Good morning! It's just Paul here today, as Jack's snowed under with other work. Today's report is now finished, have a lovely weekend!

Agenda -

Paul’s Section:

Jet2 (LON:JET2) - outside of our scope, as it’s £2.5bn market cap. So just a quick mention of what seems like an encouraging update today - which could have positive read-across to other travel company shares. It says that Feb & Mar 2022 saw load factor “approaching seasonal norms”. Summer 2022 bookings “are encouraging”, and close to pre-pandemic levels. Fuel costs are mostly hedged. In any case, I see that the oil price (whilst volatile) has come down from recent peaks.

My view - this could be a good time to buy travel shares, as strong demand returns, but share prices still look depressed. Could be a nice trade, for a (say) 20%+ sector bounce? That's it, no section below.

Vp (LON:VP.) - a positive trading update, ahead of expectations for FY 3/2022. This strikes me as a good business, and attractively priced, with a decent divi yield too. Looks good value. Worth considering.

Hollywood Bowl (LON:BOWL) - an excellent H1 (Oct-Mar) update, with very strong LFL revenues continuing, from pent-up demand - but how long will that last? Ahead of expectations for the full year, but we can't access any broker research, which seems an own-goal by the company. The recent big recovery in share price looks justified to me, this seems a good business, and it's expanding, on a valuation that still looks reasonable.

Sensyne Health (LON:SENS) - shares crash nearly 80% on news it's delisting, and fresh funding from lenders will involve massive dilution from lowered conversion price (and warrants). We rang the alarm bells here on 14 Jan, and 26 Jan, when the company announced it had run out of cash. It's since dropped over 90%. Anyway, that's it, de-listing means that we won't need to cover this crock again. It's worth studying situations like this, so you can spot the warning signs in future at other companies in terminal decline.

Ramsdens Holdings (LON:RFX) - a reassuring H1 trading update, with all 4 activities doing well. Liberum ups FY 9/2022 profit estimate by 19%. There should be a c.5% divi yield by next year. Sales of forex are expected to improve, as leisure travel returns. Looks OK overall, and priced about right for a sector that is always cheap.

StockSlam - sadly, the online StockSlam event is now on hold, due to a lack of new people prepared to do 3-minute pitches on shares of interest, it was felt that we couldn't just have the same speakers appearing time after time. Also, I think the organisers, Damian, and PIWorld, need a break. I'm hoping StockSlams return in the autumn, we might have to do some nagging!

Here's the video of this week's StockSlam, including my "pitch" for Beeks Financial Cloud (LON:BKS) (which readers here already know that I'm bullish on as a long-term core holding in my portfolio). Obviously not cheap now, and I'm hoping for a pullback so I can buy some more a bit cheaper.

Link to StockSlam recording for April 2022.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Vp (LON:VP.)

870p (yesterday’s close)

Market cap £349m

Vp plc, the equipment rental specialist, today provides a trading update for the period since the Interim Results were issued on 30 November 2021 (the 'period').

VP has a year end of 31 March 2022. It is an equipment hire group.

Positive update -

The Board is pleased to report that the Group has maintained its recovery in trading performance with our core markets of infrastructure, construction and housebuilding providing increasing levels of demand and we expect to report results for the full year, ahead of the Board's expectations.

Outlook - no signs of any recession worries here -

We are encouraged by the improvement in sentiment and performance experienced in the final quarter and look forward to a period of further progress in the new financial year.

Commenting on the Trading Update, Neil Stothard, Chief Executive of Vp, said: "Since our interim results in November, the Group has seen increased demand from our core markets as Covid restrictions have eased and we are pleased to say that overall performance is expected to be ahead of the Board's expectations. Additionally, we have made excellent progress with both our technology offering and with the introduction of more environmentally friendly equipment solutions for our customers."

"We look ahead with optimism, confident that we will continue to deliver excellent value growth for our shareholders."

My opinion - I do wonder if the stock market (especially in small caps) might be over-reacting to inflation worries? VP’s update today reflects a buoyant economy, with full employment.

Valuation metrics below look pretty good value to me. After the recent dip in share price, VP seems worth considering. It strikes me as a decent company, well managed, with a fairly good long-term track record, and attractively priced right now, especially after today’s ahead of expectations update & buoyant-sounding outlook.

.

.

.

Hollywood Bowl (LON:BOWL)

280p (up 7% at 08:27)

Market cap £478m

Hollywood Bowl, the UK's largest ten-pin bowling operator, is pleased to announce a trading update for the six months ended 31 March 2022.

Preamble - I last looked at this share here in Oct 2021, when it published a strong trading statement for FY 9/2021. Pent-up demand had produced a positive H2. However, pandemic disruption meant that full year results for both FY 9/2020 and FY 9/2021 were barely above breakeven, helped considerably by Govt support measures.

The balance sheet was strengthened during the pandemic with a fundraising, which increased the share count from c.150m to 171m shares - not too much of an issue.

Note that the IFRS 16 lease entries are large, and show a net liability of £41.6m - this should largely disappear in future as sites become profitable again. Taking that into account, the balance sheet looks OK, with plenty of liquidity.

Today’s update - the prior year comparatives are meaningless, due to pandemic disruption. More importantly, the like-for-like (LFL) revenue growth compared with pre-pandemic is highly impressive, at +26.8% - this really matters, because there are a lot of cost headwinds (e.g. wages) these days. So +26.8% revenue growth is way more than needed to mop up cost increases, I reckon.

Although I suspect that rate of growth is probably due to pent-up demand, hence should probably be seen as a temporary bonanza.

As mentioned above, demand for holidays is returning, so could that see UK-based leisure attractions wane in popularity, as squeezed incomes require savings to be made elsewhere to fund a family holiday abroad? Who knows - every household has their own priorities, and behave differently.

Inflation & cost control - this is very interesting, especially the benefit of installing solar panels. Hedging of energy costs is a key issue right now, so we need to ask that question on company webinars.

I’d like to see more companies disclose what their % labour cost is. Actually, this is in the notes to Annual Reports, so we can easily find out that information ourselves -

Cost control remains a focus for the Group. Although not immune from inflationary pressures, centre level labour accounts for less than 20 per cent of sales and the Group has taken a number of mitigating actions including maintaining a simplified food menu introduced during the pandemic.

The main potential exposure is energy costs, which the Group has hedged out to the end of FY2024. Additionally, five solar panels installations were completed on centres during the period with five further planned during FY2022. The Group expects that by the end of FY2022, 15 centres will have installed solar panels that result in up to 33 per cent of the sites' required electricity being self-produced. We plan to roll out solar panels to more centres in FY2023 and beyond, subject to landlord consents.

Cash - was £30.0m (and no interest-bearing debt) at end Sep 2021. This has improved strongly, to net cash of £49.6m at end March 2022. Very impressive, especially as that’s obviously after taking into account cash outflows for capex - refurbs & new sites, and improvements like the solar panels.

Dividend to be reinstated. This should be quite good, because the company has plenty of capacity to pay generous divis, due to its hefty cash pile, and cash generative operations.

Full year guidance -

The Group anticipates that its full year performance will be ahead of current market expectations.

Broker updates - there’s nothing on Research Tree. It’s very frustrating when companies fail to ensure forecasts/research gets out to private investors - a big oversight.

Looking back at my notes from last autumn, I thought at the time that consensus of c.15p EPS looked light, and that something nearer to 20p this year, and maybe 17.5p thereafter (as pent-up demand waned) might be more appropriate.

With another really positive update today, that could be too conservative now maybe?

If we value the share on say 20p EPS (this year could be more), then the PER would be 14 - that’s not expensive, especially as the finances are sound, with plenty of net cash in the bank.

My opinion - I still like BOWL, despite a recent big recovery in share price after the mad panic sell off in early March. This rebound looks justified by strong fundamentals, in my view.

I’m not sure I could bring myself to buy now though, looking at this chart -

.

.

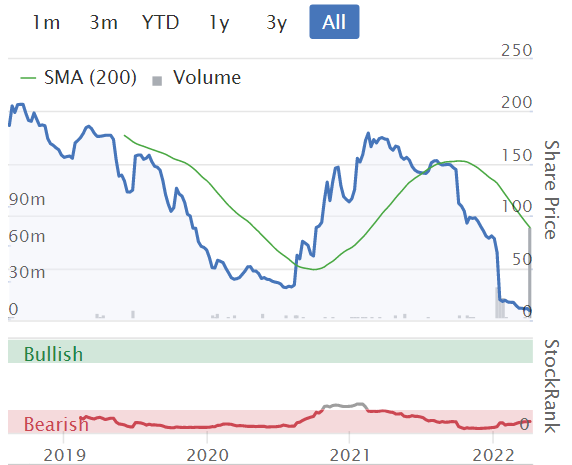

Sensyne Health (LON:SENS)

2.2p (down 78% at 10:16)

Market cap £3.6m

It’s around this time of the morning that I check out the top risers & fallers, to pick up news stories that I missed on my first sweep of the RNS.

Today’s top faller today, by far, is this massively loss-making AI company in the pharmaceuticals sector.

It came up previously on the top fallers list, so I covered it here on 14 Jan 2022, at 24p, warning that a price of 0p looked highly likely, concluding “ditch them at any price”, which on reflection probably crossed a line in terms of not giving advice, but the financial situation looked so bad that I felt compelled to warn in the strongest terms I dared.

Then again we looked at it here on 26 Jan 2022, after major shareholders extended an emergency loan to keep the lights on temporarily whilst a sale of the company was sought, concluding “Very dangerous, beware”, and “I wouldn’t touch this with a bargepole”.

Just to clarify, that wasn’t hyperbole, we would only use language like that if a company is a complete financial basket case, and about to go bust. Or rather where the probability of a 100% loss is extremely high. Sometimes companies do manage to rise from the near-dead, but it’s very rare in the worst cases like this, where a heavily loss-making company runs out of cash.

I’m making the above point not to sound smug, but to emphasise that when shares collapse, it’s predictable just from looking at the balance sheet, and cashflow. Companies don’t go bust due to losses, they go bust when they run out of cash.

Today’s Update has triggered a further 78% fall, so it must be grim.

- The founder/CEO has stepped down with immediate effect, to be replaced by Alex Snow, an “experienced entrepreneur” with relevant experience.

- The new CEO will conduct a restructuring, focusing on core activity, “with the support of the Noteholders” - so clearly the creditors are now in control of the situation.

- Cash - there’s only £1.5m left as of 6 April.

- Noteholder creditors have agreed to provide another £15m in new loans, to include 10p warrants, in tranches of £5m. Loan notes will be convertible into shares.

- Share capital being restructured.

- Cancel listing on AIM - this is the killer, so it’s game over for most people, who won’t want to hold shares in a private company. Although that is still possible.

- Waive requirement for a mandatory offer under the Takeover Code (because Noteholders will own most of the company if they convert into equity).

- Formal Sale Process announced in Nov 2021 has not worked so far, but “discussions remain ongoing with a small number of parties…”

This warning is very clear (that existing equity is now worth very little) -

Shareholders' attention is specifically drawn to the proposed term to cancel the Company's shares from trading on AIM and the highly dilutive impact of granting conversion rights to the Noteholders and the proposed change in exercise price of the warrants associated with the loan notes.

My opinion - it looks as if the company could survive. However, because it’s run out of cash, the new financial backers (lenders) have taken control, and existing equity now looks likely to be diluted away to virtually nothing.

The approvals will allow for the conversion price for the loan notes and the exercise price for the warrants to be set at a new nominal value for the ordinary shares of £0.008 per share.

This bit above seems to be saying that the new shares (if Noteholders convert) will be at 0.8p per share. The nominal value of the shares is being lowered to 0.8p, through the usual device of splitting into (worthless) "deferred shares". Therefore if we work on the basis that total noteholders end being owed £20m after the new loans have been drawn down, that would mean conversion into 2.5bn new shares. There are currently 166.2m shares in issue, so existing shareholders would go from owning 100% of the company, to owning about 6% of the company, massive dilution, assuming the noteholders do convert their loans into shares at some point.

At this stage, there’s little point in selling, if your shares are only worth a few quid - the dealing commission might even be more than they’re worth, for small shareholders.

As the company’s got fresh (loan) funding, it could survive in restructured form, and existing shareholders would then own a tiny proportion of a private company, which could conceivably survive, and a remote chance of it prospering maybe?

This situation is a reminder, that if you must punt on blue sky, jam tomorrow shares, that are burning cash at a prodigious rate, then it’s vital to ensure there’s enough cash in the bank to get to where the company needs to get to. Repeat rounds of funding really don’t work well on the AIM market, companies like this should stick to private ownership.

.

Ramsdens Holdings (LON:RFX)

182p (up 3% at 12:11)

Market cap £57m

Ramsdens Holdings PLC, the diversified financial services provider and retailer, announces a trading update for the interim period ended 31 March 2022 (the "Period").

H1 profit guidance -

During the Period, Ramsdens delivered a strong performance across each of its four segments. As a result of this, the Group expects to report H1 profit before tax of approximately £2m.

Brokers don’t give out half year guidance, so it’s not clear how this compares to market expectations. That the share price is up 3%, and the company describes its H1 performance as “strong”,and “very strong”, suggests that this is a bit better than expected.

Outlook - interesting comments here, especially the above-inflation pay award for staff. Reading between the lines, it seems to imply that higher wages can be taken in their stride -

"We are pleased with the Group's very strong performance during the Period, the first half of a financial year marked by the continued easing of restrictions and consumers' transition to normality.

Whilst being mindful of the impact of current macroeconomic events and well-publicised inflationary pressures, the Board is encouraged by the growing demand for Ramsdens' services and believes that the strong momentum reported today will continue over the coming months.

Demand for Ramsdens' foreign currency services in particular is expected to grow significantly as more people travel abroad this summer, and we are confident that the Group's ongoing strategic investment in its jewellery proposition will continue to deliver strong results both in store and online.

We have rewarded our staff with pay rises in excess of inflation, and I would also like to take this opportunity to publicly thank them for their dedication both to the business and to our customers over the last two challenging years.

We remain on track to open eight new stores in this financial year, and underpinned by our diversified model and well-invested proposition, look forward with confidence to the key summer trading period ahead."

That all sounds pretty good.

Broker update - many thanks to Liberum for providing us with an update today, much appreciated. Liberum analyst Shailesh Raikundlia has put through a chunky +19% increase to his FY 9/2022 forecast PBT, but no change to FY 9/2023 forecast.

I find it easiest to work on EPS forecasts, which are 14.8p this year, and 18.5p next year.

Shares are 182p now, so the PERs are 12.3 this year, and 9.8 next year - which looks about right for this sector, which always seems to trade on low multiples, due to the regulatory risk, and slip-ups which seem to occur from time to time.

Dividends - are forecast to be about half earnings, giving a c.5% yield by next year - the main attraction of owning shares in this sector.

My opinion - this looks like a smaller version of H & T (LON:HAT) - both companies are income shares, with the long term charts showing zig-zag sideways movements. Hence it seems to me that the time to buy is when they periodically sell-off, not when they’ve just put on an impressive share price spurt, as of now.

Here’s the RFX share price since it floated, obviously heavily disrupted by covid, like most shares.

It’s also paid out 19p in total divis since listing.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.