Hi, Jack here - Paul is delayed in London so I'm taking over until he gets back.

With lockdown easing, I finally caught the train back from York to Oxford myself at the weekend. As much as it pains me to say it, the weather is a bit better down south…

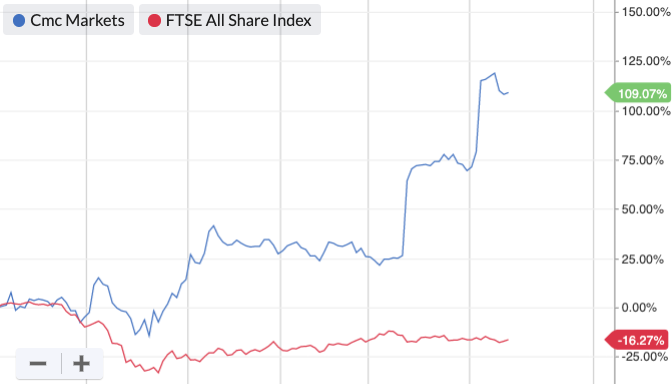

Some quick news to kick off. CMC Markets (LON:CMCX) has appointed Brendan Foxen as its new chief technical officer. Foxen was previously CTO of Contino, a digital transformation consultancy, where he helped grow the consultancy from 16 to 400 employees. CMC says the appointment will ‘will support the accelerated development of the many opportunities that are in the pipeline’, which sounds promising.

Of course, the group’s shares have been tremendously strong given recent market volatility - but given the above, maybe there is more growth to come?

On 12.3x forecast earnings, that still looks like a modest valuation for a high quality, growing company. The question is if the company can replicate this year’s (probably) bumper results or if they will normalise in time towards a lower level.

Note that broker forecasts have nearly trebled for FY21 but FY22 estimates are anchored at around 16p.

If you treat FY22 as a more ‘normal’ earnings level though that still puts shares on a forecast year 2 PE of just over 20x. So if there are good company-specific growth opportunities here, it could be worth a closer look.

Anyway, onto some results.

Global Ports Holding (LON:GPH)

Share price: 68.98p (-11%)

No. of shares: 62,826,963

Market cap: £48.75m

This is an absolute dive bomber of a share price chart. Global Ports Holding (LON:GPH) has been a bloodbath for shareholders unfortunately, and COVID has ruined recent trade.

Shares are down 11% today as GPH has abandoned its pursuit of a premium listing. This was an explicit ambition mentioned in the group’s IPO documents, so it’s a blow that three years later this has not materialised.

The group says:

These decisions have been taken in order to strengthen the Company's ability and provide flexibility to respond to challenges created by ongoing Covid-19 disruption to the global travel sector and the economies in which the Group operates.

A lot of this has been priced in. Back in March its shares tumbled from around 200p to its current levels.

It’s an unusual company. An independent cruise port operator with a presence in the Mediterranean, the Atlantic and Asia-Pacific regions and one large shareholder owning some 62.5% of the company.

In the group’s statement, GPH repeatedly reiterates its commitment to strong corporate governance. This has the ironic effect of making me wonder about the company’s corporate governance...

Even if that’s an unfair first take, the company has nearly ten times its equity in net debt and poor F and Z-Scores:

That said , the group does appear to be able to generate a good amount of cash flow in normal conditions. If it could get back to 2018 levels, that would put its shares on just over one times ‘normalised’ free cash flow…

In all though, there are plenty of warning signs to put me off any kind of contrarian bet. If there’s one thing we’ve been looking for in recent months regarding Leisure companies, it is balance sheet strength. It looks like Stockopedia is right to class this one as a Value Trap.

Yellow Cake (LON:YCA)

Share price: 224p (+0.45%)

No. of shares: 87,593,910

Market cap: £195.33m

Yellow Cake (LON:YCA) is an interesting company some subscribers have mentioned before that is worth bringing to attention. There’s no trading update today but there is another share buyback announcement.

This specialist operation was set up by the experienced and well connected investment banking team at Bacchus Capital as a ‘unique uranium commodity investment vehicle’. There really aren’t that many plays on the uranium price so YCA is worth flagging on that basis alone.

It’s recently listed and does not have much of an operating track record, so that is a risk. But this kind of stock can be hard to value, which should present opportunities from time to time. Management seems to think YCA’s shares offer good value as its news feed is littered with similar buyback announcements.

The team here looks financially savvy, with decades of experience in the markets. If they think YCA shares are attractive at current levels then it might be worth looking at in a little more detail.

The group has a VM Rank of 99 and strong relative momentum. There’s also been a lot of community buying recently:

The group operates almost like an ETF, buying and holding the physical commodity. There are no operating risks and no mines to run, so it’s a very low cost structure.

Here’s how it all works:

- Yellow Cake acquires uranium through its 10-year framework agreement with Kazatomprom (the world’s largest and lowest-cost producer)

- This gives it the right to purchase up to $100m of uranium per year from 2019 through to 2027, with the purchase price based on the spot price

- YCA has a storage contract with Cameco in Canada (the world’s second largest producer). YCA’s 9.7mmlb of uranium is stored here.

- YCA’s activity is informed by 308 Services’ uranium commodity market expertise.

Then you just sit back and bank on stronger uranium prices, if that’s your view.

The initial digging I’ve done into the uranium market suggests attractive fundamentals, with steady demand growth jutting up against supply cuts and restricted investments.

Market

After a couple of down months, the spot uranium price rose sharply during March, increasing 11% to US$27.40/lb. Transactional volumes increased markedly totalling 9.0m lbs with a monthly record number of transactions.

According to YCA, it is likely that the principal recommendation of a pending Nuclear Fuel Working Group report will support a uranium purchase programme by the US federal government.

Meanwhile forward uranium requirements remain substantial especially for nuclear utilities in the US and EU.

In March, Cameco announced that the world’s largest uranium mine would be placed on safe care and maintenance for an initial four weeks, subject to ongoing assessment. On 13 April Cameco announced that it would extend the temporary shutdown at Cigar Lake from four weeks to an indeterminate period.

Then in April, Kazatomprom announced that on-site staffing at its uranium mines would be reduced to minimum levels for a three-month period, resulting in the loss of production estimated at 4,000 tU (10.4 million lbs U3O8) for the year.

Similar shutdowns have occurred at other sites around the world - so might a supply freeze lead to a price hike? It seems like that has partially occurred, at least temporarily suspending a downtrend in uranium prices.

Source: Yellow Cake presentation

My view

In YCA’s recent quarterly trading update, management said:

Supply side pressures have been building in the uranium market for some time, as low prices have forced many producers to cut output. These have now been exacerbated by the effects of Covid-19, which has resulted in further downward pressure on uranium production, taking yet more supply out of the market.

We have already seen uranium prices respond with a strong uplift in March, and this has continued into April with the spot price exceeding 30 dollars per pound. Yellow Cake remains uniquely positioned to benefit from this supply side pressure and the resulting uranium price increases.

All in all YCA looks like an interesting and fairly unique company. It could offer portfolio diversification as well as good Value and Momentum. I don’t have a developed view on the uranium market, but the recent share buybacks and shareholder activity suggest that there could be something worth investigating here.

At current levels there could be scope for a rerating but it’s not one I know well so DYOR.

There is a recent interview with the CEO over at BRR Media (link here) for those that would like to get more of an insight into this company.

Novacyt (LON:NCYT)

Share price: 267p (-0.19%)

No. of shares: 58,094,754

Market cap: £156.29m

I’ve been slightly wary of looking into companies with business directly related to COVID-19 as there’s potential for stocks to get hyped up to unreasonable levels on little news flow.

Take Filta (LON:FLTA) for example - the deep fryer cleaner whose shares more than doubled in a week on the news that it was trialling a COVID-19 related sanitising service. Perhaps something like that might materially improve the group’s prospects - all I know is that since then, the group’s shares have retraced somewhat.

That said, somewhere in amongst all the COVID-related newsflow, there will be some real winners. Novacyt Sa (LON:NCYT) is one such contender after rapidly developing and launching one of the world's first molecular tests for COVID-19 back in January. This development, the group says, ‘established Novacyt as a pioneer and a leader in COVID-19 diagnostics’.

A bold claim - and one that looks to be backed up by some transformational half-year numbers...

Highlights

NCYT is firmly in Momentum Trap territory right now after a stratospheric first half of 2020 - just look at the relative strength on display here:

Shareholders are expecting big things - and NCYT begins this update with a bang: ‘Sales growth of more than 900%, debt-free and significantly cashflow positive’.

In terms of the actual (unaudited) figures, we have:

- A 900%+ increase in revenue from €7.2m (£6.3m) to €72.4m (£63.3m), with 91% of revenue coming in the second quarter,

- Anticipated EBITDA of over €45m (£41m),

- A cash position as at 30 June 2020 of €20m (£18m) compared to €1.8m (£1.6m) as at 31 December 2019.

- NCYT has achieved this even after significant investment to meet continued demand for the COVID-19 test expected in H2, and

- The group has paid down all outstanding debt, making Novacyt debt free for the first time in the Company's history.

That’s some pretty transformational trading momentum.

A big unknown is just how long this window of extremely high demand for COVD testing will last, but you can see that although Europe is no longer the eye of the storm, the number of global daily new cases continues to rise.

Some contracts for NCYT’s test have also been extended into the second half of 2020 and in some cases into 2021. Novacyt expects significant ongoing demand for COVID-19 testing well into the next calendar year.

In the US, the Company has signed a major distribution agreement for its COVID-19 test with a new global strategic partner. The US is delivering significant sales growth for Novacyt and a ‘major new agreement with a global strategic partner’ will help to further open up this market. Furthermore, the agreement can be expanded into new territories in time.

My view

NCYT’s test is being sold worldwide. The group is capitalising on the opportunity and has invested in a significant scale-up of operations, while paying down debt entirely. And even after all that, cash has piled up on the balance sheet.

Demand for the COVID-19 test remains strong, with June sales of €25.4m (£22.5m) showing the sixth consecutive month of growth. If you just linearly extrapolate that for the rest of H2, which might be conservative, you get £63m of revenue in the first half and an expected £135m of revenue in the second half (£198m total).

Heading over to the group’s 2019 Annual Report, it looks as though NCYT generated a gross margin of c64%. Applying that to my rough take on FY20 sales would give possible gross profit of nearly £127m.

That would make for a price to sales of 0.78x and a price to gross profit of 1.23x, which seems low to me given the trading momentum.

Alternatively, we can work out the group’s half-year EBITDA margin as 65%. Assuming that holds steady and using the above simple revenue forecast, we come to full year EBITDA of £128.7m. The company is now debt free with £18m of cash. This cash pile could build but let’s assume it stays the same. That makes for an updated enterprise value of around £138m. Put those two estimates together and it would make for an FY20 EV/EBITDA of just 1.07.

Maybe my assumptions are way off here, but this looks cheap given the prospects. If anybody has spent a little more time forecasting revenue it would be great to get a range of opinions on this point.

This is undoubtedly a transformational period for Novacyt and it looks to be seizing the opportunity with both hands. I wonder if the market has fully priced in its short term growth prospects. More importantly, what foundation for future long term value creation can NCYT develop with its rapidly escalating levels of revenue? And what in-house expertise can it leverage with all the cash?

The group’s CEO, Graham Mullis, commented:

The Company has rapidly established itself as one of the market leaders in COVID-19 PCR testing, with a significantly increased customer base, a recognised reputation for the performance of its products and established multiple significant strategic partnerships. This solid foundation, combined with a strong financial performance, will enable us to greatly enhance and accelerate our strategy for delivering long-term value to shareholders.’

To me that is the most promising part of the whole statement - perhaps NCYT can use current trading to power itself on to bigger and better things. It’s interesting to see the higher levels directors have bought stock at:

I’ve seen enough here to want to take a closer look - particularly since the share price is down nearly 50% from the April peak of 491p.

Avacta (LON:AVCT) and Modern Water (LON:MWG)

AVCT share price: 267p (-0.19%); MWG share price: 2.14p (+15.68%)

AVCT shares: 268,125,159; MWG shares: 524,693,214

AVCT market cap: £297.31m; MWG market cap: £9.71m

Rounding off the COVID-related newsflow today, we have the Avacta (LON:AVCT) collaboration with Integumen which will be facilitated by Modern Water (LON:MWG) ’s ‘award winning’ Microtox water contamination system.

All of these companies are low ranking Momentum Traps with blood red Financial Summaries - it’s not a part of the market I usually look at. Take Avacta for example:

But after reading through NCYT’s update above I did end up warming to the stock, at least enough to want to do a bit more research. So let’s look at this story too.

Avacta says its affimer agents can be used to detect coronavirus in waste water. Today’s announced collab with Integumen will see its affimers used in real-time bacteria alert systems developed by Integumen, which will then be integrated into Modern Water’s sensors.

Upon successful completion of an evaluation at a University of Aberdeen lab, AVCT and Integumen will enter into a supply agreement that will see the latter retrofit Modern Water’s microtox systems with the new sensors.

How material is this development, I wonder? It’s all quite early-stage. The proof is in the pudding, as they say - at least with NCYT we can now see the 900% increase in revenue.

My view

It’s too early for me. This isn’t my area so I will wait for more concrete financial information in Avacta’s first half trading update, which should be coming out soon judging by the group’s 31st December financial year end.

With NCYT at least we are seeing the early signs of the company graduating from loss-making story stock to something more profitable. Perhaps in AVCT’s next results we will see confirmation that it is following a similar trajectory.

As for Modern Water - highly speculative, loss-making micro caps that suck up cash are just not a part of the market I focus on. I’m particularly put off by MWG’s poor financial health scores:

You get the occasional big winner here, and some investors are presumably specialists in this space. I’m sure there are shareholders reading so if you have a more informed view of these companies’ prospects then leave a comment and let us know.

I wish AVCT and MWG good luck in this endeavour but it’s not something I can add value on at this stage.

.jpg&w=384&q=75)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.