Good morning from Paul!

I've got to prepare for an introductory call with mgt of Property Franchise (LON:TPFG) a little later, which I thought would be useful as one of our favourites, Belvoir, is absorbed within TPFG today. So if anyone can think of anything intelligent-sounding that I can ask them, please do leave a comment below! I'll ask them to continue with the small shareholder communications that Belvoir excelled at (coming to conferences, doing presentations on Mello, etc)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

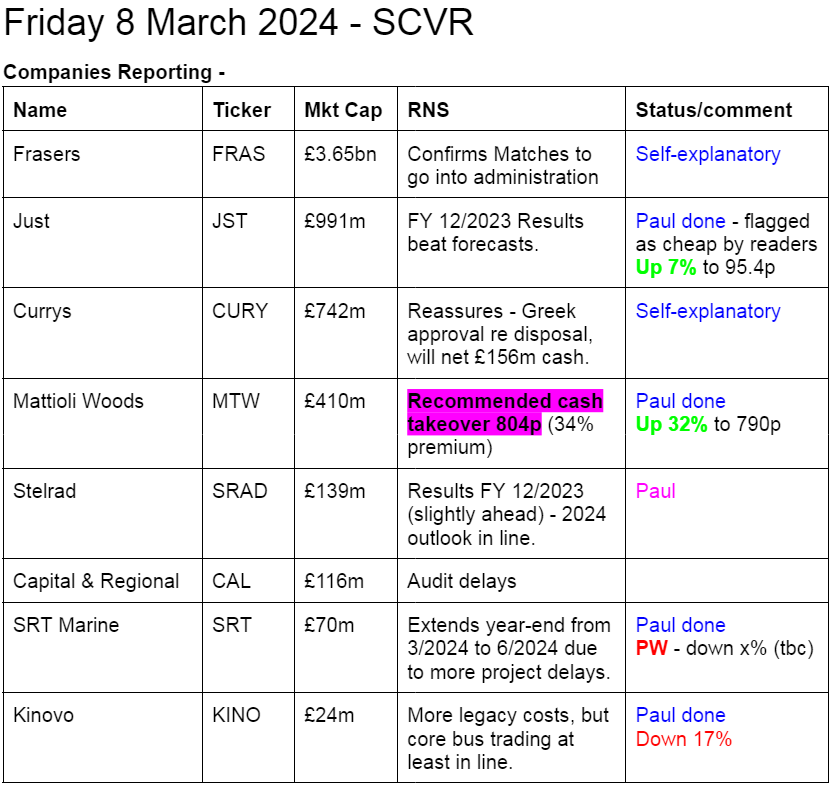

Quiet for news today, so I'll do a couple of backlog items too -

Quick comments on movers with news

Just (LON:JUST) - up 12% to 99.5p (£1033m) - Results FY 12/2023 - Paul - no view - too complicated! So I’ll mark it as AMBER.

Very interesting reader comments today on this specialist financial services group, focused on the retirement income market.

The attraction of this share seems to be -

- Strong results out today: 27.9p u/l EPS actual vs 26.6p broker consensus (upwardly revised several times in 2023)

- Big discount to NTAV (claims it has 224p NTAV/share) vs 99.5p current share price.

Not so good points are -

- Modest divis, but it says will “grow over time”

- Govt consulting on ground rents may affect JUST’s £176m portfolio

- Balance sheet NAV is a small difference between huge assets, and huge liabilities

- Complicated accounts.

Paul’s view - I don’t usually review banks or insurance type businesses, as it requires specialist expertise to properly analyse them, which I don’t have.

Another reason I avoid personally investing in these sectors, is that unforeseen world events can cause shocks to the system, with outside investors never really knowing what huge contractual assets or liabilities could become problematic. Look at any bank’s balance sheet at the gigantic numbers called “derivatives”, and any number of future horrors could be lurking in there. The key lesson from the 2008 crisis is that big financial organisations think they’re managing risk, but some unforeseen event can quickly cripple them - which applies to insurance companies too. Look at the debacle with the autumn 2022 mini budget, where derivatives forced pension funds to start panic selling due to margin calls on their contracts that were supposed to manage risk.

Anyway, sorry if this sounds weak, but I don’t want to give any opinion on this share, as it’s way outside my area of expertise.

Summaries of main sections

SRT Marine Systems (LON:SRT) - 31.6p (pre-market) £70m - Change of Year End & Update - Paul - BLACK (profit warning), on fundamentals RED

Misses forecasts for FY 3/2024, so it's extending the year to a 15-month period to 30 June 2024. Yet another, in a long track record of big disappointments. Shares look impossible to value, due to wide range of potential outcomes.

Mattioli Woods (LON:MTW) - up 32% to 790p (£410m) - Recommended cash takeover - Paul - PINK (takeover)

Not a particularly generous bid, at a 34% premium. It will be interesting to see if the mainly institutional shareholder base will welcome a liquidity event, or push for a higher price? Yet another example of the stock market undervaluing UK shares compared with private markets.

Kinovo (LON:KINO) - down 17% to 39p (£24m) - Update on Discontinued Operations - Paul - RED

More cost over-runs for its discontinued operation are announced today, but also reassurance that the core business is trading well, "at least in line". I think a recovery trade is possible here, but for me there's too much risk of dilution, due to its weak balance sheet. So I continue to flag the risk, with RED, but I don't know what's likely to happen with the share price, it could be a recovery candidate possibly?

Paul’s Section:

SRT Marine Systems (LON:SRT)

31.6p (pre-market) £70m - Change of Year End & Update - Paul - BLACK (profit warning), on fundamentals RED

SRT Marine Systems plc ('SRT'), the AIM-quoted developer and supplier of maritime surveillance systems and navigation safety products hereby provides a business update and notification of a change in financial reporting date...

I think this update has been heavily PR’d, but there’s no getting away from the fact that it’s a profit warning. Key points -

Delays in project deliveries (blamed on Govt bureaucracy, and even Ramadan &EID!) will miss 31 March year end cut-off, slipping into Q1 2025.

No problem, they’re just changing the year end, extending it by 3 months to 30 June 2024 (so a 15-month one-off period).

It says this is necessary because poor FY 3/2024 results would mean SRT failing financial checks from key potential customers (no details provided).

Cash is said to be strong, after a £10.5m fundraise in Dec 2023, but no figure provided for current cash or net cash (remember it has gross debt too, of £9.6m at Sept 2023).

15-month forecast revenue is the same as previous 12-month forecasts - so effectively a reduction. H1 was £5.5m revenues, so £70.9m FY forecast looks like fantasy to me.

Paul’s opinion - checking back, the forecasts for FY 3/2024 showed a gigantic H2 weighting, which looked unrealistic from the start. SRT once again demonstrates that it has little to no visibility over revenues.

What’s the betting it will need yet another placing at some stage? Fairly high, I would say.

I imagine the market is likely to take a dim view of today’s latest disappointment. Maybe SRT would be better off as part of a private group?

I went up from red (after lousy H1 figures) to amber/red (after 21/12/2023 fundraise, which included £7m from a “strategic investor”). However, today’s profit warning means I have to go back to RED.

I see a pattern emerging over the last 18 years -

Mattioli Woods (LON:MTW)

Up 32% to 790p (£410m) - Recommended cash takeover - Paul - PINK (takeover)

Recommended unanimously by MTW’s Board.

Cash bid of 804p cash (£432m), plus divi already declared.

34% premium to last night’s close - so not particularly generous.

The bidder is a fund managed by recently floated Pollen Street (LON:POLN) which we’ve not yet looked at in the SCVRs.

Valuation - interestingly it doesn’t mention EBITDA, but instead bid price is 16.3x adj PER.

Irrevocables only 12.4% - so might be an uphill battle to get shareholders to agree this deal.

Paul’s view - looking at the chart below, this bid only takes the share price back to where it traded in 2017-2022. Arguably, it might recover back to that level (maybe beyond?) of its own accord in the next bull market.

Although institutions might welcome a liquidity event, freeing up cash to meet redemptions or make new investments, plus of course an instant boost to their performance statistics.

It’s yet another example that private buyers are valuing some UK shares at prices well above the public market, which is very exciting in my view, offering us opportunities to make money, if you can look beyond the short-term gloom (what is it about being greedy when others are fearful?).

MTW looks a decent company, and I’m not convinced this takeover approach is generous enough to succeed. The ideal scenario for holders would be if someone else comes along with a higher bid. I like the niche activities MTW has within its range of services, and I vaguely remember a management presentation a few years ago which impressed me.

Kinovo (LON:KINO)

Down 17% to 39p (£24m) - Update on Discontinued Operations - Paul - RED

Kinovo plc (AIM:KINO), the specialist property services Group that delivers compliance and sustainability solutions, provides the following update on its discontinued operations.

I’ve only reviewed this once recently, here on 9/2/2024 (55p) - where I viewed it as red, because the expensive legacy issues and weak balance sheet seemed to present unattractive risk:reward. That’s even though the core, ongoing business, looks OK.

Today it says there will be another £2.9m costs to finish off the remaining disastrous projects of its incompetent former building division.

However on the plus side, we get an upbeat-sounding trading update for the core business -

The continuing business is performing strongly during the peak trading season and the Board continues to anticipate the outlook for the full year ending March 2024 to be at least in line with that provided on the 9 February.

Paul’s view - there could possibly be a risky recovery trade here, if the legacy issues can finally be shut down without any more additional costs.

However, having looked again at the last balance sheet, and adjusting it for more provisions since announced, I think it’s too weak for me to want to get involved. So I’d say dilution risk seems quite high, and it mentions continued support from HSBC today, which makes me nervous.

Good luck to anyone punting on KINO, but for me risk:reward still doesn’t stack up. I prefer situations where the upside is obviously tilting in my favour, without having to use hope, or guesswork, so I’ll stay at RED just to flag the higher risk here. Remember we’re not predicting the outcome with RED, as risky situations can occasionally produce lovely rebounds. It’s up to you to decide how you see risk:reward, and this one could go either way I think.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.