Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

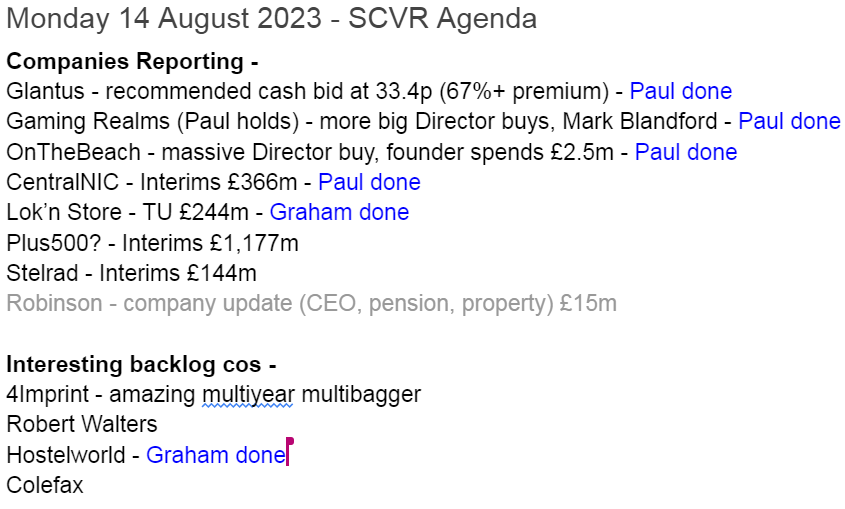

Summaries of main sections below

Lok'n Store (LON:LOK) - up 1% to 738p (£242m) - Trading Update (in line) - Graham - AMBER

Forecasts unchanged as this self-storage company delivers a good increase in pricing and continues to expand. The share price has weakened but personally I’d hold out for a better entry. Insiders have been selling and valuation remains high vs. after-tax NAV and earnings.

CentralNic (LON:CNIC) - Unch at 131p (£366m) - Interim Results - Paul - AMBER/RED

Trading and outlook seem fine, and the valuation appears cheap. However, on closer inspection my previous concerns remain - a horribly weak balance sheet, with the bank debt now costing $6m for H1. Buybacks can't really be afforded in my view. Also are profits/cashflows sustainable? I discuss the bull & bear points below, and come out moderately negative overall.

Hostelworld (LON:HSW) - 134.5p (£166m/€192m) - Interim Results (in line) - Graham - AMBER

This online travel agent for hostels has seen a terrific upswing in trading over the past 12 months, as long-distance international leisure travel has boomed. The company is close to a statutory profit but isn’t quite there yet. Cash flow is good, enabling debt reduction.

Paul's Section:

Some quick comments first -

Glantus Holdings (LON:GLAN)

20p (£10m) - Recommended Cash Offer - Paul

A very lucky escape for shareholders in this Irish accounts payable niche software company. It was floated in May 2021 at 102p, by Arden, and very quickly turned into a disaster, losing 90%+ of its value by Oct 2022, after a nasty profit warning, and running out of cash. It had to use heavy borrowings to survive, but managed to cling on.

We only commented on it once, here in Sept 2022, writing it off as a hopeless float, with woefully inadequate funding. 2022 accounts were absolutely dire, and it looked insolvent (but lenders gave it more time to sort itself out).

It did report improved trading in July 2023, which I didn’t notice at the time, although finances were still perilously weak, which made it uninvestable for me regardless.

Today we get news that an accounting software specialist, Basware, is offering 33.42p to buy Glantus, which is a terrific, and very lucky outcome for shareholders. Way below the IPO price of 102p, but this could easily have been a zero without fresh funding, so a good outcome in the circumstances. I won't say well done to shareholders, as owning it was a terrible decision!

Gaming Realms (LON:GMR) (Paul holds)

34p (£100m) - NED buying shares again - Paul - GREEN

I recently flagged up large Director buying by one of GMR's NEDs, Mark Blandford. He's been at it again - news today of another purchase by him of 350k shares, at an average 35.17p = £123k. He bought £180k-worth a few days ago on 4 August. Who is he? Google reveals that Mark Blandford is the founder of Sportingbet, a pioneer in online gambling. That's similar to the space Gaming Realms operates in, so it's encouraging to see him enthusiastically buying up shares in it. I wouldn't comment normally on Director buying, but when it's a in £6-figures, I sit up and take notice - that's not messing about for PR purposes!

I explained why I've turned positive on this share, after previous scepticism, here on 27 July 2023. It's worth a fresh look I think, as the numbers are now looking very good, with a forward PER of only 15.0x, based on realistic-looking forecasts.

On Beach group (LON:OTB)

Up 4% to 95p (£159m) - Director buy - Paul - GREEN

I last looked at this holidays company on 19 May 2023, concluding AMBER, that there was too much guesswork involved at that stage, but that at 105p it might be a possible trade for a bounce? I'm going GREEN on it today, because news has just come through of a pretty spectacular Director buy - the founder (now a NED) Simon Cooper, has through an intermediary just spent £2.5m buying 2.82m shares at 88.1p. That takes him up to 7.5% of the company. When a founder Director buys on that scale, I'm inclined to follow suit, especially as I was already eyeing it as a possible trade.

This share was also flagged in the reader comments below by our star contributor, Wolf of Small Street coincidentally, so many thanks for that.

CentralNic (LON:CNIC)

Unch at 131p (£366m) - Interim Results - Paul - AMBER/RED

I inwardly groan when this company comes up on the list to analyse.

Checking back to my previous notes, I’ve looked at this internet advertising/domain names company 4 times this year -

31/1/23 - 146p - AMBER - top end of exps. Looks quite interesting.

24/4/23 - 115p - AMBER (almost red) - positive Q1 update. But I dislike the 2022 accounts, and question why it has large cash pile and large debt? Awful balance sheet.

16/5/23 - 114p - AMBER - My most thorough review of the figures, better than I expected, but some concerns remain - how sustainable is profit/cashflow?

3/7/23 - 116p - AMBER - Big expansion of share buyback programme.

Note that the share price has put on a decent spurt since the buybacks announcement.

On to today’s news, which is interim results for the six-months to 30 June 2023.

CentralNic Group Plc (AIM: CNIC), the global internet company which helps online consumers make informed choices, is pleased to announce its unaudited financial results for the six months ended 30 June 2023 ("H1 2023").

Not a very good start, with a (deliberately) vague self-description.

CNIC reports in US dollars, some key numbers -

Substantial revenue of $396m, up 18%

Net revenue/gross profit of $91.2m (up 11%), so presumably the main element of revenue above must be pass-through revenue of some kind?

IMC webinar is at 13:00 today here. I’ll try to attend, although that sometimes coincides with my lunchtime nap.

I see the commentary is pushing the idea that CNIC is an Artificial Intelligence type of share. There’s a lot of that kind of talk about at the moment.

H1 profit - take your pick from £44.6m adj EBITDA, £17.5m operating profit, or £9.4m profit after tax. These are the highlighted figures in the “performance overview” table. I don’t really find any of those measures satisfactory.

Adj EPS (diluted) is 11.26 US cents, up 37%, but note that last year H1 suffered from a much larger tax charge, which flatters this year’s H1 adj EPS.

Balance sheet - this is usually where CNIC falls over for me as a possible investment.

It’s the same this time too, I’m afraid. NAV is $162.5m, little changed from 6 and 12 months earlier. This includes a huge $335m intangible assets. Getting rid of that means NTAV is heavily negative, at $(173)m.

Working capital is balanced, with $178m current assets (including $83m cash), and $183m current liabilities. On a day-to-day basis, I would expect those to move around a fair bit, since annualised revenues are c.$800m - there could be large intra-month swings in working capital, depending on when customers pay, and when liabilities are settled.

This is the problem area - non-current liabilities contains $147.6m in “Borrowings”. Whilst net debt might look reasonable at $68.2m, it’s the gross debt of $147.6m that worries me more. What we need is the average daily net debt number, which would give us the true picture, ironing out working capital swings. Without that number, I don’t really know how to assess the overall financial position. Other than to say that a negative $(173)m NTAV looks unpalatable to me.

Companies with such a weak overall NTAV really should not be doing big share buybacks, or paying divis in my opinion.

Outlook - sounds reassuring -

Whilst the Directors continue to monitor the global macro-economic environment closely, they are confident in the Group's targeted investment in product innovation, vertical integration and international expansion. These strategic moves have positioned the Group to succeed. Therefore, the Directors expect that the Group will trade at least in line with current market expectations for the full year.*****

Latest analyst forecasts are within a range of USD 783m and USD 834m for FY23 revenue and USD 91m and USD 98m for FY23 Adjusted EBITDA

Cashflow statement - there’s good cash generation at the top, in all 3 periods covered.

Note almost half of this $35.3m operating cashflow went out paying $15.2m deferred consideration. So if you’re considering buying/holding this share, it would be worth digging into the hefty $177m trade and other payables, to check if any of this is additional deferred consideration, since that’s a one-off outflow (bad), as opposed to normal trade creditors that just rotate (good).

Ignoring small items, the rest of the cash generation was spent on $13.9m share buybacks, $3.6m divis, and a hefty increase in interest costs to $6.0m in H1.

Put it all together (with smaller items I’ve not listed), and cash outflows exceeded cash inflows by $13.9m. Coincidentally, that’s exactly the same figure as the share buybacks, so I would argue it can’t really afford to be doing share buybacks, and is decreasing the cash pile, thus increasing net debt as a result of buybacks.

Although you could argue it the other way, that the $15.2m deferred consideration is what caused the cash pile to drop. Depends on how you look at it.

The bank debt is expensive now remember, and note 6 shows H1 interest charges on bank borrowings of $6.1m, so $12.2m annualised, which is a lot. This also suggests that the $148m bank borrowings are fully drawn down all the time, with an interest rate around 8.2% implied. Note 6 doesn't seem to show any credit interest at all on the cash balances.

My opinion - as you’ve probably gathered, this one’s not for me.

The weak balance sheet, and heavy interest costs don’t appeal.

Although, as mentioned before, my main reservation is that however it’s dressed up, this is an online advertising group. I’ve seen lots of similar companies go badly wrong (eg XLMedia (LON:XLM) and maybe Tremor International (LON:TRMR) ), when factors outside their control go against them. All the while the shares look really cheap, and have interesting spikes up sometimes, before resuming the downward path.

Director deals can sometimes shed light on the outlook. M Royde has been a repeat buyer at CNIC, but 3 other Directors have banked about £8m from sales in 2023 to date. That doesn’t give me confidence.

Overall, the investment case here is pretty simple -

Bulls: Low PER, good growth (AI), trading well despite some other online marketing groups reporting subdued demand.

Bears: Profit/cashflow may not be sustainable (cigar butt advertorial websites?), weak balance sheet with too much (expensive) debt.

Take your pick! My instinct is to go AMBER/RED, it’s just not something I want to invest in. But of course we all look at companies in our own way, so good luck to investors who see it in a more bullish way. As always, I’ve no idea what the share price is likely to do, I’m only reviewing the company fundamentals.

Graham’s Section:

Lok'n Store (LON:LOK)

Share price: 738p (+1%)

Market cap: £242m

Lok'nStore, the fast-growing AIM listed self-storage company, is pleased to provide the following update on trading for the year to 31 July 2023.

I like this company but I’ve suggested that its stock may be too expensive. The stock has been coming off the boil in recent months, so maybe it’s starting to get into value territory?

Here are the highlights from the full-year trading update:

Same-store revenue +12.1%

Pricing up 6.8% (good but not quite keeping up with inflation). There is “continued strong demand”.

Total self-storage revenue up 5.3%

The slow self-storage revenue growth of only 5.3% is explained by the company’s strategy to dispose of certain sites after it has built and developed them, on a “sale and manage back” basis. It continues to generate management revenues from these sites, but not self-storage revenues.

This strategy results in the company having very little leverage as defined by its loan-to-value ratio (LTV). LTV was only 8.9% at the time of the interim results.

No. of stores in the portfolio: 42. Bedford and Peterborough opened during the year. Staines, Basildon and Kettering to open in the next 12 months.

Andrew Jacobs is the founder and Chair of Lok-n Store. He says:

"We continue to deliver on our strategy of opening more new stores in the under supplied self-storage market, adding 9.7% to our owned available space in the last 12 months. We are onsite at 3 further new stores, all of which will open in FY24 and have a secured pipeline of a further 8. These new stores will accelerate our growth in cash flows to fund more dividends to shareholders and more growth of the business."

Estimates - today’s RNS doesn’t provide much information on estimates but a note from finnCap confirms that there is no change to forecasts. For FY July 2024, these suggest revenue of £29.8m and adjusted EPS of 25.4p.

Graham’s view

In June, I said that I would be more interested in these shares “around 700p”. With the shares currently around 730-740p, I’m going to stubbornly stick with a neutral view on them.

I previously calculated that NAV (including deferred taxes) was 645p, a much lower number than the company and its broker uses but one which I think is fair. I’ll revise this figure when I get the next balance sheet. Remember that the earnings multiple here isn’t cheap, either (pushing 30x, depending on how you measure it).

Also in my mind is the Director Dealings page:

There were token-sized purchases of stock back in 2022 but they have been fully reversed by sales and the sales have been substantial.

Therefore, while it’s tempting to turn bullish on this given the recent weakness in the shares, I think it’s important to stay disciplined. So I’m still neutral, waiting for a lower entry point.

Hostelworld (LON:HSW)

Share price: 134.5p (+5.5%)

Market cap: £166m/€192m

10th August 2023: Hostelworld, a leading global Online Travel Agent (OTA) focused on the hostel market, is pleased to announce its interim results for the six-month period ended 30 June 2023.

These results were published late last week, but we didn’t get around to them at the time.

As a reminder, Hostelworld is a post-Covid deleveraging/recovery story. Its balance sheet has improved, its revenues have recovered to pre-Covid levels, and it is encouraging travellers to use its “social network” to make friends during their holidays.

Here are the H1 results:

Record gross transaction value of €339.5m

Record revenue €51.5m

H1 loss €7.5m (improved from a loss of €14.3m in H1 last year).

Last year, the company was still suffering from Covid-related disruption.

But it’s in a totally different place now.

Let’s consider it from the perspective of adj. EBITDA:

In H1 last year, adj. EBITDA was negative €5m.

Full-year adj. EBITDA was positive, so the H2 result was positive by over €5m.

In H1 this year, adj. EBITDA is +€5.1m.

And the expectation is that H2 adj. EBITDA will be up to €12m, for a full-year result of up to €17m.

Granted that these aren’t “real” profits, but they are hopefully a good start on the road to real profits.

Net debt finished H1 at €16m, down from nearly €22m at the start of H1. The company is now only paying a margin of 3.25% over EURIBOR - a great value facility, compared to what the company was paying before.

CEO comment: among other things, he discusses the resurgence in cross-border and especially long-haul flights, and “follow-on” flights after an initial journey. All of these things are good for the hostel sector.

Outlook is similar to before. Hostelworld now routinely includes a disclaimer that their performance depends on flights/travel not being disrupted as they were before:

The Board remains confident in the long-term resilience of our business model and the potential of our differentiated growth strategy and reiterating earnings guidance of adjusted EBITDA in the range of €16.5 million to €17 million for the full year, absent any deterioration in the macro-economic climate, the re-introduction of travel restrictions or other air travel related disruptions.

Which earnings measure is best? Hostelworld provides multiple earnings measures, so it’s not easy to decide which one to focus on.

Going down to the income statement to investigate, I think the one I’d use is operating profit/loss.

This wouldn’t work for a company with lots of lease liabilities, as leases have an interest expense that is excluded from operating P/L. But Hostelworld has minimal lease liabilities.

Also, Hostelworld’s exceptional items this year almost all relate to the cancellation of its old borrowing facility. These exceptional items are considered a finance cost, so again they aren’t relevant to the operating P/L.

Hostelworld’s operating loss in H1 was c. €1.6m (an enormous improvement from the c. €13m operating loss in H1 last year).

A large part of the loss relates to amortisation of intangible assets. Hostelworld’s cash flow statement is much more impressive than its income statement, so it could be argued that the income statement is overly harsh on the company.

Graham’s view

In July I said: I’m close to turning green on this one, but I’ll hold out and wait for proof of convincing profitability down at the bottom of the income statement.

It’s tempting to go green today, but I think that would be a little bit rash. I did say that I wanted proof of profitability on the income statement. The company has not yet done that.

Hopefully it will do it soon.

Stockopedia doesn’t rate the value on offer here very highly: the ValueRank is only 19. That’s a helpful sense check for someone writing a “Value Report”! With the ValueRank so low, I feel a little better about sticking with a neutral view. But I do rate this company highly, and I’ll be very happy for them if/when they start to generate real profits. They did that pre-2020 and they should be capable of doing it again.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.