Good morning, it's Paul & Jack here with the SCVR for Monday.

Disclaimer -

A friendly reminder that we don’t recommend any stocks. We aim to cover notable trading updates & results of the day and offer our opinions on them as possible candidates for further research if they pique your interest. We tend to stick to companies that have news out on the day, and market caps up to about £700m. We avoid the smallest, blue sky type companies, and a few specialist sectors (e.g. resources, pharma/biotech).

A central assumption is that readers then DYOR (do your own research) and discuss in the comments below. The comments, incidentally, sometimes add just as much value as the articles. We welcome all rational views, whether bull or bear!

It's helpful if you include the company name or ticker within reader comments, otherwise some readers may not be aware of what company you are commenting on.

Mello Monday

Reminder that our favourite fortnightly online investor show is on again this evening. Full details here.

Agenda -

Paul's Section:

Science (LON:SAG) - another positive trading update from this interesting owner/managed technology group. I like it, valuation still looks reasonable, and all 3 divisions are trading strongly.

Quiz (LON:QUIZ) (I hold) - Q1 update shows strong growth against lockdown 1 last year comps. Gross margins high, and net cash has grown in the last quarter. Looks strikingly cheap to me, especially when compared with online-only ITS & SOS. Problem leases were ditched last summer in a pre-pack administration, so now QUIZ is only operating from cheap turnover rent sites on short leases. Illiquid share though, so it can be very difficult to buy or sell.

Photo-me International (LON:PHTM) - good performance in H1, driven by restructuring rather than much top line growth. Strong balance sheet. The big question mark is what the long-term profit outlook is going to be?

Jack's Section:

Secure Trust Bank (LON:STB) - impairments reduced once more and profits now expected to be materially ahead of expectations. The valuation currently looks undemanding given the positive news.

Uls Technology (LON:ULS) - residential conveyancing software provider has brought in some new senior hires and made a 'transformational' disposal that gives it net cash of £24m and an enterprise value of £28.2m on FY21 continuing revenue of £16.9m. Probably worth a closer look on valuation grounds but there's little to no mention of market position or the strength of competition.

Paul's Section

Science (LON:SAG)

400p (Friday’s night close) - mkt cap £165m

Science Group is an international, science-led services and product development organisation with a significant freehold property asset base. Following the Frontier acquisition in 2019 and the natural evolution of the services operations, the Group now comprises three divisions: R&D Consultancy; Regulatory & Compliance; and Frontier Smart Technologies ('Frontier').

[Paul: extracted from final results statement, issued 9 March 2021]

Background - as usual, I’m re-reading my previous notes on the company to get up to speed -

Here on 9 March 2021 I awarded the company a “looks interesting” view, on positive results for FY 12/2021.

Here on 19 May 2021 it got an upgrade to the coveted SCVR “thumbs up” view, on a positive trading update. Like many companies, it did mention supply chain issues, but despite that H1 profit guidance was +30% on the previous year’s H1 (a strong comparator).

Other key positives for SAG are: owner/managed business (lots of skin in the game), and freehold property on the balance sheet. No dilution during the pandemic, another key thing to check at the moment.

The share price is quite unusual, in that it’s had an excellent run (remember that shares doubling is normally quite unusual, we’ve been spoilt in the last year with a one-off powerful rally in practically everything). However, whereas many other small caps have succumbed to profit-taking, Science shares have remained buoyant. That seems to indicate shareholders are committed long-term, rather than short-term traders. The share’s probably too illiquid (with associated wide spread) to interest traders anyway.

.

Today’s update -

- Previously said on 19 May 2021 that all 3 divisions had a good start to the year

- “Momentum has continued” in remainder of H1

- Guidance H1 revised up again - revenue >£40m, and adj operating profit >£7m (over 40% up vs LY H1)

- “Excellent performance”, another upgrade from 19 May guidance

- Achieved despite currency exchange headwinds

- Diary date - H1 results due out in last week of July 2021

- CFO leaving at end July, “by mutual agreement”, appointed in Jan 2021, so clearly this hasn’t worked out. Unusually, we’re given a little colour on the CFO’s departure, which I like. Usually these things are hushed up -

Science Group's success is derived from its integrated organisation, with a hands-on operating management culture at all levels of the Group. After a career in significantly larger companies, it has become apparent that the role within Science Group is not aligned with Mr Vohra's aspirations.

The Group Financial Controller is taking over as CFO.

My opinion - Science Group looks to be on a roll, and still doesn’t look expensive, even on existing broker estimates. Hence increased forecasts after today’s trading update should keep the valuation reasonable.

I like it, a decent, entrepreneurial business, trading well, priced at a reasonable level. The departure of the CFO doesn't sound concerning, sometimes new appointees don't work out, as seems to be the case here.

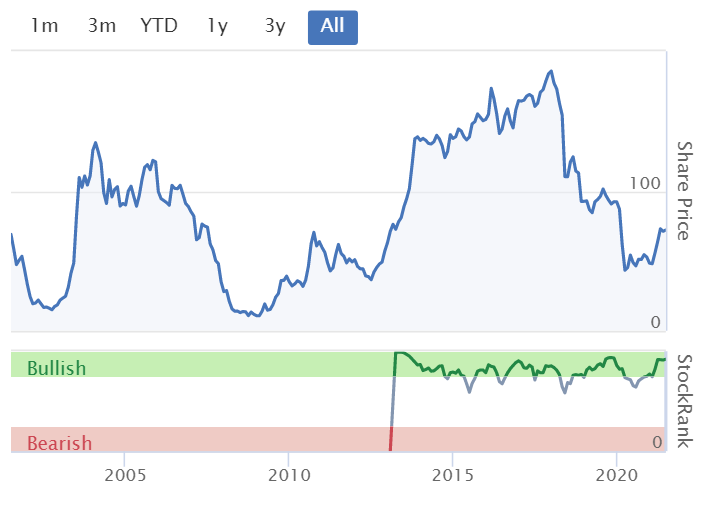

The high StockRank is reassuring -

.

Quiz (LON:QUIZ)

(I hold)

11.75p (up c.12%, at 08:48) - mkt cap £14m

QUIZ, the omni-channel fashion brand, announces an update on trading and its cash position for the period between 1 April 2021 to 30 June 2021 ("the Period").

Two factors have continued to impact sales -

- Closure of stores & concessions for some of the period, and

- QUIZ’s niche is special occasionwear - hit hard by covid restrictions

Despite this, Q1 total sales (incl or excl VAT?) were £17.3m - that’s not bad actually, and better than I was expecting. It’s a huge % increase on last year, not a meaningful comparison though, as lockdown 1 was so severe.

I’m encouraged by the near-doubling of online sales though, as that is near enough to a like-for-like comparison -

This is for quarter 1 -

Given that covid is still having an impact, particularly suppressing demand for special occasionwear, then I’m estimating that a more normal run rate might be nearer £25m per quarter, so c.£100m p.a., which assuming the sales numbers include VAT, dividing that by 1.2 to remove VAT (assuming everything standard rated), gets to c.£83m p.a. run rate of revenues. That’s a sensible sized business, doing a fair bit online, should be profitable at that level of revenues, and the market cap of £14m seems an anomaly (i.e. much too low) when you compare it with smaller online-only competitors In Style (LON:ITS) and Sosandar (LON:SOS) .

Sosandar (I hold) is growing fast, and is forecast to reach c.£24m revenues for FY 03/2022, a very aggressive forecast doubling of LY revenues. It’s been heavily loss-making in the past, would only reach around breakeven if forecasts hit this year, and is valued at £55m mkt cap.

InTheStyle is a recent float, currently valued at £117m, so has a newness premium. It’s also growing fast, and is forecast to hit c.£47m revenues this year, and make £2.5m PAT this year (also FY 03/2022). In my view ITS probably had a one-off benefit from lockdowns, hence the opportunistic float on AIM. It’s previous performance was lacklustre.

Finally we have QUIZ, valued at only £14m, yet likely to achieve revenues at least double of either ITS or SOS this year. Probably going to be profitable, given that all the store leases were ditched in a pre-pack administration last year. Hence the only physical sites it now operates are on turnover rents, and short duration (average 24 months), hence are not a millstone any more. Therefore with no problem leases any more, I think it's a reasonable thing to compare it with online-only competition, although using a lower valuation multiple to reflect sluggish/no growth.

QUIZ also has management that are more experienced rag traders than either SOS or ITS, but maybe lack the creative flair of those competitors? QUIZ isn't really a direct competitor with either SOS or ITS, but there is some overlap, hence I think it's interesting to compare their respective valuations.

Concessions - only 45 sites left, as the Debenhams ones have gone - they re-opened for long enough to clear most of the inventories held, which is pleasing. Personally I think the concessions (sections within a larger store, e.g. Dept Stores) are a bit of a distraction, but at least they get the brand out there into more locations, and are rarely loss-making.

Gross margins - good, and above both 2020 and 2019. Historically, QUIZ made strikingly high gross margins, so I’m encouraged by this. In H1 2020 the gross margin was 52%, and in H1 2019 it was 62% (pre pandemic). So being told today that both have been exceeded, is very encouraging indeed in my view.

Outlook - demand should increase further as lockdown restrictions ease. In particular I think weddings could be very useful for QUIZ, as it specialises in that area, and my thirty-something friends tell me they are inundated with wedding invitations from their friends. How long the restrictions are eased for though, is the big unknown.

Net cash - has actually gone up in Q1, from £1.5m at 31 March 2021, to £2.7m at 12 July 2021. Nothing is said about stretched creditors though, so I’m not sure how sustainable that cash balance is.

There is also an undrawn £3.5m bank facility, expiring 31 Oct 2021, but the company says it intends to renew it, which suggests the bank is comfortable with the situation (the founders are wealthy, having taken a substantial sum out in the original float).

Balance sheet - when last reported, as at 30 Sept 2020, was remarkably strong. Taking out the £3.9m intangible asset, resulted in NTAV of £18.7m, and a perfectly healthy working capital position, current ratio of 1.87 (anything above about 1.3 is strong for a retailer, the way I look at things). There’s no debt either, and the lease liabilities mostly disappeared in the pre-pack administration of June 2020.

My opinion - if you look at this share with fresh eyes, it’s an interesting special situation. Usually my investor friends just dismiss it as being rubbish, and won’t even look at the numbers! Therein lies the opportunity in my opinion.

It’s survived the pandemic, come out in better shape (problem store leases ditched), and with a strong balance sheet. There’s been no dilution since the original float, so theoretically the share price could get back to previous levels, if performance were to recover accordingly (probably very unlikely though!)

The main risk is if management decide to snatch away the upside by taking it private.

A return to decent, profitable trading maybe next year, could see this share double or triple from its £14m market cap now. It’s not even particularly high risk, due to the strong balance sheet and net cash position. The founding family still own about 50%, so I think are motivated to get things back on track, and it seems to be heading that way, given the encouraging update today.

Do be careful not to chase the price up, as it tends to have short-lived spikes upwards, which quickly reverse, and then people blame me for stoking buying interest. I’m only giving my honest opinions, and have no intention of selling any QUIZ for the foreseeable future.

Terrible chart, but remember there's been no dilution, so the upside has not been curtailed since there have been no fundraisings, and none is needed in my opinion.

.

.

Photo-me International (LON:PHTM)

75p (up 5% at 11:03) - mkt cap £284m

Photo-Me International plc (PHTM.L), the instant-service equipment group, announces its results for the six months ended 30 April 2021 (the "Period").

Good half-year performance

H1 revenues up only 3.4% to £94.6m, although the prior year H1 figures would have only caught the start of lockdown 1

Adjusted profit before tax much improved from breakeven H1 LY, to £12.9m this year - driven mainly by restructuring cost-cutting, not top line growth

Net cash of £16.9m

Photobooths are still the main business, but self-service laundry machines are rising, and now 25% of total revenues

As in the past, no split is given of profitability by activity, so we have no meaningful way to analyse the business - i.e. declining vs growth areas

The CEO’s summary is quite useful -

"The Group has had a better initially expected start to the current financial year, with a promising return to pre-COVID business conditions. We have completed a multi-country restructuring programme which has radically reorganised our business areas and our country management. This includes a restructure of operations in the UK, which is expected to return to a cash positive position in the short-to-medium term.

"We are introducing new photo services and upgrading our photobooths. ID photos are proving to be a sustainable market, serviced through our established network and partnerships with site owners, including in the UK.

"We continue to have a great success in the rollout of our Revolution laundry machines in petrol forecourt locations, and our first 100 self-service apple juice machines have been delivered to the market alongside our 2,700 orange juice machines...

"Looking ahead, I am confident of a return to our fundamentals more quickly than previously expected, unless the COVID situation presents new difficulties."

Geographic split - as you can see below, most of the group profit comes from Continental Europe -

.

Balance sheet - looks solid, with a healthy cash position, which makes me wonder why they don’t pay off at least some of the outstanding bank debt, to save on interest costs?

My opinion - until the company discloses the split of where its profit comes from - i.e. the declining area of photobooths, vs the growing area of laundry machines & other activities, then it’s impossible to properly analyse the future outlook without having to guess key facts & figures.

I am impressed that covid triggered a restructuring, which conjured up significantly better profits. Which suggests to me that the group had a lot of fat in it, which was tolerated in the good times, but fairly easy to strip away in tougher times. That’s quite encouraging, as it suggests to me that deeper cuts could be made in future, if needed, to protect profitability.

The big question mark remains over the longevity of photobooths? They already seem an anachronism, and the group’s profits really seem to be dependent on the decisions of a few key Governments, over policy for photo ID required on official cards.

Capex is very high, so bear that in mind when admiring the buoyant EBITDA & cashflow numbers. On the plus side, note there was no dilution, since no fundraising was necessary during the pandemic.

Note that the low forward PER shown on the StockReport hinges on a large jump in EPS next year (latest Finncap forecast is 4.6p this year (10/2021) and 8.2p next year (10/2022).

Overall, I can see the attractions of this share, if you think profits are sustainable long-term. For me personally, there’s too much guesswork involved in this share, in terms of forecasting, so it’s not for me.

Here's the long-term chart, which is interesting as it shows how previously the market has gone through wild gyrations in sentiment towards the core photo booth business.

.

.

Jack’s section

Secure Trust Bank (LON:STB)

Share price: 1,140p (+9.62%)

Shares in issue: 18,638,372

Market cap: £212.5m

Secure Trust Bank is a UK retail bank based in Solihull. The group's lending portfolio currently focuses on two sectors: (i) Business Finance through its Real Estate Finance, Asset Finance and Commercial Finance divisions, and (ii) Consumer Finance through its Motor Finance, Retail Finance, Debt Management and Consumer Mortgages divisions.

Secure Trust uses a traditional savings and loan banking model. It takes savings from retail customers and makes loans to retail and business clients.

Banks can be complex and tricky to value, but Secure is well flagged by Stockopedia’s Ranks with a StockRank of 90 and appears modestly valued across multiple metrics. It trades at a discount to tangible book value.

And unlike the majority of stocks out there, this one has yet to return to pre-Covid levels despite a notable rerating so far.

Today the group issues a profit upgrade.

Trading statement

This is very brief but as noted above it’s an upgrade so worth flagging.

Secure says the positive trends experienced in the first quarter have continued into the second quarter.

IFRS 9 impairment provisions in the current financial year are expected to be significantly lower than the preceding year. As a result, profit before taxation for the full year ending 31 December 2021 should be materially ahead of current market expectations and be above the top end of the range of those expectations.

Those expectations were for an average profit before tax of c£29.5m within a range from c£26.4m to £36.8m.

Secure ‘remains cautious on the near to medium term UK economic outlook and will maintain a prudent provisioning policy, in case economic conditions worsen in the second half,’ however.

Conclusion

It’s not a stretch to see Secure Bank rerate closer to book value given its profitable operations and improving impairment forecasts.

Profits for the year will be ahead of £29.5m. Assuming the prior year’s tax rate and, say, £35m in PBT, we get £28.2m of net income or 151p of earnings per share. That makes for a forecast PE ratio of about 6.9x.

This is guesswork for now but it shows that today’s pre-open share price could prove to be undervaluing Secure’s prospects.

It has generated quite good operating margins in the past for a bank.

Returns on equity have also been comfortably ahead of larger peers like Lloyds in recent years, so it could be that Secure Bank is worth doing some more work on. The group looks to have a solid capital base and is capable of generating returns above its cost of equity. It’s quite possible that a blend of organic and acquisitive growth can propel the share price beyond a Covid bounce back.

This is not a part of the market I tend to get involved in though, and it’s only a brief update, so I’ll leave it there for now.

Uls Technology (LON:ULS)

Share price: 80.4p (-6.51%)

Shares in issue: 64,871,276

Market cap: £52.2m

ULS was founded in 2003 and provides a number of online services for consumers and intermediaries across the property, legal and financial services industries.

Services include its flagship eConveyancer, which is a fully automated online comparison platform that enables customers to obtain residential conveyancing quotations from ULS’s solicitor partners, then instruct their selected solicitor. This can be own brand or white label for the likes of BM Solutions, which is a division of Lloyds Bank.

Other services include estateagent4me, Property Searches, Energy Performance Certificates, and ID Checks.

The group has a clear mission to ‘revolutionise the home buying, selling and owning experience’ and to ‘make the process of moving home more efficient and a better experience for everyone’.

An important point here is the ‘transformational’ disposal of Conveyancing Alliance Limited ("CAL") for £27.4m. Net cash at the year end was some £24m, giving an enterprise value of just £28.2m. There have been a few changes at the senior management level too, so this could be a situation worth tracking.

According to the group’s chairman:

The [CAL] sale ensured that everyone at ULS was united in our desire to disrupt and transform the home moving process through a seamless digital journey, with the proceeds raised from the sale not only repaying all existing debts but also providing the funding for us to continue to invest in both people and innovation across the business, putting us in a much stronger position today than we were 12 months ago.

Final results

Highlights (from continuing operations):

- Revenue -18.4% to £16.9m, reflecting the COVID impact and market standstill in the first two months of the period and slower pick up of the first-time buyer market,

- Gross profit -20.7% to £6.9m,

- Underlying EBITDA £0.4m (FY 2020: £3.5m)

- Underlying loss before tax £0.8m (FY 2020: £2.4m profit) reflecting market dynamics and increased investment strategy

- Reported loss before tax £2.4m (FY 2020: £2.1m profit)

The first half was disrupted but the group has flagged improving conditions in the second half continuing into the new financial year. Conveyancing completions in the second half were 18,667 compared to 15,100 in H1, and there’s been a 21% increase in the number of active users in the group’s broker channel.

And while a loss is a loss, ULS really has been investing for growth - particularly in its DigitalMove offering, which has now handled more than 50,000 cases and has been moved to a cloud based third party environment to speed up the roll-out.

The underlying loss before tax on continuing operations was £0.8m against a profit in the previous year, with IFRS operating profit on continuing operations coming in at a loss of £2.4m, reflecting challenges in its core first-time buyer market and investment spend on DigitalMove. ULS is also working on a digital Rapid Remortgage proposition, which speeds the process of refinancing.

For the year ahead, the group expects to benefit from increasing demand and growing number of completions as the current year progresses. It aims to grow its routes to market for eConveyancer and develop the product suite, with substantial investment earmarked for DigitalMove.

Additional senior hires have also been made: Jesper With-Fogstrup joined as CEO in January 2021, and Ed Mardell and Simon McCulloch joining after the period end as chief technology officer and chief commercial and growth officer respectively.

Conclusion

The last time I wrote about ULS was to cover an ‘ahead of expectations’ announcement at 96p back in May.

So I’m surprised to see the shares down 5.5% to 81.31p less than two months later. Since then delays to the audited accounts have perhaps weighed on the price. Delays to accounts merit consideration but I’m not ruling ULS out on account of the large sale, resulting transformation of the balance sheet, new senior hires, and its desire to reinvest cash back into its product.

But just how good is that product, how much value is added, and how fierce is the competition? If similar product suites are being built by competitors then margins could fall over time. I’m sure the revamped management will look to communicate the investment case in more detail in the weeks and months ahead. It seems like a market ripe for disruption.

The company has a market cap of £52.2m, net cash of £24m, and an enterprise value of just £28.2m. Continuing operations generated revenue of £16.9m, so that’s 1.67x revenue, which could grow over the next year with a fair wind. It looks cheap compared to other software companies.

ULS says the housing market is in a ‘fluctuating’ state but notes the surge in completions approaching the first stamp duty deadline at the end of June might be repeated at the end of September.

Longer term, rising house prices and the shortage of supply continue to make it difficult for first-time buyers. At the same time potential buyers have been able to save more quickly towards deposits, higher LTVs are becoming available and the new Help to Buy scheme should also help.

Given the valuation, it’s worth taking a closer look at the group’s software and markets to gauge the strength of its position and the potential for growth, in my opinion.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.