Happy Friday!

Hollywood Bowl (LON:BOWL)

- Share price: 186.5p (+1%)

- No. of shares: 150 million

- Market Cap: £280 million

I last covered this ten-pin bowling operator at its H1 results earlier this year.

Like-for-like sales for that period were only up 1,2%, but the company said it had lost 2% due to unusually dry weather.

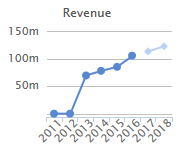

According to this update, like-for-like revenue growth for the full year is 3.5% - so H2 must have been a lot better. Total revenue, including new sites, is up 8.9% year-on-year.

Earnings are set to be marginally ahead of Board expectations.

It continues to hint at dividends:

Hollywood Bowl's business model means that it is able to sustain its investment programme going forward through its ongoing cash generation. Therefore, as initially noted in April at the Group's half year trading update, the Board is considering returning capital to the Group's shareholders.

My opinion: This only listed in September 2016, and with the mess at Accrol Group (LON:ACRL) fresh in the memory, investors are right to be sceptical about the quality of some recent flotations.

But every stock should be treated on its own merits and this is a more interesting proposition. Offering modest but self-funded growth, it looks promising to me. Stockopedia computers appear to agree, giving it a StockRank of 63.

Motorpoint (LON:MOTR)

- Share price: 142p (+5%)

- No. of shares: 100.2 million

- Market cap: £142 million

This used car supermarket (specialising in cars less than two years old) listed on the main market last year at 200p. Results for the previous financial year (ended March 2017) were marred by the operating expenses at four new sites.

Things are getting back on track now, as those sites have matured:

The Group has delivered more normalised margin levels in the first half compared to the same period last year, and the breadth and quality of stock on hand going into the second half of the year is encouraging.

Underlying H1 PBT is set to be c. £10.5 million (vs. £6.4 million last year)

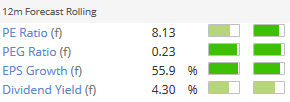

This sector as a whole is unloved, and it's understandably difficult to built an economic moat. Hence the cheap pricing. I can't say the market is wrong, since it's probably not something I'd buy and hold either. The yield could be tasty in the short-term, though.

Finsbury Food (LON:FIF)

- Share price: 106p (-2%)

- No. of shares: 130.4 million

- Market cap: £138 million

Closure of Grain D'Or and Trading Update

We discussed the final results here last month, noting that the competitiveness of the sector was the explanation for low operating margins and a cheap valuation.

Well, today Finsbury announces that it is partially withdrawing from some of the most competitive segments, i.e. pastries, muffins and specialty breads.

Grain D'Or has been historically loss making and for the 12 months ended 30 June 2017 it reported an operating loss of £3.33 million on revenues of £28.5 million. Due to the products it produces, Grain D'Or trades in a particularly competitive environment which creates strong competition for contracts and loss-leading pricing.

Finsbury generated an adjusted operating profit of £17.4 million last year. So without the Grain D'Or losses, it would have been materially higher on a percentage basis.

Excluding the exceptional costs of closing this factory, expectations for the current financial year "remain consistent" with previous guidance.

Following the closure, the Company's lower cost base and greater focus on profitable markets means that it is well positioned for future growth, despite current market conditions, and to benefit from any future upturn in the market.

The almost passive dependence on market conditions is an acknowledgement of how hard it is for bakeries to differentiate themselves. In economic parlance, they're an example of "price-takers", not "price-makers".

That said, it makes sense to shut down unprofitable operations. A sad decision for employees, no doubt. From a shareholder point of view, it does make sense, and I could see these shares getting an uplift in due course from the effect of no longer carrying this dead weight.

Innovaderma (LON:IDP)

- Share price: 292p (-9.5%)

- No. of shares: 12.6 million

- Market cap: £37 million

No surprise to see the share price down here on the news that £4.4 million is proposed to be raised at 276p, a 14% discount to the prior closing price.

This owns a range of brands including Skinny Tan, which had originally received funding on Dragons' Den. The shares are up c. 80% since I first mentioned them in May!

Checking back to the results statement last month, its cash balance was again very low (£200k) as inventories had ballooned to £2.3 million in order to keep up with orders from SuperDrug.

Working capital is needed, along with some other uses for the cash:

The net proceeds of the proposed Placing will be used for additional working capital purposes, investment into key marketing programmes across the product portfolio and employment of new talent in multiple markets, especially in the US andAustralia.

Trading is in line with expectations, and a significantly second-half weighted financial year is anticipated.

My opinion: I must admit that I find this stock sort of intriguing. On the one hand, you have huge sales growth and orders from exactly the retailers you'd like to see ordering this product.

On the other hand, the product reviews (here and here) are really mixed, with plenty of users suggesting that the company's marketing abilities are stronger than the product itself.

And then there's the company's foray into a range of parallel markets: cosmetics, men's skincare, hair regrowth, shampoo and sexual health. It entered all of these markets in 2017 alone. I can understand the desire to build a house of brands, but doesn't it seem too soon and overly distracting to attack so many different product categories at the same time?

If it had stuck to Skinny Tan and closely related products, and if the Skinny Tan reviews were indisputably excellent, then I could justify paying over the odds for these shares. As things stand, I have a few unanswered questions.

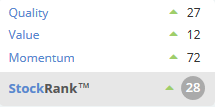

The StockRank is improving but still rather sceptical at this stage:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.