Good morning, it’s Paul here, with Monday's SCVR.

I hope that subscribers survived the weekend storms, without any harm to family, friends, or outbuildings.

Estimated timings today - I have a conference call with a company to prepare for & participate in, which is eating into my time this morning. I'm taking an early lunch break today too, to get out in the sunshine before it disappears (am trying to have a better work/life balance, exercising when I can - EDIT too late, it's started raining again lol!). Hence today's report will be mainly done by 1pm, but I'll carry on until c.4pm to finish off anything left dangling.

EDIT at 15:46 - I've covered as much as I can today, so today's report is now finished.

Being forced to stay indoors yesterday did at least allow me to get on top of the mountains of paperwork in my office, with what I call "speedy filing". This involves leaving large piles of paperwork untouched, for several years, whereupon it can simply be transferred directly into the recycling bin. Much more efficient than actual filing.

It's also useful thinking time, with my attention currently focused on;

China supply chains

We've discussed this before, but I noticed late last week that several shares which rely heavily on imports from China, began to drop sharply. A good example is Up Global Sourcing Holdings (LON:UPGS) which imports branded consumer goods, e.g. small domestic appliances, a lot of which come from China. Its business is bound to take at least a temporary hit from supply disruption. The market has anticipated this, with a sharp fall in share price recently, giving up all of the Boris bounce;

At what point does this become a buying opportunity? After all, with small caps, it only usually takes a handful of sellers to smash up a share price in times of uncertainty. If buyers are sitting on their hands due to that uncertainty, then sellers have nobody to sell to, hence the price is just marked down until bargain hunters emerge. This can create some marvellous opportunities.

As we know, catching falling knives can often be dangerous as there could be deeper underlying problems that the sellers know about, and the buyers don't. E.g. I got caught out with that on Mysale (LON:MYSL) shares in 2018, when the company's upbeat trading update turned out to be misleading, as much deeper problems were about to emerge. The seller(s) clearly knew that, but I didn't. Thankfully I twigged that something was wrong, and ditched my shares at a far smaller loss than would have been the case if I'd held.

Profit warnings which are due to a one-off, fixable problem, are my favourite type of profit warnings. It can often make sense to buy the dip, when a fundamentally strong company warns on profits in this way. Coronavirus & the supply chain problems it is creating, looks exactly that type of one-off hit type of situation. Although at this stage, we don't know how long it's going to have an impact, nor crucially if it's likely to spread outside of China on a large scale. If it does, then all bets are off.

Like many investors, I'm monitoring the data every day. There are lots of websites providing this data, although how reliable the data is, we don't know. The rate of growth is slowing, and numbers of cases have not yet reached into triple digits for any individual country outside China.

Here are the key questions to ask (not exhaustive, just what I could think of) when looking at companies that report supply chain problems from China (which I expect to see starting imminently, in trading updates);

- What is the level of inventories in the UK, and how long will these last? Just-in-time supply chains are not looking such a good idea right now

- If supplies from the Far East are being disrupted, then what alternative supply arrangements can be made, and how quickly (and at what increased cost)?

- How easy is it to cut costs (laying off staff, etc, if needs be)? Or are costs high, and fixed (worse case) - e.g. retailers, many of which import most of their goods from the Far East

- Crucially - how is the balance sheet structured? Running down inventories due to supply problems improves cashflow, but will the business be strong enough to be able to fund the re-stocking when it comes? This might involve having to pay cash up-front to alternative, new suppliers?

- Bank borrowings - how much spare capacity is there, and will the bank remain supportive? What are the bank covenants, and is there a risk of breaching them? In practice, in such a low interest rate environment, it's very unusual for banks to withdraw support from listed companies, but they can force companies into dilutive equity fundraisings. In wobbly situations, if banks see inventories run down, and short-term bank borrowings correspondingly reduced, could they be tempted to pull the plug in order to minimise their losses?

- On the flip side, could UK companies benefit from potential customers re-shoring production back to the UK? There could be winners from all this

- What would the financial impact of supply chain problems be? If inventories available for sale dry up, then will sales be lost permanently, or just deferred? What will the P&L hit be? Broker forecasts probably won't be reduced enough, so profit warnings could be multiple. Or, companies might adjust better than expected, we don't know at this stage.

- How aggressive or prudent are the accounts? Prudent CFOs always keep some excess provisions tucked away, which can be released to mop up the damage from unexpected problems. Aggressive companies don't have this luxury, or might even be tempted to start fraudulently mis-stating their accounts.

My view - even though the market is already pricing in these risks, I tend to find that shares still drop (often heavily) when anticipated problems are later announced. Giving a double downturn. For that reason, I'm keeping my powder dry, and watching carefully for trading updates that mention China. Expect a lot of them in the coming weeks.

It could also be the new "Brexit uncertainty" excuse, for businesses that need to find some reason other than "We're not very good at what we do" - which is often the underlying reason for under-performance!

Nmc Health (LON:NMC)

Share price: 760p (up 8.6% at 08:54)

No. shares: 208.7m

Market cap: £1,586.1m

Statement regarding possible offer

This share has been trashed by short sellers, who I imagine will probably be having kittens right now.

I'd expect to see a dash to cover short positions today, so a big bounce in the share price. Could be an interesting one for traders to jump onto?

Although approaches are said to be "highly preliminary", this announcement mentions the names of two potential bidders - KKR (a huge US outfit with about $148bn assets under management, according to google), and GK Investment Holding Group, whose website says they're based in Switzerland, and invest particularly in Africa and M.East. Publishing specific names, adds to the credibility that the bid interest might be real. I wonder if either company will comment on this?

There's a separate announcement which suggests that major shareholders have not been complying with disclosure requirements. This also contains a brief trading update, saying;

The Company's operations continue to perform strongly, and the Company expects to report full-year 2019 results in-line with management's expectations.

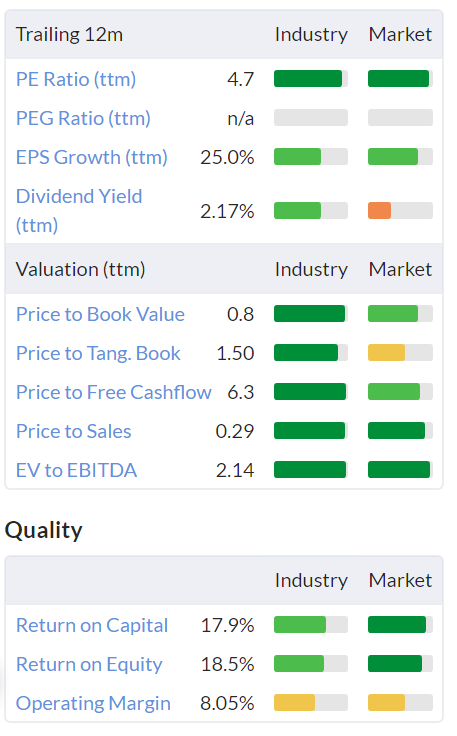

EDIT at 08:56 - quite a muted jump in the share price today. The value metrics shown on Stockopedia look dangerously low - e.g. a PER of 4.7 is not necessarily a good thing. It can be the market saying there's something wrong. In this case the problems seem to arise from high debt, and questions raised by shorters. Plus there's a bad smell around the major shareholder disclosures. I'm not tempted to take either a long or short position here, but it's a fascinating & topical situation, that's fun to watch from the sidelines.

Up Global Sourcing Holdings (LON:UPGS)

Share price: 61.4p (down c.6%, at 09:01 )

No. shares: 82.2m

Market cap: £50.5m

Trading update

As if by magic, UPGS has published an update - I wrote the above section before 7am, so wasn't aware an update was coming.

Ultimate Products, the owner, manager, designer and developer of an extensive range of value-focused consumer goods brands, announces the following trading update for the six months ended 31 January 2020 ("the period").

Today's update sounds reassuring to me;

Outlook

Given that the majority of the Group's manufacturing is based in China, the Board is closely monitoring developments with the coronavirus outbreak there. The extension of the Chinese New Year holiday by nine days to today (Monday 10 February) in the Group's main manufacturing areas is expected to cause production delays. As further information becomes available, we will continue to evaluate any short or long term impact on the Group's business and take all necessary action to mitigate any disruption. We have extensive experience of managing supply chain disruptions in China, including those caused by previous viral outbreaks.

The Board currently expects full year profitability for FY20 to be in line with market expectations.

Interim figures - this is just a snapshot, prior to the full figures being published (last year this was on 29 April).

Key points;

- H1 revenues up 2.8% to £67.7m

- Bank facilities extended to 2024. Funding headroom of £13.2m at 31 Jan 2020.

Balance sheet - I last reviewed it here on 9 Sep 2019, and found it satisfactory.

My opinion - I don't see any serious worries here, based on the update today, and a balance sheet that looks OK. Yes there is some bank debt, but it's comfortably covered by inventories & receivables.

It's too early to be certain, but the signs are that there's no reason to panic here, if you're a shareholder.

Update at 08:25 - I'm surprised to see that UPGS share price has dropped about 8% this morning, at 08:26, to 60p. Why are people selling, when a known factor is reported on in a reassuring way? Mind you, there are only 161k shares traded so far. It does make me wonder if some investors just don't anticipate seemingly obvious potential problems? It's getting to a level where I'll add it to my watch list.

Audioboom (LON:BOOM)

Share price: 247p (up 11% today, at 09:03)

No. shares: 14.0m

Market cap: £34.6m

Statement re media speculation and review of strategic options

This podcast company has put itself up for sale.

I don't see this as coming from a position of strength at all - it's had a financially dismal track record as a listed company, never turning a profit. Repeated fund raises have succeeded in growing the top line (up an impressive 91% in 2019), but it remains stubbornly loss-making. OK, plenty of growth companies burn cash, but after a certain length of time, investors just get bored with hearing the same story over & over again, every time it wants to raise more money.

I see that a major shareholder recently supplied a $4m loan. That reinforces my view that Audioboom has probably exhausted all opportunities to raise more funding from the stock market. Hence other options (if there are any available) need to be explored now.

As this looks to be an announcement forced on them by weakness, then I cannot see why the share price is actually up today.

The good news is that there are lots of PE/VC outfits with vast amounts of other peoples' money to spend, and typically they love tech companies. Although surely someone would have spotted BOOM by now, and bid for it, if they thought it was any good? There's always the chance that Raine Advisors might find a deep-pocketed optimist, prepared to buy into the story here.

This share is just a lottery ticket.

Tandem (LON:TND)

Share price: 190p (down 7%, at 09:33)

No. shares: 5.0m

Market cap: £9.5m

Trading update & board changes

Tandem Group plc (AIM: TND), designers, developers, distributors and retailers of sports, leisure and mobility equipment, announces a trading update ahead of its annual results for the year ended 31 December 2019 which are due to be announced in March 2020.

Here are my notes from this announcement;

- Revenues - up 15% in H2 vs LY, blames weather & macro for slower growth than H1

- FY 12/2019 revenues £38.8m (getting revenue back up to 2016 level, after declines in 2017 and 2018)

- "Strong year", profit before tax "expected to be well ahead of the prior year". (FY 12/2018 was £2,081k underlying, or £1,872k statutory PBT). Well ahead - what does that mean? 10%, 20%, who knows? There are apparently no broker forecasts - why not?

- Operating expenses up 11% on LY (which, assuming static gross margin %, would consume most of the 15% improvement in revenues)

- Cash generation strengthened balance sheet, but no figures given

- Pension/divis clarification - agreed with pension trustees that dividends won't exceed deficit contributions

- Additional (presumably this means increased p.a.) deficit recovery payments may be needed once 2019 triennial agreed

Outlook - 2020 has "started more slowly". Some major customers have stock left over from 2019, so not yet re-buying.

Coronavirus - this is important, as it has read-across to so many other companies that import from China;

The Coronavirus outbreak in the Far East appears to be a significant threat. A number of factories have not returned to work after Chinese New Year.

The restriction on travel imposed by the Chinese authorities is hindering the movement of raw materials and labour throughout China.

This has already delayed the production of orders and made it difficult for our QA/QC inspections to take place.

Further, the welfare of our staff is paramount and we will not put them at undue risk of infection until we have greater clarity of the situation.

This gives us virtually no ability to forecast. All we know is that there is a problem, but it's not known how big, or how long it will last.

There are two ways to look at this;

1) It makes the share uninvestable, as we cannot forecast with any accuracy

2) The share is already dirt cheap on valuation metrics (see below), and some temporary stock intake problems might present a buying opportunity.

Another key point to consider, is that valuing companies on a PER basis makes us short-sighted. When we're buying shares, we're not just buying this year's or next year's earnings. We're buying the company's future earnings, in perpetuity. So one bad year really doesn't matter, in the long term. In the short term though, it can be incredibly painful.

Therefore everyone has to make up their own minds, and different people handle things differently.

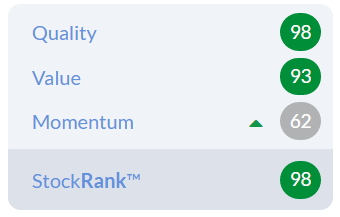

Tandem does look very cheap indeed, but I'll come on to the reasons why, in the next section after these graphics;

"ttm" means trailing twelve months, i.e. cobbled together from interim & final results, because there are no broker forecast figures available.

Balance sheet - this is important, as some investors mistakenly think Tandem has net cash. I reviewed the last balance sheet here on 1 Oct 2019. It actually had net debt of £2.0m, taking into account invoice discounting debt, and a mortgage on its freehold property. That's fine, as the freehold is in the books at £3.1m, so overall the position is sound.

This matters because the China disruption should not risk solvency of Tandem, given its sound balance sheet.

.

Board changes - oh dear, this is a dismal section of the announcement. It reads like one of those emails that you write when you're drunk, intending to delete it, but then mutter "Sod it!" under your breath, and hit the send button anyway. The next morning is usually then embarrassment & damage limitation!

The long-serving Non-Exec Chairman, Mervyn Keene, has decided to retire on 31 July 2020.

The long-serving CEO, Steve Grant, will become the new Chairman.

The group FD becomes the new CEO.

Musical chairs then, with no fresh blood other than a (yet to be secured) new CFO.

Chairman's rant - popcorn at the ready, let's see what he says!

When I was appointed Non-Executive Chairman the share price was 110.5p. Today as I announce my intention to step down the price is 205p per share. Despite this, it is disappointing that internet posters, who often hide behind absurd pseudonyms, continue to type inaccurate statements and offensive remarks.

There are an irritating few of these keyboard warriors who have no commercial experience but think that they could run the Group better.

He's been Chairman nearly 10 years, and the share price has doubled. Adding it up in my head, I reckon divis paid have totalled c.35p in that 10 years. So not a bad total return for shareholders, but not stellar either.

As for the internet trolls, we all know about the loonies on advfn & LSE bulletin boards ("many of them need to be sectioned!" as the Chairman of a different company quipped to me recently). They're best ignored, and it really isn't sensible for the Chairman of a listed company to be venting his spleen in an RNS about this issue. Also, on a technicality, if they're hiding behind absurd pseudonyms, then how does the Chairman actually know that they don't have any commercial experience?

People posting inaccurate things on bulletin boards is above all, a symptom of Tandem's extremely poor communications with shareholders. Directors of listed companies should (and most do) realise that part of their job is making sure that investors understand their business model, and to provide accurate facts & figures, and answer any queries from investors. Therefore, companies need to be an open book, and happy to communicate with their shareholders, who after all, own the business.

I've had a lot of feedback from Tandem shareholders that the Board are terrible at communicating with shareholders, and seem to view outside shareholders as a nuisance. The Chairman's comments below rather reinforce this perception. The outgoing Chairman doesn't seem to understand that part of his role, is to manage investor expectations, and communications. He wants us to just let them get on with it. That's not how it works with listed companies.

As I move on to other opportunities I know that, providing shareholders understand that we have a great team running the business and let them get on with it, all will benefit."

There should be no conflict between management running the business, and also having sensible communication with shareholders, such as;

- Results presentations & webinars each 6 months, open to private shareholders as well as institutions

- Occasional presentations at investor meetings/shows, to get the story out there

- Open days once a year, to show people round the facilities

- Broker research - get a house broker that puts research out to the PI community (ideally via Research Tree) - e.g. finncap, Liberum, or N+1 Singer

- Engage a financial PR firm, to introduce the company to more private investors, and to act as a point of contact for queries from investors, journalists, etc.

It's too small to interest institutions, so private investors are the market in Tandem shares - why hide away from us?! We create the (limited) liquidity, and set the share price.

No wonder the share is on a PER of about 4, and market liquidity is poor.

Directors put together only own 777k shares (15.5% of total shares), yet seem to treat the company as if they owned the whole thing! The petulant communications of the Chairman today, are indicative of an attitude that I've seen at some other small caps - usually ones where the founder still controls the business.

Perhaps the change in Chairman could be used as a refresh point, to adopt a better approach to handling investor relations? There's an opportunity here for the share to re-rate from a PER of 4, to a PER of 8 - doubling the share price potentially, if the new Chairman opens up the company to its investors. After all, what's the point in having a listing, if you're going to neglect outside shareholders?

On fundamentals, Tandem is a nice little company, profitable, and with sound finances.

Volex (LON:VLX)

Share price: 141p (up 3.7%, at 15:05)

No. shares: 149.9m

Market cap: £211.4m

Statement re situation in China

Volex, the global supplier of complex assemblies for performance critical applications and power products, today provides an update on the current situation in China.

This is what the company says in full;

As a result of the outbreak of Coronavirus in Wuhan, all major operations in China have been subject to an extended and mandatory closure over the Chinese New Year holiday period. The welfare of our employees continues to be the top priority for Volex. Over the past week we have been working closely with local government agencies in China to implement certain precautionary measures [Paul: such as?] to allow our employees to return to a safe work environment.

Volex has 14 manufacturing plants across the globe, four of which are in China. [Paul: What proportion of global production do these Chinese sites account for?]

Three facilities are located in Guangdong province, Southern China, approximately 1,000km from Wuhan and one facility is located in Jiang-Su province, Eastern China, approximately 600km from Wuhan. [Paul: which means what, exactly?]

As of today, one of our four sites in China has resumed operations at a reduced capacity. The other sites will follow once the necessary approvals are received from the Chinese authorities.

.

That's absolutely uesless! It doesn't tell us anything, just leaves questions unanswered, e.g.

- How much production has been lost?

- How quickly can it be recouped?

- "Reduced capacity" - what % reduction?

- What is the financial impact of all the above?

- Can other plants make up for lost production in China?

- Is this going to affect the company's ability to meet, beat, or miss market expectations?

Presumably, we are meant to surmise that Volex plants being 600-1000km away from Wuhan province means that the impact is less serious? If so, why not say so?

My view - this gives us nothing much to go on. I don't see any updated broker notes either.

The purpose of an announcement like this, should be to clarify the situation. Instead we've just been given bare, disjointed facts, with zero interpretation of those facts by the company.

Luceco (LON:LUCE)

This share has fallen sharply today, presumably on China supply concerns, it's down 14% today to 123p.

Unfortunately, there is no statement from the company as yet, so hopefully they'll be preparing one for release tomorrow?

As with the other companies I've looked at, the share price has fallen a lot, but it's only really giving back some of the recent gains. We're a long way from things actually looking cheap yet;

Maybe we should then be looking at China supply issues as having pricked a bubble, rather than (yet) making shares affected genuinely good value?

I'll report properly on this when the company issues a statement. Let's hope it actually contains some useful information, unlike the one from Volex.

Intu Properties (LON:INTU)

This is a crisis hit owner of major UK shopping centres.

We already knew it was trying to raise fresh equity, this is confirmed today;

Further to recent press speculation, intu properties plc ("intu", the "Company") confirms that it is engaged in constructive discussions with shareholders, including the Peel Group and others, and new investors including Link Real Estate Investment Trust and others, in relation to a proposed equity raise alongside intu's full year results at the end of February.

The share price has bounced 24% to 16.6p. The big risk here is that new equity might dilute old equity out of the picture.

Looking at the major shareholders list, Peel owns 27.3%, being the largest shareholder. Therefore if Peel is prepared to stand its corner in a fundraising, that could protect some value in the old equity, perhaps? i.e. Peel is incentivised to want new equity to be injected at a high share price, in order to limit the dilution of its existing stake.

It remains too risky for me.

That's me done for today, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.