Good morning!

Paul added further sections to yesterday 's report, which now includes:

- Debenhams (LON:DEB)

- Sopheon (LON:SPE)

- Churchill China (LON:CHH)

- Cambria Automobiles (LON:CAMB)

- Walker Greenbank (LON:WGB)

- Taptica International (LON:TAP)

- Ethernity Networks (LON:ENET)

- Be Heard (LON:BHRD)

- Cyanconnode Holdings (LON:CYAN)

Today, I'm going to start by covering £G4M (Gear4Music) and Crawshaw (LON:CRAW).

Regards,

Graham

£G4M (Gear4Music)

- Share price: 740p (-4%)

- No. of shares: 21 million

- Market cap: £155 million

This is a fast-growing online retailer of musical instruments, which is the UK's largest.

Not having purchased a musical instrument in many years, I've just been doing a little bit of googling to see who else is prominent when you search to buy musical instruments online.

It looks like the biggest player in Europe is Thomann (external link), a family-owned German business in Bavaria. It is several times larger than G4M, earning revenues of €525 million back in 2013, according to Wikipedia. By contrast, G4M is forecast to earn £81 million in revenue during the latest financial year.

It's a fragmented marketplace. According to an Edison research note, Thomann's market share in 2016 was 13%, making it by far the largest company in the sector.

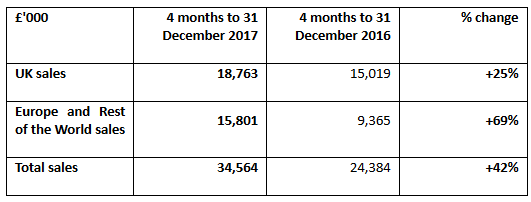

So can G4M catch up? The growth rates are certainly encouraging. Today's trading update includes the following table:

Christmas is a key buying period for G4M, making this an important update for the company's annual performance.

If I go back and compare this update versus the equivalent one from last year, growth rates last year were as follows: UK + 29%, International +129%, and total + 55%.

We can also compare against the growth rates in the interim results. In those results UK sales were +30%, International sales were +70%, and total sales were +44%.

It's easier to grow from a smaller base, of course. But perhaps today's slight reduction in the share price reflects that growth is moderating a little bit, which may have disappointed a few holders?

That said, today's update is still good enough to be considered in line with expectations. So things are still more or less on track.

The CEO comment is upbeat, and concludes as follows:

"We are confident that the Group will continue to grow rapidly over the medium and longer term, as we continue our mission to become the best musical instrument and equipment retailer in Europe."

My opinion

This is an interesting little business. It's very positive that G4M sells its own-brand instruments - that makes it more valuable than a simple distributor. Ideally, I'd like to see it develop pricing power through the strength of its own brand, rather than merely standing as the middleman between customers and more powerful brands.

Own-brand sales are growing at the same rate as the company's overall sales, which is encouraging. Own-brand sales account for about 25% of total sales.

The problem is valuation. A lot of future growth is priced in already, and small reductions in future growth rate assumptions could seriously affect the share price.

Forecasts see it earning net income of £3.8 million in the fiscal year 2020. At least a couple more years of strong growth after that would be needed to justify the current share price. It looks like it has the momentum to achieve this. But there is still potentially a long time to wait for the company to catch up with its current valuation.

My conclusion is hopefully not too predictable. It's a nice company, but the share price assumes too much growth, especially since 75% of its current business is distributing products made by other brands. That's not a particularly high-quality activity to me.

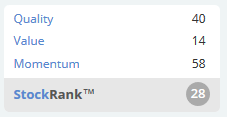

So I will reluctantly agree with the Stockrank:

Crawshaw (LON:CRAW)

- Share price: 10.4p (-9%)

- No. of shares: 113 million

- Market cap: £12 million

This is a chain of value butchers. In Paul's words, it's a "roll-out that has gone wrong". The share price has slumped from a high of 95p in 2015, down to its current level.

Today's announcement is a "seasonal update" for the 15 weeks leading up to Christmas.

Total group sales for the 15 week period increased by +0.6% versus the prior year, with group gross margin also increasing by +0.6%. The performance for the 15 week period was underpinned by the strength of the growing factory shop format, which helped to offset the impact of lower footfall on the high street and the overall softer consumer sentiment (group LFL sales at -6.1% and group LFL customers -2.6%).

Wouldn't it be better if the poor LFL sales were given more prominence than this?

The statement strikes an incredibly positive tone throughout, relative to the reduction in LFL sales. It's a shame that some companies can't be more straightforward when trading is going poorly.

It's also frustrating when companies blame conditions beyond their control for poor results ("overall softer consumer sentiment"). The same companies are unlikely to attribute good results to conditions beyond their control.

The statement is a profit warning, as it admits in the sixth paragraph:

The softer consumer environment has impacted the progress we were seeing on LFL sales and, coupled with the certainty of additional cost inflation flowing through, we expect this to continue to act as a drag on profitability in the high street shops. We are making progress on re-balancing the portfolio towards the factory shop model, which underpins the long-term profitability of the business, and we anticipate a period of transition as the necessary actions are taken.

It reads like the company is thinking about abandoning the high street shop model altogether. That course of action seems increasingly likely at this point.

How much will it cost to close the high street shops? What sort of leases are they tied into? I'm not sure, but at least the company had £6.8 million in cash as of last July 2017.

The cash pile was earmarked for the factory shop roll-out. Perhaps it can be partially diverted to the costs associated with closing down some of the high street shops, keeping the group alive while it transforms?

Thanks to the cash pile, Crawshaw (LON:CRAW) may have the wiggle room it needs to trade its way out of this situation.

Note that if the share price recovered to 40p, there would be significant dilution through warrants, but I suppose that most people buying or holding the shares today would be happy to get 40p back.

Conclusion - Personally, I would like to see the tone of the announcements adjusted for realism. It bothers me a lot when a trading update reads like a commercial.

In practical terms, moving away from the high street model is likely to be expensive and complicated, if many of the stores need to be closed.

For these reasons, I'm not in any rush to buy the shares.

However, I do think we should keep it on our watchlist for the time being. If it avoids going bust at a group level, the factory shops might be worth investing in. And it's possible that the share price could remain unnecessarily depressed, as shareholders who bought at higher levels continue selling to get some of their investment back.

I'm going to leave it there for now. See you next week!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.