Good morning, it's Paul here!

It's a very quiet day for trading updates, and results.

Graham and I had a natter about some stocks in my portfolio, just after the market closed on Friday evening. Here's that podcast, which is a potentially painful 1 hour long. We continued chatting about Brexit for another 1.5 hours after that, but you'll be relieved to hear that Graham had switched off the red button before that started!

Incidentally, the picture that Graham chose to illustrate the podcast, of some people playing football, perfectly sums up my school memories of football - namely the player (in red) on the right, who is recoiling in horror, in a slightly camp way, as the football comes in his direction & he feels the pressure of having to do something with it. Yep, that was just like me;

UP Global Sourcing Holdings (LON:UPGS)

Share price: 65.2p (up 12.4% today, at 11:38)

No. shares: 82.2m

Market cap: £53.6m

Ultimate Products, the owner, manager, designer and developer of an extensive range of value-focused consumer goods brands, announces the following trading update for the six months ended 31 January 2019 ("the period").

This company, which imports consumer goods from China, I think, was a very disappointing stock market float in March 2017. It floated at 128p per share. Note that the float did not raise any cash for the company, it was a sale of 50% of the company, raising £52.6m for the selling shareholders. I'm really not keen on this type of float, as they often seem to go wrong later.

Initially UPGS shares did well, and rose to a high of about 223p. Then came the (first) profit warning, in Sept 2017, just 6 months after floating. I really do think that selling shareholders should be legally required to repay some or all of the proceeds, if a share price collapses so soon after listing. Maybe listing proceeds should be put into escrow, and released gradually over say 3 years? Or have a clawback clause?

After languishing for a while, the share price has had something of a recovery recently, so this share could be worth a fresh look. People who follow sentiment via the chart & moving averages, etc, might like this. I think there's also something to be said for looking at shares which are resilient in a lousy market such as we have now.

H1 trading - this company has a 31 July 2019 year end date, so today we're looking at H1 performance, and full year outlook.

My summary of today's update;

- Revenues - good growth, up 36% reported, up 20.8% underlying (stripping out one-offs) - impressive that the company has disclosed this openly

- Comfortable headroom on funding (i.e. bank facilities) of £10.5m

- Nothing said about H1 profitability (doesn't matter though, as FY outlook is given below)

Current trading & outlook - this is good;

As a result, and notwithstanding the higher overhead costs associated with servicing the increased revenue and the investment in the growth of the international business, the Group now anticipates that its EBITDA performance in FY19 will be above the market's current expectations.

Why do companies use EBITDA as the performance measure? It just arouses suspicion. Profit before tax is the correct performance measure to use. That gripe aside, above expectations is a clearly positive outlook.

Broker forecasts - there's an update from Equity Development today.

FY 07/2019 EBITDA (yuk!) is raised 10% to £8.7m

Adjusted EPS forecast is 7.0p, half paid out in divis of 3.5p

That gives: PER of 9.3, and yield of 5.4%.

My opinion - it always takes time for investor confidence to rebuild after companies disappoint with profit warnings.

UPGS share price has more than doubled from its recent lows. That to me looks justified, given today's update.

Looking at its last balance sheet, overall it's OK. There's a fair bit of debt, but that is only partly financing inventories & receivables, which looks fine to me.

Taking everything into account, I think the current share price looks about right. The positive chart might lead to momentum buyers taking it a bit higher, perhaps?

Avation (LON:AVAP)

Share price: 273p (up 4% today)

No. shares: 64.5m

Market cap: £176.1m

Avation PLC (LSE: AVAP), the commercial passenger aircraft leasing company, provides investors with an update on current operations concerning the half-year period ending 31 December 2018.

Things seem to be going well;

The Company's business continues to perform well.

Results preparation is underway and Avation expects to report increased profit for the six months ended 31 December 2018, with both earnings per share and profit before taxation expected to be approximately double that of the comparable half-year period ended 31 December 2017.

Revenue (unaudited) is expected to increase to approximately US$58 million (2017: US$52.4 million).

Outlook - there is no mention of expectations for the full year, which is a glaring omission. That's the whole point of a half year trading update - to let investors know how the company is performing against expectations, and what the outlook is like for the full year.

I can't find any broker updates today.

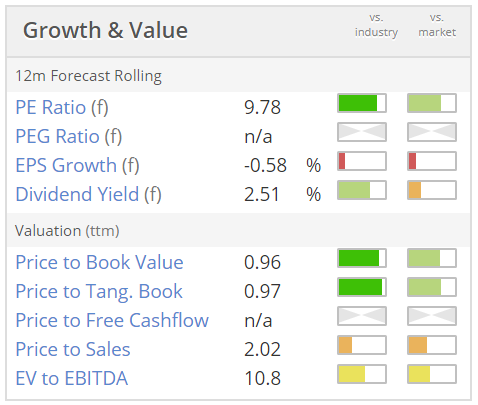

Valuation - it looks good value (measures as stated before today's 4% share price rise);

Of the above, I focus on the PER, which looks good value.

Also important is the P/TBV of 0.97, which again looks good value.

Dividends of 2.5% are unexciting, but worth having.

My opinion - We've discussed this share here a lot in the past, with it having looked good value most of the time.

As you can see from the 3-year chart below, shareholders at Avation have done well. It's of particular note that this shares has been unusual in having shrugged off the recent market correction which has dogged many smaller caps, and growth companies;

The main issue with leasing companies, is that investors need to carefully assess the depreciation & residual value calculations. That's where the financial risk lies.

Avation's CFO, Richard Wolanski, has proven very shareholder friendly - attending many investor events. I remember attending several of his briefings, where he always sounds very alert to the risks, and it's clear the company carefully considers & manages its risk - e.g. with interest rates, bad debt risk, etc.

Overall then, I think this company has established a good track record to date, and seems reasonably priced.

Stride Gaming (LON:STR) - has put itself up for sale, in a strategic review.

It also counters press reports which said it was fined twice by the Gambling Commission. Stride says it was actually fined once.

I looked at this share last week, concluding that it looked cheap. The regulatory problems & fines, and tax increases, put me off buying any. With possible bid interest now added into the mix, this could be quite an interesting each-way bet - being cheap on fundamentals, with a big dividend yield, and possible upside from a potential sale of the business, maybe.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.