Good morning, it's Paul & Jack here, raring to go, with what should be a busier week for trading updates. Today's report is now finished.

Agenda -

Paul's section:

Cambridge Cognition Holdings (LON:COG) (I hold) - contract win, and positive outlook comments from CEO. This remains one of my favourite small growth companies.

Electra Private Equity (LON:ELTA) (I hold) - final stage of the breakup of this investment trust. ELTA now becomes "Unbound", the holding company for Hotter Shoes (comfy shoes for the over 55s, mainly women). Looks cheap, but I reserve judgement until we get clean accounts for the standalone company in due course.

Quartix Technologies (LON:QTX) - a really comprehensive TU for FY 12/2021, giving very clear profit guidance. This share looks expensive, but the international growth now being achieved looks impressive.

Audioboom (LON:BOOM) - we didn't spot the series of "significantly ahead" updates in the autumn, sorry about that, as this share has done really well. Another impressive update out today. There's a lot to like here, apart from the high valuation. Nice to see a serial disappointer turn the corner into being a viable, fast-growing company.

Marks Electrical (LON:MRK) - impressive figures in this update to end Dec (Q3). However, I question how sustainable its sector-leading profit margin is?

Nightcap (LON:NGHT) - very strong like-for-like (LFL) sales growth in July-Dec, but how much of that has been driven by refurbishments? We're not told. Also the cash figure reported is gross, not net. There's a big difference, and the company's balance sheet is not strong, as it claims. Too expensive for me, and I don't like selective reporting of positives.

Jack's section:

Tortilla Mexican Grill (LON:MEX) - strong end-of-year update from Tortilla which ensures full year results should be materially ahead of expectations. Profitability is helped by Covid-related government initiatives and profits over the next year or two are forecast to fall, so there’s still a question over the underlying profitability of the enterprise. But as an operator, Tortilla looks good and is ready to roll out.

Does anyone read this I wonder? It's still useful to include, to help new subscribers, and as an occasional reminder to existing subscribers who expect us to be clairvoyant.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Cambridge Cognition Holdings (LON:COG) (I hold)

130p (up 5% at 08:40) - mkt cap £40m

Contract win with a top 20 pharma. £700k over 2 years. Upbeat comment from CEO (who I rate highly, having turned around the company) - this is almost a trading update, hence me mentioning it -

“This is the second pharmaceutical client to award Cambridge Cognition major contracts for cognitive assessments for schizophrenia in the last year(1) . Approximately 30 clinical trials on new drugs for schizophrenia run every year(2) , demonstrating the potential for further sales in this therapeutic area….

We are pleased with this client win which continues the very positive momentum in the business and further improves our revenue visibility."

My opinion - I remain keen on COG, because it has reached profitability, shouldn’t need to raise any more cash from shareholders, and has good tailwinds from increased drug testing online (triggered by the pandemic). It has relationships with the big pharmas, and wins repeat business at high gross margins. Mkt cap only £39m, probably because it has disappointed in the past, so some investors remain sceptical perhaps?

Electra Private Equity (LON:ELTA) (I hold)

67.2p (unchanged, at 09:10) - mkt cap £26m

Unbound Group planned AIM listing; trading update

As planned, this is the last stage in the dismantling of Electra Private Equity. The last big investment (casual dining chain “Fridays” [formerly TGI Fridays]) was disposed of through a demerger, with ELTA shareholders receiving Hostmore (LON:MORE) (I hold) shares. That looks very promising to me, priced way below sector peers, so I am hoping for a 50-100% re-rating of MORE in due course.

So far, the demerger has been a flop, with Numis and the company itself noticeably failing to drum up buying interest in the company. That doesn’t matter in the long term though, if we’re patient.

The last bit of ELTA is Hotter Shoes (comfy shoes for the over 55s). This is now being renamed “Unbound Group PLC”, will carry on the ELTA listing, but transferring onto AIM, to reflect its currently tiny market cap of c.£25m.

The Unbound strategy is to capitalise on its big customer base (affluent over 55s) and expand into complementary product/services, on a low-risk partnership basis. Potentially interesting, so let’s see how it develops.

Unbound's expanded offering beyond footwear is expected to feature apparel, wellness and lifestyle products and services, with third-party complementary brands featuring alongside new Unbound brands, as well as Hotter.

Today’s update explains the strategy, which I won’t repeat here, see RNS if you’re interested.

Timescale -

First Unbound revenues from sales of products other than Hotter footwear expected in Q2 2022, with medium-term ambition to generate more than half of Unbound's profit from non-Hotter products.

Current trading - sounds OK -

Hotter has continued to deliver strong growth during November and December, with revenues being +9% compared with the previous year and gross margin continuing to perform positively at 65.5%.

This robust performance despite supply chain cost and availability issues, coupled with the negative impact of Omicron suppressing high street demand in the latter weeks of December is encouraging.

I particularly like that gross margin of 65.5% - very high.

My opinion - I’d like to see the first set of proper numbers as a standalone listed company, before forming a clearer view. At the moment though, I like Hotter Shoes niche, and the market cap of only £26m seems a very gloomy assessment by the market.

It has been suggested that the price could be artificially depressed by forced sellers - some of the original ELTA shareholders are apparently not mandated to hold individual company shares, only investment trusts. In which case, we could have an opportunity to buy now, at an artificially depressed price - that’s just the sort of special situation that I like, buying a quid for 50p.

Personally I hold a small existing position here, and am waiting for more facts & figures, before deciding whether or not to increase my position (or sell, if the numbers are no good).

.

Quartix Technologies (LON:QTX)

Quartix Technologies plc, a leading supplier of subscription-based vehicle tracking systems, software and services, is pleased to provide an update on trading for the year ended 31 December 2021 (the "Period").

Nice clear guidance here, with specific numbers, and a market expectations footnote, excellent stuff! -

The Board is pleased to report that it expects revenue and free cash flow to be in line with consensus market forecasts1 at £25.6m and £3.8m, respectively. Adjusted EBITDA is expected to be substantially ahead of those forecasts,1 at £5.7m.

[1] The Board believes that consensus market expectations for 2021, prior to this announcement, were as follows: revenue: £25.6m; adjusted EBITDA (which excludes the US 3G provision) £5.0m; free cash flow: £3.5m.

Personally, I’m not interested in EBITDA, and would prefer to see the adj EPS guidance, because that’s the number we need to be able to quickly value the shares, by comparing it with the share price.

If revenues are in line, but EBITDA is substantially ahead, then that suggests gross margin and/or overheads must be better than expected. Yes, the commentary says that some marketing spending was deferred into 2022, therefore the higher than expected EBITDA is not significant, it's just down to timing of discretionary marketing spending.

Checking back to last year’s accounts, here are the comparisons -

Revenue - 2021: £25.6m, 2020: £25.8m - so slightly down this time

Adj EBITDA - 2021: £5.7m, 2020: £7.9m - a decrease of 28%

I hate to say it, but that’s not very good, is it?

Reduced EBITDA is blamed on increased marketing spending vs 2020. So why hasn’t that fed through to faster revenue growth? There is the drag of declining (low margin) insurance telematics. Core fleet revenue did grow, by 8%.

Continuing disruption from covid is mentioned, so hopefully growth might accelerate in future - it really does need to, if this share is to retain its growth company rating.

Fleet - the figures here look more impressive.

The subscription base (i.e. customer vehicles using Quartix telematics) grew an impressive +17%, to 202,734. Particularly good growth in France (+29%), and USA (+19%). Also Rest of Europe was up 141%, but from a low base.

Maybe this is why Quartix shares are on a high rating - because it’s demonstrating strong overseas growth, which could result in it being a bigger business in a few years?

Also, the subscription growth is much better than revenue growth, which could be because new customers only contribute a small amount in the first partial year, but would then show up better the following (full) year?

It’s good that the company discloses the attrition rate (customers lost), which is 11.6% (improved from 12.2% in 2020).

Insurance division - low margin business which Quartix has been winding down, now described as “insignificant” for the company (revenues, and profits), which is good, as it should no longer be a drag on revenue in particular - declines there partially masked the growth in the core business previously.

Diary date - 1 March 2022, for FY 12/2021 results.

My opinion - this is a comprehensive update, giving lots of information, and clear guidance, so a thumbs up for that.

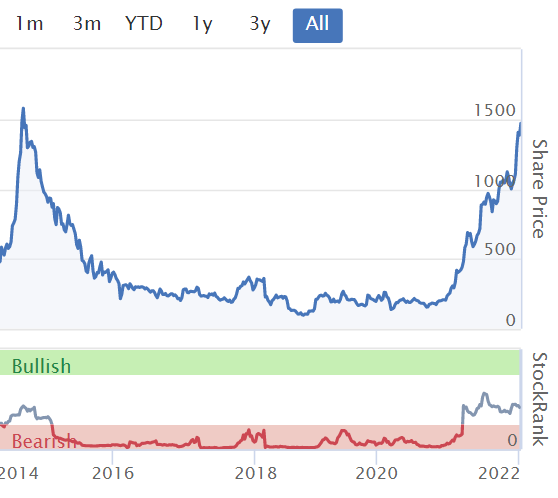

My main issue is that revenues, and profits at Quartix have gone nowhere in the past 5-6 years. In fact, profit has actually fallen. Yet it’s rated as a growth share, with Stockopedia showing the forward PER as 41.3

See the graphs below - reduced profits, but graph 4 shows that the shares have re-rated to a much higher PER, which is very surprising for a company with declining profitability.

The bull case is that spending is now being done on marketing, which is driving good international growth, which would take time to feed into profits. I can see that argument holds water, but it’s been several years already, waiting for this growth.

As you can see from graph no.5 below, it has been a consistent, and quite decent dividend payer, unusual for this type of company. So is it a value share, or a growth share?

.

.

Overall, I do like the international growth coming through now. However, you do have to take into account that there’s attrition each year from losing customers too, which shouldn’t be ignored. It’s the net increase that matters. There’s also constant pricing pressure, due to widespread competition.

On balance, I can see that the international growth could result in a much bigger business, and revenues are recurring in nature, monthly subscriptions typically, which tend to be valued highly by the stock market.

As things stand now, Quartix shares are certainly not a bargain, despite the share price essentially trading sideways since the peaks in 2016. However, I do like the international growth coming through, so this might be worth considering, if you can stomach the high valuation.

Here's the long-term chart, and note the middling StockRank of 51 , which has come down from previous higher levels, so the disappasionate StockRank system is a bit more sceptical these days -

.

.

Audioboom (LON:BOOM)

1460 (up 3% at 09:41) - mkt cap £229m

Looking back through our archive, we last covered BOOM in July 2021, when sales growth was increasing, and it received a daft all-paper bid approach, which was never credible. Unfortunately, I dropped the ball on this one, and didn’t notice that the company issued strong trading updates in succession in H1 2021 - “significantly ahead” updates on 13 Sept, 13 Oct, and 16 Dec. It’s really bad that we missed those here at the SCVR, so profuse apologies, as this turned out to be one of the biggest share price risers of 2021. It came up the other day on one of my year end screens (biggest % annual risers).

Possibly I didn’t look at its previous trading updates due to skepticism, given the company’s lamentable long-term track record? Or I might have wanted to actually see the full year numbers? Anyway, we missed a big riser, so that’s a bit disappointing.

They’re not just pleased, but delighted!

Audioboom (AIM: BOOM), the leading global podcast company, is delighted to provide a trading update for the 12 months ended 31 December 2021.

Revenue growth - very impressive indeed, at +125% to $60.2m - that’s all organic growth too, I believe (i.e. no acquisitions of other companies to boost growth).

Acceleration of growth in H2, since H1 revenue growth was +93%

On profitability, it quotes both EBITDA and proper profits -

Maiden annual adjusted EBITDA(3) profit, ahead of market expectations, of approximately US$3.0 million (2020: US$1.8 million loss), with the Company recording positive adjusted EBITDA(3) in every month in 2021

· Maiden annual net profit of approximately US$1.4 million (2020: US$3.3 million loss)

3) Earnings before interest, tax, depreciation, amortisation, share based payments, non-cash foreign exchange movements and material one-off items

H1 adj EBITDA was only $0.2m, so H2 works out at $2.8m - impressive.

Note that the $(3.3)m loss last year, was the statutory loss, after all costs. The adjusted operating loss last year was $(1.7)m.

Cash - looked tight when I last looked, but currently $3.0m, with $3.3m of undrawn loan facility. Maybe it can carry on without a placing, but with a big market cap now of £229m, and terrific growth numbers, they would be crazy not to do a placing - from a position of strength, for the first time ever! Raising say £10m would only dilute existing holders by about 5% - worth it, for the reassurance of having a cash buffer.

Often companies which fail to raise fresh cash when their share price is buoyant, regret it once the party is over.

Outlook comments - positive - there's good visibility too, with advance ad bookings -

Significant pricing growth for premium inventory in 2022. Q1 2022 Average Unit Rate (AUR) for top 25 podcasts is 26% higher than Q4 2021

· As of 31 December 2021, the Company had contracted revenue in excess of US$45 million for 2022 through advance advertising bookings. At 31 December 2020, US$20 million revenue was contracted

The Board is delighted to report this strong performance for the year to 31 December 2021 with the Company exceeding market expectations once again. The Board continues to be excited about the opportunities for the business and is confident that this positive momentum will continue into 2022.

Global growth - BOOM is not just a UK business, it’s doing well overseas too, which helps explain why the market is prepared to value it so highly -

Our revenue growth has once again significantly outperformed the wider industry. We've gained strong market share, and now rank as the 4th largest podcast publisher in the US. Alongside our ranking of 2nd in New Zealand and 3rd in Australia, we continue to develop a strong global position.

Investor presentation - on Investor Meet Company at 15:00 on 20 Jan 2022.

My opinion - when looking through the numbers recently for BOOM, my main reservation is that the gross margin is low - only 21% in H1. Therefore, there’s not much operational gearing. So it needs to achieve continued very high revenue growth, to move the dial on profitability. And companies which have scraped along for years, with a tight cash position, often have pent-up costs, which snowball once they reach cashflow breakeven. Hence forecast profits are rarely achieved.

Receivables looked high in the interim numbers, and cash looked tight. So I’d want to see another set of numbers before being convinced this is turning into a profitable company.

Much to my surprise, after many years of dreadful performance, BOOM looks to have reached an inflexion point, where it’s becoming a viable, and very high growth business. Internationally too. If that growth can continue, then it’s looking quite exciting.

How do you value BOOM shares though? It’s sky high at the moment, at £229m, so it’s really up to you to decide if you’re prepared to take a leap of faith (with the risk of it plummeting if growth slows), and pay up, or whether (like me!) you want to watch from the sidelines as the price goes up & up!

Your money, your choice!

As an aside, it’s really pleasing when a serial disappointer finally turns a corner, and becomes viable. As you can see from the long-term chart below, investors who spotted the turning point, have a multibagger on their hands now. Although also note how the initial boom in BOOM in 2014, was followed by a 6-year flop. That said, the company was just a start up back then, so not comparable at all to today’s proper business.

The more I think about this, the more tempted I am to have a little speculative punt on BOOM (very late to the party though, which worries me). Also we need to consider stock market conditions - the US (which sets the direction here) is seeing a widespread & large sell-off in highly rated growth stocks. Hence I'm worried this might be a really bad time to start buying a highly rated stock like BOOM? On reflection, I'm inclined to add it to the watch list, and wait.

.

.

Marks Electrical (LON:MRK)

119.5p (unchanged, at 11:31)

No. shares on AIM admission (Nov 2021): 104.95

Mkt cap £125m

This is an online electricals retailer (mostly kitchen appliances), website is here, which listed on 5 Nov 2021, at 110p per share.

The StockReport is not yet populated, so I’ve raised a green blob to chase up HQ on this.

For background info, a subscriber gmtrader has posted an excellent briefing on the company here. He even publishes a short Q&A with the CEO. I’m impressed, thank you for posting that!

I’ve looked at MRK myself at some point in late 2021, but can’t find my notes either here, or on paper. However, I do recall thinking it looks interesting, and a nice little business. Much better than larger competitor Ao World (LON:AO.) - due to having a smaller, simpler, more focused business model. The founder of AO World always struck me as a bit of a fantasist, and not enough gritty, hard-nosed businessman, which is what you need in a low margin sector.

The year end seems to be 31 March 2022, so today’s update is for Q3 to date.

Marks Electrical Group plc ("Marks Electrical" or "The Group"), a fast-growing online electrical retailer, today announces its trading update for its third quarter ended 31 December 2021 ("the period" or "Q3-22").

Revenue in Q3 is up 27% on LY, and YTD (year to date) revenue up 55% - so slowing growth in Q3, but still good. Paragraph 8 of the Admission Document does fore-warn that growth would slow in H2, so no surprise there.

On track to deliver full year revenue target.

On track to achieve adj EBITDA margin target of 9% (much larger competitor AO World only achieved 3.8% adj EBITDA margin in FY 3/2021, which looks to have been a one-off good year! So MRK is achieving a much higher profit margin than AO).

Current trading -

Our momentum has continued into January and we look forward to maintaining our performance management discipline [Paul: eh?!] on revenue, profit and cash in the final months of the year."

Thumbing through its Admission Document, it strikes me that the company doesn’t have much track record prior to the pandemic - e.g. look at the modest profit, and low profit margin in FY 3/2019, and FY 3/2020, which is what I would expect from a company in this sector.

.

Hence I am wondering how realistic it is, to expect MRK to continue achieving the 9% EBITDA margin it is reporting for FY 3/2022? Could there be some unsustainable elements in that? Maybe favourable purchasing deals that could expire, with higher priced production feeding through from manufacturers? I don’t know, it just seems strange to me that a small company like this can suddenly produce sector-leading profit margins in the last 2 years (pandemic) which it didn’t achieve previously. And float the shares on the back of it, at a punchy rating.

My opinion - the figures look impressive, but eCommerce as a sector has been battered in 2021. That leaves MRK shares looking an outlier, on a hefty multiple of sales, when larger eCommerce businesses which theoretically should have better buying power, are cheaper.

For me, the valuation on MRK looks too high, and I’d be surprised if it can maintain such high margins long term.

.

Nightcap (LON:NGHT)

20.6p (up 6% at 11:49) - mkt cap £40m

Trading and openings update for the 26 weeks ended 26 December 2021

This is a rapidly expanding, but still small, bars group.

Very strong +22.4% like-for-like sales increase versus pre-pandemic 2019 numbers. Although I imagine the sites would have been re-fitted since acquisition, so does that really count as like-for-like? Excluding the last 2 weeks, LFL was even more impressive at +28.3%.

Only £15.5m sales in H1, which is not much for a £40m market cap business, but that’s rapidly growing through acquisitions of more sites.

Christmas bookings - this is a very interesting point, and something I picked up on when visiting other bars in December. When asking them if everyone was cancelling Xmas parties, they said most are just being deferred into the new year, once covid is in retreat (we hope). So it’s good to hear NGHT confirm this, which has very good read-across for the whole sector I think -

Although more than 7,500 bookings for the Christmas period across the Group were initially cancelled following Plan B, the Board is pleased that over 70% of these bookings were re-scheduled to take place between January and March 2022.

New sites - lots in the pipeline -

Nightcap currently has a further 25 sites in legal negotiations or under offer across several of its brands. The Group expects for several new site leases to be entered into before the end of March 2022.

Cash - this is highly misleading in my opinion, as it ignores debt -

The Group's balance sheet is solid with unaudited cash at bank of approximately £9.4 million at 26 December 2021.

See my review of the FY 06/2021 results here, to get the full, true picture.

The balance sheet is actually quite weak, and I can’t see that any fresh equity has been raised since then. Correct me if I’m wrong on that.

I also question the huge share options charge in the FY 06/2021 accounts.

My opinion - performance looks good re LFL sales growth, but I’d want to see a breakdown of those numbers, in particular which sites have been refurbished in the comparison period?

Also, hiding the debt and only reporting gross cash, is unacceptable, and I personally wouldn’t trust anything the company says after that - everything needs to be checked, when companies gloss over negatives, and cherry-pick positives.

This share has a premium for newness, which I’m not prepared to pay.

.

.

Jack’s section

Tortilla Mexican Grill (LON:MEX)

Share price: 192.25p (+4.77%)

Shares in issue: 38,664,031

Market cap: £74.3m

Tortilla is the UK’s largest fast-casual Mexican restaurant brand. It has expanded since inception in 2007 to more than 60 sites across the UK and UAE.

The group floated last October and the shares have not really done much since then, so it looks fairly off the radar with not much activity. That said, the market cap of £74m is not obviously cheap.

Trading momentum is good though, and placing proceeds are being used to accelerate the UK rollout, develop franchise opportunities, and expand its cloud-kitchen portfolio. The group hopes to open 45 sites in the medium term but, given the nature of the sites, there’s scope to possibly double beyond that (to about 200 sites).

There’s a six month lock-in, so it’s worth keeping an eye out for any director selling from March onwards. Directors sold into the placing but continue to hold around 12.3% of the company.

Trading update to 2nd January 2022

FY21 revenue and profits are materially ahead of our expectations following stronger trading in Q4, despite the emergence of the Omicron variant of Covid-19

- Group revenue +79% to £48.1m (and up 36% compared to FY 2019),

- UK two-year like-for-likes up 23.8%, and +30.3% excluding lockdown affected Q1,

So revenue is coming in comfortably ahead of broker forecasts of £44.8m and profits should be materially ahead of expectations after a strong end to the year. Once you account for the VAT benefit, the UK 2Y LfL figure ex-Q1 falls from 30.3% to closer to 11% however, and there are a few government initiatives over the past year that for now obscure underlying profitability.

Strong cash generation sees the group end the financial year with net cash.

Seven UK company-operated restaurants and two UK franchise restaurants opened, taking Tortilla's estate to 64 stores: 51 UK company-owned, three UK franchised, and 10 franchised in the Middle East.

The group is developing business away from the High Street, including a partnership with Merlin at Chessington World of Adventures and the opening of two further sites in partnership with £SSP at Gatwick Airport and Skelton Lakes motorway services.

Delivery now comprises more than 30% of total revenue, down from about 80% at the height of lockdowns. Presumably, tacos and burritos are more transportable than other dishes, but it is lower margin with more costs involved. It’s somewhat diversified revenue at least, providing a greater degree of resilience than some other operators out there.

All in all, the openings and delivery performance suggest demand for the product.

The Board remains confident that the Group will perform in line with expectations for FY22, as the reduced financial assistance from the UK Government will be offset by reduced trading restrictions.

The Board also remains confident in the Group's ability to make good progress against its store roll-out strategy to open 45 new sites in the next five years.

Conclusion

Underlying trading is currently obscured by several factors such as business rates relief, none of which are broken down in great detail in today’s update. So it’s still hard to get a feel for what normalised results might look like lower down the income statement.

See below for the positive impact of government grants receivable over Covid. That’s just under £3.5m of help in FY21.

It appears as though reduced profitability is forecast.

The business itself could do quite well in terms of driving revenue and rolling out sites, but this is a tough sector with competition at all times. Meanwhile, there are cost pressures - labour, recruitment, food. These are big costs for such businesses. I wonder slightly about the timing of the IPO too, particularly with profitability set to fall in FY22E and FY23E.

Tortilla is comfortably ahead of the UK Mexican competition however, and the flexible format suggests quite a few sites could be set up, so I think the group can continue to grow beyond the 45-site target it has set in the medium term. The days of 400+ site brands are probably past (the last one to manage that was Nando’s) but a couple in the space should be able to get to 200 or so, particularly in the current property environment.

The group is performing well and has a product that appears to resonate with customers, so it’s one of the more interesting Leisure situations out there. And today’s update is certainly encouraging. Future success will depend a lot on the quality and experience of the management team here.

I’ve never met them, so I’m staying on the sidelines for now, but the shareholder register suggests some institutions have been impressed and the group looks like it has executed well so far.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.