Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

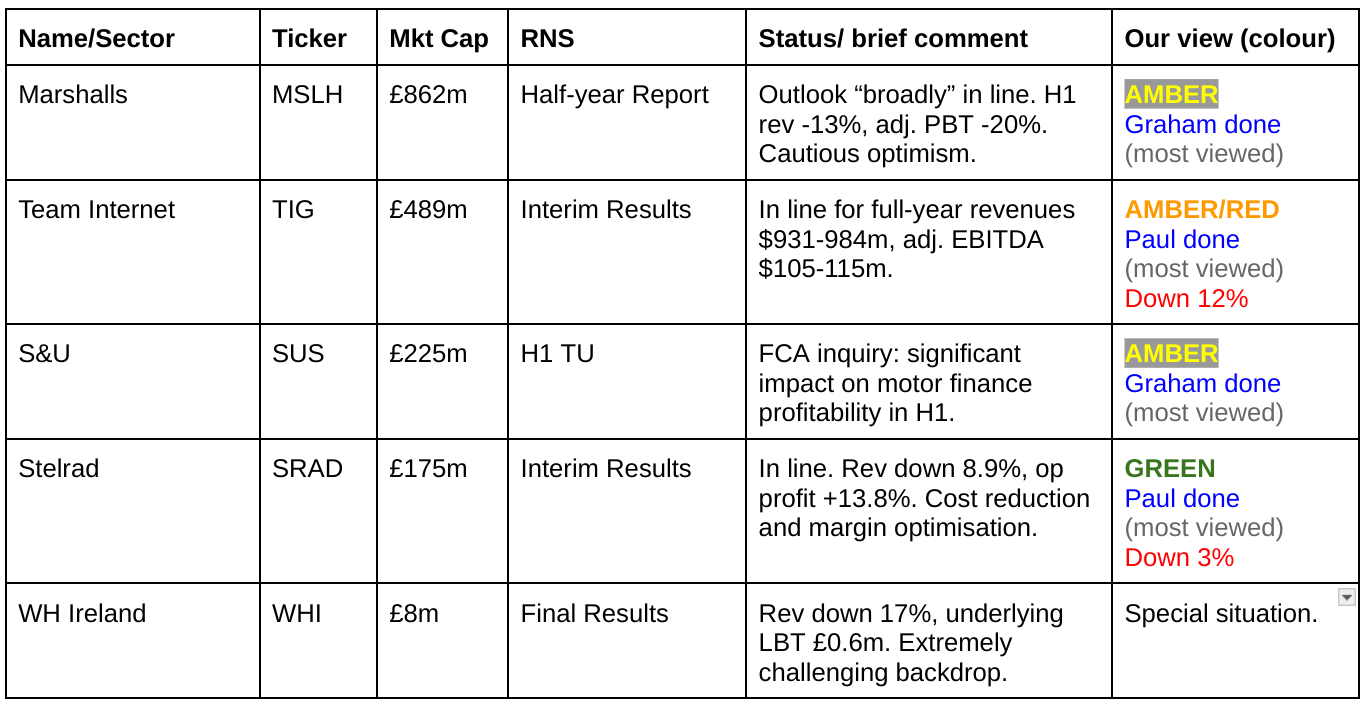

Companies Reporting

Summaries

S&U (LON:SUS) - up 0.5% to £18.95 (£230m) - Trading Update - Graham - AMBER

Plenty of optimism from management here that performance will rebound in H2. I’m a long-term fan of this business and I believe and expect that they will emerge in good shape, but I wish to remain disciplined while the Skilled Person Review/FCA inquiry is ongoing. I’m also a little concerned by the company’s high utilisation of its existing debt facilities (£240m out of £280m), and the large drop-off in up-to-date collections.

Marshalls (LON:MSLH) - down 1% to 336.8p (£852m) - Half-year Report - Graham - AMBER

Unpleasant numbers with more negative operational leverage dragging on profits. Full-year results are expected “broadly in line” (i.e. a slight miss). More positively, net debt and the leverage multiple have reduced slightly. I do like this company but it seems to me that the wider investor community shares this positive view and has priced the shares at an accordingly high level.

Stelrad (LON:SRAD) - down 2% to 137p (£174m) - Interim Results - Paul - GREEN

I maintain my positive view of this maker/distributor of radiators. Improved operating margins have offset reduced revenue in H1, which is impressive. The balance sheet isn't perfect, with more debt than I'd like, but half is supported by freehold property. A reasonable PER, and a good dividend yield, plus there should be decent further upside on SRAD shares once its markets recover.

Team Internet (LON:TIG) - down 15% to 162p (£420m) - Interim Results - Paul - AMBER/RED

A rather questionable business model, in my view - will profits be sustainable long-term? Very weak balance sheet, with far too much debt, hence why divis are only small. It's been doing share buybacks using increased debt, which I disapprove of. I am biased against this sector, as I've seen many internet-based advertising companies go badly wrong.

Paul’s Section:

Team Internet (LON:TIG)

Down 15% to 162p (£420m) - Interim Results - Paul - AMBER/RED

We’re overdue a review of this collection of businesses that has often struggled to explain clearly what it actually does, as you can see below -

“Team Internet Group Plc (AIM: TIG, OTCQX: TIGXF), the global internet company that generates recurring revenue from creating meaningful and successful connections: businesses to domains, brands to consumers, publishers to advertisers, is pleased to announce its unaudited financial results for the six months ended 30 June 2024 ("H1 2024").”

About a third of net revenue comes from selling domain names. The remaining two thirds comes from online marketing, which seems to be advertorial and review websites - which doesn’t appeal to me, as I’ve seen so many online marketing companies go badly wrong in the past. These businesses tend to be vulnerable to changes in algorithms by eg google, so it’s a space I’ve tended to very much avoid. Shares in this area often look superficially cheap, with low PERs, often with rather opaque accounts.

Its previous name was Central NIC (CNIC), since changed to Team Internet.

I last reviewed it a year ago, here on 14/8/2024 H1 2023 results, coming out moderately negative at AMBER/RED, due to balance sheet & debt concerns, also whether its business model is sustainable?

The company’s headline sounds perky, so why are its shares down 15% today? -

“Year-on-year growth in all key financial metrics including a 7% increase in net revenue, 13% increase in operating profit and an 8% increase in profit before tax”

Profit -

“Profit before tax increased by 8% to USD 14.4m (H1 2023: USD 13.3m)

Adjusted EPS (diluted) increased by 12% to USD 10.74 cents (H1 2023 restated(iii): USD 9.63 cents)”

That doesn’t sound a lot for a company valued at £420m.

Although there is a large amortisation charge, which Zeus adjust out in their useful note today, with est. adj PBT of $92.8m for FY 12/2024. Zeus says that TIG is the cheapest tech share in its index.

Outlook - is in line -

"Team Internet has once again delivered a strong quarter, with growth in both adjusted and statutory earnings. Although the Group prioritises earnings growth over top-line growth, a robust 9% organic revenue growth has been maintained on a pro forma basis for TTM 2024. Adjusted EBITDA conversion remained healthy at 48% (H1 2023: 49%) of net revenue, demonstrating continued strong profit margins.

The Directors remain confident in the Group's strategic investments in product innovation, vertical integration, and international expansion. These initiatives have positioned the Group for success. Given these strong foundations, the Directors are confident that the Group will meet market expectations for the full year.(vi)”

Balance sheet - remains weak. NAV is $142m, but that includes $338m intangible assets. So NTAV is horrible, at negative $(196)m. That rules this share out for me.

Cashflow statement - all of the cash generated in H1 was spent on an acquisition. So this means that shareholder returns of divis & buybacks, were funded through increased debt. I’ve flagged before that I think with its highly indebted balance sheet, TIG should not be doing share buybacks funded through debt.

Interest on the heavy debt burden in expensive too, at around $12m pa.

Director trades - seem to mainly be M Royde buying, who is connected to major shareholder Kestrel who own 25.8%. Note that Slater are also involved here, with 11.6%, so some heavyweight investors clearly like this share.

Other Directors have been sellers though, with several £7-figure Director sells in recent years.

Paul’s opinion - my concerns are unchanged - a weak, heavily indebted balance sheet mainly. Also I just don’t rate this sector at all - these internet advertising businesses can be very vulnerable to changes that are outside of their control. It tends to be a fast-moving space, where business models can wither away, or suddenly collapse. Hence they are often doing M&A, trying to find the next big thing. Note that dividends are negligible, and they have to ask the permission of the bank to pay them.

This might infuriate some readers, but I’m sticking with AMBER/RED, due to my various concerns.

On the upside, the fwd PER of 8.7x does look superficially cheap, if you’re happy to ignore the weak, indebted balance sheet.

Also shares have done OK long-term, roughly tripling since the 2019 lows.

Stelrad (LON:SRAD)

Down 2% to 137p (£174m) - Interim Results - Paul - GREEN

Stelrad Group plc ("Stelrad" or "the Group" or "the Company", LSE: SRAD), a leading specialist manufacturer and distributor of radiators in the UK, Europe and Turkey, today announces its unaudited interim results for the six months ended 30 June 2024.

Strong performance; on target for full year outlook

Checking my previous notes this year -

29/01/2024 - AMBER/GREEN at 128p - in line TU & fairly upbeat outlook. Looks well set up for a sector recovery. Main downside is high debt.

11/03/2024 - GREEN at 112p - FY 12/2023 Results - looks a nice cyclical recovery value share.

SRAD was a 2021 float - the infamous year when brokers killed the UK IPO market by floating overpriced and often poor quality companies. SRAD was certainly an over-priced IPO, but it seems a decent quality company to me, priced attractively (PER 9.8x and 5.5% divi yield, and although debt looked high so I’ll check that carefully now) -

The latest H1 results show a story of reduced revenues, but offset by a higher operating margin, leading to adj PBT and adj EPS (my preferred measures) flat at £8.1m and 6.3p. This is just H1 remember, so full year numbers are about double -

I see net debt has come down 8%, but still looks high at £64.6m. The commentary says June half year end is a seasonal high for working capital, so debt should be reduced by Dec year end. Debt is more expensive now of course, note that in 2023 finance charges consumed 28% of operating profit.

Maybe it should cut the divis to de-gear faster? Although a gearing multiple of 1.49x is not in danger territory.

Summary/outlook -

"Stelrad's performance during the period, particularly in terms of market share growth and growth in contribution per radiator, combined with cost base reduction and ongoing margin optimisation actions, demonstrates the strength of our business model, and further underpins the Board's confidence in the outlook for the full year.

"Stelrad remains well positioned for a sustained period of profitable growth as markets recover across our core geographies, with the Group well placed to benefit from strong underlying replacement demand across Europe and the long-term regulatory tailwinds for decarbonised, energy-efficient heating systems."

The Group's outlook for the full year remains unchanged with the Board remaining confident in its long-term growth plans.

While challenging economic conditions across the Group's key territories have begun to show indicators of easing, interest rates remain elevated, which continues to subdue both RMI and new build markets for now.

There have been some early indicators of a recovery in the volumes in some of the Group's European territories, with recent volume increases in Belgium, the Netherlands, Poland and Sweden.

Valuation - no broker notes are available I’m afraid, but we do have the broker consensus figures on the StockReport, showing 12.7p for FY 12/2024 and 15.2p for FY 12/2025. We shouldn’t go crazy on the PER multiple to apply, due to significant net debt. So I’d be happy with 12x, hence a price target for me of 152p, rising to 182p on 2025 estimate.

Hence the current share price of 137p looks reasonable, and should have further upside as its markets recover hopefully in 2025, which is what the UK housebuilders are telling us to expect.

Balance sheet - NTAV is £50m.

It’s a capital-intensive business, with £82m in fixed assets. Checking note 17 in the 2023 annual report, I’m delighted to see freehold property of £31.5m. I often offset this against net debt, so looking at it this way, almost half the net bank debt is supported by freehold property assets.

Inventories seem high at £70.5m, which works out at just over a third of full year cost of sales. So a question to ask management would be whether they are holding too many stock lines, and if the business could be run more efficiently and at lower borrowing costs by slimming down the large inventories?

Gross long term bank debt of £89.6m stands out as too high for comfort.

Overall then I find the balance sheet a little troubling, but it’s not a deal-breaker.

Cashflow statement - impresses me. SRAD is managing to not only service its high debts, but also gradually reduce them, whilst funding capex and generous divis. This looks a decently cash generative business. Although as its markets recover, more cash could be sucked into working capital in future, hence why I’d like to see a greater focus on keeping inventories under tighter control.

Paul’s opinion - I’m happy to stick at GREEN.

This strikes me as a good candidate to add to the research list for building supplies companies that should benefit from a cyclical upturn in their markets.

SRAD seems sensibly priced, with pretty good potential upside, and seems to have traded well, improving margins, despite tough macro conditions. That’s very much what I look for in cyclical recovery investments.

We also have the comfort of a very high StockRank -

Graham's Section

S&U (LON:SUS)

Up 0.5% to £18.95 (£230m) - Trading Update - Graham - AMBER

S&U PLC, the specialist motor and property finance lender, today issues its trading update for the period from its AGM statement on 6 June 2024 to 31 July 2024. S&U will announce its half year results on 8 October 2024.

We had a good discussion here on the topic of Jarvis Securities (LON:JIM) and its FCA-ordered “Skilled Person Review” last week.

The experience with JIM has taught me to treat Skilled Person Reviews with the utmost caution from a shareholder perspective.

S&U is also in the throes of this type of review, although it can’t bring itself to use the phrase Skilled Person in today’s H1 trading update.

This review was announced back in December, causing me to reluctantly switch to a neutral stance on this stock.

I’m glad that in this case at least, I seem to have found the necessary caution:

Let’s get into today’s update.

Firstly, on the subject of the review itself.

S&U has restrictions on its ability to trade during the review, however: “constructive but vigorous negotiations [are] taking place to remove the restrictions, which are now nearing their conclusion”.

S&U expect a “sensible and proportionate conclusion” to the process.

They berate the regulatory regime and urge Labour ministers to deliver change.

Motor Finance (Advantage Finance):

“ restrictions on managing customer arrears and on repossessions have seen a year to date level of 87% repayments to due, from 94% last year”

“Up-to-date live receivables have fallen to 69% of the total, from 79% last year, although a release from current restrictions should see a bounce back in the second half of this year.”

At the AGM statement in June, we were told that collections in Q1 were 87.7% of due. With a year-to-date level of 87%, that suggests a slight deterioration.

The “up-to-date live receivables” figure of 69% is scary to me, since that is a drop of 10% (from 79% last year) and the total receivables book here is £327m. So there’s £30m+ of additional receivables that have a question mark hanging over them.

Property Lending (Aspen Bridging)

This division is unaffected by the FCA review and it continues to grow:

..A firming residential property sector, a recent fall in interest rates and a youthful and dynamic team have seen record profits achieved in June (more than double last year) followed by good results in July too…

The Aspen loan book now stands at around £149m (31st July 2023: £104m).. The deal pipeline is good and we anticipate further steady growth in the second half of the year. Credit quality remains excellent…

I’ve always valued S&U on the basis of prospects at Advantage, but perhaps it’s time to start treating Aspen as a major division with long-term prospects that could rival Advantage?

Borrowings have increased to £240m (vs £224m at year-end Jan 2024, £184m a year ago).

This is said to be “well within current committed facilities available of £280m”, but the way I see it, S&U is using 85% of its facilities and this should start to ring alarm bells. I’d prefer if the company had facilities of £300m+ right now.

Chairman comment:

"Although current trends at our Advantage, our motor finance business are undoubtedly challenging, we thrive on challenges and work for a significant rebound in the second half. By contrast, Aspen continues to trade sensibly and at record levels. We remain confident and determined for the year ahead."

Graham’s view

The share price hasn’t moved today, and management appear confident around prospects in H2.

Personally, I can’t be budged from a neutral stance. Scarred by the events at JIM, I don’t have faith that the Skilled Person Review will end shortly and that business will be back to normal very quickly - although of course I hope that happens.

In terms of the substance of the review, it’s worth reminding ourselves that S&U is not at risk of regulatory action with respect to discretionary commissions (whereby brokers could historically receive higher bonuses for selling loans at higher rates).

Instead, it’s about Consumer Duty and how Advantage Finance treats customers in financial difficulty. As I understand it, the entire sector is under review on this front.

Fortunately, from what I can gather, Advantage Finance are best-in-class when it comes to how they treat customers in financial difficulty.

They have 4.7 out of 5 on Trustpilot from nearly 4,000 reviews, and here is the most recent one:

I still believe that Advantage Finance treats customers very well, and I would be shocked if their longstanding collection practices were inconsistent with Consumer Duty.

However, until the FCA agrees, I will hold back from changing my stance.

The shares do offer some value for those who wish to the plunge right now, but they aren’t at distressed levels.

Marshalls (LON:MSLH)

Down 1% to 336.8p (£852m) - Half-year Report - Graham - AMBER

Marshalls plc, a leading manufacturer of sustainable solutions for the built environment, announces its results for the half year ended 30 June 2024.

I covered full-year results for this stock in detail back in March.

Today’s interim results show continued deterioration, although the company describes it like this:

Resilient Group performance in weak end markets, with the impact partially mitigated by decisive management actions and the benefit of our diversification strategy.

There has been a 19% like-for-like revenue decline in the company’s main division, Landscape Products, where weak demand resulted in both lower volumes and pressure on pricing.

Building Products saw a 6% fall in revenues, while Roofing Products was down 5%.

Demand from new building housing and private housing RMI (repair, maintenance and improvements) is described as particularly weak. Commercial/infrastructure demand, by contrast, seems relatively robust.

The full-year result will be “broadly in-line” with previous expectations, which as we know is management-speak for a slight miss.

The results table:

The company had already suffered negative operating leverage last year (i.e. profits falling at a faster percentage rate than the fall in revenues) and that remains visible today.

On the bright side, net debt (excluding leases) reduces from £185m a year ago, to £173m at the most recent financial year-end six months ago, to £156m today - a nice progression.

The company calculates its leverage multiple at 1.8x. I’m impressed that this has fallen slightly from 1.9x at year-end, despite the fall in profits (when profits fall, this tends to increase the leverage multiple).

Dividend: showing no signs of panic, the company declares an unchanged interim dividend of 2.6p that is well-covered by earnings (H1 EPS was 6.4p).

Outlook:

The Board remains cautiously optimistic of a modest recovery in its end markets during the second half of the year predicated on a progressive improvement in the macro-economic environment.

Against this backdrop and with the benefit of decisive management actions taken in 2023, the Board believes that profit and pre-IFRS16 net debt for the full year will be broadly in-line with its previous expectations.

CEO: the new CEO has been in place for six months, and is working on a new 5-year plan to be outlined in November.

Adjustments: I complained that the full-year results were unclean and involved too many adjustments.

So it’s only fair that I acknowledge a huge reduction in the adjusting items in this H1 report.

In H1 last year, adjusting items added up to £15m. For the full-year, they were nearly £30m.

In H1 this year, they have only added up to £5m. There were no restructuring charges this time, and no impairments - great news and well done to management for giving us cleaner numbers to work with.

Graham’s view

I’m inclined to leave my neutral view unchanged on this one. I do have a favourable impression of this company and it strikes me as a good way to bet on positivity: if you have a sunny outlook when it comes to the consumer, the housing market, and interest rates, then owning MSLH is probably a fine way to express that view.

But for me, the shares already price in quite a lot of positivity:

When conditions improve, operating leverage should start to work positively again and we should see profits soar back to prior levels, but again I think this is already to a large extent priced in.

The shares are already up 25% since I expressed a similar view in March, so maybe I’m just not getting it?

One important feature I should point out: this is larger than the typical company we look at here - it’s a FTSE-250 stock with blue-chip investors on the shareholder register ("abrdn", BlackRock, AXA, Vanguard).

With names like this on the register, who in recent times have been buyers of the stock rather than sellers, perhaps it’s unrealistic to expect to get bargain pricing. But that only strengthens my sense that there are probably easier ways to find value than to get involved here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.