Morning folks,

I'm looking at these today:

- Future (LON:FUTR) - trading update - ahead of expectations

- Gfinity (LON:GFIN) - trading update - slightly ahead of expectations

- GAN (LON:GAN) - update, sounds positive

- Science (LON:SAG) bids for Frontier Smart Technologies (LON:FST)

- If I have time, I will scroll back and look at Creightons (LON:CRL).

Future (LON:FUTR)

- Share price: 1072p (+11%)

- No. of shares: 82.5 million

- Market cap: £884 million

Update on current trading and Board change

This is a short trading update, so let's just briefly confirm what it says:

- more positive trends, performance tracking ahead of expectations

- The CFO is becoming "Chief Strategy Officer" from January 1st, 2020. A new CFO will be found before then.

My view - I don't have a strong view on Future's financial prospects, but I can comment on the CFO movement.

It's worrying when a CFO steps down. And it's more worrying when you have a complicated, acquisition-led strategy which a new CFO will need to take over.

In this particular case, we have a CFO moving into a new, non-Board position. Stepping down from the Board means having less overall influence, I think, even if the new title sounds important. While each case is different, a move like this can sometimes be the prelude to the individual leaving the company.

I understand that shareholders in Future have been extremely active this morning, with possible explanations for what has happened.

In my view, the CFO moving into a non-Board role is net neutral for shareholders. If the CFO was unhappy with her prior work for the company, or could predict bad news in the short-term, she would have resigned and moved on as quickly as possible.

For her to stay around means that she still believes in the company's prospects, at least to some extent. It also means that she could potentially help her successor to deal with particular problems, if it is needed.

It also means that Future has the opportunity to hire someone for the next phase of the company's growth.

Changing CFO every four or five years is not so unusual, after all. According to a US study, the average tenure of a CFO is 5.1 years. Future's incumbent has been in the role since july 2015. So it's perfectly normal to move along after this sort of timeframe.

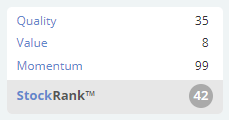

As for the investment merits of Future (LON:FUTR), I still don't have a strong view. Organic growth is not bad, but it's really all about acquisitions. I remain neutral on the stock, a bit like the algorithms:

The algorithms are in fact a little negative, calling it a Momentum Trap - apart from strong Momentum, they don't think it has much going for it.

Gfinity (LON:GFIN)

- Share price: 5.1p (+1%)

- No. of shares: 363 million

- Market cap: £18.5 million

Gfinity plc (AIM: GFIN), a world-leading esports business, today announces a trading update for the year ended 30 June 2019.

This company's financials have been heavily loss-making so far, and FY June 2019 is unlikely to be any different.

On the bright side, this update is slightly ahead of expectations and it reiterates its target for breakeven by FY 2021.

According to the forecasts visible to me, FY June 2019 is set to show EBITDA of minus £9 million, improving to minus £5 million in FY 2020 and then a small positive result in FY 2021.

To hit these targets, according to the forecasts, revenue needs to almost double each year.

Strategic achievements so far:

- Appointed by Activision Blizzard ($ATVI) to host a Call of Duty event, EA Sports to host FIFA events, and Formula 1 to host their events.

- New partnerships with the Premium League, the eSports World Cup and HP's gaming PCs.

My view: the company claims to have a "proprietary technology platform" enabling gamers to play against each other on a level playing field. Perhaps this is unique IP, giving it a competitive advantage?

Without having studied this company in detail, I'm a bit put off by the fact that it needs revenue of almost £27 million (according to the forecasts) just to reach breakeven. Why does it cost so much to run esports competitions?

And doubling revenues every year is a big ask for any company, even if they believe that they are currently on track to do so.

Unfortunately, this one is much too speculative for me.

Top Gaming Picks

As a potentially more relaxing investment in this space, I continue to find Activision Blizzard ($ATVI) interesting: it owns massive game franchises including World of Warcraft, Overwatch, Call of Duty and Candy Crush. In my view, it's much safer to be involved with the owners of valuable gaming IP, rather than their support service providers.

With a market cap of c. $36 billion, ATVI is forecast to generate profits of $2 billion next year. Not overly expensive, then? It would be my first port of call if I wanted to invest in gaming.

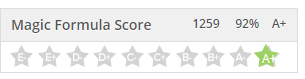

It has a QualityRank of 98 and is top-ranked by the Greenblatt Magic Formula:

I might also check out Nintendo (Tokyo:7974). It's a long-standing favourite of Nick Train.

My favourite UK company in this space is Frontier Developments (LON:FDEV), which I might buy into if it was cheap enough.

GAN (LON:GAN)

- Share price: 71.8p (+2.6%)

- No. of shares: 85 million

- Market cap: £61 million

Favorable Second Quarter Trading Update

At a tangent to gaming is the gambling sector.

This is another sector I like, especially the B2C brands. I own shares in 888.

The main challenge in the sector is navigating the regulations posed by various governments.

This has been a downside risk for years but more recently we have had opportunities to the upside with piecemeal deregulation in the United States.

There is a handy table on Wikipedia showing the status of sports betting in each US state. As you will see, there has been a wave of legalisations since last year. There is also a table on Wikipedia showing the status of online gambling in each state.

The situation is fluid, with news only last month about the interpretation of the Wire Act of 1961.

My assumption is that further deregulation is not going to happen, but it's an exciting possibility!

GAN

GAN (LON:GAN) is a B2B software and service provider for this industry. It reports today that the traditionally quiet summer months are being offset by:

- New Jersey demand for basketball and baseball

- New Jersey cross-selling from internet sports into internet casino.

I note that online sports betting has been legal in New Jersey since June 2018.

GAN has a big contract with a casino in Pennsylvania and expects to launch similar internet services for additional clients this year. It expects high double-digit revenue growth. The forecasts on Stocko as of last night suggested revenue growth in excess of 60%.

CEO comment:

In the second half of this year, we remain focused on landing new clients, and expanding upon existing contracts with clients, in addition to preparing ourselves for a rapidly expanding market due to an acceleration in sports betting-led online gambling regulation in the United States as well as enabling browser-based Internet gambling on Apple iOS compatible mobile devices...

My view

GAN is not in my investable universe, as I can't predict the success of a B2B platform in this space. It's difficult enough to predict whether a B2C platform can survive, and analysing a B2B platform is even harder!

And GAN has a poor track record when it comes to profitability. Perhaps it will move into profitability in future, given the rapidly growing US market? I think you would need specialised knowledge to figure it out, however.

It's not going to make me invest in it, but the shareholder register at GAN does stand out to me: it includes many members of the extended Smurfit family (of Smurfit Kappa (LON:SKG) fame), including CEO Dermot Smurfit with a 10% stake.

It also includes the Irish billionaire Dermot Desmond, and a man called Andrew Black - if that's who I think it is, he is a well-known poker player from Northern Ireland. [Correction - it is this Andrew Black.]

This is the sort of "useless" background info that I like to collect when sizing up a company!

There is an ongoing formal sale process at GAN, with the potential for the entire company to be sold, the introduction of a strategic industry investor, or a US listing. With so many US-centric activities, it sounds like a sensible move.

Science (LON:SAG)

- Share price: 198.5p (-0.3%)

- No. of shares: 41 million

- Market cap: £81.5 million

Response to Science Group Statement by Frontier Smart Technologies (LON:FST)

Science Group does "science as a service" (yuk!) projects across a wide range of scientific disciplines.

It took a shining to Frontier earlier this year, looking to take it out at 30p per share. FST has a profitable business which makes modules and software for digital radios and an unprofitable, speculative "Internet of things" business.

Science increases its offer today to 35p, valuing FST at about £14 million. It already owns 28% (11.5 million shares), and has put a bid in the market at 35p for another 10 million shares. Nice support for the share price!

And it warns that it might try to block anyone else who wants to own FST:

Science Group does not anticipate supporting any proposals made in respect of Frontier by any alternative bidder.

Talks between Science and FST broke down, and relations between the two sets of Directors turned sour. Science accuses the FST Board of committing a "breach of trust" by revealing its original offer price to the market.

FST has responded with the message that it is still in talks with a "credible industry player" about a possible approach. It sounds like this entity would be the Board's preferred bidder. Perhaps they think it will make a higher bid and aren't simply hoping to delay proceedings - they mention their "fiduciary duty to maximise value for shareholders."

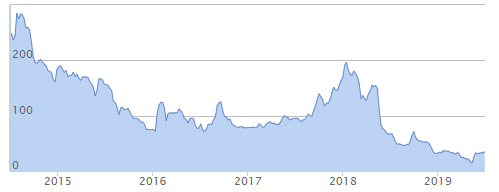

Anyway, it's a nice position to be in if you timed your FST purchase within the last few weeks. Performance over five years has been terrible, however:

My view - I think the share price floor at 35p is virtually guaranteed and that Science will end up devouring FST. But it's impossible to say for sure.

Thinking about the combination of the two companies:

Science enjoys a strong StockRank of 77, with a QualityRank of 95. As a consultancy/advisory group, I'm surprised that its financials are so good.

FST, meanwhile, despite some interesting activities, has a StockRank of only 19 and a QualityRank of only 2. It might have good technology and reasonable prospects, but its poor results and share price collapse in the last couple of years have paved the way for this (opportunistic?) bid. I wonder if FST shareholders have the willpower and determination to turn down 35p?

Creightons (LON:CRL)

- Share price: 38p (+3%)

- No. of shares: 62.5 million

- Market cap: £24 million

(Please note that I have a long position in CRL.)

I've finally had a chance to watch the entire preliminary results presentation at PIworld. I got burned out last week, and only managed to watch the first half of it.

You're encouraged to watch the entire thing, but here are my notes:

- Balance Active Formula (acquired recently) cost £500k, and has turnover of £1.2 million. Expecting quick payback.

- Wants to be more active online, hoping to acquire a beauty-focused retail website. Upgrading its own web sales platform.

- Also looking to acquire the freehold of its factory site. Possible deal at 80% LTV, margin rate 1.8% over base.

- Hiring a new sales manager with experience at McBride (LON:MCB) to consolidate the sales effort for private label/contract sales.

Financially:

- Revenues +26% is all organic growth from new and existing customers.

- Private label sales (+42%) and contract sales (+32%) growing a lot faster than owned brand sales (+1%). Owned brand sales were affected by the company abandoning licenced brands, which it felt were a distraction, and also moving out of some discount retailers which it felt were losing on the High Street.

- Gross margin down >1% due to customer mix (private label work) and cost pressures but operating profit margin up nearly 2%. Operating leverage: controlled overhead costs up by 10.9%, much slower than revenue growth.

- Excluding the costs of outsourced sales last year when the company ran out of capacity, underlying operating profit margin has been on a steady upward trend.

- Post-tax profit margin doing well, even if we use a normalised tax rate (see the next bullet point).

- EPS for FY 2019 was flattered by a very strange tax year, when the company claimed historical R&D relief for prior years.

- The normalised tax charge is expected to be 13%, assuming the continuation of R&D relief and R&D activities at the same rate. If I apply 13% to PBT of £2.87 million and use the latest number of shares outstanding, I get normalised EPS for FY 2019 of 4p. Dilution is coming from employee schemes so in that sense, 4p is an over-estimate of future periods.

- Return on Capital Employed is up at 24% according to the company's estimate, with great progress over 3 years (less than 8% in 2016). "No reason why that shouldn't continue to improve as we go forward", considering that acquisitions are to be funded from existing resources.

- Cash drag by working capital increase, and spending on capital items and intangibles. Has unwound the Brexit stock increase post-year end. Latest cash of £1.5 million prior to month-end salaries.

- Also reducing debtor days. Virtually no money lost in recent years to bad debts.

- Sales up 20% so far in the new financial year.

Operationally:

- Production management efficiency +20%, output +17%. Unit costs keep falling. New high speed bottle filler and high speed tube filler having big effects, high speed jar line maybe by early 2020.

- Bonus system focused on individual performance, good for motivation.

- Still thinking about more capacity at both existing sites, maybe add an extra shift.

- Could bring warehousing in-house, has some spare land.

2017 Targets:

- Still shooting for £60 million revenue by FY 2021. Will need a mix of organic and acquisitive growth.

- Net profit margin of 5% has been achieved.

- Pay a 2% dividend yield - probably going to fail on this front, but this seems like a badly designed target since it depends on where the share price is. So I don't care about this.

- ROCE of at least 20% has been achieved.

Marketing Director:

- Health and beauty sector growing +9% p.a.

- UK is a major market, lots of new product launches. New product launches get to market more quickly than ever. Purchases shifting online. Amazon could impact.

- Average order intake per month £4 million (+25%), average total order book £8.5 million (+29%).

- Greater than 100% growth in High Street distribution of owned brand sales. e.g. The Curl Company revenue +153% year-on-year. Feather & Down +115% year-on-year. BAMbeautiful off to a great start (launched May 2019).

- Balance Active Formula is the first owned skincare brand. A good fit since CRL makes a lot of skincare products for other companies, has expertise in the category. Ideas for expanding distribution internationally and public profile.

- Drivers - unchanged key drivers. Partnering with winning brands and retailers, strong consumer insight, agility to react to changes in the market, and talent development.

Aspirations (by CEO):

- complete ongoing acquisitions

- acquire an additional brand. Most deals fall through on price - a good sign that the company is being very careful. Might buy an "overvalued" brand if CRL can compensate for this overvaluation strategically. A German brand unlocking access to German retailers would be an idea. Could use debt and equity to buy a brand.

- Hit the 2020 KPIs mentioned above (Sales, Net profit margin, ROCE, dividend yield)

- 2024 aspirations: £100 million sales, net profit margin 8%, ROCE 30%, dividend yield 2.5%. Would like to raise £10 million in fresh equity and use borrowed funds to help it get there.

- Would spend £5 million on factory capex and £30 million on acquisitions and web retailing activities.

- £100 million of annual sales might comprise: £30 million in web sales, £25 million in branded sales, £20 million contract manf., £25 million private label.

My view

I'm delighted with this company's results and its level of ambition.

I also love management's style of communication. They deserve credit for being so open with investors about their thinking. Credit to Tamzin and PIworld too, for recording these presentations so professionally.

The 2024 aspirations are very stretching, maybe a little bit too stretching? Earning ROCE of 30% while perhaps only one-third of business comes from CRL's own brands sounds like a big ask. The Marketing Director said in the Q&A that contract manufacturing and private label can be higher-margin than own-brand, but I still prefer the certainty that comes with CRL owning its own brands, rather than competing for manufacturing work.

If the 2021 revenue target is hit, compound sales growth p.a. of 18.5% would be needed thereafter to hit the £100 million target. I hope the company remains very disciplined in its approach.

I'm going to have to keep a close eye on progress, as there are clearly some risks associated with the growth strategy. But I shouldn't complain - the share price is up by more than 60% since my purchase early last year. Well done to Creightons and long may its success continue!

Ok, I'm all done! Paul will be with you tomorrow.

Thanks

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.