Good morning, it's Paul here.

This is a dual-purpose report - partly for today's news, also to catch up from Friday, in particular with my thoughts on the latest profit warning from "omni-channel" fashion retailer, QUIZ (LON:QUIZ) .

Revolution Bars (LON:RBG) is reporting its peak period Christmas & NYE trading today. As this is my 2nd largest long position, I'll be heavily focusing on that, once I've got the Quiz section out of the way.

QUIZ (LON:QUIZ)

Share price: 24p (down 33% on Friday, at market close)

No. shares: 124.2m

Market cap: £29.8m

(at the time of writing, I hold a long position in this share)

Christmas Trading Update (profit warning)

Quiz calls itself an "omni-channel" (meaning physical stores, concessions, online, and international) fashion brand (mainly womenswear, with a focus on garments for special occasions, rather than basics).

AIM Admission

- Floated on AIM in July 2017, by Panmure Gordon, at 161p per share

- Raised £9.4m (after fees) for the company, from issue of 6,583,851 new shares

- 100% family-owned prior to float, 54% after float

- Family trousered cash of £89.8m (after fees) from selling 46% of the company in the float

- Share price has since lost 85% of its value, in 18 months

The float was very polished, presenting the company as an exciting growth story, achieving a high valuation. I attended a presentation shortly before the float, and was impressed with management. The online growth seemed to offer the potential for this to become something like Boohoo (LON:BOO) in the long run. Thankfully, I gradually lost interest in it, as it became clearer to me that the float price had been set too high, and that online (the bit that interested me most) was only a smallish percentage of total revenues. Also, from looking at product, I began to have doubts about the quality of the product designs.

As you can see from the share price chart, the wheels really came off in Oct 2018, and it's been downhill ever since;

Oct 2018 profit warning - there was a nasty profit warning, which I reported on here. Low footfall was blamed, but I stated that it was more likely that the new in autumn range had flopped - making another profit warning likely.

So at the time, I kept my distance, thinking that the share could drop further. Although I never imagined it would crash down to just 24p now.

What's gone wrong now? In summary, this is what the most recent, 11 Jan 2019, profit warning said;

Period covered: 6 weeks from 25 Nov 2018, to 5 Jan 2019

- Total group revenue up 8.4% (not like-for-like though)

- Online - very good growth still, up 34.1% (including own website revenues up a very impressive 50.8%) - this is, by far, the most interesting part of the group

- Stores & concessions saw revenue up 1.6%. Again, this is not LFL, so fairly meaningless. Due to new store openings, the (undisclosed) LFL performance is certain to be negative. Obscuring the truth is not helpful

- New stores - 3 new, and 2 enlarged - pleased with initial performance

- Strong balance sheet (this is actually true, see below) with £12.3m net cash at 5 Jan 2019, which is 41% of the market cap

- Challenging retail environment (especially in Nov 2018) - fair comment, this is true

- Trading improved over Xmas, but not enough to catch up. Overall sales below expectations

- Prudent to revise down expectations for remainder of financial year 03/2019

- Lower gross margin in H2 (6m to 03/2019) - at 60.5%, down from 62.0% in H1. However, 60.5% is still an excellent gross margin

- Increased overheads, to drive growth

Revised guidance - helpfully, the company quantifies the hit to revenues & profit;

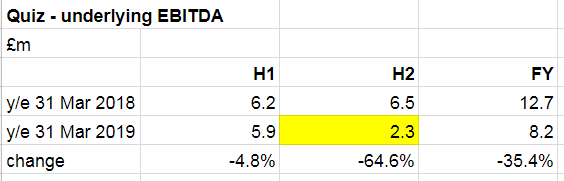

As a result of these factors, the Board now anticipates that the Group's EBITDA (excluding the previously announced write-off of £0.4m debt arising from the administration of House of Fraser) will be in the region of £8.2m for FY 2019.

EBITDA is a perfectly valid measure for retailers, as it approximates to cashflow before capex & tax. This is of the utmost importance when trying to assess if a company can survive a bad patch (since it can turn off expansion capex). Obviously you also have to look at the depreciation charge, and net profit too. Both measures are important - there's no single performance measure that we should focus on, everything has to be considered in the round.

At first look, the share looks amazingly cheap, at a market cap just under £30m, for a business that (despite setbacks) will still generate £8.2m EBITDA, and has £12.3m in net cash. That's an EV/EBITDA of just 2.1 - astonishingly low.

A couple of caveats though;

Cash just after Xmas will be at or near a seasonal high. Although bear in mind that Quiz won't yet have received the cash from its concessions, as this is banked with the host retailer, and paid in arrears. Therefore, cash may not fall back after Xmas as much as it does with other retailers - once the concession sales proceeds are paid over to Quiz (probably in Feb or Mar 2019).

The run rate of annualised profit could now be a lot lower than £8.2m EBITDA. Consider this table I've drawn up;

I have deduced the H2 EBITDA figure (shown in yellow) from the full year guidance of £8.2m EBITDA, less the actual H1 EBITDA of £5.9m.

What can we conclude from this?

- Either, the company just had a bad season, and could have great recovery potential in 2019/20.

- Or, it's going downhill, and if this trend continues, it could even become loss-making in 2019/20

- Or, somewhere in between. We don't know, as we're trying to predict the future.

Concessions - Debenhams

I think part of the reason that the Quiz has been smashed up so much recently, is that its profit warning coincided with news that Mike Ashley orchestrated the removal as Directors of the Chairman and CEO of Debenhams (LON:DEB) thus , tightening his grip on it.

This could be a precursor to some form of insolvency procedure at DEB, much like happened at House of Failure. The pre-pack administration there left Ashley in charge, but a long tail of bad debts (including £0.4m hit for Quiz, with its 11 HoF concessions).

The potential problem, is that Quiz has a lot of exposure to Debenhams. Looking at the presentation pack from IPO, the bulk of its concessions are within Debanhams stores: 101 stores, and online sales too.

The main risk is therefore twofold - if DEB has to do a pre-pack administration (the most likely scenario, in my view), then;

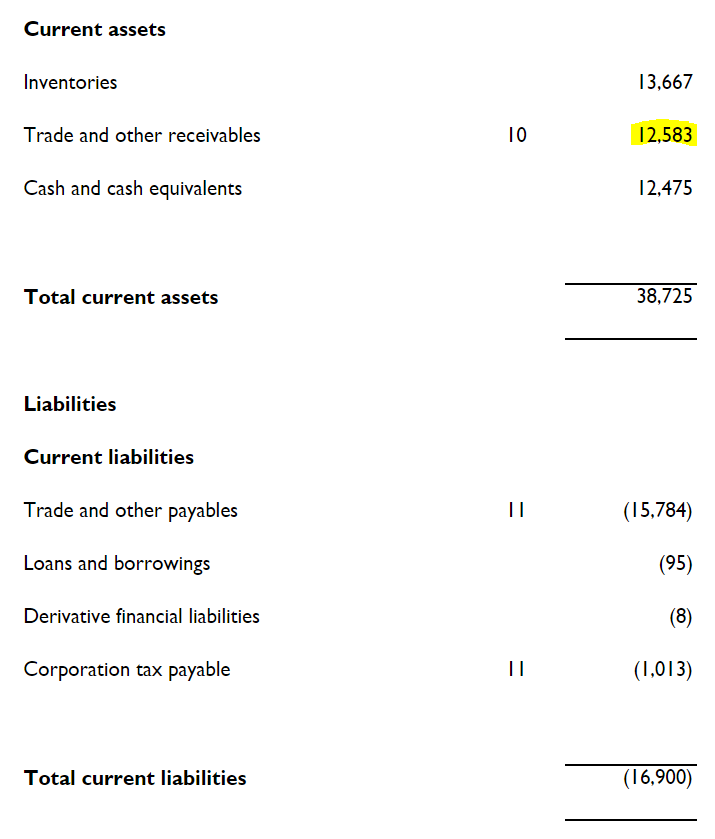

- Quiz faces a bad debt, which I estimate at £4-5m. I've arrived at this estimate in 2 ways which both point to a similar figure;

1) The HoF bad debt was £0.4m, on 11 concessions. There are 9 times as many DEB concessions, suggesting a £3.6m bad debt. Add a bit on for peak Xmas trading (if DEB goes bust imminently), and £4-5m makes sense.

2) Trade receivables were £5.9m at 30 Sep 2018. I reckon DEB would probably be the bulk of that, say two thirds. That drops out at £4-5m also.

- Quiz also faces reduced future revenues (and profits), since some DEB stores would undoubtedly be handed back to landlords

Could Quiz survive a £4-5m bed debt from DEB? Absolutely, yes.

Here is the working capital position from Quiz's balance sheet, as most recently reported at 30 Sep 2018;

That's a bulletproof balance sheet, with £21.8m in net current assets, including cash of nearly £12.5m.

What would happen if DEB does default? My estimate of £4-5m would come off receivables, as a bad debt, but would not affect cash immediately. The cash impact would gradually occur as a new receivable is built back up again, from a resumption of trading with the new iteration of DEB.

The second impact would be reduced profits from Quiz's concessions estate. This is because fewer DEB stores would be open. Although obviously it would be the weaker DEB stores which would shut, thus mitigating the profit impact on Quiz.

Both of these factors are distinctly unhelpful for Quiz, but not disastrous, and don't threaten its survival.

Below is a picture I took over the weekend of a Quiz concession in a Debenhams store - which looks unremarkable, but it's within a rund-down DEB that's probably earmarked for closure, at a guess. I estimate it is about 500-600 sq.ft..

Looking at the IPO document, 148 concessions produced £24m in revenues, which averages at £162k p.a. per site. If profits (undisclosed) are say 10% of revenues, then I make that £16.2k profit per site, or £2.4m profit p.a. for all the concessions. That might drop by about a third, if DEB does go bust, and say half DEB stores close.

Therefore, if my estimates are in the right ballpark, then a DEB pre-pack administration could hit Quiz for the £4-5m bad debt on receivables, and an ongoing reduction in profits of only about £0.8m p.a. (assuming the most profitable concessions continue trading within a reconstructed, and smaller Debenhams group).

My opinion - with the share price now down at only 20.5p, I'm going to stick my neck out here, and say that I think it's now priced very attractively.

The bad news has been wildly over-stated in my view. I see this as a successful & rapidly growing online business, with some retail stores as well.

It's had a bad season, so the jury remains on whether it is likely to recover, or whether problems are set to continue. We just don't know at this stage. I do think that the next bad news could be on DEB going bust. Let's hope that doesn't happen until after Quiz has received its Xmas takings from DEB. Even so, armageddon is already priced in. This is an (easily) survivable risk.

Why is the price still falling? Looking at the shareholder register, there are 2 names which jump out at me as being known for brutal selling in the market when they lose confidence in a company - Hargreave Hale, and BlackRock. Once they're gone (if they are selling), then the door is open to a strong share price recovery, in my view.

The business is still majority owned by the founding family. So they are mightily motivated to fix the problems, both financially, and reputationally. The danger is that the might be tempted to take it private on the cheap.

So, at 20.5p, I'm definitely interested in buying. Whilst bearing in mind that there could be more bad news from DEB at any point. Hence why many investors might be tempted to sit on the sidelines until clarity is achieved.

Revolution Bars (LON:RBG)

Share price: 121.8p (pre-market open)

No. shares: 50.0m

Market cap: 60.9m

(at the time of writing, I hold a long position in this share)

Revolution Bars Group plc ("the Group"), the leading operator of 79 premium bars trading across the UK under the Revolution and Revolucion de Cuba brands, is today providing a trading update for the 26 weeks to 29 December 2018 ("H1 FY19") and for the important Christmas and New Year trading period.

Christmas & New Year peak trading

- Positive Christmas & NYE trading, at +2.6% LFL - on top of strong comparative (up +5.9% last year)

- Late surge over Xmas, with last 2 weeks of H1 up 8.1% LFL

H1 trading (26wks to 29 Dec 2018)

- H1 revenue up 6.4% to £78.5m

- New sites - 5 opened in H1, overall these have traded ahead of expectations

- H1 LFL sales down -4.0% - showing a poor, but improving trend: Q1 -5.0%, Q2 -3.1%

- Revolucion de Cuba doing well, with positive LFL. Main brand "consistently traded below last year" in H1, apart from 4 wk Xmas period (which was positive)

Outlook & guidance

The Board is well progressed with its work on revitalising the Revolution brand proposition and continues to implement the required changes to the customer offer with further initiatives being launched in the coming weeks. The Board expects to be able to provide an update on the Revolution brand proposition when it publishes interim results on Friday 1 March 2019.

Adjusted EBITDA for 06/2019 expected to be £3.0m lower than last year (£12.0m vs £15.0m LY). This is split as follows;

- H1: £2.0m lower (due to lower LFL sales, and higher costs)

- H2: £1.0m lower - so at least an improving trend, although this is obviously helped by new site openings

Directorspeak - sensibly cautious, given the macro & political environment;

"The uplift in like-for-like* sales performance over the festive period gives us momentum going into the second half and I'm pleased with the progress being made in refreshing the Revolution brand proposition.

However, given the uncertain economic and political outlook we are adopting a more cautious outlook on trading in the coming months."

My opinion

Positives:

- New site roll-out is producing good results - this helps take up some of the slack from older sites performing less well.

- Positive peak period trading was achieved (especially the biggest 2 weeks at end Dec), but below what Stonegate achieved. I was hoping for nearer to +5% LFLs, as opposed to +2.6% achieved in Dec 2018. Still, at least they've turned around the negative LFLs reported before the peak trading period. A sign that the new, very hands-on CEO, is starting to make a difference perhaps?

- This all has to be seen in the context of a bombed-out share price, so the market has already priced in bad news. Although we're in a brutal market right now, where bad news is punished twice - in advance, with a falling share price, and then punished again on the release of negative news.

- Takeover talks could resurface (with Stonegate, or other parties. Although it's debatable whether the same price of 203p (cash bid from Stonegate which RBG shareholders [bizarrely, in hindsight] rejected would necessarily be achievable now.

Negatives:

- Overall H1 LFLs still negative

- More cautious outlook for H2 is bound to dent market sentiment today - although what did people expect, for goodness sake? How could anyone not already know that there's political & economic uncertainty?!

It looks like we'll have a big spike down this morning, as this is quite an illiquid stock.Then there should be some recovery in share price, as bargain hunters move in. This is only a mild profit warning for H2, so a massive share price reaction really isn't justified.

I'm getting tired now, so will switch to brief comments mode!

XP Power (LON:XPP) - good finish to 2018. Full year trading in line with expectations.

Order intake in Q4 fell 4% lower than prior year Q4 - due to weakness in semiconductor manufacturing equipment sector.

Net debt much higher, at £52.5m (vs. £10.1m at 31 Dec 2017).

While we are not immune from macroeconomic conditions we are encouraged by our ongoing new design wins and healthy order book. On this basis and with the benefit of the Glassman acquisition, we expect further revenue growth in financial year 2019.

My opinion - I've followed this company for years, and it seems a good business.

The share price (2070p) has come down a lot since the summer of 2018 (as have most shares), and the valuation metrics strike me as rather attractive now - a fwd PER of just 11.8, and dividend yield of almost 4%, for a decent quality business.

Worth a closer look, if you understand the sector.

Restore (LON:RST) - so many charts look the same at the moment - bumping around in H1 of 2018, then nose-diving from the summer/autumn onwards. This is another one that's lost almost half its value currently when compared with its 52w high.

It's down 14% today, so the market doesn't like its trading update.

Today's update is "broadly in line" for calendar 2018.

I'm not keen on the balance sheet here - NTAV is negative, after you write off the huge £258.2m intangible assets. Acquisitions have been funded by a lot of debt, plus the share count goes up every year too.

It doesn't interest me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.