Good morning from Paul, near the end of another super-busy week!

We've now covered 440 unique companies in the SCVRs in the 4-months to date. Not long hopefully until we exceed last year's 609, now we're also covering some interesting-looking mid caps too. Someone queried why I'm also mentioning nano caps lately? It's because my new mid-morning movers section picks up some of the interesting news from nano caps. Also, it helps avoid banana skins when they're junk companies that need to raise fresh equity, as many are, but trying to ramp up their share prices with spurious good news releases. It gets something into the archive for quick future reference too.

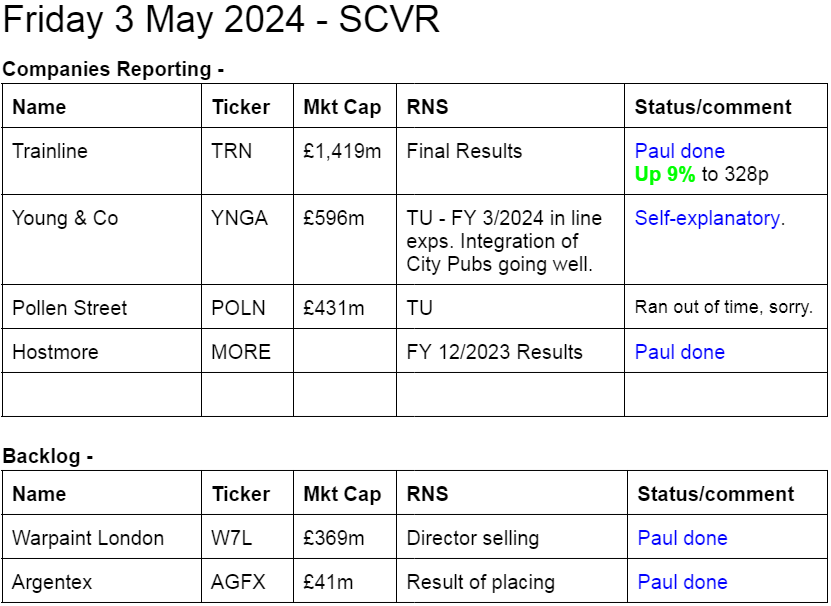

I had a late surge, and did some more work yesterday afternoon, covering everything on the list (13 companies), even if only a brief comment in the colourful list at the top. Even if it's only a brief comment, I do have a proper look through the numbers for each company, although I don't have time to read all the commentary if it's a full set of results - hence the need to always do your own, more detailed research - it's not just a slogan or a disclaimer - time constraints mean our reviews are necessarily superficial.

Also remember we're only flagging relevant facts, figures, and forecasts. I see some people on advfn were personally attacking me over Concurrent Technologies (LON:CNC) but didn't actually say which facts I had flagged up that were wrong (hint: none of them were wrong!). They just had a different, more bullish opinion, which is absolutely fine. My review was neutral, and flagged up both the positives and some negatives, which is surely the right thing to do, and then let readers decide what weight you give to each factor.

List of companies reporting

Other mid-morning movers (with news)

Fletcher King (LON:FLK) - up 26% to 44p (£4.5m) - Trading Update - Paul - No colour

A strikingly good update from this tiny firm of chartered surveyors & asset managers. No idea why it’s listed, but it’s been on AIM for donkey’s years, which cannot be a good use of cash costs. So de-listing risk must be high, which is why I can’t really give it a traffic light colour.

Trading has gone from being subdued when last reported, to buoyant in H2. It made £50k PBT in H1, but for FY 4/2024 it now says this (below), which looks rather good - are they saying £400-600k, or £600-800k PBT? It seems ambiguous to me, but maybe I’m being a bit thick? -

The Company reported a profit before taxation of £192,000 for the year ended 30 April 2023. Overall, it now expects to report profit before taxation for the year ended 30 April 2024 that is likely to be in the range of two to three times higher than last year.

Paul’s view - I like the look of this. It’s got a nice balance sheet too, with net cash of £2.6m at 31/10/2023, and hardly any creditors, so that’s proper, surplus cash I would say, supporting half the market cap.

Pity shares are so illiquid though - I just got a quote for a small scrap, and they wanted 2p over the offer price. So I would need about 5 years of divis just to recoup the bid/offer spread! That together with de-listing risk, means it’s probably uninvestable. Might be one to keep on the watch list though, in case a clumsy seller ever smashes the price down to exit in future? Looks a nice little business, but absolutely no point in it having an AIM listing.

Angle (LON:AGL) - up 15% to 15.75p (£41m) - Agreement with AstraZeneca - Paul - RED

An eye-catching RNS, saying it’s done a deal with giant AstraZeneca to develop a prostate cancer detection system for use in studies. Trouble is, the deal is only worth £550k to Angle, and is long-term in nature, when I think the share price is telling us that investors want some jam today, and not more of the heavy cash burn for many years that AGL has so far inflicted on investors -

"This is further validation of ANGLE's Parsortix system which shows potential for long-term large-scale revenues in bringing innovative new cancer drugs to the market. We anticipate that success in this first phase of assay development may lead to much larger contracts for use of the assay in clinical trials."

Cash was £22.2m at 30/6/2023, and it said the cash runway lasts until Q1 2025, despite cost-cutting.

Paul’s view - Angle technology sounds great, but as with so many innovative medical things, it takes an eternity of heavy losses to get anywhere - Angle has been listed on AIM for 20 years, and has got nowhere in commercial success, just year after year of heavy losses, along with never-ending exciting sounding technical development announcements, like the one today. It might be great technology, but the begging bowl is almost certainly going to come out again later this year. As we’ve seen with other struggling minnows, the investor appetite for pouring in more & more cash is very weak, and often brutal in the discount demanded. Why get involved? It’s a pure punt at the moment, with a very large risk of considerable dilution, so for me it has to be RED until it’s properly refinanced (again). Stuff like this should not be listed on the stock market.

Mirriad Advertising (LON:MIRI) - down 41% to 1.275p (£6m before, £12m after placing) - Discounted placing - Paul - No colour.

Another placing from this cash burner. It will double the share count from 489m to c.978m, with the new shares being issued at 1.25p (a c.45% discount) to last night’s close. This raises £6.1m (before costs of probably a few hundred k). Retail offer through REX (a new platform) will be open until 11am on 7 May, hoping to raise £0.55m extra.

Paul’s view - I last looked at this in-game advertising company on 8/4/2024, concluding it was too high risk, but seemed to have interesting potential. With the coffers now being topped up, it should be able to last well into 2025 I imagine. So it’s moved up my list of possible reckless punts (where I usually wait for a refinancing to happen, as in this case). I’m tempted to have a small dabble, with money I can afford to lose. It’s just a punt though, as the track record has been dire.

Summaries of main sections

Warpaint London (LON:W7L) - 478p (pre-market) £369m - Director Selling - Paul - GREEN

Substantial Director selling in a secondary placing. Providing the price isn't at a discount, then I'm not concerned by this, because owner/managers retain a huge 43% of the business after this selling, and agree a 12-month lock-in. UPDATE: the price is at a discount of 6% at 450p, and the amount was raised from 6m share to 7m shares. So I'm a little perturbed by this morning's update. Institutional demand can't have been that strong, if they required a 6% discount to take the shares away.

Argentex (LON:AGFX) - 35.9p (pre-market) £41m - Result of Placing - Paul - AMBER

Looks like the take up of its placing might have undershot the target.

Trainline (LON:TRN) - up 7% to 322p (£1.51bn) - Final Results FY 2/2024 - Paul - AMBER

I have a quick look through the FY 2/2024 results. It doesn't really float my boat, being pricey on a PER basis, having a negative balance sheet, and spending too much on buybacks that are helping to mop up very generous management share options. On the upside, EBITDA margin is improving, which combined with revenue growth and opportunities in European markets, does mean nice profit growth. Could be a bid target maybe?

Hostmore (LON:MORE) - suspended - FY 12/2023 Results - Paul - RED

Late 2023 accounts don't impress me, it's still a very sick business. Debt reduction has come from stretching working capital, not from underlying trading. Very weak balance sheet, totally dependent on bank borrowings, but a 1-year extension to end 2025 does give breathing space. Will the reverse takeover of US brand owner save the day? Combining two highly geared businesses will surely make one larger highly geared business? There are considerable risks here, including the "material uncertainty" going concern, so it has to be RED from me until the waters become clearer and the cokes more fizzy!

Paul’s Section:

Warpaint London (LON:W7L)

478p (pre-market) £369m - Director Selling - Paul - GREEN

Announced just after the market close yesterday, Shore Capital is doing a secondary placing of Director shares, totalling 6m shares (c.£22m, 7.8% of the company). There are currently 77.3m shares in issue.

PLANNED: Sam Bazini (CEO) - Before: 19.45m shares (25.2%), Selling: 3m shares, After: 16.45m (21.3% of the company).

ACTUAL RESULT: Sam Bazini (CEO) - Before: 19.45m shares (25.2%), Selling: 3.5m shares, After: 15.95m (20.6% of the company).

The numbers for Eoin Macleod (MD) are identical.

Lock-up (ie agreed no more selling) for 12 months afterwards, which I like to see, this is good.

Paul’s opinion - substantial Director selling is never positive, as the people who know the business best want to sell. The question is, how bad is it? In my view, the founders each dropping from 25.2% to 20.6% is fine, I don’t have any quibble with this, because they retain enormous personal stakes in the business.

We’ll have a short wait to find out the price, which will be the best indicator of how much genuine institutional demand there was. Hopefully nil discount. UPDATE: unfortunately there is a 6% price discount, at 450p. That doesn't tie in with the broker stating there was strong institutional demand. If that had been true, the shares could have been placed at market price, with no discount needed.

It’s bound to slightly take the edge off the bull case, but you can’t blame owner/managers for wanting to enjoy a bit of the wealth they’ve created, and a combined 41.2% remaining holding is more than enough. Top-slicing after a very strong rise in the share price is sensible, especially when their shares probably make up the overwhelming majority of their personal wealth, I imagine.

Hence I’m happy to stay at GREEN, providing there isn’t a large discount on the price when announced shortly. Let us know your views, especially if you hold this share personally.

UPDATE: results of the placing of Directors shares is a little concerning. The price is 450p - if there was such strong demand as the broker claims, why did they agree a 6% discount? That doesn't stack up with the claims it was over-subscribed (of course it would be if they're being offered a 6% price discount). 7m shares were sold instead of the planned 6m.

Overall, I think 450p is probably now the benchmark for what W7L shares are currently worth, so I'd expect to see the market price fall to near the Director selling price. However, any wobble on this news might be quickly forgotten if/when the next "trading ahead of expectations" update comes out!

A nice success for many readers, and the SCVR, as we were all over this one early in the 4-bagging bull run that started in 2022 -

Argentex (LON:AGFX)

35.9p (pre-market) £41m - Result of Placing - Paul - AMBER

I speculated in yesterday’s SCVR whether any institutional investors might pull out of the placing at 45p per share, given that the market price undershot, ending up at 36p on yesterday’s results & downbeat outlook.

Sure enough, it looks like the placing has undershot, with only 7.2m shares at 45p being taken up (£3.2m). the original announcement said 11.3m shares (but that might have included an open offer?)

I don’t suppose there would be much take up of the retail offer if the share price remains below 45p, since people could buy in the open market at a lower price.

Paul’s opinion - clearly not good news, but AGFX has a sound balance sheet, so I was surprised it needed to do a placing at all. It does make me wonder if management might be expecting much worse trading in future, and want to get some cash in the bank ahead of that?

AGFX is either a cheap turnaround, or a disaster in progress. It’s not obvious to me which is the case, so I’ll remain on the fence with AMBER.

Trainline (LON:TRN)

Up 7% to 322p (£1.51bn) - Final Results FY 2/2024 - Paul - AMBER

Results for the twelve months ended 29 February 2024

Strong growth from Europe's most downloaded rail app

A 7% share price rise on results day is usually a good reason to investigate, although this might just be a rebound after recent falls maybe? I think a reader here mentioned the other day that recent falls could have been due to fears of possible railway nationalisation in the UK in future?

The news BUZZ feature on Stockopedia under the “NEWS” tab for every company is really handy, as it gives a one-line quick view of results. For Trainline, today BUZZ says - “Trainline rises as labour worries subside, sees strong forecast”. I find these snippets are usually accurate, so definitely useful as a shortcut.

Nice highlights table below, with excellent growth in most metrics (I’ve highlighted the only one I’m interested in) - giving a PER of 26.2x - seems very pricey, but maybe not so if strong growth is continuing, rather than just a one-off rebound from lockdowns ending & travel normalising?

Guidance - why couldn’t they work out the figures, and give us a profit number? Instead we get this -

I make that net ticket sales of £5.82bn (mid point of range), and hence adj EBITDA of c.£143m (middle of range again). That’s up 17% on FY 2/2024 actual - good, but not madly exciting for a share rated on 26x.

Previous guidance was adj EBITDA range of 2.15% to 2.25%, so the new range is usefully higher.

New share buyback of £75m announced.

CEO comment sounds interesting -

"New entrant carrier competition is revolutionising rail in Europe as more customers benefit from greater choice, lower prices and the opportunity to choose greener travel. We are becoming the aggregator of choice in the UK and internationally and are delivering strong growth, particularly in those markets liberalising fastest such as Spain.

Reconciliation between adj EBITDA and PBT is an eye-opener. Very big rewards for management here -

Balance sheet - not great. NAV is £312m, but taking off £489m intangible assets gives us negative NTAV of £(177)m. So there’s literally nothing in asset backing here. That may not matter, if it’s generating plenty of cash and doing buybacks using cashflows. But if something unexpected were to go wrong, then there's no asset backing to catch any share price fall.

Cashflow statement - note that of the £121m post-tax cashflow, almost a third (£37m)was spent on capitalising (presumably IT development spending) into intangible assets. Taking off other real world costs lower down the cashflow (interest costs, lease liabilities, etc) I arrive at £71m free cashflow. Not bad. It used roughly half of that for share buybacks (which you could argue are not doing a lot more than mopping up management share options). The balance was a £35m increase in the cash pile. No divis paid - there should be!

Broker notes - nothing available.

Paul’s opinion - just a quick review as always, but I don’t see enough to get me excited about the valuation or the upside potential. Also there’s no balance sheet support, and buybacks are significantly offset by generous share options issued. There aren’t any dividends, which is not great. Which does make me wonder if the business is primarily run for management’s benefit? Don’t shoot the messenger, I’m only pointing out relevant facts.

Has anyone got a more bullish view, to explain the upside potential maybe? I suppose it might be along the lines of gaining market share in Europe, and having an established market position that might be difficult to dislodge, especially in the UK, and making decent cashflows.

Also, IT businesses like this can attract remarkably high takeover multiples from the private markets, usually based on a multiple of EBITDA. Valuing TRN on say 15x EBITDA would give a £2.1bn valuation, enough for a 40% bid premium above the current share price. We know that US private equity funds are all over UK mid caps, so maybe this might be a target, who knows?

Hostmore (LON:MORE)

Suspended - FY 12/2023 Results - Paul - RED

Hostmore plc ("Hostmore" or the "Company" and, together with its subsidiaries, the "Group"), the hospitality business focused on 'TGI Fridays' and 'Fridays and Go', is pleased to announce its audited annual results for the 52 week period ended 31 December 2023 ("FY23").

Shares should come back from temporary suspension, given late accounts have now been published.

The commentary tries very hard to put a positive spin on these results and outlook, but there are still major problems here. I think the turnaround implemented by management has made a little progress, but has mainly succeeded in staving off collapse, rather than fixing the business.

That’s reflected in a “material uncertainty” going concern statement, reminding us that this is still very high risk.

Bank - a key point is the bank’s given it more breathing space, extending the vital borrowing facilities to end 2025 (1/1/2026). Net bank debt has come down, from £31.3m end H1, to £25.1m end H2. Although the cashflow statement shows that’s been achieved from stretching other creditors, and squeezing receivables too. There’s no underlying cash generation.

EBITDA on the old (sensible) basis has almost vanished, from £11.3m in 2022, to only £1.6m in 2023.

LBT was £25.5m in 2023, after more write-offs.

Balance sheet is really bad, which is likely to eventually need an equity raise to fix it.

Current trading - poor, with LFL revenues down 7% vs Q1 2022, blamed on weak demand. That’s not sustainable long-term, since costs (esp wages) will be rising considerably. Although cost cutting means it has been able to report an improving trend on EBITDA compared with last year, and within Q1 itself - which does strike me as clutching at straws (to drink the disappointingly flat coke maybe!?)

Paul’s opinion - this business is clearly still on life support (the bank facility). I don’t see a convincing turnaround here at all so far, and the shares still look very high risk.

I haven’t touched on the deal to do a reverse takeover of the US brand owner, which could be a lifeline, but that means taking on even more debt. So I think it is too complicated for me to want to spend time digging into the detail of that deal.

Good luck to any holders here. You’ve either got a zero, or a recovery trade, I just don’t know which yet!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.