Good morning, it's Paul & Jack here, with the SCVR for Monday.

Timing - today's report is now finished.

It's re-opening day today, with retailers & outside hospitality opening up again. It will be interesting to see if we get a boom in spending, or not. The problem is, that many share prices seem to have already priced-in a full recovery. So where's the upside going to come from?

I've been stranded in Bournemouth, going slowly mad, over the last 4 months. So I'm looking forward to strolling into the town centre this afternoon, to see what's occurring. I'm not holding out much hope of getting a crisp, cold pint anywhere, as I expect it's likely to be booked up everywhere, but we'll see.

I'm wondering what there is, in town centres, that I actually need? Just Primark really, and that's about it. I now buy everything else online, or from small local shops. Hence I'm a bit sceptical that High Streets and shopping centres would just return to normal.

Mello Monday

Is tonight! Full details here. It starts at the earlier time of 5pm today.

Star of the show is the Queen of Tech, Vin Murria.

I'll be doing a brief results update on Saga (LON:SAGA) (I hold) near the end, in the charity pledge section. As you know here, I jump at any opportunity to promote the wonderful little humanitarian aid charity, ZANE, helping many good causes in impoverished Zimbabwe. Thank you to all the subscribers here who have also shown an interest in, and made donations to ZANE. I tend to bung over a bit of cash whenever I bank a nice profit from something on the stock market, on top of some standing orders. What ZANE needs more than anything, is regular income, as it has regular outgoings, helping destitute individuals often for the remainder of their lives.

Agenda

Paul -

Treatt (LON:TET) - trading update - an in line update, but hints at possible further upgrades. Lovely company, but shares look expensive now (as lots of things do)

Cake Box Holdings (LON:CBOX) - trading update - in line with expectations. Rapid roll out underway, of franchised cake shops. Looks good.

Belvoir (LON:BLV) - Final results - for FY 12/2020. I'm impressed with all aspects of this company's performance, including the balance sheet, which now looks OK (I had previous concerns about it, since resolved). Looks good, and still reasonably priced, I reckon.

Vitec (LON:VTC) - upbeat trading update.

Jack -

Instem (LON:INS) - in-line update from this acquisitive life sciences software group

Concurrent Technologies (LON:CNC) - shares down today but improving conditions for this UK-based computer board manufacturer

.

Paul’s section

Treatt (LON:TET)

958p - mkt cap £571m

Treatt has risen strongly in price, and is a bit above our usual market cap cutoff of c.£400-500m (flexible), but it’s such an interesting company I’m going to keep reporting on it.

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, today publishes a trading update for the half year ended 31 March 2021 (the "Period").

Momentum continues with strong growth in revenue and margins

The highlights today read well, but it’s only an in line update, so not really something to get terrifically excited about, especially given how strong the share price performance has been (along with almost everything else) in the last year.

Here are the highlights from today's update -

There’s more operational detail in the announcement, which I won’t regurgitate here.

New UK facility - sounds like it’s nearing completion. This is a big capex project, that should increase production capacity.

Work on our new UK facility continues apace and we are now a significant way through the operational fit out. We will begin transitioning colleagues across in late April 2021 and will start the commissioning of the new plant and machinery later this calendar year as planned, to enable production to relocate. We believe this site, along with our recently expanded US facility, will provide Treatt with a much stronger platform to support its growth ambitions.

Net debt - seems modest at only £5.1m, with £21.2m undrawn bank facilities. So liquidity sounds fine.

Forex - stronger sterling vs dollar is a small benefit of £0.4m in H1.

Outlook - expecting a boost in H2 from re-opening of hospitality venues. Promising outlook, but “we are taking a conservative approach” - I’m not clear what that means. Possibly it might mean that they’re not raising guidance until it’s clear what the order book looks like for H2?

Diary date - Interim results are due out on 11 May 2021.

Valuation - I’m well aware of the merits of Treatt - it’s a decent company, with a good track record, operating in an interesting niche.

This share does look very expensive though - a forward PER of 37.3. It looks like the market must be anticipating a beat against forecasts, and strong growth when the new production facility starts production. Forecast for next year doesn't seem to factor in much growth, considering a large new production facility is coming on stream later this year. So that could explain why the shares currently look so expensive - i.e. unrealistically low forecasts, possibly?

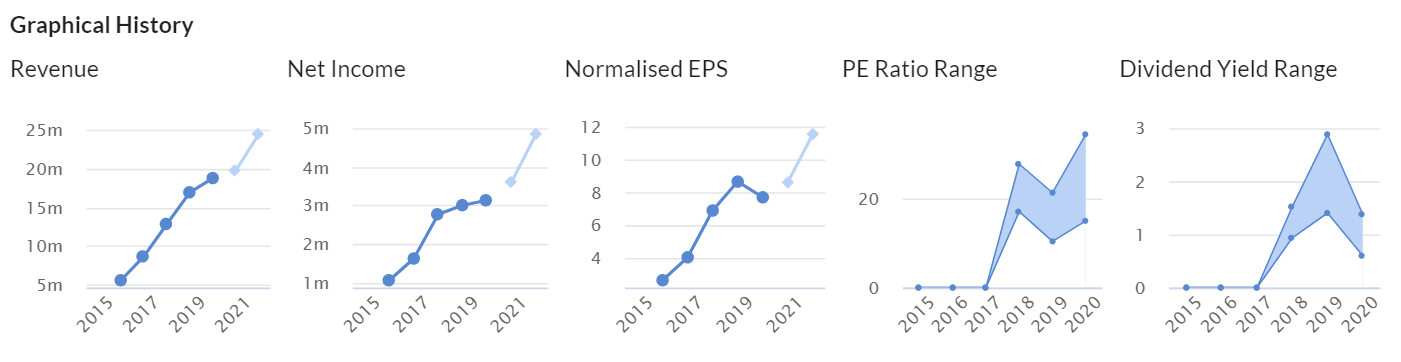

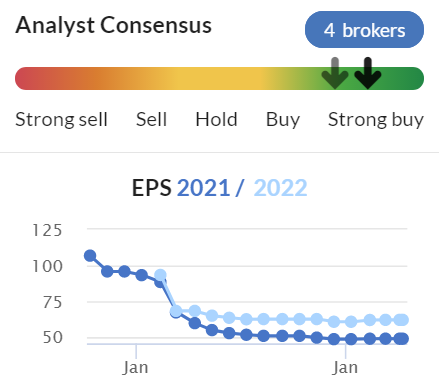

Note that a trading update on 22 Jan 2021 indicated profitability for FY 09/2021 would “materially exceed” market consensus forecasts. As a result, brokers considerably upgraded EPS forecasts, as you can see from the graph below. Reading between the lines today, it sounds as if another upgrade could be in the pipeline for later this year, possibly?

.

.

My opinion - very nice company, but the high valuation is clearly based on expectations that earnings & growth are likely to exceed expectations again.

So many shares have had an amazing run in the last 6 months, that I can’t help feeling it might be a good time to recognise this has been an exceptional period, that can’t last forever, and top slice some positions to raise cash for buying future dips? That's obviously just a personal view. The alternative is to accept market volatility, and ride out any downturns, the best strategy in the long run.

Personally I wouldn’t be interested in buying TET at the current valuation, but recognise that it’s a quality company.

EDIT: There's a new note out today from Edison, which confirms that "risk" to its forecasts are now to the upside, which confirms my inkling that the company is probably on track to beat forecasts (it needs to, to justify the valuation). The Edison note also has an interesting section on international competitors, which suggests that Treatt is priced in line with the competition (i.e. all are expensive!). End of edit.

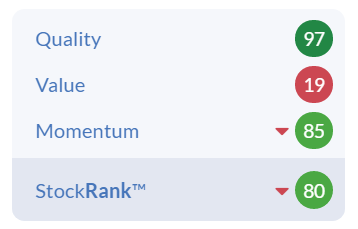

The StockRank system sums it up nicely - a quality company, with good momentum, but expensive:

.

.

Belvoir (LON:BLV)

207.5p (down 1% at 08:49) - mkt cap £73m

There’s an investor presentation being given by Belvoir management at 18:00 tomorrow (13 April) as part of a Shares magazine investor evening - details here.

EDIT: InvestorMeetCompany are also hosting a webinar here today (12 April) at 16:30. End of edit.

Belvoir Group PLC (AIM: BLV), one of the UK's largest property franchise groups, is pleased to announce its Final Results for the year ended 31 December 2020.

Resilient business model delivers another year of strong growth

Revenues up 13% to £21.7m (7% organic, 6% re Lovelle acquisition). Bear in mind revenues look low because the key revenue stream is management fees from the franchisees, which is effectively a profit share.

Profit before tax (continuing ops) - up 17% to £6.5m

EPS (diluted) up 13% to 14.6p. That’s a PER of 14.2 - probably about right. Note that Finncap seems to use a different measure, adjusted EPS of 16.7p is showing as actual for FY 12/2020 in its update today. That’s an adjusted PER of 12.4 - good value.

Can I suggest that the company, and brokers, liaise to report EPS on the same basis in future? That would make things a bit more logical for investors.

Taxpayer support - I did wonder if these figures might have been boosted by Govt support measures (something to bear in mind for all companies reporting). However, it seems not, as Belvoir has done the right thing and repaid taxpayer support -

Full repayment of the £260,000 Government Covid-19 financial support received under the Coronavirus Job Retention Scheme and small business grants

Track record - a very strong statement here -

In 2020 Belvoir achieved its 24th year of uninterrupted profit growth which, when considering the challenges of lockdowns and economic uncertainty, is a tremendous result.

Dividends - impressive to see catch up divis, on top of usual divis. The forecast yield for 2021 is 3.5% - not bad.

Outlook -

- 2021 so far is in line with management expectations.

- Property market is being boosted by the stamp duty holiday (extended to 30 Sept 2021), and new Govt scheme to guarantee 95% mortgages.

- Uncertainty re macro economic picture longer-term

- Resilient business model, as proven in 2020 covid/lockdowns

Acquisition - post year end looks good - buying in £1m additional operating profit, for just £4.0m price paid. That looks an attractive deal, I wonder why the vendor sold?

Balance sheet - NAV is £28.3m. Strip out £29.9m intangibles and £1.4m deferred tax, and NTAV is £(0.2)m. That’s fine for a business with very little in the way of fixed assets - a capital light business model doesn’t need a strong balance sheet. Net debt is now modest relative to profits, so that's OK.

Also the resilience of profits & cashflows demonstrated in 2020, is another reason why it doesn’t need a strong balance sheet.

Therefore, whilst I’ve had concerns about debt, and the generally weak balance sheet in the past, I’m happy to sound the all-clear, in that the figures now look OK to me, hence I no longer have any concerns about Belvoir’s balance sheet.

Cashflow statement - is impressive. This is a genuinely cash generative business, even in a really tough year like no other, in 2020.

The cash generated is used to self-fund bolt on acquisitions, and to pay a respectable dividend too. This looks good.

My opinion - this share gets a thumbs up from me.

Given this strong performance, I think the big rise in Belvoir’s share price looks fully justified.

Further growth in earnings should follow, from good value acquisitions made.

Finncap has upgraded its 2021 forecast EPS by 11% today, to 17.3p, a current year PER of 12.0, and I think the Finncap forecasts look conservative, so we might expect to see a beat against that in due course.

As always, I have no idea what the share price will do in the short term, as that’s purely down to sentiment. But the fundamentals justify further upside on the share price, over time, and I’m increasingly seeing this share as a good one to hold long-term. It's pleasing to actually find something reasonably priced, as most other shares look terribly expensive at the moment.

It’s very unlikely to be a 100-bagger, but could still be a decent share to tuck away forever, a coffee can stock. It seems to have a good business model, and looks well managed. I’ll make a diary note to tune in to the webinar this afternoon, to find out what management are like.

It tickles Stockopedia’s fancy too, with a high StockRank. Note that the value score could improve once higher earnings forecasts feed through in the next few days.

.

.

A strong share price, but the fundamentals reported today do justify this move up, in my opinion:

.

Cake Box Holdings (LON:CBOX)

261p (up 2.7%, at 12:10) - mkt cap £104m

Coincidentally, this is the second franchising business I’ve looked at today.

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, today announces a trading update for the full year period ended 31 March 2021 ("FY21").

Strong recovery in trading sustained through H2

Another period of strong growth in an unprecedented year

Two PR headings, that's just greedy!

This FY 03/2021 trading update reads positively. Here are my notes & comments -

- Very good like-for-like (LFL) sales up 14.7% for the 40 weeks since lockdown 1 lifted

- Revenues for the year reached a new record, +16% on LY (last year)

- Adj PBT (profit before tax) in line with market expectations (but no figures given)

- Stores roll out has continued, and is fast - 157 stores at year end operated by franchisees. 24 of those opened in the year, 17 in H2. This is such a good time to be rolling out a retail format, as tremendous deals are available from landlords. There must be scope for lots more locations in the UK, as national retail chains can reach a size of 1,000+ sites - assuming that Cake Box has universal appeal, and isn’t just a niche thing for people who don’t eat eggs

- Has deposits from franchisees for 52 new sites - very impressive, and of course with a franchise model, expansion can be extremely rapid, as the franchisees do most of the work.

- Trialling new concept of kiosks in supermarkets, 5 done so far - results so far “very encouraging”

- Own brand delivery platform added to existing third party delivery options

- Online sales up a very impressive +84% year-on-year - so clearly CBOX has been resilient during covid, and the franchise model protects it, providing the franchisees don’t go bust

- Net cash at 03/2021 of £3.6m

- Dividends - Special declared in Sept 2020, Interim declared in Nov 2020. Forecast yield is 2.2%, but expect that to grow as the business expands

- Repaid furlough funds (only applies to central staff, as everyone else is employed by franchisees)

- Results - date TBC, but will be in June 2021

My opinion - assuming the numbers are correct, then this does look really good.

It’s not cheap any more, after a big rise in the last 6 months, but I think the rapid roll-out does justify a premium valuation. So a thumbs up from me.

.

.

Vitec (LON:VTC)

1165p (up 1.3% at 12:42) - mkt cap £527m

Acquisitions - two are announced today, totalling £30.4m in cash and shares.

Trading update -

... despite some uncertainty about when markets will fully reopen and foreign exchange fluctuations, is increasingly confident about delivering a strong recovery in 2021.

Good trading performance in Q1 2021 - order intake & revenue similar to Q1 2019 (i.e. a pre-covid year).

Scanning the StockReport, Vitec doesn't look particularly good value, based on existing broker forecasts. However, if you look at how much forecasts have fallen, and wonder if the company could in time recover to pre-covid forecast profitability, then that would reduce the PER down to not much above 10, which would look cheap. There might be pent-up demand also, when customers do re-open?

.

My opinion - neutral, as I haven't done enough research to form a view either way.

It is striking though how many companies are sounding more upbeat about the future of late. Also, there was a newspaper report over the weekend, saying that finance chiefs in the UK are now much more optimistic, and are in hiring & expanding mode, instead of cash conservation & retrenching. That's bullish for equities.

.

Jack’s section

Instem (LON:INS)

Share price: 690p (+1.47%)

Shares in issue: 21,742,032

Market cap: £150m

Instem (LON:INS) is a leading provider of IT solutions to the life sciences market, with a product suite that handles Study Management and Data Collection; Regulatory Solutions for Submissions and Compliance; and Informatics-based Insight Generation.

It enables clients to bring products to market faster.

The solutions address aspects of the entire drug development value chain and are used by over 600 customers worldwide, including all the largest 25 pharmaceutical companies. In fact, the team estimates that over 50% of all drugs on the market have been through some part of Instem's platform at some stage of their development.

The group recently acquired d-wise via the issue of 868,203, taking its share count up to 21,742,032. Instem has also purchased The Edge recently, and in 2019 it bought Leadscope, so it’s possible that an increase in operating scale can justify the recent strong share price.

As with a lot of tech stocks, valuation is a consideration given that Instem trades on a forecast PE ratio of 32.1 and a forecast PEG of 2.1. That means you are paying up for the Quality Rank of 88, especially with that near 30% increase in the share price over the past few weeks.

The Financial Summary shows good earnings per share progression but if you head over to the Income Statement and check out the Diluted Normalised EPS line you’ll see that earnings fell consistently for a long time before that.

Ultimately, smaller tech stocks are one area where investors can generate outsized returns, so it’s well worth looking at the merits of this company to see what the future might hold.

Highlights:

- Revenue +10% to £28.2m,

- Software as a Service (SaaS) revenues +25% to £8m and recurring revenues (annual support and SaaS) +13% to £16.9m

- Organic revenue growth (excluding Leadscope acquisition in November 2019) of 3% to £26.3m

- Adjusted EBITDA of £5.9m (2019: £4.9m)

- Reported profit before tax of £2.5m (2019: loss of £0.9m)

- Adjusted profit before tax of £4.0m (2019: £3.2m)

- Fully diluted earnings per share of 11.6p (2019: 5.7p loss per share)

- Adjusted fully diluted earnings per share of 19.1p (2019: 18.4p)

- Cash balance as at 31 December 2020 of £26.7m (2019: £6.0m) - reflecting operating cash generation and an oversubscribed placing in July 2020.

The results value Instem shares on 35.6x FY20 adjusted diluted earnings (with the adjustments being £664k in acquisition amortisation, £606k in non-recurring costs, and £208k in intercompany foreign exchange losses).

It’s worth remembering that both The Edge and d-wise were acquired after the reporting period, so the real scale of Instem is not reflected in these results. Instem says these acquisitions extend its reach across the drug discovery and development lifecycle.

The group estimates pro forma unaudited revenues and adjusted EBITDA for the enlarged group in the 12 months ended 31 December 2020 to be approximately £49m and £10m respectively (compared to a £150m market cap).

The current cash position after these two post-period acquisitions is around £14m but with deferred and contingent consideration payable of up to c£11.1m.

Conclusion

All the numbers are travelling the right way and it’s a relatively good performance given the wider market impact of Covid, but with a £150m market cap and a 680p share price, valuation is a consideration.

But there are two ‘strategically significant’ acquisitions to account for in the form of The Edge and d-wise, which together would have almost doubled adjusted EBITDA on a pro forma basis.

The acquisition strategy is interesting. Management competence in this tricky area is an important consideration, but if done responsibly it can add quite a lot of fuel to growth.

Management points to a ‘wealth of opportunity’ here. In fact, it is in discussions with a number of candidates now so we can probably expect more news in future.

As with most tech stocks it’s an asset-light balance sheet with quite a lot of intangible assets (in Instem’s case, intangibles of £18m make up 33.5% of total assets at year-end, although this figure has presumably increased following the use of cash in acquisitions).

Slightly more unusual for a tech stock is the presence of a pension deficit. This has increased year-on-year from £1.8m to £3.9m and is something to account for. To this I would add the acquisitive strategy and valuation as further risks, and I would like to know more about the period of declining earnings leading up to 2015 - particularly what changed, and why.

There was director selling back in July 2020 (presumably in the placing) but this could always be for retirement planning etc.

Life sciences is a good place to be, with global population growth and life expectancy underpinning increased demand for successful innovation here, so Instem looks interesting on a longer term basis. There is a presentation on investormeetcompany at 4pm today.

Concurrent Tech (LON:CNC)

Share price: 95.7p (-8.9%)

Shares in issue: 73,363,490

Market cap: £70.2m

Concurrent Technologies (LON:CNC) designs high performance Intel® processor boards, switches, networking, storage and software products for use in embedded solutions. It’s got a board manufacturing factory in Colchester.

The group’s products are used in the Defense, Security, Aerospace, Telecommunications, Transportation, Medical and Industrial markets and are designed to be operated in a range of temperatures and environments.

The semiconductor space is supposed to be doing well but the group’s shares are down c8% today and Stockopedia classifies Concurrent as a Falling Star with a declining Momentum Rank of just 23, so I’m curious to see what’s going on here.

Highlights:

- Revenue +9% to £21.1m,

- Gross profit +12% to £11.4m,

- Gross margin up 100bps to 53.7%,

- EBITDA down from £5.2m to £5.0m,

- Adjusted PBT down from £3.1m to £2.8m; PBT down from £4.1m to £2.7m,

- Adjusted EPS down from 4.38p to 3.75p

Earnings are down but the company is still operating and investing in R&D. Production and design & development have remained open throughout the COVID-19 pandemic and Concurrent has not needed any help from the government.

Exports made up 91% of group revenue and the group has nearly completed the shutdown of its R&D facility in India, with functions transferred to the UK. Savings made from ceasing operations in the Indian office will largely be reinvested to increase and broaden the skills and technical expertise within the UK team.

Spending on R&D increased to £3.89m in 2020 (2019: £3.51m), of which £1.88m was capitalised (2019: £2.26m). The group is expanding its current range of advanced technology products with a particular focus on the OpenVPX™ bus architecture, featuring the latest Intel processors.

Concurrent's long-standing chairman Michael Collins retired from the board in September 2020 after some 31 years of service and has been replaced by Mark Cubitt. Collins remains a Major Shareholder.

Although short term trading appears to have disappointed the market, longer term there are some characteristics to like here and so the company could be worth monitoring.

The new chairman comments:

The Group's proven ability to adapt to the challenges brought about by the pandemic, the overhead savings from closure of the Indian design office, its ability to provide a well-supported, UK designed and manufactured product, and the current record order book, which has seen a substantial increase during the first quarter of 2021, gives the Board confidence in the Group's continuing solid performance.

The group’s order book has seen a significant increase during the first quarter of the new financial year and its telecoms business is back in growth after last year's second half slowdown.

Conclusion

There are a couple of things I look out for here, namely:

- Founder owner (Collins has now stepped down but he retains a c6% shareholding),

- Stable shares in issue over time,

- Net cash position over time,

- Double digit operating margins and returns on capital,

- Compound annual revenue and earnings growth,

- Steadily increasing and well covered dividend payments.

But there are also some concerns. Obviously, Concurrent has disappointed the market today and it looks like results can be volatile from one year to the next. Profitability metrics look to be trending downwards recently, which is a worry.

The group also consistently spends a fair amount of capex. That’s not always a bad thing, as long as the company is spending on future growth rather than just spending lots of cash to maintain existing operations.

Concurrent is looking to grow organically and via acquisition in order to increase its potential share of the total available market. Its markets are still exposed to Covid disruption but on balance there’s enough about the group to warrant a closer look.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.