Good afternoon,

Drat, I forgot to put up the placeholder last night, my apologies. I blame Emily Thornberry, who worked me up into a lather, with her bullying of Isabel Oakshott on Question Time. She's a nasty piece of work if you ask me.

Anyway, it looks as if there's little for me to cover today. I'll be updating this article throughout the afternoon.

Motorpoint (LON:MOTR)

Share price: 211p (up 3.9% today, at 12:44)

No. shares: 97.6m

Market cap: £205.9m

Motorpoint Group PLC, the UK's largest independent vehicle retailer, is pleased to announce the following trading update ahead of its Interim Results for the half year ended 30 September 2018.

- H1 revenues expected to be up c.9%

- Operating margin similar to last year

- Pleased with quality & mix of current vehicles in stock

- 12th site, in Sheffield, is performing well

- Pipeline of new sites under review

Outlook - sounds alright;

The Board continues to closely monitor customer confidence in light of the ongoing economic and political uncertainty. However, the Board is encouraged with the recent trading performance and remains confident that Motorpoint's independent and flexible model leaves it well placed to increase market share.

My opinion - it's striking how some companies are blaming Brexit uncertainty, the weather, football, etc, for poor performances. Whilst other companies are just getting on with things, and doing well. Motorpoint seems to be in the latter category.

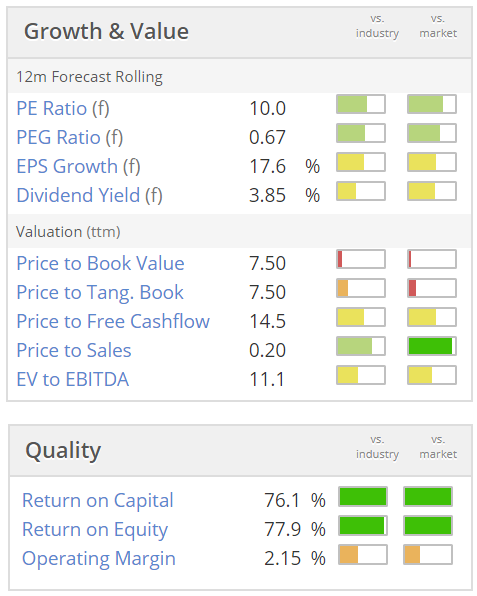

The valuation looks attractive to me - see below - for a company with a proven formula, which is opening new sites. Could be worth a closer look, and adding to my watchlist for things to buy on any panic sell-off. The return on capital & equity look very good. It doesn't seem to need much capex. Just a piece of land with a few large sheds on it.

Flogging good quality secondhand cars to the public, at bargain prices, won't ever go out of fashion. So this is a good business.

Cloudcall (LON:CALL)

Share price: 103.5p (up 9% today)

No. shares: 24.2m

Market cap: £25.0m

(at the time of writing, I hold a long position in this share)

Large trades

There's no announcement as yet, but there will have to be soon. I note that 4,781,288 shares have changed hands at 90p today - that's significant because it's 19.8% of the whole company.

I've been able to tie some of these trades to the disclosed >3% holders.

Miton - holds 1,440,288 shares - so that could be the 100,000 + 1,340,288 trades above.

Legal & General - holds 1,146,000 - the same size as the 4th trade on the list above.

I've asked my broker to make some enquiries, but we've been rebuffed & told we'll just have to wait for the RNS(s). Could be interesting anyway. I won't speculate on what might be happening, as I got into trouble last time I did that. One to keep an eye on maybe?

The company is growing strongly (organically), but keeps missing its breakeven target, which has clearly driven some large holders into throwing in the towel. Pity, as I think the company's on the cusp of something good. Mind you, I've been saying that for about 5 years!

High margin, high recurring revenues SaaS businesses are in demand at the moment, so at some stage I think there's a chance of a decent re-rating here. It seems that an overhang has been cleared anyway. We'll soon find out who the buyer is.

Plastics Capital (LON:PLA)

Share price: 114p (up 2.7% today)

No. shares: 39.0m

Market cap: £44.5m

This is a small group of companies making niche plastics products.

It's half way through the current year ending 31 Mar 2019.

... the Company continues to trade in line with market expectations...

Trading during the six-month period ended 30 September ("H1 2018/19") saw an improvement on the prior year.

Sales have continued to grow at double digit rates and profitability has improved as the revenue mix shifted towards the higher margin Industrial Division.

- Forex has been helpful, as old currency hedges are being replaced with cheaper ones.

- The films division is expanding capacity.

- Matrix business also performed well. Strong sales growth.

- Mandrel business - weak order book.

- Comments on plastic waste, recycling, environmental issues.

My opinion - I can't get excited about this company.

Dividends ceased in 2016, which reinforces the reality that this business does not generate much cashflow. Free cashflow has been negative for the last 4 years. It's quite capex-hungry too, and has a fair bit of debt. None of which is good.

The share price has gone nowhere in the last 5 years. It's just not a very good business, in my view. I cannot understand why anyone would want to buy or hold this share.

QUIZ (LON:QUIZ)

Share price: 98.5p (down 33% today)

No. shares: 124.2m

Market cap: £122.3m

Trading update (profit warning)

QUIZ, the omni-channel fast fashion brand, announces a trading update for the for the six-month period to 30 September 2018 ("H1 2019" or the "period").

What's gone wrong?

- Stores & concessions did well over the summer, but sales were lower in Sept 2018 - blamed on lower footfall. More likely to be due to new season autumn product not being good enough, in my view.

- Previously reported, on 5 Sep 2018 trading update, a £0.4m hit related to the collapse of House of Fraser. So this is not a new point - hence I'm unsure why it has been mentioned again today?

- Online sales via third-party websites (e.g. Next, Zalando) were disappointing, with no growth on the prior year's H1. However, own-website sales are growing very strongly, at +70% (and these are higher margin sales too).

Quantifying the H1 impact - the company has very helpfully spelt out the impact of the above factors;

EBITDA for H1 2019 will be not less than £5.5m, being £1.5m lower than its previous expectations.

This is quite worrying. Given that the company said it was trading in line with expectations as recently as this update on 5 Sept 2018, then a £1.5m profit hole has appeared in the last month. To me, that suggests that the autumn range has probably flopped - which has read-across for the full year figures. Sales may continue to be subdued in H2, and there may be a need for more discounting, to shift slow-moving lines.

Full-year outlook - again, very helpfully, the company updates us on its full year expectations;

In addition, the Board has taken the prudent assumption that should the trend in online third-party sales continue during the second half of the financial year, Group revenue for the full year to 31 March 2019 would be lower than current market expectations at approximately £138m (FY 2018: £116.4m) and the Group's EBITDA for FY 2019 would to be in the region of £11.5m.

The most recent broker forecast I have found suggests £150.2m revenues for FY 2019, and £15.7m adjusted EBITDA. Therefore this seems to be quite a large miss, at -27% below forecast EBITDA. That suggests to me something more significant has gone wrong.

Also note that £11.5m forecast EBITDA for FY 2019 is actually down on FY 2018, which was £12.7m. Therefore unfortunately, I think this seriously damages the profit growth credentials of the business.

Using EPS, the adjusted FD EPS forecast was previously 7.7p. If we reduce that by 27% as well, then it falls to 5.6p (down from 6.3p last year).

Valuation - this share previously attracted a fairly high PER, due to its growth. With profit growth now apparently stalling, then I think the share is likely to de-rate considerably.

The still-rapid growth in own-website sales means that I think a PER of perhaps 13-15 can still be justified. That suggests a share price of 73-84p would be about right, the way I see things.

My opinion - it's always tempting to leap in after a profit warning, since our minds naturally anchor to the previous share price, and we imagine it looks a bargain. However, crunching the numbers shows that it probably isn't a bargain yet.

I liked this share a lot when it listed, having been impressed by a polished performance from management at an IPO meeting. Plus the figures & growth looked outstanding.

It's all gone a bit wrong today. I'm minded to keep my distance for the time being. If it drops into my 73-84p target range, then I would consider a purchase. The risk is that, if autumn ranges have not been well-received, then that could set the company up for another profit warning later in the season perhaps?

I have nagging doubts about the quality of the brand too, which seems not terribly aspirational. The website isn't a patch on the better quality look of say Sosandar (LON:SOS) (in which I hold a long position).

That's it for today, unless there's another profit warning!

Apologies again for being late today, but we got there in the end.

Have a smashing weekend!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.