Good morning, it's Paul & Jack with Monday's SCVR.

Mello - tonight at 17:00 - a Christmas special, with the highlight being David interviewing Sir Martin Sorrell! More details here.

Agenda -

Paul's section:

Purplebricks (LON:PURP) - yet another problem has surfaced this weekend, with an administrative failure opening up more legal claims against PURP. Do the cash pile & well-known brand offset the problems? I don't know, so it's impossible for me to value the shares.

Tristel (LON:TSTL) - in line with expectations trading update at today's AGM. However, expectations have been lowered considerably. It's a nice little company, but as before, I have to challenge the valuation as seemingly excessive.

Jack's section:

K3 Capital (LON:K3C) - strong end to the year, with revenues up 70% and adjusted EBITDA up 61% as the company continues its transformation into a more diversified multi-disciplinary professional services group. Shares have more than doubled since Covid lows, but enough going on here to suggest it’s still worth looking at.

Sthree (LON:STEM) - results look good to me, in line after upgrades a couple of months ago and with the contractor order book up 43% year-on-year. The shares have rerated quite strongly though and, while SThree looks like one of the better recruiters, I’m holding off for now in case valuations are peaking. Next time, I’d like to buy before the rerate. CEO is stepping down for personal reasons, not much detail given.

Costain (LON:COST) - update on trading to confirm year-end net cash of c£100m. That makes the company extremely cheap by most metrics, but the recent track record has been poor and the group is still working its way through a dispute with National Grid. Very low margin business and seems accident-prone.

Tungsten (LON:TUNG) - mixed results harshly judged today, with shares down around 20%. The company is pushing back investment in order to preserve cash so that it can settle a £1.5m employee claim against the company. It’s got some big customers but has been heavily loss-making in the past, and today’s news is a further hit to sentiment.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's section

Purplebricks (LON:PURP)

27p (down 15% at 08:36) - mkt cap £82m

Update on lettings business, and delay to half-year results

Yet another problem has emerged at this accident-prone online estate agency. Just to set the scene, the existing issues were -

- Profit warning on 4 Nov

- Change of CFO on 14 Oct

- Legal action over status of previously self-employed staff could result in large payouts?

- Cyber outage at a third party conveyancing site used by PURP

- IT glitch last month re failing to properly register tenant deposits with Govt protection scheme

Today’s news, revealed in the Telegraph yesterday, reports that PURP could be liable for as much as £30m in claims by landlords, if tenants pursue them for a technical breach of regulations re serving proper documentation for tenant deposits.

PURP’s announcement this morning confirms the problem, but quotes a much lower potential liability, albeit a wide range -

Early provisional estimates by the Company suggest a potential financial risk in the range of £2m-9m. Purplebricks is now in the process of finalising the level of provision required and associated disclosures and has therefore taken the decision to delay its results for the half year ended 31 October 2021 which were due to be published on 14 December 2021.

My opinion - PURP has a substantial cash pile, so the question is how much of that cash is likely to be squandered dealing with these various own-goal legal claims? If it’s not going to bankrupt the company, then there’s still value in the equity.

My worry is that this latest issue could possibly blow up into a situation where anyone who had a tenancy through PURP could try it on, and make a claim. The Telegraph article suggests that even if tenants have not suffered any loss, they can still claim 3-times the level of their deposit from their landlord, if the landlord didn’t serve the correct legal paperwork - which it seems PURP should have done on their behalf, but didn’t. How long do these legal claims, and uncertainty drag on for?

The obvious (and probably sensible) decision is to avoid PURP shares altogether. However, I do think there is some value in the shares, because of the cash pile, and that PURP is still the best-known (by far) online-only estate agent, with very high brand recognition. Is it tainted though? As we’ve discussed here before, the business model of charging up-front fees, leaving behind a long tail of disgruntled customers whose properties didn’t sell, might have gradually eroded the attractiveness of its brand? Also, there’s evidence that conventional estate agents have been fighting back against the online-only upstarts.

On balance, I feel this can only be seen now as an uncertain special situation. With plenty of bargains around right now in small caps, we don’t need to get involved in complicated, problematic shares like this, in my view. There again, sometimes being brave, and buying problematic companies can pay off. So who knows?

.

.

Tristel (LON:TSTL)

490p (up 1%, at 09:21) - mkt cap £231m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products…

The current financial year is FY 06/2022.

"As the half progressed, in all our geographical markets sales have picked-up well as hospitals have gradually returned to normal service levels for diagnostic procedures. We expect revenue to exceed £15m compared to £16.8m in the first half last year, noting revenue last year included a one-off sale of £0.9m to the NHS for Brexit-related inventory. This stock was released back to UK hospitals during this first half, creating a £1.8m period-on-period distortion.

I’m scratching my head about the above. Even if we adjust for the £1.8m distortion caused by a large NHS order, that still only leaves H1 revenues flat against last year. Which doesn’t seem to tie in with the positive first sentence.

Given that Tristel supplies hospitals with niche disinfection products, then it stands to reason that the pandemic would have impacted revenues & profits, as we keep hearing that elective surgery has been delayed extensively, with large waiting lists building up. Hence it seems reasonable to assume that trading should improve at TSTL in future. There’s just not a lot of evidence of this happening so far, given that flat revenue number above.00

Overseas revenues -

Overseas revenues are expected to account for 64% of worldwide sales during the half compared to 60% in the comparable period last year. Reducing our exposure to the UK NHS by growing our existing overseas businesses and entering new geographical markets is a key objective for the Company.

Given the one-off large sale to the NHS in H1 LY, then that would naturally make overseas sales go up as a proportion, so I can’t get excited about this.

It reinforces that TSTL sells a niche product, in very small quantities, into lots of countries. That’s fine as far as it goes, but surely the opportunity/challenge for this company is to make a meaningful scale breakthrough in some of these markets? The hope is that this might happen in the USA in due course, but that’s easier said than done - the USA is a notoriously difficult market for small foreign companies to break into, if/when regulatory approval is eventually granted. The shares have been dining out on this potential for several years now.

Cash - above £8m, after having paid the dividend. TSTL is conservatively financed, with a lovely strong balance sheet.

Outlook - in line -

Based on continued normalisation of hospital procedure numbers in the UK and elsewhere, which is clearly dependent on Covid-related updates, we are on track at this stage to be in line with market expectations for the year."

My opinion - before bulls start attacking me, I have to emphasise that this is a nice little company, generating steady growth, big profit margins, and with a lovely balance sheet, so there’s lots to like. Business should improve, as hospitals hopefully begin working their way through the post-pandemic patient backlogs, which I imagine is likely to take years, providing a possible tailwind for Tristel.

Graph 4 below shows what the problem is here - excessive valuation - look at how the PER has expanded greatly, without any change in the company’s growth rate. Is this justified? We can buy some of the world's best companies at PERs between 20-30, so I have to question why pay more for Tristel?

.

There’s been a sharp correction in share price recently, but I wouldn’t read too much into that, because we’ve seen irrational & panic selling in lots of small caps lately. There’s not much liquidity in UK small caps, and the market mood seems ridiculously short termist right now. It’s important to remember that today’s despondency is creating opportunities for tomorrow’s profits, for investors who can look through short term market mood swings.

TSTL maybe reporting in line with expectations today, but expectations have been substantially lowered -

.

The forward PER is now 45, which still looks way too high to me. I can’t understand why anyone would find that a reasonable valuation - the only explanation must be that shareholders think earnings could rise strongly once hospitals return to normal? If we assume that earnings could recover to previous expectations of around 20p EPS, then the valuation comes down to a much more reasonable PER of 24.5

Hence my conclusion is that I like the company, but can’t get to anywhere near the current valuation, based on the current forecasts. I’m not keen on expensive companies that need to thrash forecasts to justify the current price, as that does not present a favourable balance of risk:reward.

.

Jack's section

K3 Capital (LON:K3C)

Share price: 332.5p (pre-open)

Shares in issue: 73,200,033

Share price: £243.4m

K3 Capital is a professional services company that offers a growing range of services to small and medium enterprises (SMEs). The group’s divisions are:

- M&A - company sales, corporate finance services, transaction services

- Tax - R&D tax credit advisory, tax planning, tax investigations

- Recovery - restructuring advisory, forensic accounting, pensions advisory

The group is busily acquiring and building out a larger and more diversified offering, with its ‘scalable’ process-driven approach and use of tech to automate processes of particular note.

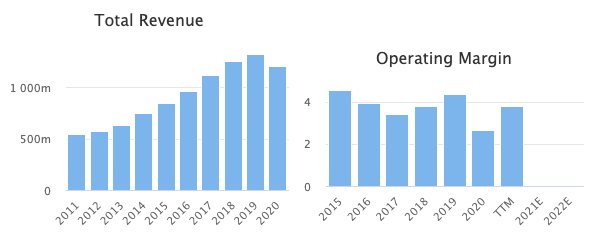

You can see the recent change in scale in the group’s revenues.

Even though the shares have more than doubled from Covid lows, the forecast PER is 15.1x and the forecast PEG is just 0.4x. And yet, K3C has a 5y revenue CAGR of more than 40%, free cash flows have increased at an average of 24.1% over that time, and the group is forecast to pay out more than 4% in dividend yield.

It seems as though the market is not quite convinced about the longer term prospects of some of these professional services companies based on the valuations compared to projected and/or historic growth rates.

Revenues for the six months to 30 November 2021 have increased from £17.6m to more than £30m, with adjusted EBITDA (before acquisition costs and share based payments) up from £5.6m to £17.6m.

That’s in line with management expectations and represents c50% of full year consensus estimates, which the group is now confident of meeting.

All business divisions have continued to perform well, driven by both organic growth in existing brands as well as the contribution of the recent acquisitions of Knight Corporate Finance Group Limited and Knight R&D Limited which completed in July 2021.

CEO John Rigby comments:

The first six months of the year has been incredibly positive, with trading in line with market expectations as we continue to deliver our growth strategy across the Group. The results are underpinned by diversified revenue streams and continue to illustrate the benefits of our strategy of building a broader professional services group with greater visibility of future revenues.

Conclusion

K3 says its acquisition pipeline remains strong and the board continues to look for complementary acquisitions within the professional services space. This is an area of the market that appears to be seeing great change at the moment, with a number of listed companies on the acquisition path.

The group is confident of meeting expectations but I wonder if there might be scope to surprise to the upside. FY22E and 23E revenue forecasts suggest continued growth, up from £47.2m in FY21 to £57.3m and then £67.6m.

Such growth would likely be magnified at the earnings per share level.

Forecasts (which were originally a big year-on-year jump) have been marked up since July as well though so perhaps the prospects are fairly reflected now.

The group’s focus on more automated, scalable solutions is a possible point of differentiation compared to some other listed professional services companies. A positive update from a growing company, albeit in a part of the market that isn’t getting much appreciation at the minute.

Sthree (LON:STEM)

Share price: 488.5p (-10.53%)

Shares in issue: 133,630,777

Market cap: £652.8m

SThree global specialist staffing business focused on roles in Science, Technology, Engineering and Mathematics ('STEM').

It’s been a strong period for recruiters all-round, but SThree comes across as one of the better operators here. The question is whether or not recent trends have further to run. Perhaps the shares are now fairly priced after a wave of upgrades, although the StockRank remains a healthy 95.

Highlights:

- Net fees +19% to £355.7m, driven by increased demand for STEM skills,

- Third consecutive quarter of 20%+ growth, with Q4 net fees up 25% year-on-year,

- Contract and permanent net fees up 17% and 24%,

- Contractor order book up 43%,

- £58m of net cash, up from £50m.

Compared to 2019 results, full year net fees are +9%, Q4 net fees +16%, and the contractor order book is up 30%.

Of its three largest countries (representing 74% of net fees), Germany net fees grew by 23% year-on-year, while the US was up 24% and the Netherlands increased by 19%. The group shows the improvement in quarterly results below:

CEO stepping down:

The Board also announces that Mark Dorman will be stepping down from the Board and as CEO of the Group on 31 December 2021. Timo Lehne, currently the Senior Managing Director of SThree's largest region, DACH (Germany, Austria and Switzerland), will be appointed Interim CEO and for that period will join the Board as Executive Director from 1 January 2022. Mr. Dorman will continue to assist the Group in facilitating a smooth handover and transition until 1 April 2022.

The chairman comments:

We are very well positioned moving into 2022, underpinned by our contractor order book which is up 43% year-on-year and provides excellent visibility. In the year ahead, we will focus on investing in our infrastructure, talent acquisition and our global go-to-market propositions. We aim to maintain our profit margin at current levels, whilst investing in the business to drive long-term sustainable growth. Although the external environment remains uncertain, we have proven that we can grow through periods of volatility and remain committed to the delivery of our strategy for the benefit of all our stakeholders.

Regarding the point on for how long the current momentum can be maintained, the group notes that it is investing in head count, that FY21 productivity improved by 31% year-on-year, and that it expects ‘this improvement to ease back but to remain above historic levels’.

Conclusion

The group expects to deliver record profits for the full year, in line with consensus expectations, which were materially upgraded in September 2021.

My feeling right now is that the recent rerating has taken a lot of near-term upside off the table, although SThree itself is well positioned and it’s possible that I might be underestimating the scale of the trend here. ONS data below shows a pretty dramatic post-Covid dynamic. SThree has greater exposure to other countries, but presumably they look at a similar picture:

This is a cyclical business though and I’d be wary of buying in at this point in case we are approaching something of a peak. It’s a funny market at the minute and lots of stocks are available at cheaper prices than they were six or so months ago.

SThree has strung together an impressive revenue growth track record, although operating margins are more variable.

Not much detail is given on why the CEO is stepping down, although the interim appointment sounds sensible and should provide continuity.

There could be more positive news to come in 2022 given the contractor order book is up 43% year-on-year, and SThree would be one of my top picks in terms of recruiters, but I’d rather wait for a valuation that offers more immediate upside. The share price momentum looks to have turned, at least in the short term (in fact I see these grumpy markets are marking the shares down more than 10% right now), so it could be worth monitoring in case that opportunity does present itself.

Costain (LON:COST)

Share price: 48.4p (-6.38%)

Shares in issue: 274,949,741

Market cap: £133m

This is one of the more notably cheap price to sales metrics on the market - more than £1bn in annual revenues from a £134m market cap company. It’s green across the board in terms of ‘value’ here, so it’s no surprise to see a Value Rank of 97.

The trouble is, it seems to be extremely hard work turning these sales into profits attributable to shareholders. Costain is a contracting group that builds roads, and other infrastructure. Margins are wafer thin, and were negative in FY19 and FY20.

We know there’s a lot of movement across the board right now in terms of input prices, so chronically low margin enterprises are especially risky, although the broader outlook for infrastructure investment is positive.

Full year adjusted operating profit is expected to be in line with market expectations. Year end net cash, before any period end timing benefits, will now be ahead of market expectations at around £100m.

Peterborough and Huntingdon contract

Update on the adjudication process regarding the legacy Peterborough and Huntingdon contract dispute.

Under the terms of the termination agreement with National Grid, there is an expected requirement to make a payment of £53.5m in January 2022, which now represents the maximum cash outflow under the contract. Given the recent adjudication decision, we have an entitlement to recover a proportion of this payment and will be discussing the timing and amount with National Grid. The payment, if made, will not affect our banking arrangements and we will continue to have a strong balance sheet that enables us to deliver our business plan. There will be an associated charge to the income statement for the current financial year reflecting such payment.

Conclusion

No surprise to see Costain pop up in a Bargain Stocks screen, but that doesn’t necessarily mean the shares are worth purchasing.

It has to be said though that once you adjust for net cash, a forecast rolling price to sales ratio of c0.03x is remarkably low. It’s deep value territory, with all the risks that tend to come with that strategy (weak business model, poor sentiment, bombed out share price, financial risk).

Costain has a history of taking on debt and raising equity. It’s not an inspiring share price chart. Shareholders have been diluted and business is extremely low margin.

The group trades at a discount to net tangible assets of £138.8m, and the cash balance of £157m goes some way to de-risking the group. These balance sheet figures are as of June 30th 2021, so there will likely have been some change in the ensuing months.

The group probably needs that cash more than others however, in case of contract disputes such as the above, and general remedial work.

Deep value plays can generate outsized gains so it pays to keep an open mind, although it would take a lot to convince me to take on the risk here. Given the precarious situation and the perennially low margins, I’d also want to be confident in the quality of the management team as there’s not much margin for error. The poor track record and ongoing contract issues do not inspire confidence.

Tungsten (LON:TUNG)

Share price: 27p (-17.43%)

Shares in issue: 126,537,962

Market cap: £34.2m

Tungsten is a global electronic invoicing and purchase order transactions network, invoicing for 60% of the FTSE 100 and 68% of the Fortune 500. Customers include Caesars Entertainment, Computacenter, GlaxoSmithKline, Kraft Foods, Unilever, and the US Federal Government.

Strange then that the company struggles for profitability - it’s racked up some large losses and burnt through a lot of cash in the past, while the share price and Stock Rank have been weak.

Highlights:

- Group revenue +2% to £18.3m (94% recurring),

- Gross profit +1.2% to £16.9m,

- Adjusted EBITDA up from £0.8m to £3m,

- Statutory operating profit up to £0.8m from a loss of £29.9m,

- Net cash up £0.9m to £1.9m.

Provision booked of £1.3 million to exceptionals relating to post period end settlement of an employment claim made against the Company initiated in FY-20.

Customer wins in H1 were behind the company’s expectations due to changes in the sales team and some prolonged customer decisions.

Continued to exert tight control on the cost base which combined with the delayed planned £1 million investment in our tech development and compliance functions will lead to cost savings in FY22, we expect to commence this investment in Q4-FY22.

Not the position a growth company wants to be in, pushing back investment initiatives in order to save on short term costs. This is in response to the ‘additional cash spend of £1.5 million relating to settlement of a FY-2020 employment claim against the Company’.

Conclusion

Within the overall performance, it's fair to say there have been mixed results…

… Provision booked of £1.3 million to exceptionals relating to post period end settlement of an employment claim made against the Company initiated in FY-20

… challenges around new customer wins driving a reduction in new sales billings of £0.8 million from H1-FY21 to £1.3 million

The balance sheet is also fairly weak, with goodwill nearly half of total assets at £49.6m and negative net tangible assets of £10.3m. Meanwhile, the group has to delay tech development in order to afford the employee claim payout.

These are not positive signs for what aspires to be a highly rated tech stock. It’s barely profitable despite years of operations and looks like a serial disappointer.

Shares are down nearly 20% on that sentiment, although they have recovered slightly at the time of writing, so it’s possible that the initial reaction has been too harsh.

In the current conditions though it’s possible to find shares that have been marked down even with strong underlying progress - I’d rather focus on those opportunities for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.