Good morning from Paul & Graham!

This week should be interesting. We had snow yesterday, and then rail strikes kick in from tomorrow. So I imagine most of the country is likely to be in chaos. Here's our back garden in London yesterday - rather lovely, especially as it's so rare here. It normally looks the same, but without snow.

Podcast - went up on Saturday, covering loads of companies. The mystery shares (my best ideas of the week) will follow further down in a short section below. I've got to work out a better way of doing this, but I tend to make it up as a I go along, and structure follows later.

Mello Monday - it's the last show of the year, online today, starting at 5pm. Paul Hill is doing a presentation with some stock ideas, he's always brimming with interesting ideas, and has a fantastic personal investment track record, so well worth listening to. Also there are 3 company presentations.

Agenda

Paul's Section:

Totally (LON:TLY) [quick comment] - announces a big contract win, for £66m, over 5-8 years. Totally looks an interesting company I think - providing outsourced services for the NHS in specific areas (this latest contract is to operate urgent treatment centres, to relieve the pressure on A&E Depts, which sounds extremely useful). Although Totally has a good growth track record, it’s not made anything much in the way of profit - this seems low margin work, won in competitive tenders. If the company can raise margins, then the shares could become more interesting. EDIT: Thanks to StrollingMolby, who points out in the comments below that this is replacing existing contracts, and we're not told if it's on better, or worse terms. So impossible to tell if this is good news or not. (no section below)

Tristel (LON:TSTL) - an encouraging update from this niche medical disinfection products company. A decent H1 performance suggests that it might be heading for a full year beat against expectations. Cash is fine, with £10m on hand. Valuation is the tricky bit - it still looks over-priced to me.

CentralNic (LON:CNIC) - a positive trading update, the CFO steps up to become the new CEO, and it suggests share buybacks are on the cards - which seems a strange decision considering its weak balance sheet, and large gross debt. I've had another look through the last Q3 results, and am starting to get a bit more comfortable with the numbers.

ENGAGE XR Holdings (LON:EXR) [quick comment] - I’ve got to cover this, as it’s a top faller, down 46%. The short version is - don’t waste your time looking at it. Net cash was E4.9m at June 2022, it’s now expected to be down to only E1.9m at Dec 2022. A heavy EBITDA loss of almost E6m is expected for 2022, as orders have failed to come in as expected. So the cash burn means it’s only got enough to keep going for a few months in 2023. Costs are being cut, and another fundraise now looks inevitable. What discount will be demanded by anyone willing to put in fresh cash? Delisting also looks inevitable. I wouldn’t touch this with a bargepole. Going into a recession, jam tomorrow companies have to be fully funded, otherwise they're likely to fail. (no section below)

Graham's Section:

Argo Blockchain (LON:ARB) (£32m - suspended) - this looks like it might be reaching a conclusion. Its shares were suspended from trading on Friday, without explanation, on the same day that it issued its monthly operational update for November. The operational update was grim: mining margin reduced to 29% (a figure which doesn’t include the cost of mining machines) even as the company mined fewer bitcoins. More crucially, there is still no sign of financing, and without fresh funds, “Argo would become cash flow negative in the near term and would need to curtail or cease operations.” Funds are needed to cover its “present requirements”. This is crunch time: it should imminently announce either a deal, or that it is giving up and changing strategy (which will surely spell bad news for shareholders). While it’s impossible to know with any degree of certainty, I imagine that the likelihood of a total wipeout for the existing equity grows stronger for every day that passes without a deal announcement.

Argentex (LON:AGFX) (£148m) - this FX broker floated in June 2019 at 106p per share. Revenues have approximately doubled since then, but the company’s share price hasn’t, and valuation now looks far more reasonable to me. Furthermore, trading momentum is superb as the company again raises its expectations for the current period, in a short trading update. While not all of the factors behind its recent success are attributable to its own decision-making, I think that most of them are. It is now forecast to generate nearly £50m of revenues in FY 2023, with adjusted PBT of £10.7m.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Tristel (LON:TSTL)

360p (pre market open)

Market cap £170m

Trading Statement (AGM)

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products, will hold its Annual General Meeting at 11am…

The current financial year is FY 6/2023.

H1 revenues expected to be £17m+ (up from £15m H1 LY)

Growth in all geographies.

Gross margin in line.

Cash position very healthy at £10m (with no debt) - I’ve always liked TSTL’s strong balance sheet, so shareholders never have to worry about liquidity, and it pays modest divis (yield just under 2%).

Update on North America -

"With respect to North America, we have made our first sales in the United States and Canada, and we are preparing the additional data requested by the FDA in September. We expect to submit it in March next year, meeting the FDA's deadline and facilitating a decision from the agency around our year-end in June. We remain confident of a successful outcome.

Broker update - Finncap issues a short update, thanks for that. Forecasts unchanged, but it points out that historically TSTL tends to have a small H2 weighting to revenues, which implies that it could beat existing forecast, which is £34.2m revenues, £6.0 PBT, and 10.7p EPS (higher than Stockopedia’s consensus of 9.75p). So it sounds like 11-12p might be a sensible guess for FY 6/2023, I reckon.At 360p (pre market open) that’s a PER of 30 times, on the most optimistic figure of 12p. Hardly a bargain - we’re being asked to pay up-front for considerable future growth.

My opinion - TSTL is a nice steady little company, generating modest long-term growth. It sells small amounts in lots of territories. So it perplexes me as to why investors think the long-awaited breakthrough into the large US market would be worth paying such a premium for? It’s notoriously difficult for overseas companies to break into the US, and it costs money to set up a sales network, promote the products, etc.

Shares remain significantly over-priced, in my opinion, for a company that looks sound, but not madly exciting.

Do these figures below justify the £170m market cap and high PER? I don’t think so.

Mystery Shares

These are my best ideas from the week's news, exclusively for Stockopedia subscribers, hence referred to as "mystery shares" in my free podcasts.

Last week's were -

Hargreaves Services (LON:HSP) - see Tuesday's SCVR here

Oxford Metrics (LON:OMG) - see Wednesday's SCVR here

MS International (LON:MSI) - also in Wed's report.

Obviously these are not recommendations, and I've no idea what the share prices will do. But they struck me as the most interesting value/GARP shares from the ones I reviewed in the week. Hence it might save you time, to flag up the best ideas in this way, if you're looking for new share ideas to research properly yourself (remember we only do quick reviews here, which are not necessarily comprehensive).

CentralNic (LON:CNIC)

136p (up 4% at 10:16)

Market cap £393m

Trading Update (leadership change, and share buyback)

CentralNic Group Plc (AIM: CNIC), the global internet software company that derives recurring revenue from marketplaces for Online Presence and Online Marketing services, is pleased to announce the appointment of Michael Riedl, currently Group CFO, as Group CEO with immediate effect. Michael succeeds Ben Crawford, who retires from the board today.

Trading update is positive -

…we are delighted to confirm that trading has remained robust since then and would now expect a full year outcome at least in line with the upper end of market expectations1. We will announce our Q4 trading update on 30th January 2023.

1 [1] Analysts forecasts as of 21 November 2022 are within a bandwidth between USD 701.0 million and USD 709.6 million for FY22 revenue and between USD 80.0 million and USD 84.1 million for FY22 EBITDA.

Checking back to the recent Q3 results, it made adj EBITDA of $62.0m, so today’s announcement implies c.$22m EBITDA in Q4, which looks a similar run rate to the 3 previous quarters (just under $21m per quarter, on average).

EBITDA of $62m for Q3-YTD turned into PBT of $21.0m, so a big difference there. The reasons for the difference are mainly quite a high finance charge (mostly debt interest), and a big amortisation charge. I’ve done some digging on this, note 14 of the 2021 Annual Report gives a breakdown of the amortisation charge, but it’s difficult to ascertain precisely what it relates to, and if this is related to acquisitions (in which case it can be disregarded), or internally capitalised costs (in which case it’s an important cost that needs to be taken into account).

Given this vagueness, I’ve checked to see if it’s capitalising a lot of internal costs, and the good news here is that no, it’s not. The 9-month cashflow statement shows only $0.6m of regular capex, and $3.6m of intangibles capitalised - i.e. not very much for the size of company.

Capital allocation - this is interesting, and sounds like a change of direction, to ease back on M&A activity, and instead focus on deleveraging and share buybacks -

The business is highly cash generative which has allowed the Company to successfully execute its M&A agenda and at the same time improve its net debt position. Having achieved these two objectives we now intend to launch a maiden share buyback before the year end with details to be communicated shortly.

Looking forward we will review our approach to cashflow deployment within the business and expect a greater focus on returns to shareholders versus M&A.

I think the reducing M&A, and deleveraging sound sensible options, but cannot see how share buybacks make sense whilst it has only recently refinanced its borrowings, which are substantial at $250m (gross) until Oct 2026, refinanced onto a lower interest rates (hedged with Swaps) recently.

My opinion - having spent a bit more time going through the numbers today, I’m getting a lot more comfortable with this share. Lots of acquisitions in the past have muddied the water, and made the accounts difficult to understand. However, it does look as if there’s a decent, cash generative business here.

I dislike the very weak balance sheet, with heavily negative NTAV. However it is a capital-light business model, in that there’s hardly any PPE (fixed assets), and also negligible inventories. Hence this type of business should be able to operate fine with little balance sheet strength. That said, I’m not keen on debt, which seems excessive. There again, the banks have happily refinanced it recently, with $250m facilities, at a lower interest rate, so they must be happy, and will presumably have gone through the numbers with a fine toothcomb.

Stockopedia is showing a forward PER of 8.3, possibly reflecting investor concern over high debt, a weak balance sheet, and accounts that are quite complex & hence difficult to understand. If they pause acquisitions for a while, I think that would be a good thing, so that we can see a clean set of numbers, without lots of adjustments.

Overall then, I’m not quite ready to give it a thumbs up, but am starting to lean in that direction, and think it looks a potentially interesting share that would be worth you spending some more time looking into. Could this be a GARP (growth at reasonable price) share? It's possible, the numbers do seem to be pointing towards that.

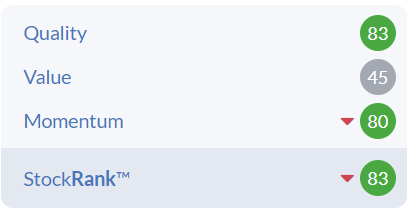

Stockopedia likes it, with a high StockRank -

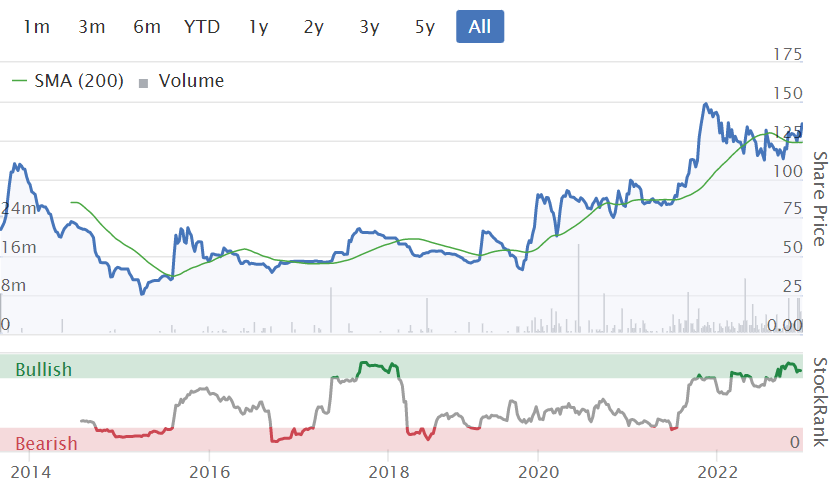

The long term chart below looks pretty decent to me - not too many gyrations, and moves up in steps, which seem to hold each time - which you often see at companies which are performing reliably well, without downside surprises -

.

Graham’s Section:

Argentex (LON:AGFX)

Share price: 130.44p (+10%)

Market cap: £148m

This FX broker’s stock was already enjoying excellent momentum prior to today’s trading update:

It has already raised full-year expectations in October, and followed that up with robust interim results in November.

Today we learn of “continued improvement to its trading”, as strong momentum has been maintained. Revenue and earnings for the current year will be ahead of current market expectations.(Note that the “year” is only nine months long, from March to December, after the company changed its reporting timeline.)

Everything is going according to plan:

The Group's growth strategy continues to deliver results with robust trading across all products and geographies. This includes our core FX offering benefiting from market tailwinds, sustained outperformance from our new Amsterdam office, continued optimisation of product mix including structured solutions and growth in client numbers in the online platform.

I would caution that the market tailwinds - unusual currency movements and unusually strong public interest in exchange rates - are beyond the company’s control and can’t be counted on as a permanent fixture.

However, the other factors cited as contributing to the company’s success are things that the company itself can take responsibility for: expanding to Amsterdam, selling more advanced, higher margin products such as options, and growing the number of clients on its online platform. All fine achievements!

I continue to rate this stock currently as my favourite listed FX broker, and I also believe that it has grown into its IPO valuation and can potentially offer decent prospects from here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.