Good morning, Jack here.

With news that Apple is now worth more than the entire FTSE 100, perhaps it’s not surprising to see a sharp pullback in US and China tech shares overnight.

Around $150bn has been wiped from the company’s market cap - an entire Unilever up in smoke - down 8%, with Amazon and others down c4%. The fall has to be placed in context - US equity markets have rallied by more than 50% since March as institutional money flowed back into big tech. The correction looks to have spread to China too. It’s not surprising to see some profit taking given equity market performances since March/April.

As we head into Q3 of a frankly astonishing year I’ve been doing some thinking (dangerous, I know).

Mostly I just look for small, well-run companies that can become much bigger in time - but recent events have been so significant that they might trigger some fundamental changes in market dynamics. So I’ve been grappling with slightly more macro considerations.

Maybe a better way of saying it is certain trends are becoming more entrenched: currency debasement; big tech and the High Street demise; increased data and IT support as more people work from home; the possibility of increased fiscal spending, etc.

Out of everything, maybe the most important dynamic is zero/negative interest rate environment monetary policies. QE has exploded recently. Central banks are regularly sending out tidal waves of cash. Everything between the Great Financial Crash up until the start of 2020 looks like child’s play compared to the post-COVID binge witnessed over the past few months.

This is a powerful driver of gold and silver. I want more portfolio exposure to these metals because I personally think spot prices there have further to run. Then there are other long term growth markets. Other metals such as palladium and copper might be worth a look.

Software and IT - Computacenter is hitting all-time highs as business booms. Gaming is a huge and maturing global industry. The UK punches above its weight here with several listed plays, although valuation remains a concern.

And then putting thematic thinking to one side, there are some attractive bottom-up valuations in UK equities. UPGS has trebled since March and so has Gear4Music. There are solid operators out there that still have yet to recover, such as Headlam, covered by Paul yesterday.

Very serious risks remain of course and with close to 0% interest rates there is precious little cushion.

What I don’t know is much greater than what I know - but I continue to believe a strategy of investing in small companies with good management, healthy balance sheets, reasonable valuations, and strong growth prospects will do well in the long term.

Zegona Communications (LON:ZEG)

Share price: 112p (unchanged)

No. shares: 219.0m

Market cap: £245.25m

Zegona Communications (LON:ZEG) is focused on a ‘Buy-Fix-Sell’ strategy within the European Telecomms market. Its first move was the acquisition of Telecable in the Asturias region of Spain, which completed on 14 August 2015. Following the sale of Telecable to Euskaltel on 26 July 2017, Zegona acquired a 15% ownership in Euskaltel. Since then the group has taken its interest in Euskaltel to 21.44%, making it the group’s largest shareholder.

Directors want to turn this into a £1-3bn enterprise value company. Right now though it seems as though ZEG is more an activist investor with one core holding. An unusual state of affairs. I looked at Sigmaroc recently which is running a ‘buy and build’ operation in construction assets. What struck me there is that to hop onto this kind of strategy early on, you need to have a favourable view of the management team.

It seems like the main men at Zegona are Eamonn O’Hare - chairman and CEO, formerly CFO of Virgin Media and the UK division of Tesco, and Robert Samuelson - founder and COO, also formerly of Virgin Media. So, two ex Virgin Media executives.

Perhaps they can cause some damage. I might investigate this team in more detail later - for now, you can see more on this part of ZEG’s investor relations site if it piques your interest.

Another thing stands out with ZEG - given its main source of income is a minority stake in another company, it looks like the group reports its share of this profit using the equity accounting method. This means no revenue (but if you want, you could probably just multiply Euskaltel’s revenue by ZEG’s stake in that company to come up with an indicative figure).

From the group’s 2019 annual report:

In March 2020, Euskaltel published its 2020-2025 Business Plan setting out its key strategic initiatives and its ambition to double the size of its customer base and grow revenues to over €1.2bn and EBITDA to over €470m by 2025. The plan details the actions being taken to grow in its existing core regions, to expand using the Virgin brand to offer high value services to customers across Spain, and to continue to drive operational efficiencies through a single integrated organisation.

ZEG’s 21.3% interest would equate to €255.6m (£228m) of revenue and c€100m (£89m) of EBITDA by 2025. Given ZEG’s £245m market cap, that makes it worth investigating. Spanish telecomms is not a market I know though, and these companies can often come saddled with debt, so I’d personally take a much closer look at Euskaltel too if possible.

Euskaltel (MCE:EKT) is the leading converged telecommunications provider in the North of Spain, with a network covering 2.3 million households. It’s publicly traded and has a market cap of £1.23bn (meaning ZEG shares trade at a slight discount to its 21.3% stake: £245m vs. c£262m) and €668m of revenue. ZEG itself calculates its underlying net asset value to be £1.23 per share.

As expected, EKT has more than its market cap in net debt (c£1.29bn) but has stable cash generation.

That to one side for now, the community’s been buying:

And Zegona itself has been buying back shares, so let’s look at today’s interim results.

Interim results for the six months ended 30 June 2020

There are a lot of words before you start getting to the actual numbers. Some sifting is required…

Record profitability - €91.8 million Q2 EBITDA within EKT's traditional business; record customer growth; limited COVID 19 impact; third consecutive quarter of year-on-year revenue increases.

Ah, Euskaltel operating cash flow up 10% to €50.9m, that feels a little more concrete. The accounting value of the investment appears to be down though, so mixed I'd say.

It appears as though ZEG is pushing a turnaround in EKT’s operations which is still at an early stage so there’s just not an awful lot to go on right now.

As for Zegona itself, for the period:

- Profit fell from €33.7m to €7.1m due to a change in the reporting of its EKT investment as a result of its increasing influence

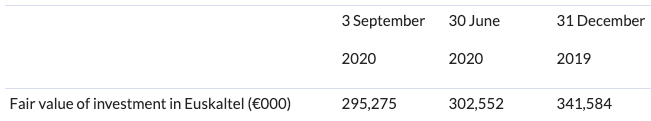

- The fair value of Zegona's investment in Euskaltel was €302.6m at 30 June 2020 (2019: €303.6m).

In terms of outlook:

In addition to supporting Euskaltel's performance improvement through its representation on the Euskaltel board, Zegona continues to see many attractive investment opportunities both in Spain and the wider European TMT market.

There seems to be a punchy management incentive that entitles the team to 15% of the growth in value of Zegona across various calculation periods, ‘provided that ordinary shareholders achieve a 5% Preferred Return in each Calculation Period.’ I would want to look at this more closely. This target was not met in the first calculation period and so no value was received by management.

Conclusion

An interesting company that looks to be helmed by an experienced team that has worked together before. A lot of whether ZEG is a good investment depends on a closer look at Euskaltel.

There is also the accounting - it’s not the standard profile of an operating company. Note 6 to the results seems to have more of a breakdown and I’ll take a closer when I can but for now suffice to say the way the StockRanks and other metrics are set up might not necessarily reflect the changes in value at ZEG, which are primarily driven by its 21.44% stake in a £1.23bn Spanish telecomm business.

That kind of situation can create opportunities though, as there is greater scope for a mismatch between market price and intrinsic valuation. Is that happening here? I’m not sure yet! The company is buying back shares. Directors are also net buyers over the past couple of years.

Still too early to tell for me, though, especially given the declining fair value of investment in EKT and underlying asset value at ZEG.

Serica Energy (LON:SQZ)

Share price: 111.8p (unchanged)

No. shares: 267.6m

Market cap: £297.58m

A very quick update here, just to tell the market that Serica Energy (LON:SQZ) has been offered a new operating licence covering four UK North sea blocks.

I’ve had a quick look at this oil and gas (mainly gas) operator before and it seems like it could be a solid pick. So much here depends on the macro outlook for gas of course but that’s why it’s worth flagging.

Some metals are rallying - will oil and gas rebound at some point too? Or are the dynamics just too different given the ongoing social drive towards a green, renewable future?

I have no exposure to the Oil & Gas sector right now and am curious to hear other people’s views on this part of the market.

I’m quite happy on the sidelines for now but if I had to be picking stocks here to look at more closely, I would probably be looking at SQZ and £JSE. SQZ has a c£100m net cash position but there may be decommissioning liabilities to read up on. Interim results are out next Thursday so that should provide some guidance.

As I said though, happy to sit out for now.

Redde Northgate (LON:REDD)

Share price: 205p (+7.33%)

No. shares: 246m

Market cap: £470m

Venturing out into mid cap territory here but I can see Jonno, Yellowstone et al talking about this modestly valued contrarian play. Redde Northgate (LON:REDD) does have a fair amount of debt but looks cheap on both a PE and EV/EBITDA basis.

There’s also that 8.75% dividend yield - I’ve had a quick check through historic RNS announcements and it seems as though it has yet to make a final decision on whether this payment will go through.

Given the group’s net debt and today’s acquisition (see below), perhaps the divi will be canceled. If you’re ever going to, you might as well now while everyone else is doing it. The vehicle hiring business (sorry, I mean integrated mobility solutions and automotive services provision) is fairly capital intensive:

Net debt has been rising so perhaps cash might be better used paying down some debt.

Mind you the group’s net assets and sales have also been increasing, and then there is the Redde Northgate merger back in February, which results in greater scale and, presumably, synergies.

A combined Redde Northgate might have a few more growth levers at its disposal. Plus if the resulting group can survive a multi-month social lockdown with a net debt balance sheet, that’s probably about as bad as it can get (famous last words?) - so the fact that it is surviving has to go in its favour.

Anyway, the actual news today is the acquisition of certain Nationwide Accident Repair Services assets alongside a trading update, so let’s take a look.

Acquisition of business and assets

Trading

- Sequential month-on-month improvements

- ‘Excellent’ progress in integrating Redde and Northgate since merger

- Strong cash inflows and increased headroom on bank facilities from £234m at end April to £291m at end August

Sounds good to me, particularly for a stock on a forecast FY21 PE of c6.7x.

A quick look at the financial health scores show that even with the net debt, REDD is in a reasonably solid condition:

Liquidity ratios are quite low - but if it’s within historic norms then that’s probably just the business model. If the current ratio is declining over time, then that probably warrants a closer look.

Returns on capital are reasonably healthy for such an asset-heavy operation, and ROE is boosted by the debt, while an operating margin of close to 10% is actually quite good.

Acquisition

Nationwide ‘is the UK’s largest wholly and the largest independent accident repair company in Europe’. It’s also a strategic partner to many UK insurers.

REDD will take on 77 of the 102 bodyshop sites from administrators in an acquisition it expects to be immediately earnings enhancing. It’s paying an initial cash consideration of £11m plus a deferred £5m payment contingent on retention of certain business.

It looks like a potentially good bit of opportunistic business, with flexibility over which sites it continues to run and increased service, maintenance, and repair capabilities in the UK. Group CEO Martin Ward also says the move should open up new markets for REDD.

Conclusion

Above in the preamble I touched on the idea of stocks out there that have been hammered but that will be eventual winners in their respective markets. Rerating opportunities, essentially.

Perhaps REDD can be added to that list.

In general I am trying to steer clear of net debt positions but REDD’s operations are recovering, its liquidity headroom is improving, this recent acquisition looks quite sharp, and even before that there were probably enhanced growth prospects as a result of the significant merger and scale economies.

I’d like to know what’s happening with that dividend. Ultimately though, given the low valuation, synergy opportunities, and improving growth prospects, this is one turnaround opportunity I’d like to take a closer look at.

Even after the recent modest share price recovery it trades at a discount to tangible book and with a bit of earnings growth and multiple expansion you could quite quickly be looking at a sizable return.

Renew (LON:RNWH)

Share price: 465p (+9.54%)

No. shares: 246m

Market cap: £612.5m

Renew Holdings (LON:RNWH) is a holding company that owns a mix of construction and engineering subsidiaries. This is actually an area I’ve been looking at in case we do see higher levels of infrastructure spending in future.

What I immediately like about Renew is a steady improvement in operating margin over many years:

Revenue has also grown very steadily at a 5y compound annual growth rate (CAGR) of 5.25%. That margin improvement means that net profit has grown at a much higher CAGR of 34% over the same period though.

The group appears cash generative, but construction is cyclical and times have been good recently. RNWH has a £32m net debt position - in contrast, I’ve written about BILN before here, which has a stronger balance sheet and net cash position. At first glance the latter is smaller, on a cheaper valuation, and looks to be more conservatively run from a financial health perspective.

RNWH can justify a higher multiple with superior trading of course.

On this note the group says that:

‘Trading... has been strong and consequently the Board expects the Group's full year results to be materially ahead of current market expectations with adjusted operating profit forecast to be between £39m-£40m. This improved forecast result is reflective of our defensive qualities, resilience and the implementation of numerous mitigation measures that have proven to be extremely effective in responding to the challenges of Covid-19.

The group’s rail, infrastructure, and environmental markets have been resilient and a majority of its activities were designated ‘critical’ by the government through lockdown.

The integration of Carnell, acquired in January 2020, is complete and trading here is in line with expectations.

Ah - cash generation ‘continues to be very strong and we anticipate reporting a net cash position at the year end, ahead of market expectations.’ That’s good. The CEO also sounds familiar...

Just a joke of course, Paul is away today but he’s not moonlighting as the chief exec of a £300m construction company.

Conclusion

I don’t know Renew in any detail. The reputation of its subsidiaries, the revenue splits, exposure to various parts of the economy.

It does sound like quite a lot of its business is in more resilient, protected parts of the market. In terms of trading, the company has turned in an excellent performance over the past five years. If the world doesn’t end, I don’t see why this trend wouldn’t continue.

And despite this continued execution, capped off by today's ‘materially ahead’ update, the group’s PE ratio has been falling and dividend yield increasing:

That said the group has quite a lot of goodwill on the balance sheet (£100m or so) and if you go on FY19 numbers, it has a negative net tangible asset value of c-£22m. By comparison, BILN has NTAV of about £28m and is around ten times smaller.

If only you could separate the trading entity from the balance sheet… Still, the swing to net cash is encouraging and if RNWH can continue to build up a cushion there then it looks like one to keep on the watch list. If you can stomach the risk and are banking on a strengthened balance sheet in future, then there could be some good upside - but there's also safer bets to make.

Christie (LON:CTG)

Share price: 74.5p (+7.96%)

No. shares: 26.5m

Market cap: £18.3m

Christie (LON:CTG) is a professional business services group with 42 offices across the UK and Europe, catering to specialist markets in the hospitality, leisure, healthcare, education, and retail sectors.

It’s tiny - a sub-£20m market cap with low liquidity. The valuation looks attractive but that aside, Christie’s StockReport flags up a couple of warning signs. Just scrolling down the screen these are:

- Very poor relative strength,

- Low Financial Health scores (F and Z Scores to the right),

- Declining operating margins over time (in the ‘Profitability’ box of the Financial Summary),

- It’s a micro cap with a tiny free float (see the Trading Information box below).

To balance it out, some positives:

- Subscribers point out this is one of Lord Lee’s stocks (see him on the register here)

- The valuation is modest, even after earnings forecast reductions (but note the final dividend has been withdrawn, leaving a yield of about 1.7%)

- Christie does generate particularly good returns on capital over time - between 20%-50%.

- Revenue has been steadily increasing and the group’s compound growth rates are steady if unspectacular - but that’s probably good for a 6.3x forecast PE ratio.

So my first take is mixed. Maybe Christie is a well run business - but does that make it a good investment? The shares are down nearly 50% on their 52w highs, so there could at least be a rerating opportunity if CTG can recover operationally.

True, it has a focus on professional services to hospitality and leisure but there’s always the chance the fall has been overdone given the recent wild market.

Bear in mind these are delayed results for the year to 31 December 2019, before companies had to react to COVID-19 and the associated lockdown.

Highlights:

- Revenue +2.6% to £78m,

- Operating profit +41.3% to £5.8m

- Earnings per share +36.2% t 15.3p

- ‘Strong cash generation in the year and ended year with a healthy cash balance’ - that’s encouraging

These look like good results to me, an expectations beat. A shame, then, that they’re so historic - a lot’s happened since December 2019. The operating profit was boosted by a £1.5m gain on the sale and leaseback of offices in Milton Keynes. Strip that out and underlying operating profit looks to be £4.3m (+4.9%).

I can imagine this is a well run business with a possible rerating opportunity somewhere down the line, but is there better organic growth potential elsewhere?

Regarding COVID, chairman and CEO David Rugg comments:

‘The Covid-19 pandemic has since caused us to re-assess our plans and expectations for 2020. The steps taken across the group in recent months has put the Group in position for the recovery that is now underway. Each of our services remain in demand. We therefore view our future with cautious optimism.’

That could be a lot worse. CTG also says:

Our transaction pipeline which had been stalled is now flowing again. We are experiencing a return of known investors and a healthy flow of new buyers. These include private equity buyers looking for good businesses which have faced Covid-19 disruption, private buyers looking to relocate to country and coastal locations and even entrepreneurs utilising 'bounce back' loans to acquire additional trading units.

Conclusion

I hope CTG will see a return of more favourable market conditions over the next two years. There are early signs this is happening, in which case today’s share price could be a good entry point and a decent way to play a normalising economy.

It did well to increase its cash balance from £4.7m to £9.8m in FY19 but then COVID came along and disrupted what looked like some promising trading momentum.

With a fair wind perhaps this stock could rerate from today’s lows. For now the momentum is very poor, but micro caps can jump in value quickly.

I wouldn’t bet against a sudden rerating at some point. In its own words ‘In the absence of any resurgence of the pandemic we should return to profitable UK trading in aggregate in 2021. We therefore view our future with cautious optimism.’ Perhaps one to keep tabs on should momentum comprehensively turn but I’m personally waiting for more proof of recovering trade.

.jpg&w=384&q=75)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.