Good morning, it’s Paul here, with Friday's SCVR.

Estimated timings today - it's a shorter & earlier report today, because I'm off to Malaga for the weekend with a couple of friends, for one of their birthdays. So I have to head to Heathrow mid-morning. So as not to short-change you, I got up at 5am to write some general ramblings here. Then I'll have a quick skim through the RNS after 7am. Fridays are normally very quiet for newsflow anyway.

For any new subscribers, I focus here on small cap results & trading updates. So I won't normally comment on other announcements (somebody asked me to comment on a placing & acquisition yesterday, which I wouldn't normally cover, unless there was something particularly noteworthy about it).

No reader requests today please, as there's not enough time.

This report will have to be completed by 10am, otherwise I'll miss my flight! And yes, I am offsetting my carbon!

Update at 09:14 - today's report is now finished. I think that's the earliest ever finish time!

USA Markets

These seem to be searching for direction. So far, fears of coronavirus haven't had much impact on the US market, as perhaps people are thinking it won't impact them, or is just a temporary factor? Also, I'm told quarterly earnings season so far has been good, which is normal for the US, where companies traditionally tend to set expectations at a level that is usually beaten.

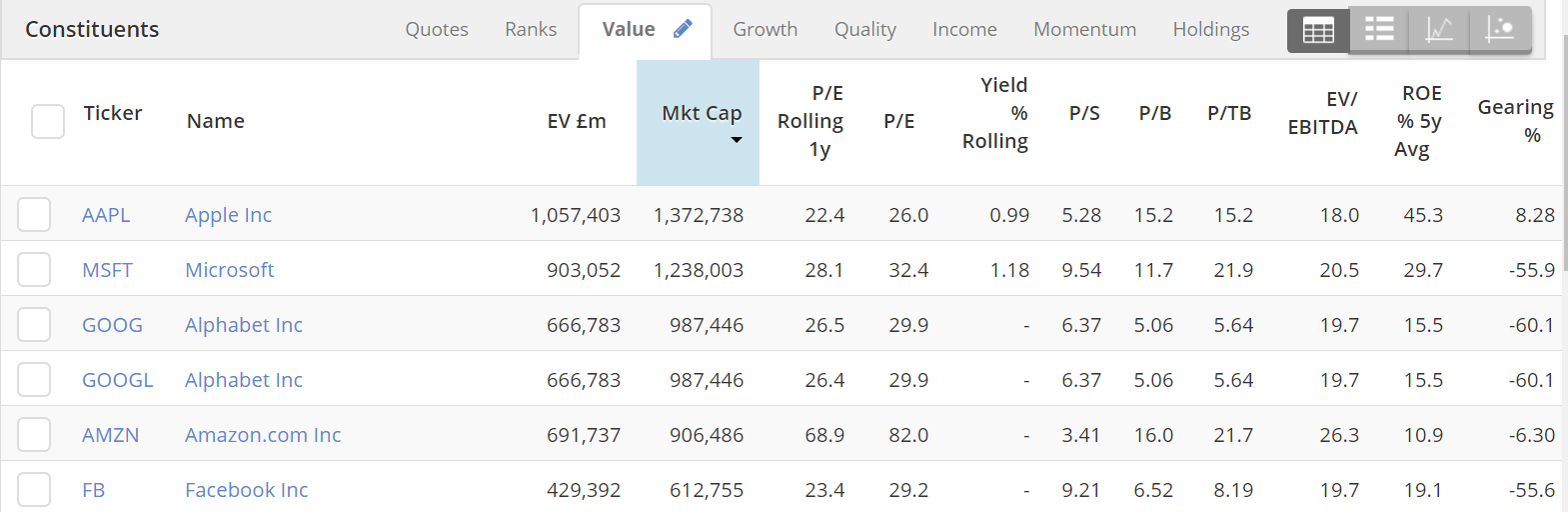

I recently mentioned here the top 5 (by market cap) US stocks are such impressive, dominant companies, that their valuations don't actually look excessive to me. Here's the table again which I posted the other day, from Stockopedia's list of everything in the S&P 500 (in the "Browse Indices" section), which you can then sort & dig into any way you want.

Reviewing the news feed for each company, here is the state of play for the top 5 largest companies (by market cap) in the S&P 500;

Apple - reported on Tuesday, with growth in iPhone sales pushing profit above expectations. BUT it is quite heavily exposed to China. Skimming through the news feed, Moody's says that Coronavirus will temporarily slow down Apple's strong earnings momentum.

Microsoft - reported positively on Wednesday, with growth in cloud computing strong. I heard some very bullish analyst commentary on CNBC, who are expecting the share price to continue rising. Microsoft seems very unusual, in that it was an early computers success story, with Windows and Office software. However, instead of withering on the vine (as usually happens) it has since become an even bigger success in new areas, such as cloud computing.

Alphabet (Google) - it doesn't look like this has reported yet, this quarter. I note from the news feed that it is temporarily shutting all its offices in China, but I don't know if that is significant or not.

Amazon - reported last night, and the shares shot up 10% apparently, on it beating forecasts.

Facebook - the only one of the top 5 to disappoint, with shares down about 6% on results.

Overall then, the 2 largest companies in America have reported positively, as has Amazon. Only Facebook disappointed. The key question is, how much of the total indices do the top 5 constitute?

S&P 500 - google says its total market cap is $28.1trn. By my calculations, the top 5 companies make up $5.3trn, or 18.7% of the S&P 500, by market cap.

Dow - Only Apple and Microsoft seem to be in this, and make up 25% of the total value. Hence the Dow is more closely correlated to its biggest elements, but is only 30 companies anyway.

My hedges - I didn't really think this through, when I decided to (in a bit of a panic) hedge my portfolio on Monday morning. More through habit than anything, I put a big short on the Dow, and also the Hang Seng 50. The idea being that I just wanted portfolio protection, in case the coronavirus spreads & hits my UK portfolio.

Obviously, it feels grubby to be thinking about money, when people are suffering, but we cannot ignore these things.

Given that the 2 largest Dow constituents (Apple and Microsoft) have just reported positively, and make up 25% of the total Dow, then it looks like I've hedged badly, and need to re-think this. So I should probably reduce, or close my short on the Dow.

The Hang Seng short has performed better, because (sad though it is), it's correlated far more closely to the risk factor concerned - coronavirus. Therefore as I want to hedge against that particular risk, this position makes a lot more sense, so I've increased it.

Realising you're wrong - this psychological factor does the most damage to investors. We all find it difficult to close losing positions. Being able to ditch shares on the opening bell, when the bull story has gone badly wrong, often saves a lot of money and anguish, but is so hard to do.

Hence why I'm thinking out loud here, in trying to convince myself that I've made a mistake in trying to hedge my longs by shorting the Dow. It was the wrong instrument to short, and I should now cover some or all of that position. I probably won't though, because like most men, I have a stubborn streak that makes it very difficult for me to make the right decisions, even when I know I'm wrong! It's vital to overcome this problem, if I want to become a better investor. Sometimes I can overcome it, but not often enough.

Tesla - The above reminds me of what's gone on with Tesla. A very heavily shorted, perennially loss-making company share has unexpectedly become a star performer, rising from around $250 to $640 in the last 3 months! The valuation is madness now, but it doesn't seem to matter. Although the company does now seem to be moving into profit, and production numbers are good. There's a ton of new competition being launched now, so it won't have the luxury electric car market to itself any more.

At least two of my friends were heavily shorting Tesla shares, and have suffered large losses. In both cases, they said the same thing to me (independently). One said, "I should have closed my short when the good production data came out" [which is what triggered the start of the huge rise].

The other friend said of his Tesla short, "I've got to learn when to throw in the towel, when I've got something wrong".

These are both highly experienced, very successful investors I should add. So behavioural flaws affect everyone, even the best investors. That's my thought for the day!

Dry January

I've successfully reached the end of Dry January! No alcohol (or, the devil's urine, as I like to call it now) has passed my lips since New Year's Eve. Apart from a shot of Bailey's, which a friend slipped into my hot chocolate without my prior knowledge at Winter Wonderland in early January, because I was apparently "being too boring". So that doesn't count.

I was going to do a charity fundraising for Dry January, but didn't get round to it. However, I'm shortly launching a big fundraising for destitute pensioners in Zimbabwe, more details to follow next week. I've come up with a great idea to leverage small donations into bigger donations, and have agreed with ZANE a specific fund which they desperately need to replenish, to continue doing amazing work with old soldiers who served the British Crown, and their widows, but have been left to die without even basic health care, by the British Govt. ZANE is putting that right (to be fair, partly using some money which was forthcoming from the UK Govt, but is now running out), so it's a brilliant cause. More info to follow next week. I met a lot of these old soldiers when I visited Zimbabwe a year ago, and can attest that they are people you would really want to help, and deserve our help, if you'd met them too. Like the shares here, I've done the due diligence on this.

I'll extend Dry January into the whole of February too, as part of the charity fundraising. Hopefully subscribers here have noticed that my productivity has shot up this month! I've been pulling out all the stops, and putting in at least double the usual time for every SCVR, because I'm hoping that will make subscribers here more likely to support my charity fundraising.

Although this weekend I'm having a free pass, to get jolly with my friends in Malaga, and it would be rude not to mark Brexit Day with a few glasses of champagne courtesy of British Airways. Although my celebrations are going to be muted, and in my head only, because I think we all need to come together, rather than have any more antagonism. Hence the bunting has remained untouched, gathering dust in my wardrobe.

Audiobooks

This section is just a time filler, as it's not quite 7am at the time of writing. Like a coiled spring, I'm waiting for the trading updates to start landing in my inbox, with various pinging noises.

My sister-in-law introduced me to audiobooks some time ago, saying that she was enjoying Brian Blessed's memoirs. Curious, I took a look/listen, and can honestly say Audible has changed my life for the better! These days I probably spend at least an hour each day listening to audiobooks, in otherwise wasted time (e.g. when mooching about in town, or walking around the supermarket, on the train, when exercising, in the bath, etc). Podcasts are great too.

EDIT: Just remembered, that one of our aims for 2020 is to start a regular shares podcast, probably with me & Graham. Or possibly some other format - I've experimented with monologues, but they're a bit boring. Two people is better & more interesting. So watch this space for our podcasts, probably once Graham's settled into his new house. End of edit.

I particularly enjoy political memoirs, and recommend David Cameron's and (surprisingly perhaps) Ed Balls, as interesting & very human memoirs. Both focus not just on the facts & events (as they see them), but also talk about human issues (such as Ed Balls speech impediment, and how he overcame it), and with Cameron of course the very moving story of his late severely disabled child, Ivan.

Gordon Brown's memoirs were pretty dire, I suffered 19 hours listening to those. It's important to challenge oneself though, and to listen to memoirs from people that I might fundamentally disagree with. That's the only way to see a wider perspective, and be less dogmatic.

Which brings me on to my latest audiobook, "Think Big & Kick Ass!" by Donald Trump, from 2007. It's actually quite good, in some respects, as a motivational book urging readers to never give up, and do whatever you're passionate about as work, etc. I don't have to agree with his politics, or like his personality, to find a book interesting.

The pinging has started, let's get stuck into today's news...

French Connection (LON:FCCN)

Share price: 22.7p (down c.30%, at 09:00)

No. shares: 96.6m

Market cap: £21.9m

(I'm long of this share)

End of sale. No, not half price clothes, but the sale of the business has fallen through.

No surprise here really. The sale process has been going on since Oct 2018 - that's not a typo, it's 16 months. If a deal was likely, it would have happened by now. So I'm not sure that talks ending is going to be price sensitive either way, as there's no bid premium in the valuation anyway.

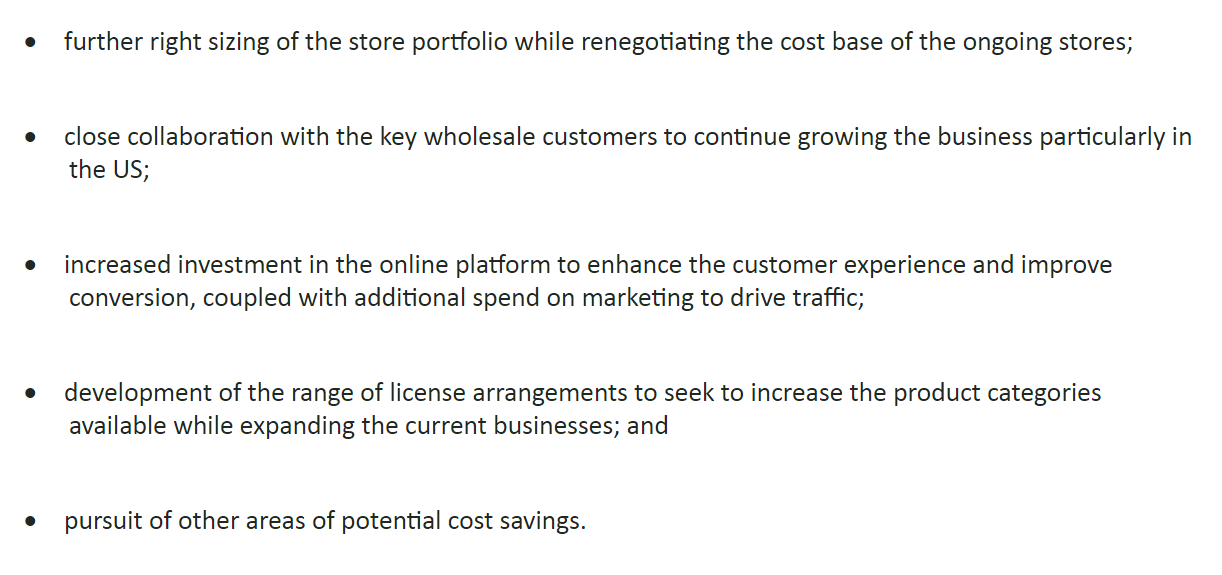

Instead it's going to focus on a turnaround strategy;

In practice, I suspect this means that potential buyers were not prepared to pay enough to satisfy Stephen Marks (the founder & major shareholder) price expectation for his life's work.

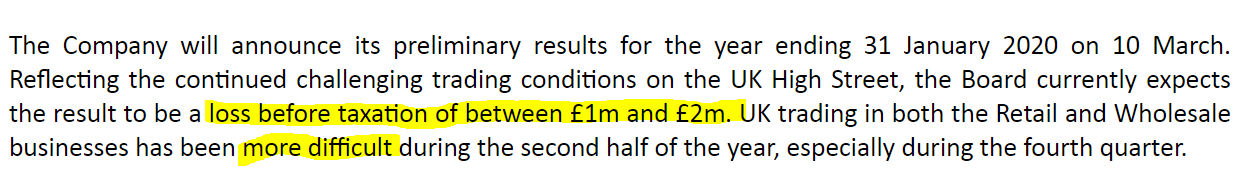

Trading update - this is a mild profit warning, so is more disappointing than the sale falling through;

That's disappointing, but not a disaster. The market cap is only £32.4m, and it is fully supported by NTAV of the same amount. The Market was expecting a small profit.

My view - annoying, but not entirely unexpected. I'm continuing to hold, as the licensing & wholesale businesses are good, and decently profitable. Retail losses are taking an eternity to decline, but as the problem leases expire, these losses will slowly disappear. Only for very patient investors though. I expect a sharp fall in share price today (this section written pre- market opening).

Staffline (LON:STAF)

Share price: 67p (down c.10% today, at 09:03)

No. shares: 68.9m

Market cap: £46.2m

Trading update (profit warning)

Investors can be forgiven for letting out a little FFS under their breath, on reading this update.

More accounting write-downs are needed;

Although the year end audit process, with our new auditors, Grant Thornton, is on-going, we have already identified that it is appropriate to increase certain provisions and make further write downs.

Therefore, it's another profit warning;

Due to these net charges, the Board now expects the Group to report full year adjusted operating profit (being profits before interest, tax and non-underlying charges) for the period ending 31st December 2019 materially below our previous guidance.

This announcement is no good, as it doesn't give us any revised figures. Not even a footnote saying what previous expectations were. What is the new guidance? It doesn't say.

Revised forecasts - Liberum to the rescue, giving us the information we need that was omitted from the RNS. An update note from them on Research Tree gives revised estimates, and also provides other useful information - thanks to Liberum for providing this information to us via RT, it's extremely useful to investors and commentators.

FY 12/2019 - EPS forecast is now reduced by 84% to just 2.0p. To understand just how bad this is, consider that the company reported 110.1p underlying EPS in 2018! That's dropping to tuppence for 2019.

FY 2020 - forecasts are unchanged, but who would rely on any forecasts from this company now? I wouldn't.

Outlook - at least things aren't getting any worse, although we're only 1 month into the new financial year;

The Board is pleased to report that 2020 has started well and the Board's expectations for the FY 2020 are unchanged.

Is it likely to go bust? - we're told the bank is being supportive;

Staffline maintains a constructive relationship with its lending banks and consequently the Board does not anticipate any covenant issues.

The Company is also actively considering certain strategic options which may significantly reduce net debt during H1 2020.

As the Liberum note explains, there is substance to this - it sounds like Staffline's Irish business might be sold. Another option is invoice discounting could replace other bank facilities (after all, STAF does have a big, blue chip, debtor book. So lending against that would be very low risk for the banks).

I'm guessing here, but the Singapore investors who recently overpaid for a big stake in the business, which was bad luck as they bought just before a profit warning, could possibly be relied on to stump up loans or fresh equity. The terms might be highly dilutive though, if there's no alternative, and could involve a de-listing, so this route could have ruinous consequences for small shareholders, in the worst case scenario.

My opinion - Banks are not charities, they act in their own self-interest. In this case, the bank(s) continuing to support Staffline, whilst it sorts out other options, is logical. So I imagine the bank pulling its funding & putting it into Administration, is very unlikely.

We don't know how shareholders will fare. There are a range of potential outcomes, and it's little more than guesswork to predict which is likely to happen.

A sum-of-the-parts valuation might be the best way to look at Staffline?

I gave up on this share some time ago, as it didn't do what I hoped for. The accounting & operational problems turned out to be worse than expected. I'm not interested in getting involved again.

There is also the issue of IR35, and companies employing people directly rather than through agencies, to take into account. We discussed that earlier this week, pertaining to £EMR and Gattaca (LON:GATC) . This must have some bearing on STAF too, I imagine.

GAN (LON:GAN) - before I go, just to flag up an interesting-sounding update from this gambling software company. The share price has more than tripled in the last year, and it looks to be gaining new clients rapidly, and moving apparently into profit.

I started researching it this morning, but have run out of time. Readers might want to take a look, and if you think it's interesting then I'll circle back to it next week.

Today it says trading is ahead of expectations, and that it intends to list in the USA.

M&C Saatchi (LON:SAA) - announces the FCA is launching an investigation into its "accounting adjustments".

Not good news for a PR company - I can imagine competitors are likely to use this news to damage SAA in their client pitches.

Not that Saatchi is such a good name these days anyway, after previous bad publicity.

I have to stop there, sorry. Have a lovely weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.