Good morning, Paul & Jack here with the last report for this week, and we'll record another podcast this afternoon too, to summarise the week's main small cap events. Hopefully with better sound quality - I've bought a new mic. Today's report is now finished.

Podcast - we've just recorded it - quicker, and with better audio quality. Should be up on Spotify in a couple of hours. Just search for Small Cap Value Report.

Agenda -

Paul's Section:

Dx (group) (LON:DX.) - shares are still suspended. Now the auditors have resigned, before signing off the accounts. We're only given DX's summary of the auditors resignation letter, not the actual text of it. Coming on the back of 2 NEDs recently resigning, this is looking grim for management. The underlying issue is some kind of disciplinary investigation. I think the auditor resignation, which makes clear that management have not been truthful, means it's overdue for a change of top management.

Virgin Wines Uk (LON:VINO) - a fairly mild profit warning from yesterday, which has clobbered the share price by about 25%. As we suspected might happen, growth from the pandemic is now proving difficult to beat, with revenue growth turning negative in Q2 (Oct-Dec 2021). VINO looks an OK company, nothing special though. Just one of several wine delivery/subscription companies.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Dx (group) (LON:DX.)

Suspended at 30p - mkt cap £172m

Good thing these shares are suspended, as I think they would have plummeted on recent news that 2 NEDs resigned, and now today the auditor Grant Thornton has resigned.

The ridiculous thing is, we still don’t know what the problem is, which caused the shares to be suspended on 4 Jan 2022, other than it is a “corporate governance inquiry”. Which covers a wide range of possible problems, and I wouldn’t like to speculate, because that could get me into trouble!

This inquiry -

…is required to be completed prior to the conclusion of the audit of the financial statements of the Company for the year ended 3 July 2021.

Which does raise the question of whether Grant Thornton will be completing the audit or not? Presumably as they’ve tendered their resignation, then a new audit firm will need to re-audit the figures? I don’t know. It’s extremely unusual for an auditor to resign without signing off the figures, so something must be seriously wrong. The company has been at pains to tell us the corporate governance inquiry doesn’t affect its figures, or trading.

This mysterious inquiry - the subject matter of which has been kept secret by the company -

The Inquiry which, until their resignations as announced on 2 February 2020, was led by Non-executive Directors, Ian Gray and Paul Goodson, has not proceeded as expediently as initially hoped by the Board. Nonetheless, it remains focused on concluding the Inquiry as soon as possible.

Auditors resignation letter - according to DX is inaccurate! This is laughable. Who would investors believe - a company which is covering up the reasons for an internal inquiry, or the auditor that has just resigned as a consequence of it?

As required in the circumstances by section 519 of the Companies Act 2006 (the "Companies Act"), Grant Thornton has provided the Company with the reasons connected with its resignation (the "Reasons"). However, the Board of DX does not consider that the Reasons provided by Grant Thornton accurately reflect the current situation. As required by the Companies Act, DX will send a copy of the Reasons to shareholders within 14 days of their receipt.

As we learned from Maynard Paton’s recent outstanding article on Cake Box Holdings (LON:CBOX) , it is essential for investors to carefully consider the reasons why an auditor has resigned. Not always easy, as companies don’t seem to like publishing resignation letters on the RNS.

I can’t find the full resignation letter from Grant Thornton, just a summary of it from DX.

With CBOX, they did publish the resignation letter on their website, but did not RNS it. So I imagine a similar thing might happen with DX? I can’t find the auditor resignation letter on DX’s website yet, but they have 14 days to publish it.

Finally we have a bit more information on what this corporate governance inquiry might be about -

The Board reiterates that the Inquiry is a corporate governance investigation and, in addition, notes that it is connected to a disciplinary matter. It does not relate to the financial performance or the financial position of the Group, consistent with the trading update released on 2 February 2022.

That sounds like somebody’s misbehaved, and is trying to cling on to their job! Meanwhile the auditors and the NEDs have signalled with their resignations, that they don’t want to work with the person or persons who have misbehaved.

What does that mean then? Probably the person(s) involved are forced to resign, and then the market is told what’s going on. As it doesn’t seem to have any financial impact, then possibly this might not have much impact on the valuation of the company? Depending on the news, a big markdown in the price of the shares when they come back from suspension, might be a buying opportunity, who knows, as we need to hear the full facts first. Or (as before) the share price might initially plunge, then recover a few days later?

DX publishes its interpretation of the auditors resignation letter, but seeing as both sides are effectively accusing each other of lying, then I’d much rather withhold judgement until I see the actual letter from the outgoing auditor. This is what DX says about it today -

Grant Thornton's stated Reasons relate to its view of the Company's governance and to executive conduct, specifically arising in connection with Grant Thornton's concerns over:

(i) actual or potential breaches of law and/or regulations by the Company and/or by an entity in the DX (Group) Plc group and/or by employees;

(ii) the performance of the investigation and subsequent corporate governance inquiry referred to by the Company in its announcement on 25 November 2021, and action in response to the evidence generated by that investigation and inquiry;

(iii) the provision of inaccurate information, which in Grant Thornton's view did not give a full picture of the scale and seriousness of the facts referred to in (i) and (ii) above; and concerns over insufficient access to relevant information and documents, in relation to the matters being investigated by the Company.

That couldn’t be clearer to my mind - Grant Thornton is saying that DX management are not to be trusted, and have lied to them, at least by omission.

My opinion - it’s anybody’s guess what price DX shares resume trading at, and what the circumstances are at the time. The cleanest position would be for CEO & CFO to resign, walk away, and new interim management reveal what’s happened, in full. Then the company can move on from whatever this disciplinary matter is about.

Trading Update - from 2 days ago.

This is a tricky one, as if we can’t trust management, which is what Grant Thornton is clearly saying, then how much reliance should we place on a trading update?

Does it matter, because the shares are suspended from trading anyway?

DX, the provider of delivery solutions, including parcel freight, secure courier and logistics services, is pleased to provide an update on trading for the 26 weeks ending 1 January 2022, the first half of its current financial year.

It’s in line with expectations -

Trading over the period was in line with the Board's expectations, despite the tight labour market and customers' supply chain disruptions.

Group revenue was approximately 11% ahead of the first half of the previous financial year, and the trading momentum has continued into the third quarter of the financial year.

This sounds encouraging -

DX Freight continued to improve its volumes and margins against the same period last year. Volumes at DX Express were consistent with the first half of last year, with the product mix showing a slight shift back towards its historic B2B weighting rather than B2C, following the easing of coronavirus restrictions.

Net new business at both divisions continued to be robust and the pipeline of new business opportunities remains extremely healthy.

Other points -

Lots of new depots are being opened.

Liquidity is good, with £14.5m net cash, and an unused £20m bank facility.

My opinion - I’m not really interested in investing in any freight or logistics companies, because it’s low margin, highly competitive, and capital-intensive. Although both Clipper Logistics (LON:CLG) and Wincanton (LON:WIN) look potentially interesting, because I think they add more value for their customers, not just moving stuff from A to B.

The other problem with DX is that it doesn’t provide a split of profits between the structurally declining part of its business (a secure postal service for lawyers, which is being replaced gradually by email), and the rest of the business. This has been obscured ever since the group floated in 2014. As with so many new floats, there’s often an underlying reason why the previous owners want to cash out (at least in part), on the back of a couple of years strong trading, and with decline most likely to be future direction. Hence we have to be so careful with new floats. Although DX does seem to have pulled off a good turnaround more recently.

Anyway, the market will decide what happens to this share, once they come back from suspension.

.

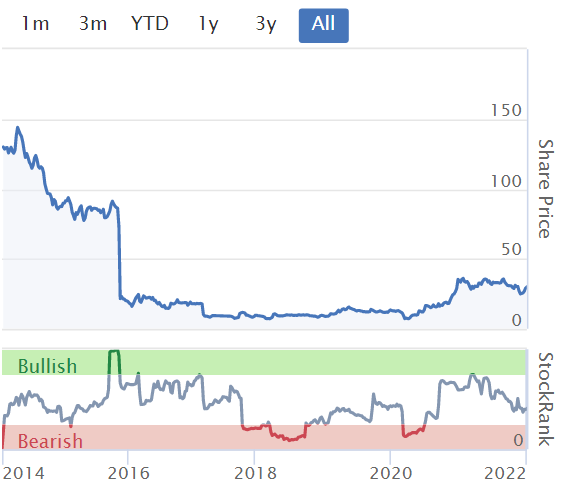

Virgin Wines Uk (LON:VINO)

150p - mkt cap £84m

Virgin Wines UK plc (AIM: VINO), one of the UK's largest direct-to-consumer online wine retailers, today announces a trading update for the six months ended 31 December 2021 (the "Period").

As I mentioned recently, we have to be a bit wary of the PR summary that is becoming fashionable to put at the top of trading updates. Usually these are helpful, e.g. if they flag up trading is ahead of expectations. But sometimes they’re misused, to gloss over negatives. That is very unhelpful, even deceitful, and it undermines trust in companies & their management. I keep a mental note of which companies tell it like it is, and which ones seem addicted to spin. I’m more likely to buy shares in the former!

I’m not impressed with the positive summary published by VINO in yesterday’s trading update, as what they said below is clearly inconsistent with the share price plunging about 25% yesterday -

Strong performance from existing customers drives growth in subscription based sales

Hi highlights -

H1 revenue flat vs last year H1 at £40.5m (but 2 year rise is +55%)

Checking my previous notes, we flagged up here on 28 Oct 2021 that revenue growth was slowing from +30% in FY 06/2021, to +13.3% in Q1 of FY 06/2022. Therefore flat for H1, implies about -13% in Q2 - clearly not good, but against tough comparatives.

Subscription revenues are up though, but the problem is that new customers have fallen. Since the company is valued on total revenues, I can’t get excited about the rise in subscription revenues. There’s inevitably customer churn, so for the business model to work, it has to constantly recruit enough new customers.

Commercial revenues (e.g. Moonpig, Virgin Money) are doing well, up 25% vs LY

Operational challenges, including freight costs & staff absences from omicron - £0.8m sales lost, and

“ the Group has largely been able to mitigate these pressures through highly efficient marketing, disciplined customer acquisition and strict control of costs.”

Outlook - not too bad in the circumstances -

Due to the uncertain trading and macro environment, coupled with numerous headwinds in relation to increased cost pressure, the Group now expects revenue and profit for the year ending June 2022 to be slightly below consensus market estimates.

Net cash of £13.6m at end Dec 2021. It sits on customer advance payments remember, so I would need to see the full balance sheet to work out how much of this cash is really the company’s money.

My opinion - it’s quite a good business, judging from the FY 6/2021 numbers. Although here are the SCVR we’ve always been a bit sceptical about how much it benefited from the pandemic drawing in new customers, and whether the growth rate could be sustained?

It now transpires that scepticism was well founded, with sales growth having turned negative in Q2. Cutting marketing spend might preserve profitability, but it’s also likely to mean further declines in revenues, if the company is not replacing customer churn which is inevitable.

As regards competition, VINO isn’t doing anything unique. As the IPO Admission Document set out, there are about 4 similar companies doing the same thing. I’ve test purchased from both Virgin Wines and Naked Wines, and they’re both OK - nice enough wines, similar to supermarket wines for about £10 per bottle. Ordering them online saves lugging around heavy bottles for the customer, if not the poor DHL delivery driver! Supermarkets also offer online delivery services though.

How to value VINO shares? Even though the profit warning was only a mild one, I think it’s highlighted that the company is now probably ex-growth. Or, like so many eCommerce companies, we don’t know for sure whether it’s ex-growth, or whether 2020 pulled forward demand, which is reversing in 2021, and could then resume a more gentle upward path in 2022 and beyond? That seems logical to me, so there could be bargains in this sector, after so many eCommerce businesses have collapsed in price in the last year (tell me about it!)

Overall, I can’t get excited about VINO. It’s an OK business, now perhaps priced a little too high, given that growth may be hard to come by?

Like so many IPOs in the last couple of years, it was over-priced, based on unsustainable growth.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.