running leaner on staffing (which would be bound to cause customer service problems), or if there are just going to be fewer sites trading?

Some kind of restructuring sounds inevitable;

The board of directors is exploring ways to minimise costs and to strengthen the balance sheet including investigating the possibility of new debt and / or equity capital and also discussing terms with landlords and trade creditors. Further announcements will be made as and when appropriate.

My opinion - I'm emotionally attached to this business, as I really like all the lovely waitresses in its Bournemouth site, and I would visit at least twice per week, using the 50% off food discount available on the BigDish app (in which I have a shareholding). The food is quite good, and excellent value for money with the 50% off.

However, we can't let emotions get involved when it comes to shares. I've not bought any shares, because I don't see this being a viable business on its current property leasing arrangements. I think the company needs to do a pre-pack administration, to jettison all the lease liabilities. Then do deal with landlords on minimal, or even rent-free arrangements, to enable it to continue trading. Another possible restructuring would be a CVA, combined with an equity fundraising.

I cannot imagine that anyone would be interested in an equity fundraising without some form of restructuring of the leases.

At just £4m market cap, there also has to be a big question mark over whether it makes sense to remain listed?

I really hope the lovely Bournemouth staff will be OK, and look forward to seeing them soon, and having garlic prawns on toast (which are gorgeous!) and a pizza. The menu is very bread-based. Talking of which, I think to survive on lower staffing levels, restaurants need to shrink the menu options right down, to a few of the best sellers. There's far too much choice in most restaurants I think, which is more confusing than helpful. Also, instead of cooking everything fresh, much more will need to be pre-prepared centrally, and quickly/simply cooked. Most people won't know the difference anyway, and some things improve when frozen (e.g. marinated dishes like curry, etc).

As for TAST shares, sorry but I wouldn't touch them at this stage. If it does a pre-pack administration though, as recently done by Quiz (LON:QUIZ) for example, then it's a whole fresh start, with no lease liabilities pulling things down. If that happens, then I might consider TAST shares.

In the meantime, I'm very sorry so many staff are losing their jobs, and hope they find alternative work soon. The rest of the economy is undoubtedly going to have to digest large numbers of unemployed from the hospitality sector. Although as sector expert Mark Brumby, of Langton Capital, points out - if a restaurant or bar goes bust, then what is the most likely outcome for that site? Answer: the landlord just rents it out to a new operator, who inherits the fixtures & fittings, and re-opens as a bar or restaurant. S(he) solidiers on for a year, discovers that it's not viable, and also goes bust. Then the landlord re-lets it to another restaurant/bar operator, etc.. For this reason, it could take years for over-capacity to permanently leave the hospitality sector.

.

Robinson (LON:RBN)

105p - mkt cap £17.5m

Robinson plc ("Robinson" or the "Group" stock code: RBN), the custom manufacturer of plastic and paperboard packaging based in Chesterfield...

It has a 31 Dec 2020 year end.

This packaging micro cap has not only recouped all its market crash share price, but is hitting a new 12-month high;

.

.

It issued a reassuring AGM update on Tuesday this week, key points for H1 2020;

Revenues - up 5% in H1 vs LY, despite challenging market conditions - this is impressive, but I suppose a lot of its products are essentials, sold through supermarkets, so demand would have continued despite covid

Margins have "maintained momentum" of H2 2019 (presumably that means they've risen?), operating costs static, consequent increase in operating profit - sounds good

Net debt down from £7m to £6m in 6 months, despite spending £2m on capex - suggesting good underlying cash generation of c.£3m in H1

Sale of surplus properties - delayed by at least 6 months, due to covid

Outlook - uncertain, but confident business can prosper

Dividends - final divi was cancelled in March. Reinstated now with a 3.5p first interim divi (same as 2018 final divi). This is very significant, in the signal it sends, but also the size of the divi is alone a 3.3% yield.

My opinion - I'm impressed. I won't be buying any myself, because it's too illiquid. Which does beg the question, why is it listed? But for those that do hold this share, well done, as the company seems to be performing well.

.

I thinki I'll leave it there for today, and this week.

Enjoy the weekend, but remember, don't have any fun, it's not allowed.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.