Good morning/afternoon, it's Paul here. I'm working the afternoon shift today, so this article will gradually update. Please refresh this page later.

Housebuilders

I like to keep track of what housebuilding companies are saying about their market conditions, as this affects so many other areas of the economy. Today we have 3 of them reporting;

Redrow (LON:RDW) - Interim results - record profits of £185m, up 5% vs last year's H1.

Current trading sounds (perhaps surprisingly) good;

The market during the run up to the festive period and the first two weeks of 2019 was subdued by macroeconomic and political uncertainty. However, sales over the last three weeks have bounced-back with reservations running at similar levels to last year's strong market activity.

Barratt Developments (LON:BDEV) - Interim results - profit before tax up 19.1% to £408m.

Current trading sounds fine too;

'Whilst we continue to monitor market conditions closely, current trading is in line with our expectations and we are confident of delivering a good financial and operational performance in FY19."

Grainger (LON:GRI) - Trading update - this is a residential property landlord, rather than a housebuilder.

Everything sounds fine here too;

"It has been a good start to the financial year....

We achieved a 3.4% like-for-like rental growth on our PRS portfolio for the first four months of the year, which demonstrates the depth of customer demand, the quality of our offering, and the resilience of the sector...

We remain confident on the outlook for the year ahead.

Overall then in terms of the new build property, and residential rental markets, things sound to be ticking along just fine. This underpins my belief that the consumer is far more solid than many commentators seem to think. It also makes me increasingly annoyed at those in the media (and on twitter) who seem to want to talk the UK down at every opportunity.

Average incomes are rising nicely, and above inflation, and we have full employment. The daily scare stories about Brexit are becoming increasingly discredited - both sides have already made clear that they will prioritise the flow of goods at the borders, and won't allow trade to grind to a halt.

Mortgages are extraordinarily cheap at the moment (deals of 2.5% p.a., fixed for 5 years, are available, so this is a great time to re-mortgage incidentally), and (judging from the above company updates) the good old British public seem to be getting on with life, undaunted by the attempts of politicians and media to scare us witless about our future. Bravo!

Retailers are suffering mainly because there's so much over-capacity, and many people have switched to buying stuff from Amazon. There's no overall problem with demand, it's just going elsewhere.

Stride Gaming (LON:STR)

Share price: 102p (down 0.5% today, at 12:43)

No. shares: 75.8m

Market cap: £77.3m

This is a gambling group, specialising in online bingo. Its update today relates to the year ending 31 Aug 2019.

Trading is slightly below expectations (I'll donate £50 to my favourite charity, ZANE, to the first company that publishes a trading update which uses the truthful phrase "slightly below expectations", rather than the ubiquitous & ridiculous "broadly in line"!

"The Group's trading performance since the start of the financial year has been broadly in line with the Board's expectations despite the continued challenging trading conditions.

Dividends - this is good news, but the 8p special divi had already been mentioned in a previous update, so it's nothing new:

"The Board believes the Group will continue to be highly cash generative and the Board remains committed to its revised dividend policy to distribute at least 50% of Adjusted net earnings in dividends.

In addition, the Board has proposed a special dividend of approximately 8.0p per share relating to the earn-out of the QSB Gaming transaction. The transaction is expected to complete by the end of May, with the dividend being paid in June."

This is one of several shares I've highlighted recently that has a terrific dividend yield, combined with a solid balance sheet - hence a good chance the high yield could continue.

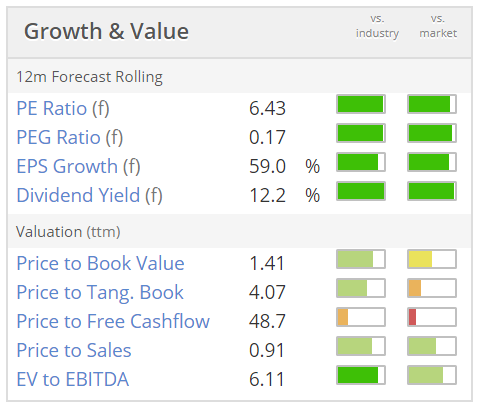

Valuation - the PER and yield look particularly attractive here, although the 12.2% yield includes the special divi, and drops to a (still fantastic) 8.65% next year;

Given these very attractive numbers, I've done a bit more digging, and some problems have emerged.

Regulatory problem - one of Stride's subsidiaries was fined a whopping £7.1m last year, by the Gambling Commission of Great Britain, for failings in its anti-money laundering and social responsibility procedures. The company commented that this seemed excessive & disproportionate. It does however represent a big risk for investors in this sector generally.

Increased taxation - gambling companies have been clobbered with an increase in "Point of Consumption Tax", which was introduced in Aug 2017, and has been hiked again in the last budget. The last interim results from Stride contained a table which showed how the increases in taxation are scooping out its profit growth, to such an extent, that after tax Stride's earnings are falling considerably, year on year. That's lead to a big fall in share price.

The latest tax increase is factored into existing forecasts, but the trouble is, where does it end? If the Government gets a taste for gobbling up the profits from the gambling sector (which can be presented as being socially responsible to voters), what's to stop it pushing through further increases?

This makes Stride's profits look rather vulnerable to further attack. Hence why the shares are on such a cheap rating, I suppose.

My opinion - this is the first time I've looked at Stride. I find the valuation, and in particular the wonderful dividends in the pipeline, very attractive. However, the regulatory side of things looks pretty scary.

I think it's worthy of a closer look, but readers would need to concentrate on researching the tax & regulatory side of things in greater detail, as from what I can see, that's the crux of the matter.

The chart looks interesting, in that it might be trying to form a base. If that 100p level holds, and it passes through the 2 key moving averages, then the share could attract traders - whose buying would then be self-fulfilling in establishing an upward trend, perhaps. That's not my bag, but it's a consideration. With such a big dividend yield, I'm quite tempted to take a small position here for the divis, and then hopefully get share price upside if traders start to come onboard on the basis of this chart, in a few months' time.

OnTheMarket (LON: OTMP)

Share price: 97p (up 4.3% today, at 13:16)

No. shares: 61.5m + dilution from agents' shares

Market cap: £59.7m

(at the time of writing, I hold a long position in this share)

I mentioned this one yesterday. It's a challenger property portal, to Rightmove & Zoopla. As previously mentioned, it tends to publish gushing RNSs about its KPIs like confetti, which the market usually ignores completely!

However, today's update does show some more interesting stats;

Website traffic - in Jan 2019 this exceeded 23.5m visits, a new record. How does this compare to the dominant players, Rightmove & Zoopla? I googled it, and they seem to have 127.5m and >50m monthly visits. Clearly much more than OnTheMarket, but it's catching up fast.

Anecdotally, I recently spoke to family who are looking at a property purchase. They told me that they'd looked on Rightmove, and also on some new site called OnTheMarket? The link they emailed me was for a property on OnTheMarket. Scuttlebutt perhaps - keeping your eyes and ears open, can often source good investment ideas, as Peter Lynch mentions in his books (I think the idea may have originally come from Phillip Fisher?)

Number of property listings - OnTheMarket is also rapidly catching up with its big competitors on this metric too;

As at 31 January 2019, OnTheMarket.com displayed over 600,000 UK residential property listings. The Company's UK property stock is already over 80% of Zoopla's and approximately 60% of Rightmove's1.

This increase in coverage reflects the sustained rapid growth in the number of estate and lettings agent branches contracted to list at OnTheMarket.com since Admission: over 12,500 contracted branches as at 31 January 2019, compared with 5,500 in February 2018.

Active property alerts - from website users is impressive, at 1.5m.

Conversion of free users - this is the crux of the matter. OnTheMarket has, very cleverly I think, recognised that it cannot compete head-on with Rightmove & Zoopla. So instead it has offered its alternative service on 1 year free trials, to prove its worth to agents. IF OnTheMarket can now convert these into paying customers, then things could get exciting for investors.

It is using shares as an inducement to get estate agents to convert into paying contracts;

Over the coming months, the Company will seek to complete the conversion process using a range of offers which will, for selected agents, include long-term agreements which will be accompanied by share issuance.

As at Admission, the Company had authority to issue 36,363,636 agent recruitment shares. Such equity issuance alongside long-term listing agreements enables agents to support the only major agent-backed portal with a view to creating a fairly-priced alternative to Rightmove and Zoopla and to share in any increase in the value of the Company.

That's considerable potential dilution, as MrContrarian points out in his excellent daily snapshot in the comments section below (thanks for these MrC, they're fantastic, keep 'em coming!)

I've put out a query to find out what the detailed terms of these shares are (e.g. are they free? What lock-in is there, etc?). The problem could be that agents just flip the free shares in the market, thus creating a permanent overhang. If that cannot be mopped up by buyers, then the recruitment shares being constantly sold, could trash the share price.

Zeus note - there's a very interesting note out today, which is available on Research Tree. It takes the unusual approach of providing dozens of detailed estate agent testimonials, who sing the praises of OnTheMarket. Now obviously these will be the cherry-picked best ones, but reading through it, there are some fantastically positive reviews - in some cases with OTMP being up there, or even ahead of RMV, in terms of customer leads.

I'm tempted to open a small short on Rightmove (LON:RMV) as its dominance & ridiculous profits must be vulnerable at some point. The trouble with that, is that Zoopla was bought out at a premium, and the risk is that someone might come along and pay a huge premium for Rightmove. So maybe not. Now it's gaining decent traction, I think OTMP could be a possible bid target too - at only £60m market cap, it could be a very cheap entry for a big company wanting to disrupt this market. Who knows? Potentially interesting anyway, but high risk - as OTMP will need to raise more cash for marketing probably.

That's it for today.

I've looked at results from Frontier Developments (LON:FDEV) but have put that into tomorrow's placeholder article, so everyone sees it. Looks interesting!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.