Good morning, it's Friday! Paul and Jack here with the SCVR.

Today's report is now finished.

Agenda -

Paul's Section:

Hollywood Bowl (LON:BOWL) - stonking LFL revenue growth of +29% since re-opening in May 2021, should deliver very much better H2 figures (H1 was mostly closed). I reckon there could be further upside on this share, as I have a stab at valuation. Looks potentially interesting. New site openings going ahead, so there's also roll-out potential. How long will very strong pent-up demand last though?

Volex (LON:VLX) (I hold) - brief comment on two small acquisitions. The buy & build strategy seems to be working well. Fairly priced for now, in my view.

Sanderson Design (LON:SDG) (I hold) - brief comment on yesterday's non-regulatory announcement about extending its licensing agreement with NEXT, into homewares. I ramble on about how expensive blinds are.

Jack's Section:

Srt Marine Systems (LON:SRT) - Revenue and losses before tax both up. Transceivers revenue +11%. Pending contracts in Systems of £71m but it looks like these contracts are difficult to negotiate so given the track record, I would say more certainty over realising this pipeline is required before considering whether or not to invest. I can't see much appeal at the moment.

Premier Miton (LON:PMI) - A 31% increase in AuM in the year, with a forecast PE ratio of around 10x, a PEG of 0.5x, and a yield of more than 6% so the valuation is appealing. Multi-asset fund outflows have increased in the quarter though and not much is said about it.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Hollywood Bowl (LON:BOWL)

243p (last night) - mkt cap £415m

Trading Statement - FY 09/2021

Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, today announces a trading update for the financial year ended 30 September 2021 (FY21).

VERY STRONG CUSTOMER DEMAND FOLLOWING ESTATE REOPENING

Complete closure of the estate for 50% of FY 09/2021

Robust customer demand on re-opening (restricted from 17 May 2021, unrestricted from 19 July 2021)

Very strong revenues on re-opening: up 29% like-for-like, against pre-covid 2019 comparative, since re-opening on 17 May 2021 - very impressive, there’s obviously pent-up demand, and it would have benefited from reduced overseas holidays by UK customers no doubt (my assumption, not mentioned by the company)

August 2021 (school holidays) a record month of £20.1m revenues, up 50% on Aug 2019 (pre-covid)

Positive EBITDA every month since re-opening - I should think so! There would be no hope if this wasn’t the case!

Refurbs (3 sites) and 2 new sites being fitted out - good to see capex continuing, which indicates no financial distress

Net cash of £30m at year end - which allows for capex to be accelerated (nothing said about any stretched creditors or not - e.g. deferred taxes, etc)

New sites - on track to open 14-18 new sites by 2024 - target 33% return on investment (ROI), i.e. 3 year payback, which is a good use of capital, clearly

New, undrawn bank facility of £25m - at cheaper margin than previously, gives ample liquidity, with net cash

Diary date - 14 Dec 2021 for FY 09/2021 results

Outlook -

The Group expects FY21 EBITDA margin % (pre IFRS16) to be in line with FY20 and for it to return to pre-pandemic levels going forward...

My opinion - LFL revenues of +29% is a superb result, since re-opening in May.

This type of business has good operational gearing, so that should translate into bumper H2 profits and very strong cash generation, hopefully offsetting the obviously poor H1 when sites were closed.

I’m looking through both the 2020 and 2021 numbers as being irrelevant, due to covid disruption. All that matters for valuing shares, is what the future holds.

How to value it? Broker forecasts are still generally not reliable at the moment (and I can't find any research notes for BOWL anyway), with some being too cautious due to covid & macro uncertainty. Why can’t they just do a range of scenarios? That’s what businesses often do internally - present the base case (what mgt think is most likely), then present a downside scenario (e.g. if covid lockdowns return for a few months early in 2022), and an upside scenario (if no covid impact, and economy does well).

Hence I think we’re best off looking back at peak, pre-covid earnings, and making adjustments for any acquisitions, cost savings, and adjusting for cost headwinds too.

There was also some dilution at BOWL from a placing in March 2021, 13m new shares at 230p. So EPS calculations need to adjust for that. And higher Corporation Tax in future.

Peak EPS was nearly 15p. So assuming new sites & strong demand roughly offset the dilution, then I reckon we could be looking at maybe 20p EPS for FY 09/2022, reflecting strong pent-up demand. Then maybe a little softening the following year.

Hence I’m going to value the share on the mid point, so 17.5p EPS (my estimate).

Stockopedia shows broker consensus EPS for FY 09/2022 lower, at 14.7p

At 243p per share, that’s a forward PER of 13.9 on my estimate - very reasonable.

Therefore, my conclusion is there could be some more upside on this share, taking a medium term view.

With LFL revenue growth currently so strong, it’s likely that the next few trading updates are likely to be positive earnings surprises, a good backdrop for investors.

How long will pent-up demand last though? Costs are likely to be rising, especially salaries, plus business rates is being phased back in, and VAT returning to normal.

.

.

Volex (LON:VLX) (I hold)

Two small acquisitions announced in Canada, totaling C$22.5m. Each Canadian dollar is worth 59p, so that’s £13.3m in sterling. Not material to Volex’s c.£700m market cap.

Expands presence and capabilities in key North American market

- The seller is an investment company.

- Management being retained.

- Cost synergies.

- Both companies are profitable and a good fit for Volex Group

- EBITDA multiple of 7.7 being paid - seems good value, and fits with Volex’s disciplined approach to acquisitions.

- Paid for out of existing resources.

These acquisitions are a further indication of our ability to identify and acquire attractive businesses for compelling valuations. Our buy and build strategy, along with our pursuit of operational excellence and organic growth, are a key element of our strategy as we target $650 million in revenues and $65 million of underlying operating profit by 2024."

My opinion - I remain bullish on VLX, as a long-term holding of mine.

You have to be so careful buying into acquisitive groups, as they often destroy shareholder value. In this case however, I think the logical approach, of buying decent bolt on businesses with synergies, at modest valuations, looks a winner. So far the strategy seems to have worked very well.

Volex last reported (positively) on trading in late July - see my notes here for a summary.

Supply chain was mentioned in July, but it sounds like Volex has a good grip on things, and has successfully passed on higher copper input prices to its customers (contracts allow for price rises, with a quarterly time lag, typically).

Given the recent sharp pullback in many small caps, Volex has suffered less than many others. I think it’s priced about right for now at 22 times forward earnings. It looks a long-term winner to me.

.

Sanderson Design (LON:SDG) (I hold)

I forgot to mention this yesterday. It’s a non-regulatory announcement, so for general interest rather than being price-sensitive.

Further Licensing Agreement with NEXT

SDG is a luxury fabric & wallpaper company, with a rich design heritage & archive, in particular the William Morris designs.

The agreement covering apparel with NEXT has now been extended to homewares -

… its Morris & Co. brand has signed a licensing and supply agreement with the major retailer NEXT for an exciting range of homewares including bedlinen, cushions, ready-made curtains, blinds, rugs, wallpaper and lighting.

Three year term, so not a flash in the pan, as these deals can sometimes be (e.g. a previous deal with H&M for clothing didn’t last long).

Launch in early 2022, online & in selected stores (presumably the larger ones that stock homewares)

My opinion - NEXT looks to be an increasingly important partner to SDG. There’s more detail in the announcement. There’s even a comment from Lord Wolfson (see below). I wonder if SDG might be on NEXT’s radar as an acquisition, to gain exclusivity of its huge design archive, and of course bolt on revenues & profits? That's pure speculation.

I really rate highly the CEO at SDG, Lisa Montague, she's worked wonders so far, making the business far more efficient & profitable. Hence it's a long-term hold for me, because I suspect it's likely to beat forecasts. Also it's not dependent on Far East supplies, I believe.

Lord Simon Wolfson, NEXT's Chief Executive, said: "We are delighted to be collaborating with Morris & Co., with whom we already have an excellent working relationship. We believe the combination of their outstanding designs and enduring brand along with NEXT's Sourcing, Online and Retail capabilities can deliver exciting new homeware products for consumers in the UK and beyond."

Incidentally, I decided that my sitting room needs some blinds, so went online to price them up on SDG’s website, after getting an email from them about the launch of new Morris & Co soft furnishings, blinds & curtains, etc. (nothing to do with Next, this was one of SDG’s own websites).

Measuring up, and putting in the details for one window (about 180cm wide, and 100cm drop), a single roman blind, in a lovely SDG fabric came in at …. drum roll please … nearly £1,500! Cushions were nearly £100 each. Who on earth can afford to spend that much on one blind?! Certainly not someone who's invested in UK small caps at the moment!

I costed out something similar on BlindsDirect (obviously an inferior fabric, but similar look) and even that was over £200, but quite a difference there.

So if NEXT can take SDG’s beautiful designs, and create affordable homewares, then I shall be delighted to buy some, to break the monotony of magnolia & cream which the previous owner of my apartment liked.

In the meantime, I’ve ordered some self-adhesive plain paper blinds from Amazon for £3 each - surprisingly effective, and they last years.

.

Jack’s section

Srt Marine Systems (LON:SRT)

Share price: 37.5p (pre-open)

Shares in issue: 164,281,939

Market cap: £61.6m

SRT Marine Systems provides maritime domain awareness technologies, products and systems, as well as turn-key solutions for applications for vessels, ports, environment agencies, fisheries, and coast guards that deliver enhanced monitoring, surveillance, safety and security.

Revenue has been volatile and the track record in terms of profits is patchy.

Free cash flow generation has been negative for each of the past six years, and net debt and shares in issue have both increased in that time frame, so it’s not an immediately enticing proposition.

Group revenue for the period was £4.7m and the expected loss before tax is £3.1m. The company does not provide comparative figures - it looks like a more detailed half year update can be expected in December - but checking back on Stockopedia shows H1 2020 revenue was £3.8m with a loss before tax of £2.4m, so revenue and losses have both increased.

Transceivers revenue grew 11% to £4.2m and the group ‘expects[s] demand to continue to grow across all segments in the second half’.

Systems did not recognise any project implementation revenue in the period, although the group continued to receive cash payments from existing contracts. SRT says pending contracts have a value of approximately £71m and are expected to commence during the second half. That sounds like a notable pick up in activity if realised.

New contracts are pending, along with the release of its GeoVS platform.

The group’s S-MDA data stream, which ‘supplements other surveillance system sources such as coast stations and drones to provide long range coverage and other open source intelligence information’ logged £0.5m of revenue. There

Simon Tucker, CEO of SRT said:

I am very pleased with the performance of our transceivers business and the consistent growth track record that appears set to continue into the second half. It is with considerable relief that the Covid stagnation affecting the progress of new contracts for our transceivers business has abated… Of particular note are £71m of long-awaited contracts for which the contract finalisation and commencement status and process is now clear and confidently expected during the second half.

Conclusion

I’ll wait until the actual interim results before forming a more detailed opinion as there just isn’t much to go on in this update. When a company is doing well, that can be acceptable (if not desirable), but when the company has a history of losses and cash burn I’d like to know a little more about the situation.

The key point for me is the ongoing loss before tax. I can accept that Covid has had an impact on the group and that this may well reverse in the second half, and there’s initial revenue from its satellite data business, plus decent growth in Transceivers, so there are some positive signs.

But I’m wary of the promise of potentially huge returns and would much rather see more proof of this and a reduction in losses. Again, it’s not the company’s fault that Covid set everything back.

It’s probably worth monitoring, as all companies with growth opportunities are, but I just don’t see why, with hundreds of potential investment opportunities, I would risk parking my capital here at present. As far as I can tell, the group’s broker (FinnCap) is not even attempting to forecast FY22 performance.

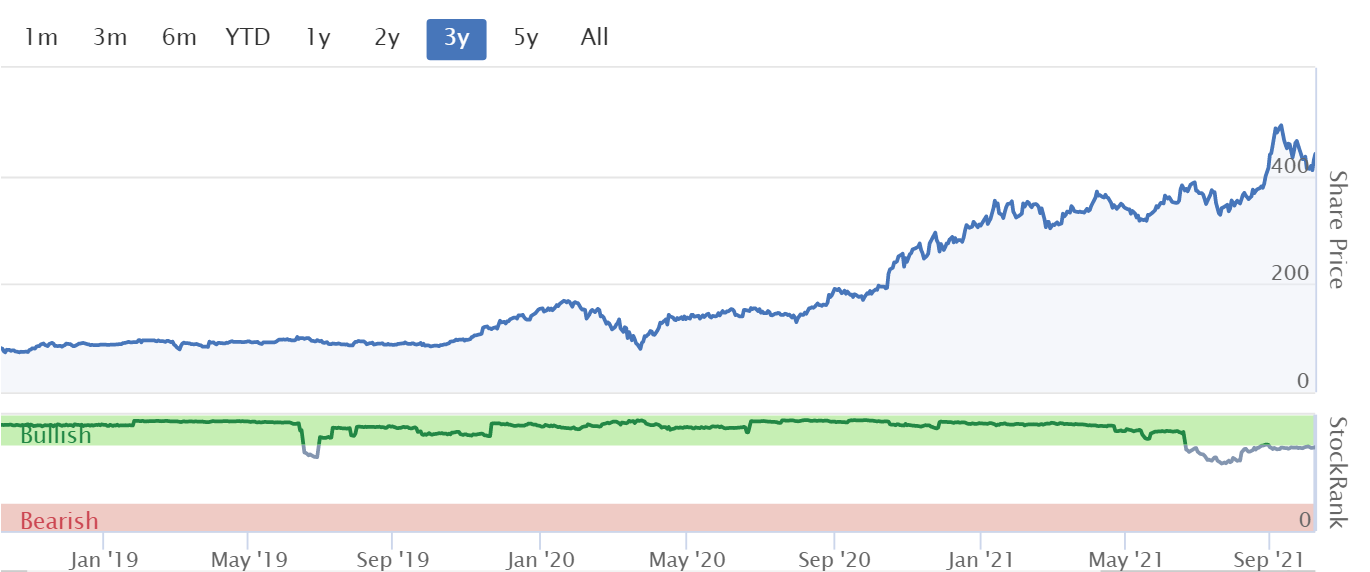

SRT notes a ‘£550m opportunity’ but the StockRanks are low for a reason. The group may well buck the trend in terms of loss-making companies with significant addressable markets, but the odds are statistically quite low. Hence why I would gladly trade off some of the upside for more certainty on the likelihood of SRT realising its ambitions.

And with a market cap of £61.6m on FY19 revenue of £20.6m and net profit of £3.41m, a degree of growth is already priced in. The potential is there, but the possibility of a decline in share price should anything get delayed is also very real at these levels.

Back in H1 2019, the group said:

Most of our system discussions are confidential in nature and usually have a long gestation period due to the nature of a government turning a general idea into a real system with all the necessary regulations, budgets and approvals. Over the last few years, we have followed a very steep learning curve in respect of understanding the realities of the intricacies and complexities of the processes that each of these large contracts must complete prior to SRT being contracted.

So it seems like hard work getting these contracts done.

Premier Miton (LON:PMI)

Share price: 176p (+0.57%)

Shares in issue: 147,491,470

Market cap: £259.6m

Premier Miton offers good value compared to other listed fund managers, with an attractive forecast dividend yield of 6.44% and a rolling PEG of just 0.5x.

It’s got a wide spread of activities: 43 open-ended funds, five investment trusts and two external segregated mandates, so the platform for scalable growth is there, but what these companies need to really take off is consistent, growing levels of net inflows.

If they don’t have that then a much higher valuation is not warranted (although you could argue that a 9.9x forecast PER and 6.44% yield does deserve a more modest rerating). PMI’s cheap valuation does make it worth watching, in case there are signs of increasing growth.

Fund managers’ fortunes are of course tied to the markets in which they invest, so a favourable backdrop there would make a rerating quite possible. You can see the group’s shares lag its peers over a two year period.

AuM increased by 31% to reach £13.9bn in the quarter, capping ‘a year of strong net fund flows’. AuM was £10.6bn by the end of Q4 2020.

£830m of net inflows for the year (and £120m of inflows in the quarter), a marked improvement on 2019’s £619m of net outflows. So momentum has improved.

This is a useful table, so I’ll just re-publish here. You can see the positive inflows but also the fact that the bulk of the increase in AuM comes from investment performance, particularly in Equity funds. Multi-asset funds continue to drag on group performance however, with outflows spiking in Q4. This point isn’t really addressed in the management commentary.

Where possible to measure against peer groups, 80% of PMI’s open-ended funds are in the first or second quartiles for investment performance (with 66% in the first quartile) since manager inception.

The Premier Miton European Equity Income Fund was added in the quarter, while the Premier Global Infrastructure Income Fund and the Premier Miton Global Infrastructure Income Fund have been merged. This reduces investor costs and ‘brings scale potential for this strategy’.

Conclusion

It’s a shame there’s not more colour on what’s going on in Multi-asset. Apart from that, the performance looks good and the valuation is modest.

Comparing performance to Polar’s most recent quarterly update (a different time period: the three months to 30 June 2021 compared to the three months to 30 September), Polar’s AuM increased by £1,959m, a 9.4% increase made up of 27.2% subscriptions and 72.8% investment performance. So that’s a 2.6% increase in AuM due to subscriptions.

PMI’s Q4 shows net flows of £120m, an increase of 1.06% quarter on quarter. Mind you, PMI’s Q3 was stronger than its Q4, with net inflows at that point marking a 2.8% increase in AuM q-o-q, so perhaps it’s unfair to compare a Q3 with a Q4 if the former was just generally stronger.

Obviously these companies are tied to the markets of their asset classes, so the picture can change there. They do tend to have good Quality metrics though, and the scaling economics make them worth considering. The question is which funds have the best momentum, with the most significant inflows, and can command the highest fees based on track record and reputation?

It’s interesting to note that brokers have recently edged down EPS forecasts, and the pick up in multi-asset fund AuM makes me pause, particularly given the lack of commentary.

The StockRank has also fallen by 11 points in the past month, although this has been driven by a fall in the Momentum Rank rather than a deterioration in value of financial health / profitability. On the other hand, it does look potentially good value and a 31% increase in AuM does point to a growing company with a low PEG, so probably worth digging into.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.