Good morning from Paul!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

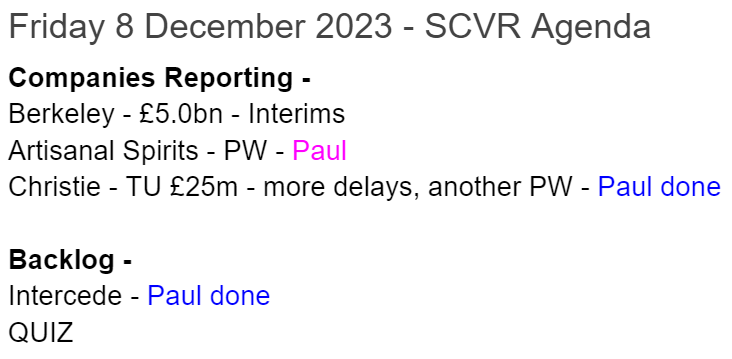

Summaries

Intercede (LON:IGP) - 95p (y’day close) £55m - Major new contract - Paul - GREEN

Fabulous contract win news this week, and a stellar upgrade to forecasts from Cavendish. I think the big upward share price move is justified, although some holders might be tempted to bank some gains in the short term possibly? Patience has certainly paid off with this share, well done to holders!

Christie (LON:CTG) - down 13% to 83p (£22m) - Trading Update (profit warning) - Paul - AMBER/RED

4 profit warnings this year now. Yet again it blames transactional delays. The hoped-for recovery in H2 has been lacklustre, only just scraping into a small profit, and the latest downgrade to forecast sees FY 12/2023 at a loss of £(1.5)m. Historically it makes c.£5m profit pa, so there could be recovery potential. Finances don't look stretched. It's not for me though, as performance/forecasting is too erratic, and de-listing risk seems high.

Paul’s Section:

Intercede (LON:IGP)

95p (y’day close) £55m - Major new contract - Paul - GREEN

We flagged that this online identities software company had turned the corner here on 21 Nov 2023, with good interims and an ahead of expectations update, turning me GREEN (with envy! At what the share price has done!) It’s been a blink and you miss it type of re-rating. There was also a positive-sounding update here on 7 Nov 2023, but as it didn’t move market expectations, it didn’t look significant on the day, so I didn’t mention it here. What a pity I didn’t see the writing on the wall and buy back in. Never mind. Well done to any subscribers here who were more patient than me (I grew tired of the time the turnaround was taking to accelerate sales, and sold out a while ago).

As you can see below, most of he last 2 years’ bear market slippage has been recouped in the last 2 months, triggered by excellent newsflow -

This week’s news has been -

5 Dec 2023 - Major new contract with US Federal agency.

Up-front licences of $6.6m (highly material to IGP’s numbers, it’s largest ever order, and all falling into FY 3/2024), plus $1.4m pa support & maintenance.

This absolutely transforms performance for this current year, although IGP is at pains to point out it’s a one-off order. There could be follow-on additional orders though, which sounds promising.

7 Dec 2023 - Update on major new contract win - the good news gets better, with an additional $0.8m order to help deploy IGP software at the major US Federal client.

Broker update - many thanks to Cavendish, which has put through the mother of all upgrades!! Adj PBT for FY 3/2024 goes up from £1.5m to £5.0m. Wowee! The following year goes up from £1.8m to £3.0m forecast (FY 3/2025).

In EPS terms, that’s 6.9p and 3.7p.

Clearly it would be rash to value the shares on the one-off bumper year, so I’d play it safe and use a PER of maybe 20-30 times on 3.7p (FY 3/2025) forecast, getting to a price target of 74-111p. The actual share price is no 95p, more-or-less in the middle of my range.

Paul’s opinion - having followed Intercede for many years, I’m delighted to see the company deliver this superb flurry of positive news. Intercede has always had an extraordinarily impressive client list, but the company’s detractors used to say it was all legacy systems, not new business. They can’t say that any more! Winning major new business through partners seems to augur very well for the future. Each system that is installed using IGP software as part of it, tends to be very sticky, and produces a typically very long stream of recurring revenues for maintenance & support.

I think the big re-rating of IGP shares looks justified. Let’s hope more contract wins continue to flow. I’ll stick with GREEN. Although I would expect some holders to bank profits in the short-term, given the size & speed of the recent move.

Christie (LON:CTG)

-Down 13% to 83p (at 08:21) £22m - Trading Update (profit warning) - Paul - AMBER/RED

Yet another profit warning from this diversified professional services group. As you can see below, forecasts have already been slashed, and this is before factoring in today’s news -

Today’s news says that further delays on deal completions, pushes some commissions into 2024. The financial impact isn’t large though, with Shore Capital (many thanks) taking its FY 12/2023 adj PBT forecast down from a loss of £(1.0)m to a new forecast of £(1.5)m.

I’m still not clear why this year is turning out to be so poor. Delays, OK fair enough, but why would that turn CTG’s usual level of £4-6m pa profit into a loss? Surely that shows something much more serious than just delays to deals completing?

CTG made a £(1.9)m loss before tax in H1, so H2 looks as if it should be a small profit.

Outlook sounds more optimistic, but given the repeated inaccuracy of its forecasts this year, I’m not sure how much credibility the market will give to the following -

…transaction pipelines and activity much improved from twelve months ago and heading into the start of 2024.

Paul’s opinion - a shambles. However, CTG has historically been a decent enough business, making c.£5m profit in normal years. If it can rebuild performance back to that level, then the shares might recover somewhat, possibly? Although will investors now eschew this share, given that it seems to have little visibility or ability to accurately forecast?

I don’t see signs of financial distress, with the last balance sheet looking adequate for a professional services type of business. Although note it seems to have some onerous leases, with liabilities exceeding lease assets.

Shares are very illiquid too, so the short term share price may not reflect the reality if you want to sell in any size, which might involve having to take a haircut, if you can transact at all.

I don’t see any reason to get involved here. We’ve previously given it the benefit of the doubt, with AMBER, due to recovery being likely (it’s a previously sound business), but notching up 4 profit warnings this year is getting a bit ridiculous. For that reason I’m going to shift it down a notch, to AMBER/RED.

I’m also struggling to see any reason for CTG shares being listed at all. The major shareholder list looks like a private company, dominated by a few individuals, and no institutions interested apparently. Hence I think de-listing risk could be elevated here, which combined with lack of liquidity, puts me off.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.