Good morning, it's Paul here!

There are 3 company updates today of interest to me (and hopefully you too).

Johnson Service (LON:JSG)

Share price: 116p (pre market open today)

No. shares: 367.6m

Market cap: £426.4m

JSG, a leading UK textile rental provider, is pleased to provide a trading update for the six months to 31 December 2018.

This group has a 31 Dec year end, so it is reporting today on H2, and the full year.

The key takeaway is this;

We remain positive about the future prospects for the business and we expect to announce full year results in line with market expectations.

Other points;

- Investment of £3.3m in its London laundry has completed on time & on budget

- Aug 2018 acquisition of South West Laundry - is being successfully integrated

- Signed contract to build a new laundry in North of England. Coming on stream in early 2020 - to increase capacity

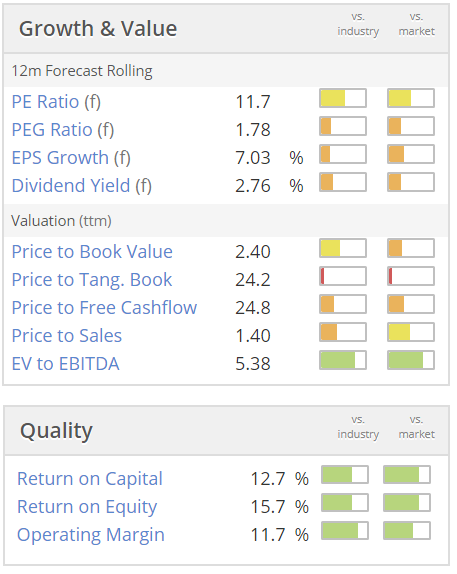

Valuation - it looks quite attractive value on a PER basis.;

Balance sheet - it's always worth looking at the Price to Tang. Book field above, which in this case is 24.2. That's not very good - i.e. the market cap is 24.2 times NTAV on the balance sheet. I've had a quick look at the most recent (interim) balance sheet, and it only has £16m in NTAV.

It's dominated by about £160m in intangible assets - reflecting acquisitions made, to expand the group. There's quite a bit of bank debt too.

My opinion - trading seems to be going fairly well.

Debt is not at alarming levels, but in current market conditions, I'm inclined to steer clear of companies with debt.

Note that this sector, of textile hire, has historically done badly in recessions. I recall in the past that big write-downs in the value of rental textiles had to be made, for customers which go bust.

It's difficult to see any particular reason to want to get involved with this share, in current wobbly market conditions. If the PER went into single digits, then it might make more sense to look at it.

Gear4Music

Share price: 255p (down 50% today, at 10:14)

No. shares: 20.9m

Market cap: £53.3m

(at the time of writing, I hold a long position in this share)

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces a trading update for the four months from 1 September 2018 to 31 December 2018 (the "Period").

The next year end is 31 March 2019 - NB this is a 13 month period, as the accounting year end was recently extended by a month, for operational convenience.

Key points;

- Continued strong organic revenue growth at +41% (up from 36% in H1)

- Europe & RoW sales growth higher than UK (+47% and +36% respectively) - overseas sales are now close to overtaking UK sales - important, as a global sales opportunity deserves a higher rating for the share than just a UK business

- Capacity constraints reached in York distribution centre - implies sales growth could have been higher. Plans to increase capacity in 2019

- FY2019 EBITDA to be slightly below FY2018 - this is not likely to go down well in current stock market conditions

- Swedish distribution centre expanded - now have good spare capacity headroom at both European centres

Outlook - strong sales expected for the rest of this financial year.

Competitive pressures on margins are mentioned;

Our focus has been on gaining market share in what has been a highly competitive environment, and in support of this target and following a period of planned investment, margins during the Period began to return towards historical levels. We are confident of further improvements as we progress through FY20.

That sounds as if margins should improve going forwards.

My opinion - I see the share price has fallen 30% in early trading, which looks a ridiculous over-reaction.

The business model at G4M is to grow as fast as possible. Then the profit taps can be turned on later, because marketing spend as a percentage of revenues can be reduced. The market probably doesn't understand, or isn't even interested in this point right now.

Long-term this share is a winner, in my view. However, at the moment, growth stocks get clobbered so badly if they put a foot even slightly wrong.

Update: since writing the above, the share price has fallen by 50% on the day, on very heavy two-way volume. That is pretty astonishing, for an update that probably would have trimmed the share price by about 10%, in more normal markets.

To reiterate, the key point to understand is that G4M's marketing spending being 8.4% of revenues last year, and that this is discretionary, and is being used to drive growth. The point is that when the business is, say 5 times its current size, then marketing will drop to a much lower % of revenues. That fall will drop straight through to profits. Hence it's nonsensical to try to value the business at this rapid growth stage, on a multiple of current earnings. We need to look forwards, and value it on a multiple of future earnings, once the net margin has gone up to something more like 5-10% of revenues.

If you get that point, and are prepared to hold for the long-term, then I am pretty sure that today's price plunge to 255p makes a very nice entry point. Time will tell.

Cambria Automobiles (LON:CAMB)

Share price: 57p (up 4.6% today, at 10:35)

No. shares: 100.0m

Market cap: £57.0m

This is a car dealers chain, with a 31 Aug 2019 year end. Today's update covers the first 3 months of this year (Sep, Oct & Nov).

Things seem to be going surprisingly well;

The Group's trading performance in the first three months of the current financial year to November 2018 has been in line with the Board's expectations and ahead of the corresponding period in 2017, both on a total and like-for-like basis.

WLTP emissions regulations have caused major disruption to new car supplies (nothing to do with Brexit, by the way - that might come later, or it may not, who knows?). However, as other car dealers have said, the reduced supply has enabled them to charge more (higher gross profits), so net profits have not been harmed.

To me, this augurs well for any future supply disruption. Bear in mind we're talking big numbers here - Q1 new car volumes were down 21% on a LFL basis. So for that not to hit profits, is remarkable, and counter-intuitive. However, thinking it through, the gross margins on new cars are tiny. So if supply is constricted, then that works to the dealer's advantage, as customers can't shop around so much, and dealers don't need to offer discounts.

Used car sales fell, by 2.9% on an LFL basis, but also benefited from higher gross margins.

Aftersales did particularly well, with LFL gross profit up 8.3%

Outlook - well positioned, but Brexit obviously mentioned as an uncertainty

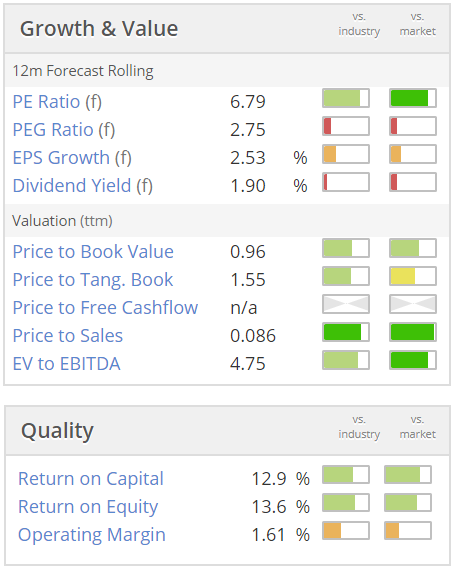

My opinion - as I mentioned recently at Mello London, car dealers are currently very cheap, and most have very good tangible asset backing too, in the form of big freehold property portfolios. That makes them doubly attractive.

Business models in the sector have proven remarkably resilient, in the recent supply constraints. Buying now, in advance of Brexit uncertainty, is obviously risky, but that's why shares in this sector are so cheap.

That's all from me today. Have a smashing weekend!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.