Good morning, it's Paul & Jack here with the SCVR for Monday.

Agenda -

Paul's Section:

Intercede (LON:IGP) (I hold) - a steady trading update, H1 performance in line with expectations. Currency headwind blunts revenue growth from 9% to 2%. Strong cash balance, so solvency/dilution no longer an issue. No change in my view, which is positive.

Science (LON:SAG) - Today's update provides the third forecast upgrade this year. My stab at valuation demonstrates that this share remains reasonably priced. My view remains positive - assuming earnings growth is sustainable. The company is also looking at further acquisitions, which could rev up the growth motor in future.

Jack's section:

Treatt (LON:TET) - a great company with sustainable long term growth prospects. The order book is materially higher and its new UK facility will support a trebling of production capacity. I would expect possible upgrades over the next couple of years, but the shares do look expensive at present.

Spectra Systems (LON:SPSY) - a larger than usual central bank order means that profits for 2021 will exceed market expectations. This is an interesting small cap with a lot going on for such a modest valuation. That suggests more communication is required to convey the investment case, so today's additional update of more broker coverage is welcome.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Intercede (LON:IGP) (I hold)

91.5p (pre market open) - mkt cap £52m

Intercede, the leading specialist in digital identity, credential management and secure mobility, is pleased to report further good progress.

The company’s year end is 31 March 2022.

Steady revenue growth, and note the considerable headwind from currency movement (stronger sterling vs US dollar), which will be affecting other companies too, if they generate a lot of revenues in US dollars -

Revenues for the six months ended 30 September 2021 totalling £4.9m are approximately 9% higher than last year on a constant currency basis and 2% higher on a reported basis (2020: £4.8m on a reported basis).

Trading in H1 is in line with expectations.

No outlook statement is provided for H2, which implies H2 is also expected to be in line. I would have preferred that to be specifically stated.

Intercede has a very high proportion of recurring/repeating revenues, so it should be fine.

Cash - the financial position has been transformed in the recent couple of years, with tight cost control, ending speculative product development ideas, and the conversion of bonds into equity. The company confirms today that it is on a very sound footing -

We are also pleased to report that continued tight cost control has resulted in a positive operating cashflow during the period with cash balances as at 30 September 2021 totalling £8.5m compared to £8.0m as at 31 March 2021.

My opinion - this is a steady announcement, nothing to get excited about, so price neutral on fundamentals (although investor sentiment is a different thing altogether).

Growth of 9% is OK, not spectacular. The weaker dollar (vs sterling) has blunted that heavily to 2% growth, but I see currency movements as swings & roundabouts - so this year’s headwind could be next year’s tailwind, who knows?

There’s a useful brief update from Finncap this morning, many thanks for that.

Forecast is for £11.5m revenues this year FY 03/2022, making an adj PBT of £1.3m - it’s quite unusual to find a small tech company that’s already profitable at this small level of revenues.

There’s no longer any anxiety about cash/dilution, as the business is now well funded.

The crux is to accelerate growth now. There are new partner relationships that could deliver that, we’ll have to wait and see. There's extremely high operational gearing here, so stronger growth should turbocharge profits, if that growth happens, which can't be taken for granted.

The market cap of £52m seems reasonable to me, underpinned by profitability, plenty of cash, astonishing client list, and steady growth. The reason I hold the shares is potential excitement if the growth rate begins to accelerate strongly, which with big operational gearing, could lead to a further re-rating.

So far, so good, it’s 3-bagged from my initial purchase a few years ago, and is now much lower risk, so I’m a happy long-term holder.

Shares can be very illiquid, due to small size, and tightly held shareholder base.

.

.

Science (LON:SAG)

460p (up 3%, at 08:41) - mkt cap £190m

We like SAG here at the SCVR (as a value/GARP share, which is our main focus), and have reported positively on it 3 times this year - most recently here on 12 July 2021, when I concluded that it still looked priced reasonably (at 400p), with all 3 divisions performing strongly.

Since then, the share price has risen 15%, not bad considering many other shares have seen a significant sell-off between July and October this year.

Main points -

Continued to perform well

“Further upside” in 2021 profit forecast (3rd upgrade this year)

Cost headwinds absorbed (forex, cost inflation, component supply constraints, and corporate action costs absorbed too - i.e. not split out as exceptional)

Frontier acquisition “very successful”

Net cash of £19.1m

“Strategic investment” in TP Group

Additional £25m bank facility being considered

Looking at further acquisitions, and “larger opportunities” (not clear what that means)

Management & staff - “another year of excellent profit share and bonus awards”

Successful placing in Sept 2021

Lots more divisional detail is provided, see RNS.

Outlook -

In summary, the Board anticipates that Science Group will close out 2021 as another outstanding year and is now starting to plan for 2022 and beyond.

Valuation - unfortunately, the 2 brokers apparently reporting on SAG don’t seem to make their work available to little people like us. This is all wrong in my opinion, because the research relies on privileged access to companies, so it should be available to everyone. That's a core principle of the Companies Act (treating all shareholders the same, re information) which doesn't always seem to apply in practice.

Science Group’s website says that Stifel is the NOMAD,with Liberum as joint broker. Liberum are normally good, in making research notes available on Research Tree, but I don’t see any research notes there for Science Group. Perhaps Liberum could kindly remedy this?

When I meet companies, I always stress this point, and suggest they move to a broker which will put out research notes (which after all, the client is paying for!) to private investors - because we create the liquidity, and thereby set the share price.

So you would think brokers would understand that research is only of use, if people active in the market can access it, instead of a privileged few (high net worth clients, and institutions).

Management of smaller caps are increasingly understanding this point, pleasingly. They can’t moan about lack of market liquidity, if they use a broker that doesn’t freely disseminate its research notes, thereby informing private investors about the company, and the investing case.

We’re making progress, but more pressure is needed. So please do emphasise this point where appropriate when you all talk to management of companies which don’t publish research that we can access.

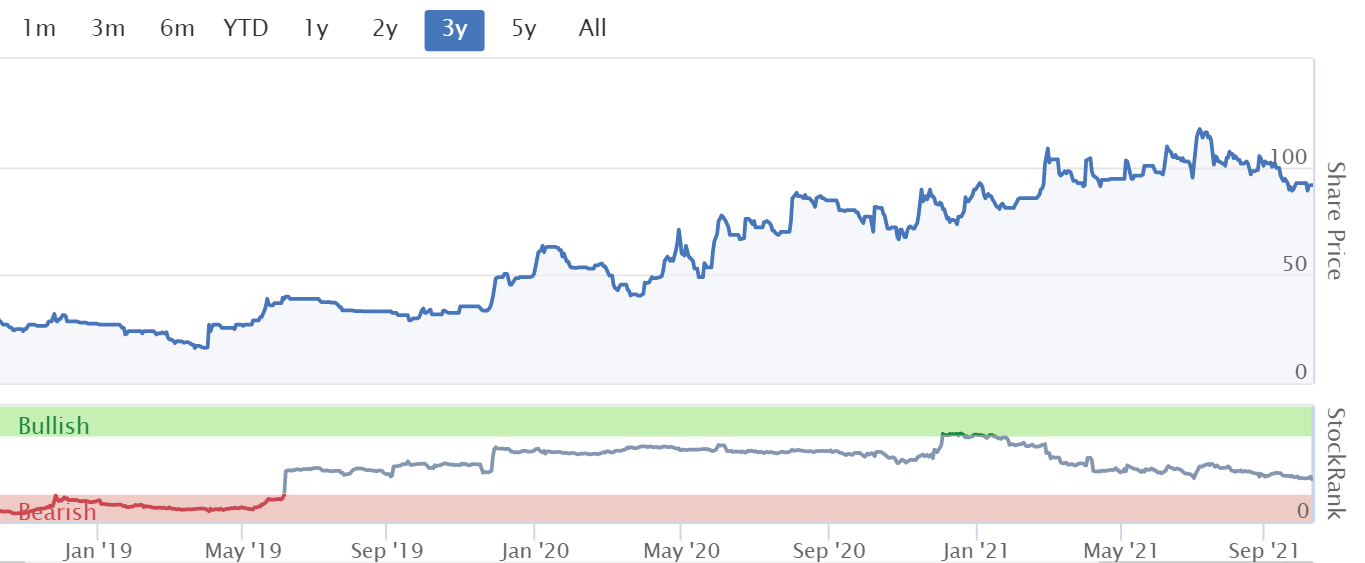

Back to Science Group. Current broker consensus forecast EPS is shown on the StockReport here at 25.78p. We’re told today there’s upside on that (but not how much).

Looking at the graph below, previous upgrades seem to be roughly 2-4p, so maybe we’re now looking at say 28-30p EPS for FY 12/2021? (my guess)

What PER should we put on that? Maybe 15-20, assuming that earnings are sustainable, not down to one-offs.

That arrives at my valuation guess of 420p-600p.

That makes the current share price of 460p look reasonable, with further potential upside, providing nothing goes wrong.

My conclusion therefore remains positive - Science Group is trading well, and still looks reasonably priced. There’s also potential excitement with more acquisitions, which the company seems to be good at. I like the fundamentals of this share, and shareholders should be happy after this update.

.

.

Jack’s section

Treatt (LON:TET)

Share price: 1,050p (+1.45%)

Shares in issue: 59,645,654

Market cap: £626.3m

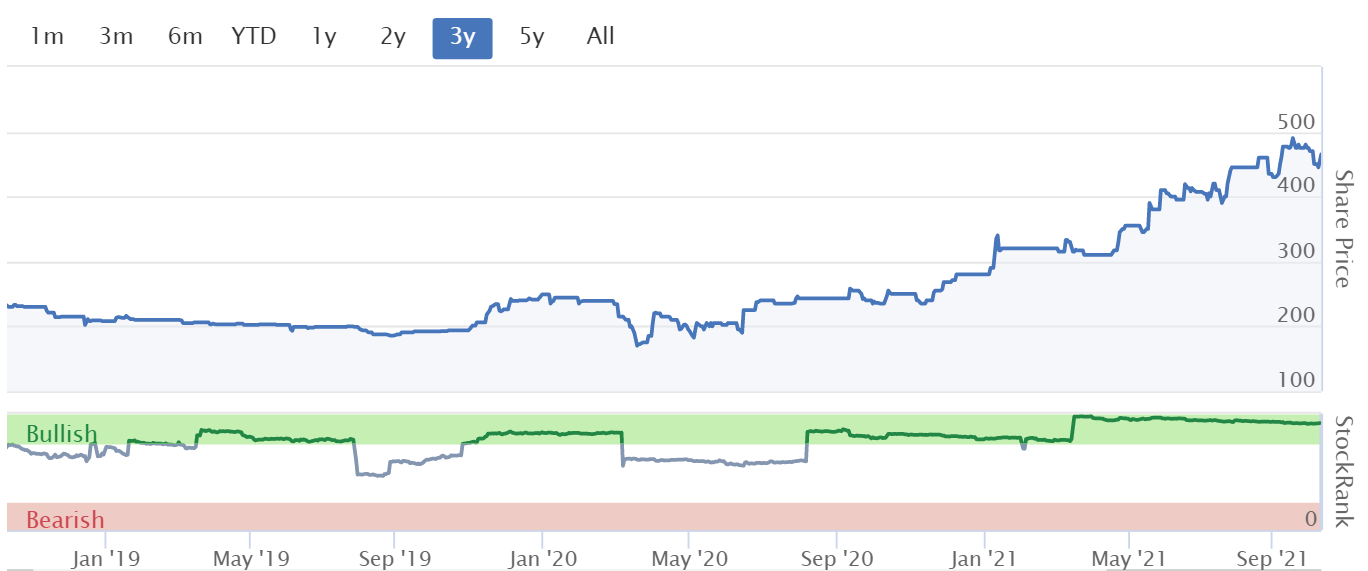

After recently more than doubling in a strong market over the past year or so, the Treatt share price has been consolidating at around the 1,000p level.

The group is expensive relative to other companies, but a premium is probably justified due to its track record of steady growth and high profitability metrics.

Nevertheless, trading at 36.7x forecast earnings and with a PEG of 5.4x, ongoing growth over the next couple of years is required if the share price is to go higher. To that point the group says it is confident of sustainable long term growth in its business of providing ingredients to the flavour, fragrance and consumer goods industries.

Revenue has grown by about 14% in the year to 30 September 2021 to £124m (+18% in constant currency), with a change in mix leading to higher margins. Healthier living product sales were up some 64% and Tea has been a particularly strong performer (revenue there up by 113% to 11% of group revenue). This is in keeping with the group’s strategy of focusing on more innovative, added-value products.

Passion fruit, watermelon, cucumber and mango natural extracts led the way in the fruit & vegetables category which has been growing consistently for many years. This category grew by 60% in the year to 10% of group revenue (FY20: 7%).

The citrus category was broadly similar year-on-year, contributing 44% of revenue (FY20: 50%). The gross profit margin improved due to the shift towards higher value, solution-based products.

The traditional range of herbs, spices & florals, representing 9% of revenue (FY20: 11%), also saw revenues remain broadly unchanged in the year.

The burgeoning alcoholic seltzer market is a promising area of growth as brands compete for market share. Treatt has two routes to market here: direct to brand owners and indirectly through flavour houses.

FY21 PBT expectations remain unchanged after previous upgrades, although the order book is ‘up materially year-on-year’.

Widely reported supply chain issues have been experienced but this dynamic has not materially impacted operations as Treatt transports concentrated product and holds prudent levels of inventory.

New UK facility - this is a big development and the group is now moving people and production to the new UK facility underway, which will triple UK production capacity once completed (anticipated in FY23). That coincides nicely with the strong order book.

Treatt is now installing and commissioning plant and machinery which will upgrade manufacturing capabilities to an advanced digital system. Most of its manufacturing and technical capabilities should be fully up and running at the new facility by mid-2022, with the final transfer and upgrade of its most complex manufacturing equipment to be completed by mid-2023.

The disposal of the old site should bring in c£5.5m net of costs.

Financial health and dividends - net debt of c£6m despite £9.5m of capital investment in the year spent on the new UK facility. Total bank facilities of £26m. A final dividend to shareholders will be proposed.

Outlook - a positive outlook with the order book materially up and ongoing investments into products, people, and production capacity ‘to capitalise on the multiple longer term market opportunities we see across the business.’ Treatt’s healthier living categories continue to trade well and there are ‘material opportunities’ in its coffee category. The group is driving Citrus up the value chain, and growth is also expected in its synthetic aroma business.

Diary date - results for the year ended 30 September 2021 are expected to be announced on 30 November 2021.

Conclusion

Treatt comes across as a quality operator with long term growth prospects in its product markets and key geographies (the US is its largest market).

The shares do look expensive based on forecast figures, with FY22 revenue expected to grow by 5.6% and net profit expected to rise by just 9.3%, compared to some pretty high multiples.

But with this new UK facility expected to triple production capacity by 2023 and the group reporting strong demand (particularly with its guidance on the order book), I wonder if it is managing expectations and setting itself up to outperform.

In my view, something like that is required in order to drive the shares beyond the current level. I can’t fault the company, its execution, or its prospects, but a lot of growth is now reflected in the share price.

Spectra Systems (LON:SPSY)

Share price: 164.9p (+7.07%)

Shares in issue: 45,286,901

Market cap: £74.7m

Spectra Systems has an unusually broad range of activities for a c£60m market cap company. Its largest income stream comes from providing covert security technologies to authenticate banknotes to 20 central banks, but it has other intellectual properties supported by more than 100 patents.

Its security and authentication materials can be found in energy drinks, coffee products, and tobacco, while its security software is used by multiple international lotteries. The group calls itself ‘a leader in machine-readable high speed banknote authentication, brand protection technologies, and gaming security software’.

And that substantial intellectual property is supported by an existing profitable and cash generative business, leaving it well positioned to continue innovating and bringing new solutions to its various markets.

The share price can be volatile though and has been coming down slightly recently. The dividend yield is now more than 4.5%. That valuation suggests to me the market is unsure on quite what to make of Spectra and its growth prospects.

This is a short update to declare a large order from a central bank partner that is 50% higher than typical. The company notes:

Based on the value of this year's order, we are confident that we will exceed market expectations for PBTA in 2021.

Dr. Nabil Lawandy, CEO and founder, comments:

I am very pleased that we have executed a five year renewal with this long standing central bank customer. The size of the order, as well as the agreement, further bolster our confidence in the role of, and demand for, reserve currencies going forward.

Conclusion

A criticism of this company is that its central business revolves around banknote authentication in an increasingly digital world. I very rarely use cash these days.

But there is still huge demand for physical money globally and Spectra currently has an attractive business with big, risk-averse central bank clients willing to commit to multi-year contracts. That gives Spectra a strong market position from which it can build its product pipeline, informed by insights from its existing customers.

The company is trickier than the average small cap to value due to the disparate nature of its businesses. It’s hard to know what the company might create next, and what product developments might be material for the group going forwards. But it certainly seems like there is ample scope for growth, especially at the current valuation, which I think is fairly modest.

Spectra often gives positive updates to the market but the share price does not always respond. In a separate update today Spectra says it has appointed Allenby Capital to provide ongoing equity research on the group. This is a welcome development, as it is exactly the kind of company that could do with more research into the prospects of its various ventures.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.