Good morning, it's Paul here, with Monday's SCVR.

Please see the header for company announcements that have caught my eye today.

Estimated timings - the bulk of today's report is now done. I'm taking a break for lunch now, and might come back with a little more later. Today's report is now finished.

Ted Baker (LON:TED)

Share price: 139p (down 10% at 09:25)

No. shares: 44.6m + 126.7m = 171.3m

Market cap: £238.1m

Ted Baker, the global British Lifestyle brand, today announces its full year results for the year ended 25 January 2020, as well as providing: an update on actions taken to strengthen the business; a transformational strategy "Ted's Growth Formula", to return the Company to profitable growth; a summary of its response to Covid-19 and an update on current trading.

There's a big placing announced today too, which I'll cover separately below.

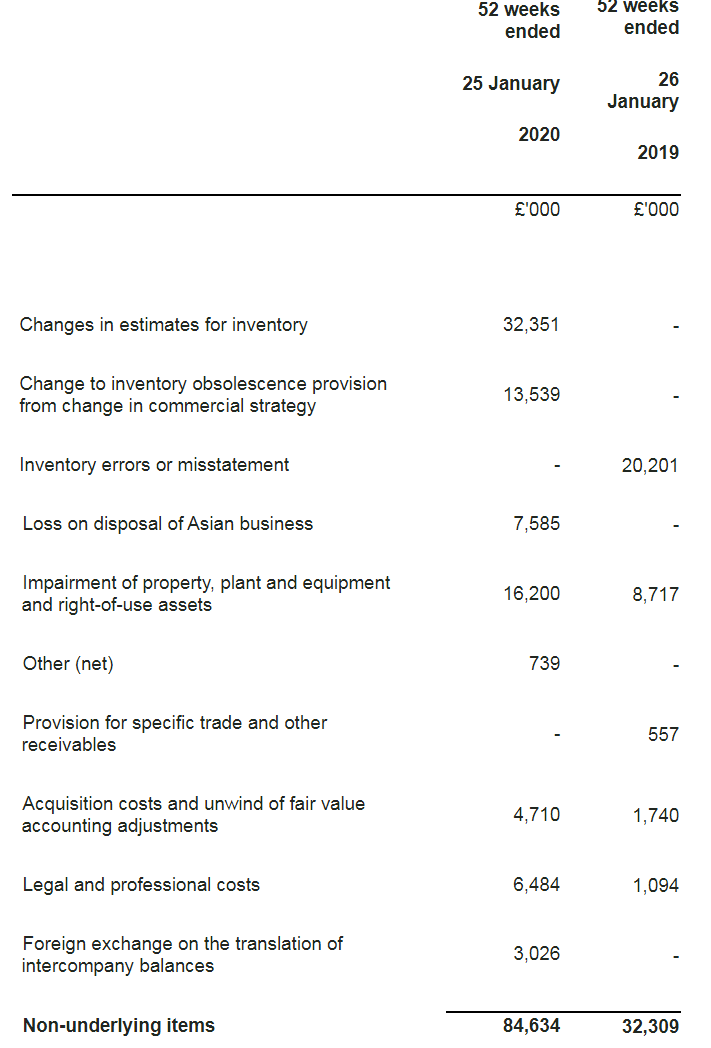

Results are pre-covid, so not terribly relevant. The figures look bad, with profitability having collapsed: underlying profit before tax fell from £63.0m last year to only £4.8m this year. Moreover, that doesn't include the inventories write-off (they were carrying stock at inflated valuations before). Reported profit before tax looks awful, at a loss of £(79.9)m.

Look at the scale of the adjustments to profit - this is really stretching credibility;

.

.

Balance sheet - there doesn't seem to be one, in the results announcement. It just stops after the financial review. So I'm not sure what's going on here.

Property disposal - highly material, with net proceeds of "at least £72m" in the pipeline, completion expected in Jun 2020. This will be used to repay debt.

Proposed placing - key points;

- Deep discount - new shares are being issued at just 75p, a 51% discount!

- Heavy dilution - share count rising from 44.6m shares, to 171.3m shares

- Underwritten - hence high fees at £5m, so £95m gross becomes £90m net

- Open offer of an additional £10m for existing holders, 4 new shares for every 7 existing shares

- Bank facilities increased slightly, but will reduce when HQ building is sold shortly

- Joint bookrunners: Goldman Sachs & Liberum

My opinion - I'm not going to plough through all the restructuring narrative, because turnarounds rarely work in this sector.

As reported previously here, this company is in a complete mess, and I see this fundraising as probably just deferring the eventual failure of the business.

This is a fairly grim fundraising - at a huge discount, and bringing heavy dilution. Quite why the share price is still as high as 139p, doesn't make sense to me, given that existing holders are about to be heavily diluted with loads of new shares issued at 75p. It might even be worth shorting at this level of 139p.

Once its shops are able to re-open, footfall is likely to be low, plus there will be masses of dead stock to shift, at discounted prices, hence the 2020 figures are likely to be heavily loss-making. It also has the problem of collecting in receivables balances from wholesale customers - will they be able to pay, many might go bust, who knows? It's a big risk though. Plus will suppliers be happy to extend credit to customers in future? It might be more difficult.

As you can probably gather, I remain very negative about this share.

Look at the 3 year chart - amazing destruction of shareholder value. I wouldn't be interested in buying this share at any price. It could be a zero in my view, today has probably just bought it more time.

.

.

Cloudcall (LON:CALL)

Share price: 84p (down 4.6% today, at 10:29)

No. shares: 38.8m

Market cap: £32.6m

(I hold a long position in this share, at the time of writing)

I seem to have held this share for most of my adult life! Not quite, but it feels like that.

CloudCall (AIM: CALL), the integrated communications company that provides unified communications and contact centre software that integrates with Customer Relationship Management ("CRM") platforms, provides a trading update covering the FY20 year-to-date...

Key points;

- Trading well until covid struck

- Cost reductions, cash burn down to £250k per month

- Plenty of cash to get through the crisis (it luckily did a big fundraising before covid hit)

- Potential customers pulling back on non-critical spending, impacted sales pipeline but now stabilising

- Lead-flow from marketing spend running at 30% down on last year, bookings down 28%

- Existing customers also drawing in their horns, with a 35% reduction in extra sales

- Customer churn running at normal levels - customer base largely stable

- Guidance - is withheld for now. More info in July

- Home working going well

- If no second wave of covid, then 2020 sales should be slightly below last year

- Virtual meeting at 1pm today, on the interesting-looking platform, Investor Meet Company - open to all

My opinion - nothing in this announcement should come as a surprise. Plenty of companies would be delighted with sales flat against last year. Most of CALL's revenues are recurring, and at £3m p.a. cash burn, it should be fine for cash. Obviously we're having to be patient, but that's the same for most shares - with 2020 being a bad year, then hopefully a resumption of growth next year.

De La Rue (LON:DLAR)

Share price: 67.5p (up 66% today, at 10:58)

No. shares: 104.0m

Market cap: £70.2m

De La Rue plc (LSE: DLAR) ("De La Rue" or the "Company") today announces a trading update from the end of the financial year ended 28 March 2020 and an update on the impact of COVID-19.

Confirmed guidance for FY 03/2020.

The Company's expectations for the financial year 2019/20 remain unchanged from the guidance given in the trading update on 31 March 2020.

I cannot see any reason why that guidance would have changed, since it was given at the year end. I suppose it means that nothing nasty has cropped up during the audit.

Contract wins - this sounds encouraging, no wonder the share is up so strongly in % terms today;

De La Rue has had a strong start to the new financial year, with a series of significant contract wins for both its Authentication and Currency divisions.

These are;

New Australian passports data pages (5-year contract), using new security features

Covid related products (authentication & immunity certification scheme) - sounds interesting

To date, in this financial year, De La Rue's Authentication division has been awarded contracts with total lifetime value exceeding £100m, which further underpins the Company's expectation of Authentication division revenue of £100m by financial year 2021/22, with strong operating margins.

Currency division - strong demand, awarded contracts which utilise 80% of its capacity. Cost cutting. Expects to achieve mid-teens adj operating margin in FY 03/2021

Covid - had little impact on operations

My opinion - I wish I'd looked at this first thing, as in the time I've written the above, it's now up 101% on the day!

This sounds a really good update, in the circumstances. Could be worth a closer look.

Hollywood Bowl (LON:BOWL)

Share price: 179.5p (flat on the day, at 11:21)

No. shares: 157.5m

Market cap: £282.7m

(I hold a long position in this share at the time of writing)

Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, today announces its interim results for the six-month period ended 31 March 2020 ("H1 FY2020").

Obviously these figures are not very relevant, other than to see how the company was performing before covid.

Jack wrote a comprehensive review of the company in the SCVR here on 17 April 2020.

H1 results look OK. Stand-out numbers for me are;

8.6% LFL sales growth - very impressive

But, operating profit margin is down from 25.0% to 23.5% (on an IAS 17 basis - i.e. directly comparable)

Raised £10.5m post H1 period end, plus additional £10m bank facility under the Govt CLBILS.

Re-opening strategy - which the company calls robust. The stand-out feature is that they're only using alternate bowling lanes, in order to distance customers, and reducing number of dining tables, etc. Hence that's bound to restrict revenues - it will be interesting to see how this pans out. Maybe they'll be able to spread business more evenly over the week, rather than relying on peak periods? The public might have to learn to socialise on weekdays more, instead of all going out on Fri & Sat nights.

My opinion - recent news of packed beaches, etc, indicate that the public has clearly got fed up with lockdown, and seem to be widely flouting social distancing rules. One senior police officer was quoted in a newspaper as saying that lockdown was effectively over now. It cannot possibly be enforced, and in reality was always largely voluntary.

Putting aside the rights & wrongs of this, which is not relevant to a stock market report, I think this is encouraging for shareholders in BOWL and other leisure businesses. The public wants to get back to normal I think, which gives businesses a better chance of survival, and rebuilding.

This share is now all about how the re-starting of business goes. It could continue rising, if the re-start is even half-decent. Or, if the public decide not to go bowling, then things could get rather sticky. So it's still risky.

All done, thanks for reading & commenting.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.