Good morning!

Stocks on my radar today are (thanks for the suggestions):

- GAME Digital (LON:GMD) - deal with Sports Direct and new loan facility

- Sosandar (LON:SOS) - revenues for Dec/Jan ahead of expectations

- IQE (LON:IQE) - more announcements

- Lok'n Store (LON:LOK) - trading update

- Proactis Holdings (LON:PHD) - trading update

- UP Global Sourcing Holdings (LON:UPGS) - profit warning

Cheers!

Macro/portfolio view - the FTSE has been strong today, up 1.3%. I still think we are in for a period of extended volatility and probably some more big downward swings. As was pointed out on ZeroHedge last week, portfolio management models are going to have to be updated for the huge upswing in VIX (volatility) last week, which will make institutional investors more careful. Retail investors, too, are likely to be anxious in the immediate future.

I am trying to be disciplined, and dealing with the volatility by placing limit order bids for stocks I'm interested in at prices which I think are attractive. I put a bid in for Creightons (LON:CRL) last week, which somebody hit, so I now own a few shares in that company. At the other end of the market cap spectrum, I also own shares in British American Tobacco (LON:BATS), and have a bid under the market to try to buy more.

GAME Digital (LON:GMD)

- Share price: 41.7p (+10%)

- No. of shares: 171 million

- Market cap: £71 million

Collaboration agreement and new borrowing facilities

GAME is the high street retailer which many of you are familiar with.

Sports Direct (i.e. Mike Ashley) already owned 26% of GAME, and now extends its involvement as follows:

The Collaboration Agreement covers the rollout of BELONG and GAME Retail Limited ("GAME Retail") stores, including plans to enter into concession agreements with Sports Direct, pursuant to which BELONG arenas and/or GAME Retail stores will be sited in selected Sports Direct locations.

BELONG is the e-sports brand which was developed by GAME.

Checking October 2017 figures, Sports Direct has 500 stores in the UK. That's a wide selection of possible new locations for BELONG/GAME.

The details are a bit tricky: Sports Direct is buying 50% of BELONG's intellectual property for £3.2 million and is entitled to 50% of the profits of all BELONG venues (whether in a Sports Direct store or in a GAME store, or as a standalone venue) and 50% of the profits of GAME stores located within Sports Direct stores.

Reading through the announcement, it sounds like it would be more convenient for all involved were Sports Direct to buy the entire GAME group. For now, the two companies will be sharing the responsibility to select new venues to open.

My opinion: If I was a GAME shareholder, I think I'd have mixed feelings about this. £3.2 million isn't very much compensation for half of the e-sports business, which was supposed to be GAME's most exciting growth channel.

The other thing is about funding: it will be GAME's responsibility to fund the opening of new BELONG venues, but it will have to give half of the profits to Sports Direct. Is that fair compensation for Sports Direct providing retail space? It's true that Sports Direct will help with funding by providing £55 million in debt facilities, but GAME will have to pay interest to Sports Direct of 2.5% over the Barclays base rate in order to use it.

Given that Sports Direct is a major shareholder of GAME and a much more valuable enterprise, I would be concerned that it might be dominating proceedings a little bit. I'd much rather see it gain control and more of a profit share in GAME by putting in a bid for the rest of the shares of GAME, frankly.

On the positive side, the growth which the two companies could achieve in cooperation with each other could make it all worthwhile. We don't know yet how big GAME's expansion into Sports Direct might be.

Conclusion? This is a special situation, with unprofitable GAME stores probably shutting down over the next few years as more games are streamed online, and more of the focus moves to the BELONG arena activities.

I honestly don't know what I'd pay for shares in GAME Digital (LON:GMD). It's a bit like the newspapers we covered last week: the industry won't be around in its current form forever. It's just about managing the decline/transformation.

This deal with Sports Direct is an imaginative way to manage the transformation. Will people want to buy or play video games inside Sports Direct stores? I am trying to picture it, but I'm not sure.

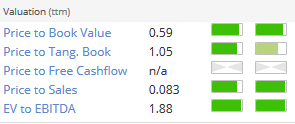

Shares are "cheap", of course. Maybe if they are at a discount to tangible book value, to account for store closing costs, they are worth another look?

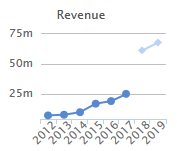

Sosandar (LON:SOS)

- Share price: 16.5p (+5%)

- No. of shares: 16.8 million

- Market cap: £18 million

This online womenswear brand, managed by former magazine executives, reversed into an AIM cash shell last November.

I commented on the previous update (share price at the time: 18p), when it said that sales from September to November were ahead of management expectations. It did not quantify this.

It does it again today, saying that revenues in Dec-Jan were exceeding management expectations, without quantifying it.

So we know that the company is doing brilliantly. We just can't say for sure how brilliantly it is doing.

Original broker forecasts shared by Paul predicted that revenues would be £1 million in the current year (ending March 2018), then £3.3 million in 2019, and £9.4 million in 2020, when it would make a small maiden profit.

Given that management would have had some input into those forecasts, and that revenue has been ahead of expectations ever since those forecasts were made, presumably it is on track to beat those original forecasts by a decent margin this year?

With two ahead-of-expectations updates, I'm intrigued. Maybe there is some excellent underlying momentum? And wouldn't it be more logical if the share price was higher now than it was after the previous update?

Unfortunately, it's still too early-stage to get a decent Stockrank. It's firmly in the high-risk/high-reward end of the market.

The company shared a link to one of its brochures in the announcement today - see here (external link).

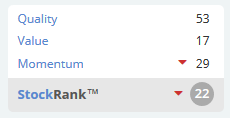

IQE (LON:IQE)

- Share price: 108.5p (+8%)

- No. of shares: 756 million

- Market cap: £820 million

Statement from Cardiff Joint Venture Partner

I'm suffering from IQE-fatigue at the moment, as we've been covering it a lot here lately.

Last week, Muddy Waters said that IQE might have "taken advantage" of Cardiff University, in the deal in which IQE contributed equipment in exchange for its equity stake in their CSC joint venture.

My view on this, which I expressed in the SCVR on Friday, was that it didn't matter, even if it was true. As I said: "Unless relations with Cardiff University were to break down, is this a problem?"

Today, IQE prints a statement from Cardiff Uni.

Among other things, it states that IQE's contributions to CSC were independently valued, that CSC is "co-owned and controlled by Cardiff University", and that "the University is represented on the CSC board by appropriate qualified directors".

I think that puts to bed the idea that relations with Cardiff University have broken down or are going to break down. It could still happen, but there is no evidence for it.

In a separate announcement, IQE says that KPMG is replacing PwC as the company auditor. Furthermore, PwC has confirmed there are no matters which need to be brought to the attention of shareholders, etc.

Accounting is not an exact science and the complexities of how to account for joint venture are challenging even for seasoned investors. The bears raised some worthwhile questions.

However, at the end of the day, they did not produce a smoking gun. IQE shares might well be overvalued (and I believe that they are, based on the fundamentals), but we don't have hard evidence of any wrongdoing by IQE or any major flaw in the accounts. All we have are some interesting quirks in how the loss-making Cardiff joint venture has been accounted for.

The statement by PwC doesn't prove much, but it does help and it will be interesting to see if KPMG are inclined to make any changes to the accounting methods.

I continue to view the shares with a lot of caution, as do the Stockopedia algorithms:

RM2

- Share price: 1.05p (unch.)

- No. of shares: 407 million

- Market cap: £4 million

This high-tech pallet designer is below our market cap limit. I've covered it before, so I'd like to mention this for continuity.

It was about to run out of cash, but has found some under the sofa and will therefore survive "through the first third of the month of March, although this could vary".

Customer feedback has been positive (trials are ongoing), and discussions with potential funding partners continue.

I would bet on someone buying its technology, rather than pouring more money into the company as it currently exists. But stranger things have happened.

Even if the tech turns out to valuable, it listed on the stock market far too early, before it had the production facilities or the funding to see it through.

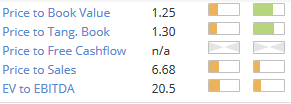

Lok'n Store (LON:LOK)

- Share price: 397.5p (+7%)

- No. of shares: 29 million

- Market cap: £117 million

This is a self-storage company which I am covering for the first time. It's not one that I'm familiar with.

I can't see any reference to market expectations, so I will presume from the share price movement that this H1 trading update is ahead of expectations.

- Like-for-like revenue up 6.9%

- Occupancy up 6%

- Six new locations in the pipeline

- Trading at new stores has been "excellent"

My opinion

While expensive on a PE basis, this is a property company better judged against its book value. Price to book ratios look like they might be justified against the improvement in trading and the growth prospects:

At the last preliminary results, the company reported net assets of £89 million (adjusted NAV of 416p per share). It was using net debt of just £17.4 million. If anything, I would suggest that it might be under-geared at those levels. It needs to use a decent level of debt in order to boost returns for shareholders, I think.

I haven't invested in self-storage before but it's a growing sector and must be outperforming the property market as a whole, as space becomes ever more limited in supply.

Proactis Holdings (LON:PHD)

- Share price: 181.5p (+7%)

- No. of shares: 93 million

- Market cap: £167 million

Trading update and notice of results

Proactis is a provider of business software. We have occasionally covered it in this report.

Trading for the six months to January 2018 was in line with expectations.

The percentage growth numbers presented have nothing to do with underlying/organic performance. The growth has been achieved through a large increase in the share count and through borrowing, to pay for the reverse acquisition of Perfect Commerce.

When that deal was announced, I opined that the SaaS sector as a whole was overvalued, which could explain how the $130 million valuation of Perfect had been achieved. In the previous year, Perfect had generated $3 million of operating profit.

The company lets us know today that since the deal (about six months), Perfect contributed £13.5 million of revenue and £3.7 million of adjusted EBITDA. We will have to wait to see how much operating profit this translates to. I still think the deal value looks on the expensive side.

The group as a whole is on track in terms of cost synergies, cross-selling opportunities and the order book/pipeline - good news.

Outlook statement is confident.

My opinion - I haven't got a strong opinion on this one. It could be a great company underneath, but I don't understand yet what differentiates it within its sector. I'm also concerned that it's going to be a complex story to follow after the reverse acquisition. I hope the forthcoming accounts are reasonably clean.

UP Global Sourcing Holdings (LON:UPGS)

- Share price: 33p (-46%)

- No. of shares: 82 million

- Market cap: £27 million

Trading Update and Notice of Results

Wow! Another nasty profit warning from this sourcer and supplier of branded products for retailers.

In September 2017, six months after listing on the Main Market (not AIM), it stunned investors with the news that revenue growth in the current financial year would be "unlikely". The share price halved, to about 100p.

The share price has drifted since then and almost halves again today with the following news:

- Unaudited Group revenues of £48.4m (H1 2017: £68.1m)

Revenue growth was indeed unlikely!

Macro factors are blamed along with the anticipated one-off delay of £4 - £5 million of revenue due to changed shipping arrangements with a customer.

There is more:

In addition, it should be noted that H1 2017 was an unusually strong period for the Group due to highly positive retailer sentiment (62% of FY revenue was delivered in H1 2017, as opposed to 53% and 54% in FY 2016 and FY 2015, respectively)

Bear in mind that the company was floated in H1 2017.

Last year, research commissioned by the company cited H1 growth as evidence of the attractiveness of the company's market positioning, predicting that revenues would grow to £120 million and EBITDA to £12.7 million in FY 2018

Here we are a year later, and the company attributes its H1 2017 success to unusually strong sentiment. EBITDA forecasts for the year are reduced to £6 million - £7 million.

My opinion

Firstly, this is a horrible turn of events for those who invested in the IPO (at 128p), expecting immediate growth.

However, with the share price just a fraction of that level now, it is arguably in true value territory. The brands owned by UPGS may not be high-end but they do sell at a small premium to retailer "own-label" products.

So there is some value at the core of this company, in addition to the supply chain expertise of the managers. Paul has dipped his toe in the water, and I agree that these shares are worth investigating.

That's it from me today! Cheers.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.