Good morning, it's Paul here with the SCVR for Friday.

Today's report is now finished.

Terrible publicity last night on the main TV news for Dart (LON:DTG) . Customers holidaying in the Canary Islands reported that DTG's Jet2.com had texted them, cancelling their return flights back to the UK, and telling them an earlier flight home would be an additional £300 each. The reason being that it wasn't economic for the company to send out an empty plane to bring them home. Whoever made that decision is a complete fool, and the damage to the company's reputation is likely to be far more costly than sending out empty planes because something has gone wrong with Govt rules, leaving people stranded. Airlines have a moral obligation to get people home, irrespective of cost.

Talking of airlines, BA's owner, International Consolidated Airlines Sa (LON:IAG) has said that it expects traffic to not fully recover until at least 2023. If they're right, then that surely makes all airline shares look uninvestable?

The on-off-on nature of travel restrictions really puts me off going anywhere near this sector, and that's being reflected in a lot of travel/retail/hospitality shares, some of which are now below the March lows e.g. Greggs (LON:GRG) - but it still looks expensive. Whilst others have reported spectacular rebounds in business, but still look cheap - e.g. Scs (LON:SCS) . So as ever, it's a confusing picture, tricky to navigate. For retailers, I think it's becoming clear that retail parks are recovering much better than town centres. Hence why a focus on companies mainly in retail parks is probably a good idea.

The news is full of stories about fresh covid outbreaks occurring in many countries. Not what we want to hear. It feels like this thing is going to be around for a while.

USA results season - I watched the 9pm onwards CNBC show last night, as several mega-cap tech companies were reporting earnings. Facebook, Apple, and Amazon, all smashed (lowered) forecasts, with big after-hours moves up. This destroyed my theory that the US market is poised to crash because earnings would fall short of forecasts. Therefore I've stopped shorting US indices. It reinforces the point that the US stock market is not the US economy. It's dominated by some of the best companies to have ever existed, with global reach because of the internet. If you have to pay 27 times earnings for a business that dominates its space, is that really expensive, in an era of zero interest rates? Arguably not. It looks like the dominance of big tech is likely to continue for some time to come.

.

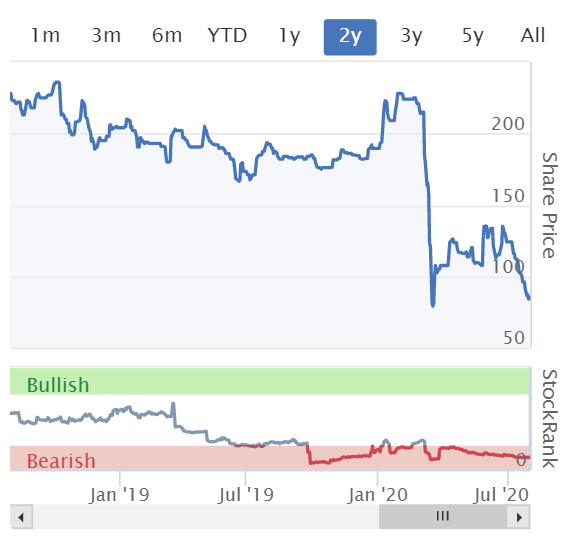

Everyman Media (LON:EMAN)

Share price: 84p

No. shares: 91.1m

Market cap: £76.5m

Shares seem to have split into 3 groups due to covid;

1. Resilient, or even improved trading (e.g. some tech/internet businesses)

2. Impacted by covid, but recovering quickly, and impact only temporary

3. Severe impact, recovery slow & uncertain

A good strategy so far would have been to stick with category 1 above. The trouble is, those shares are so expensive now. Hence I'm generally looking for opportunities in category 2 (ScS yesterday was a good example), because they're cheap, and recovering well. I'm trying to avoid category 3 altogether. Cinemas seem to fall firmly in category 3. Who on earth would want to sit in a room, with lots of other people, and watch a film, and possibly be exposed to a nasty virus? If they space out the seats, would a cinema be able to make a profit? It seems to me one of the most obviously terrible places to invest. Also, with huge flat screen TVs now so cheap, you can get a similar immersive view at home, and maybe movies could move to direct-to-streaming, or people just use Netflix instead? I see big structural challenges for cinemas in this regard. I hate going to the cinema, as the experience is ruined by constant rustling of sweet papers, and people coughing, using their mobile phones, etc. . But I despise the uncouth general public mostly, so perhaps I'm not typical?

The upside case relies on the virus being completely eliminated, which is looking a tall order any time soon.

Everyman did a placing, raising £17.5m at 100p per share (a 7% discount at the time) in April 2020 - a sensible move, to raise money early during the pandemic, to shore things up.

Looking at its last balance sheet, at 2 Jan 2020, net debt was fairly modest at £9.8m, so ignoring any subsequent capex, the placing should have at least cleared all the bank debt. Lease liabilities are substantial though. That's not a problem if sites are operating profitably, but since all closed sites will be loss-making, then the lease liabilities would be a millstone now. Quite possibly locked in to uneconomic rents now, if revenue settles at a lower level than pre-covid.

Today's update -

Everyman along with all other cinema operators closed its doors in the middle of March. All venues remained closed for the rest of H1 with no further revenue from that point until 4 July.

Our banking partners have been supportive with appropriate changes to the covenants on the Group credit facility, and the Group will remain within its banking covenants in H2 and beyond.

That sounds OK. Although in my experience, banks are highly averse to funding losses. Therefore if its cinemas have to close, or continue operating at a heavy loss, then the bank probably won't want to cover those losses through a borrowing facility. Therefore, another placing might be necessary if trading doesn't recover.

During the period of closure all but 18 staff were furloughed, and further government support was received in terms of rates relief and the Retail, Hospitality and Leisure Business Grant. In addition, the reduction of VAT from 20% to 5% on admissions and certain food and beverage items will benefit the business in H2.

That's a lot of support from the taxpayer. The VAT reduction is a particular boost, not available to other sectors.

Rents -

Property costs are the second largest overhead in the business and Everyman has worked with all of its landlords throughout the period to agree variations to the lease agreements. Concessions have been agreed on over half of the estate, and further discussions are still ongoing.

"Concessions" may just mean more time to pay - e.g. monthly instead of quarterly payments? I doubt many landlords would reduce the contractually agreed rents - why would they? The only reason to do so, would be if the tenant were about to go bust (not the case here), or if a lease was coming up for expiry, which is usually the only time that landlords think about rent reductions, as the alternative is an empty unit.

New sites - I would have expected this to be zero. But the company is planning on opening 8 new sites, down from 11. That strikes me as very odd. Surely at a time like this, it would make sense to halt all expansion? Possibly there might be signed contracts that make it uneconomic to pull out, but that would be a key question I would want to ask management. Why open new sites, when the future is so uncertain?

Re-opening - 17 sites have started trading;

Whilst current trading has inevitably been soft with no major releases, encouraging numbers of customers are returning. This validates the strength of the business model, which is well positioned to take advantage as the sector recovers. The Group has a strong balance sheet to support its activities during what is expected to be a restricted trading period in H2.

No figures given, so one person's "encouraging" may not be another's.

My opinion - there's not enough information in today's update to enable me to take this any further.

With a second wave of covid seemingly underway, in the UK and abroad, I'd be surprised if cinemas are allowed to continue trading. For that reason, I don't see any attraction to this share. It would need to be a fraction of the current price, to make risk:reward attractive to me. Why pay up-front for a recovery that may not happen?

.

.

Hml Holdings (LON:HMLH)

Recommended offer at 37.5p

Announced yesterday, this offer looks reasonable to me, and provides a cash exit from a disappointing investment.

The bidder is Harwood Capital, which is a very shrewd investor, headed by Christopher Mills. He's an excellent stock-picker in my opinion. The trouble is, he often takes big stakes in small caps, and if he likes them, bids for the whole thing, often at a low valuation, forcing out private investors. Therefore it's a double-edged sword following him into particular listed companies - we might make a bit of a profit, but if there's big upside, he'll grab it for himself.

In this case, I think a lot shareholders in HMLH will be glad to take the money, and let him have the company. It was meant to be a buy & build, in the property services space, with operational efficiencies building from growing scale. A series of acquisitions were made, leading to an increasingly top-heavy balance sheet with a lot of goodwill, but profit didn't seem to budge much. So the failure to gain traction with acquisitions, meant a falling share price, hence difficulty raising equity for more acquisitions. Therefore the stock market listing, and all its costs and hassle, didn't make sense. I don't rate management here, given their lacklustre track record.

HMLH is far better suited to be a private company. Watch it probably come back to the stock market, in 3-5 years time, with new management, and having made some successful acquisitions, and priced at 10 times what Harwood buys it for!(speculation on my part, but it's typical of what Harwood sometimes does, and good for them I suppose)

.

Science (LON:SAG)

Share price: 239p

No. shares: 41.5m

Market cap: £99.2m

It's too hot to even think today in London, 33oC. I was hit by a wall of heat, stepping out of my bedroom after my mid-morning nap (I hate 7am starts!). But I did half-promise a reader that I'd look at SAG, so we'll round off with this one.

Science Group is an international, science-led services and product development organisation with a significant freehold property asset base. Following the Frontier acquisition in 2019 and an organisation restructuring, the Group now comprises three operating divisions: R&D Consultancy; Regulatory & Compliance; and Frontier Smart Technologies.

The group sounds pleased with its H1 performance, helped partly by the acquisition/merger of Frontier in Sept 2019. Checking back through older announcements, Frontier seems to have been a sort out job, with its premises being shed, and operations moved to SAG's large properties (which look like stately homes with modern units built i the grounds, judging by aerial photos on the internet). It also brought with it large tax losses. Looks quite an interesting deal, and it has moved back into profit due to the cost cutting, as planned. Nice to see SAG management able to execute on a deal which required some sorting out, adding value.

Adjusted PBT of £4.6m in H1 (up 59% on H1 LY) - helped by the acquisition of Frontier. It's not clear what organic growth is, but seems to be much lower at 13-15%

Adjusted EPS in H1 is 8.8p, or 8.5p adjusted, up very well from 5.9p LY

Odd structure, with freehold properties, which it says are worth more than book value. £22.6m to £33.9m recent valuation. Partially offset by property debt of £17.1m, annual interest charge of £0.4m is much less than the likely rent, if they were leased. So I like this structure. Also, if you own freeholds, you don't have to worry about upward only rent reviews, that are the undoing of so many companies. This is an old fashioned structure, but I like it.

No divi for now, but sounds like they might pay one later.

Share-based charges seem a bit warm, at £0.7m this half year, and £1.17m last year.

Balance sheet overall is OK, but not amazing. NAV: £39.1m, but that includes £26.5m intangibles, and £4.1m of client funds, which I would deduct, to get £8.5m NTAV. The main reason the balance sheet looks better than £8.5m NTAV implies, is because trade creditors is very large, at £23.9m. I suspect that probably includes a lot of deferred income (where clients pay cash up front) maybe?

My opinion - this is only a quick review of the H1 numbers, I'm not claiming to know the company well.

I very much like that it seems to have sailed through the covid crisis, and still produced excellent H1 figures. Plus I like that it has spare cash for more acquisitions. The unusual freehold/debt combination is interesting.

Overall then, it looks like something that readers might want to take a closer look at. I can't see anything wrong with it anyway!

In summary, the performance of the Group in the first half of 2020 has been ahead of the Board's pre-Covid-19 expectations, despite the operational challenges resulting from the pandemic. The excellent first half provides a solid platform for the rest of the year.

While actively recruiting for key roles to strengthen the Group and to position the organisation in a post-Covid-19 world, the Board recognises the inherent uncertainty and lack of predictability in the months ahead and will therefore remain prudent. However, with a strong balance sheet including significant cash resources, the Board continues to cautiously explore both add-on acquisitions and larger opportunities to increase the scale of the Group.

.

It's far too hot to do any more work today, so I shall sign off & hope you have an enjoyable weekend.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.