Good morning, it's Paul here with the first of this week's SCVRs.

Mello - tonight!

It's Mello Monday time again - David Stredder's very popular investor evenings, now on Zoom.

This evening Ed will be presenting a review of Stockopedia’s Stock Picking Challenge 2021, and reviewing the leaderboard for 2020. It’s a great way to find out what stocks the community is looking at, so tune in to see the breakdown.

Jack will also be there later on, to take part in the Mello BASH (Buy, Avoid, Sell, Hold), with 4 new investment opportunities up for discussion alongside renowned investors Leon Boros, Alan Charlton, and Kevin Taylor. Find out more here.

Message from David Stredder;

"There are at least another 17 Mello Monday evening webinars already planned for 2021 and if you would like to make the most of these during lockdown then I really would recommend buying an annual pass for just £95 (or £85 with the early 2021 discount until 11th January using the code APXMAS10 when buying one here https://melloevents.com/mellom... Alternatively if you want a half price ticket just for this show on Monday and maybe want to 'try before you buy' the annual pass then please use this code MMStocko21 and it will be just £9.75"

Timing - Update at 12:22 - I'm taking a break now for lunch, and some exercise. I'll do some more sections from mid-afternoon onwards, so please do check back later. Update at 18:14 - sorry I've been busy with other things, so didn't get round to looking at any more companies today. I'll put them into tomorrow's report instead. Today's report is now finished.

Agenda -

Jd Sports Fashion (LON:JD.) - not a small cap but: remarkably good trading update

Cloudcall (LON:CALL) - another recruitment sector integration

Innovaderma (LON:IDP) - profit warning

.

Jd Sports Fashion (LON:JD.)

850p (pre market open) - mkt cap £8.3bn

This company has clearly emerged as the big winner in the sports retailing space, in the UK, and increasingly internationally.

Trading Update - this morning is strikingly good, and clear. Here it is in full -

JD Sports Fashion Plc (the 'Group') today announces an update on performance following the Christmas trading period.

Against a backdrop of further forced temporary store closures in many of our global territories, it is pleasing to report that demand has remained robust throughout the second half, including in the key months of November and December. Total revenues for the twenty two week period to 2 January 2021 in the Group's like for like businesses were more than 5% ahead of the prior year as consumers readily switched between physical and digital channels.

The positive nature of the demand through the second half to date means that we are now confident that the Group headline profit before tax for the full year to 30 January 2021 will be significantly ahead of the current market expectations, which average approximately £295 million. It is now anticipated that the outturn for the full year will be at least £400 million...

... Under normal circumstances, we would be confident that the results for the forthcoming year to 29 January 2022 would show a strong improvement on the current year. However, given the ongoing uncertain outlook with stores in the UK likely to be closed until at least Easter and closures in other countries possible at any time, our current best estimate is that the Group headline profit before tax for the full year to 29 January 2022 will be 5% to 10% ahead of the current year.

.

My opinion - this looks a remarkably strong update. Once again, it shows the importance of retailers being able to move sales online, as a key way to soften the impact of the pandemic.

My worry is that the big brands might move towards internet sales direct to customers (Nike has already indicated it favours this strategy in the USA). For that reason, I'm wary about whether JD's performance has longevity. So far though, that worry has cost me dear, as I've missed out on probably the best performing retailing share in recent years.

Well done to shareholders here, looks like you're in for an enjoyable day, with a big price rise likely, due to beating market expectations by a long way. Nice to see the company set out its trading update in such clear language, giving us the precise figures of;

1) What profit it expects to make, and

2) What the existing consensus market expectation is.

That's it, that's all we need! Why can't all companies do this? It's simple, and helps everyone understand the situation quickly & easily. I'm coming round to the view that some companies & brokers are being deliberately obstructive, by withholding this information in trading updates.

.

Cloudcall (LON:CALL)

(I hold)

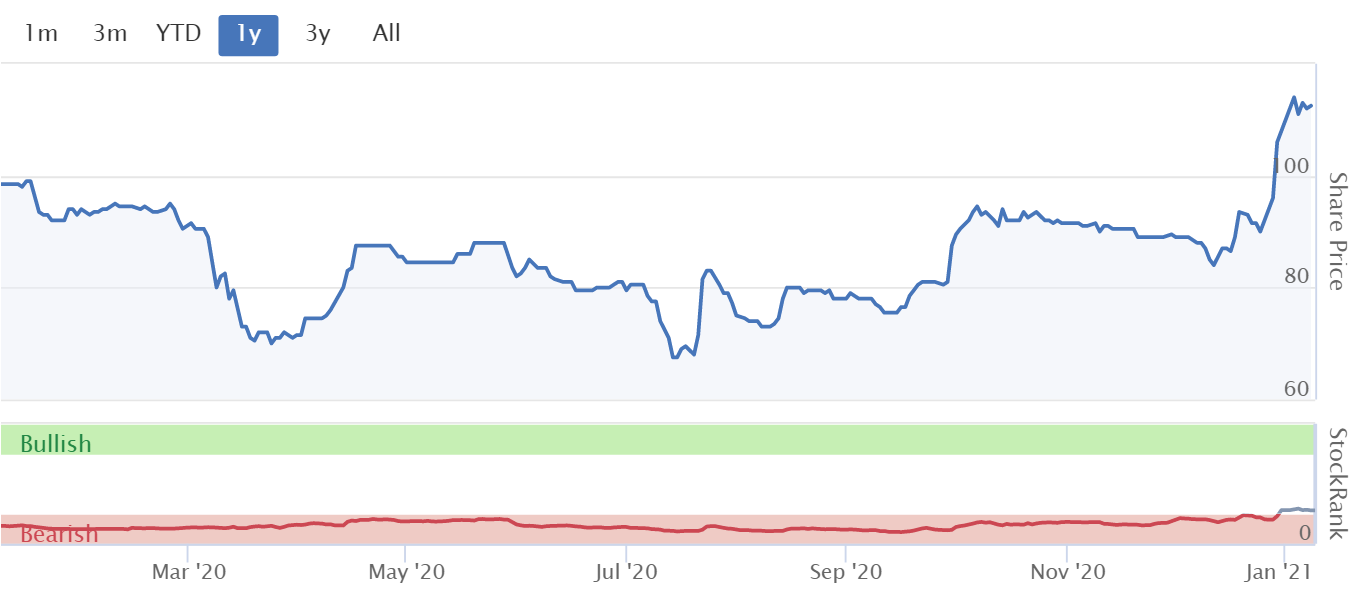

112p (pre market open) - mkt cap £44m

Second integration with The Access Group

I've had to read this statement 3 times to understand it. It looks like a nice to know, rather than a price sensitive announcement.

CloudCall (AIM: CALL), the integrated communications company that provides

unified communications and contact centre software that tightly integrates

with Customer Relationship Management ("CRM") platforms...

- The Access Group is an important CRM software provider to the recruitment sector, including well known names such as Adecco, Alexander Mann, Impellam & Staffline.

- CALL has "strengthened its partnership" by integrating its own communications software with a second of its products.

- Opens up CALL product to a "new group of users".

.

Directorspeak -

... This is a significant launch for CloudCall within the UK recruitment industry,

solidifying our position as the integrated communications provider of choice

for any of the leading Recruitment CRMs and further bolsters our vision of

providing users with the ability to discover business insight from

communications complexity."

My opinion - useful background information, but not particularly price-sensitive, in my opinion.

Note that CALL shares have been overlooked by investors for a long time, but have perked up a bit recently. There's a massive tech boom underway in the USA markets in particular. CALL does a significant proportion of its business in the USA, and also has about (from memory) 40% of its shareholders are now American, including several disclosable major shareholders. The CEO mentioned on a webinar a while ago that US investors had pushed for the company to do a big fundraise, which it did, and go for it, in terms of more rapid growth. I think that's great - UK companies & investors are generally far too cautious, scared of cash burn, and hence so often become also-rans, rather than leaders.

Maybe we're seeing some of the sparkle in US markets rub off on CALL? It's been a long haul, but I think the company is on its way to success now. Difficult to value mind you. Hopefully a US investor might decide to get out the chequebook and buy it for a whacking great premium!

The cash position should be fine for the time being, so we don't have to worry about another placing. Another lesson that can be learned from CALL, is that speculative, cash-burning companies tend to be floated in the UK market with nowhere near enough cash. Brokers need to address this, because performance usually falls short of plan with almost all speculative companies, leaving them high & dry, needing more equity fundraisings, often into a falling share price. Much better would be to build in a decent cash reserve, into the original float. So simple, but usually overlooked when companies are floated. Why is that same mistake made over & over again?

.

.

Innovaderma (LON:IDP)

50p (down 23% at 09:27) - mkt cap £7.3m

Bad luck to shareholders here, nursing a 23% loss this morning. It's very small, so just a brief comment from me, as I happened to have looked at this share last year when it seemed good value. A Director sold £2.15m-worth of shares in Nov 2019 (often a worry that something might be going wrong). Although I see from the Director dealings page, that a different Director bought £270k-worth at 69.5p more recently, in Oct 2020.

Trading Statement today -

InnovaDerma (LSE: IDP), a UK developer of beauty, personal care and life sciences products, provides a trading update for the six months ended 31 December 2020 [Paul: H1 of FY 06/2021]

My summary of main points -

- Covid restrictions have impacted performance

- H1 revenue £4.1m, down 20% on LY

- Skinny Tan doing well overseas

- Direct-to-consumer channel is priority, and now 62% of company sales - interesting. I'm guessing this must be mainly online sales? Do any readers know?

- Expecting tanning products (83% of total revenues) to improve as covid restrictions are eased. Peak season is April-June.

- 2 new product launches in Dec 2020 "very successful"

- "Strong roster" of new products launching in 2021

Cash position - uh-oh, I don't like the sound of this -

The Company has agreed in principle to enter into a loan agreement in the amount of £500,000 with M.Ward, a Non-executive Director and the largest shareholder of the Company.

A further announcement will be made shortly providing details of the agreement once it has been signed.

"Substantial" impairment review of balance sheet intangibles - doesn't matter to me, as no cashflow impact.

Board update - clearly there's been a massive falling out (or worse?) here, as the Chairman who was resigning with effect from 31 Jan 2021, has now been dismissed with immediate effect. It's very unusual to see the word dismissed used. To borrow, and amend MrContrarian's usual wording on these matters, he is not thanked.

An existing NED is taking over as Chairman.

Outlook -

- Strong H2 weighting expected, as in previous years, due to seasonality of tanning products

- Anticipating recovery in Q4 (Apr-Jun 2021) as covid restrictions hopefully ease

- Should be EBITDA positive in H2

- Exploring options to strengthen the balance sheet - oh dear, that means we should probably expect a placing, at who knows what price?

- Substantial growth opps once restrictions eased

- New (7 weeks) CEO talks up future growth potential

My opinion - this one looks too risky for the time being. Needs to do a placing, and being propped up with a Director loan, is not a good position to be in. I might look at it again once the balance sheet has been repaired with a placing. Why take the risk before then? Looks too small to be listed, so de-listing risk seems elevated.

Does anyone know what the new CEO is like, track record, etc? I like turnaround where a brilliant new CEO comes aboard, such situations can occasionally be terrific investments. Although important to remember that lots of attempted turnarounds don't work.

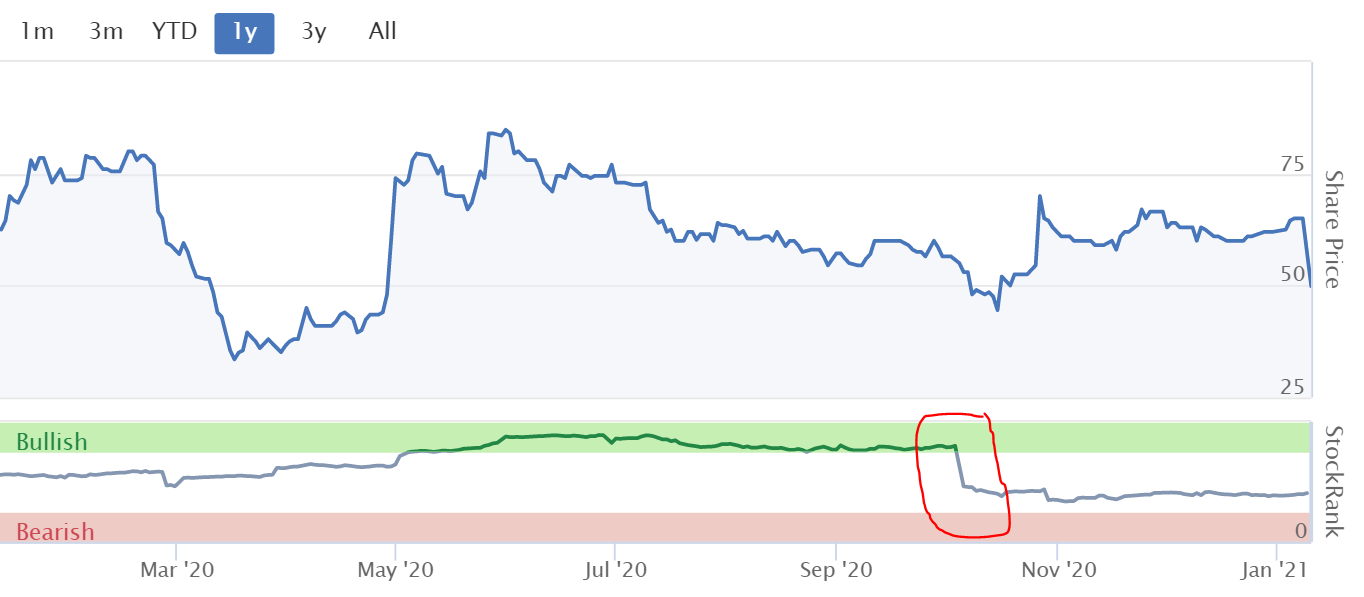

Interesting to see that the Stockopedia computers spotted something they didn't like in early Oct 2020 - see below (red circled by me).

.

.

John Authers article today

I'm a big fan of John Authers (formerly FT, for a long time, now at Bloomberg) daily email articles. I try to read it every day. Today's article is particularly interesting. In it, he compares Tesla (disclosure: I'm short, again) 800% rise in the last year, with the 1999-2000 TMT boom & bust. His conclusions, and the evidence he provides, are thought-provoking.

I agree with his conclusions, that there are good reasons why markets as a whole are where they are, but within that, there are pockets of really extreme over-valuation. Risk:reward on Tesla is therefore terrible at current levels - even if it does as well as people hope, in the upside bull case, it's still too expensive!

In the 1999-2000 TMT boom, people buying at the top, had to wait 10+ years to get to breakeven, even for great companies like Microsoft, Amazon, and Cisco, which he uses as examples.

Well worth a read! I'm not sure how you sign up for his free daily email, but it's highly recommended. Many thanks to MichaelFBS for providing the signup link, which is here: https://www.bloomberg.com/acco...

I'm also short of Bitcoin again, as I've digested all the bull & bear arguments, and understand it pretty well. It strikes me as a gigantic speculative bubble. If you're worried about fiat currencies being devalued with QE (a reasonable position), then don't hold so much cash. Put it into property, or shares, or other genuine assets. Putting it into worthwhileless computer code, seems to me to be folly, long-term. In the short-term though, Bitcoin bulls can thumb a nose at bears like me, as they're making the money (at least on paper), for now. It remains to be seen who is right in the long run.

EDIT: I forgot to mention, that the appalling energy consumption/waste of cryptocurrency mining, means that nobody with a shred of ESG credibility could possibly hold bitcoin.

Manias, Panics & Crashes (Kindelberger) - book review

I listened to an audiobook review of Kindelberger's classic, "Manias, Panics, and Crashes" over the weekend, and both Bitcoin & Tesla tick the boxes for a speculative frenzy, namely -

- Easy access to credit

- Over-optimistic mania

- Assumption that price of asset will rise forever

- Some significant event triggers an end to a boom (e.g. a bank failure) - prophetic, re Bear Sterns, and Lehman in 2008)

- Eventually a selling panic, and crash happens

- Banks liable to go bust as bad debts pile up

- Wave of insolvencies, creating international contagion

- Financial crises can't be stopped, but only contained (probably no longer true, given extreme Govt & central bank actions possible these days)

- One country should lead the international response to a major financial crisis

- Prophetic book, as written just before a series of major financial crises hit

- Debunked the efficient market hypothesis, which was academically fashionable (but clearly wrong) in the 1970s

- Entertaining text - novel in an economics book, for being an entertaining/human story, not full of numbers & formulae

- Irrational investor behaviour will always exist - an unorthodox view at the time

- Spawned the field of behavioural economics, e.g. Schiller (a student of Kindelberger)

- Investors are consistently over-optimistic in researching, assumptions, and their own ability to forecast & stock pick! So experience can actually count against you - if it makes you too certain of your forecasting ability

.

Well worth a read of the original, I'll add it to my (groaningly weighty) reading wishlist.

Sorry, I didn't have time for any more today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.