Good morning subscribers! It's Paul here, I'm on duty this week.

Thanks to Graham for his interesting reports last week. I think he made a compelling case for Tandem (LON:TND) and I picked up a little stock myself after reading Graham's report. Although tiny, illiquid shares, can be problematic, especially in turbulent markets, as it can be very difficult to sell. The bid/offer spread was horrible.

The so-called Brexit cliff-edge seems to have receded until end Oct 2019 now (and likely to drag on well beyond that). So I think we could see buyers returning to oversold small caps. Or at least ones which report positive trading updates.

I'm experimenting with the format here, and have today trialled the idea of posting some earlier, briefer, comments each day. Then expanding on the more interesting announcements in more detail, as the day progresses, and when I've had time to do some more digging, got broker updates, etc. Let me know what you think!

IG Design

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of Gift Packaging & Celebrations, Stationery & Creative Play, Giftware & related product categories announces its trading update in relation to the year ended 31 March 2019.

Strong final quarter, which was expected, as the result is in line with expectations (not above);

The Group's strong trading performance continued in the final quarter delivering revenue and profit growth across all regions in the year.

As a result, the Board anticipates the financial performance of the Group to be in line with market expectations and significantly up year on year.

- Results helped by acquisition, called Impact

- Net cash better than expected, and improved on last year

- Dividend will be increased

- Directorspeak emphasises international operations

- Outlook - nothing specific, but management sound positive about further growth

My view - remains positive. This group has a superb track record to date.

Valuation of 19 times FY 3/2020 forecast earnings looks justified.

StockRank of 77 is good. Classified as a "High flyer".

(above written at 07:30)

UPDATE: The initial market reaction to IGR's update seems somewhat underwhelmed, with the share price down slightly - albeit with only 45k shares reported as having been traded so far. Of course it's only the small trades that are reported straight away. Larger trades could be being "worked" in the background, and are only printed once they are complete. Hence why share prices do not necessarily move in the direction that the small trades would appear to indicate. This is why it's a waste of time trying to analyse reported trades as "buys or sells". All transactions are by definition both a buy and a sell. You can tell what small, retail shareholders are doing, from the reported trades, but that's only part of the overall market. The big trades are hidden, and reported at the end of the day, or later still if a very large buy or sell order is being worked.

IG Design

Share price: 586p (down 2% at 11:07 today)

No. shares: 78.3m

Market cap: £458.8m

I can't find any updated broker research yet.

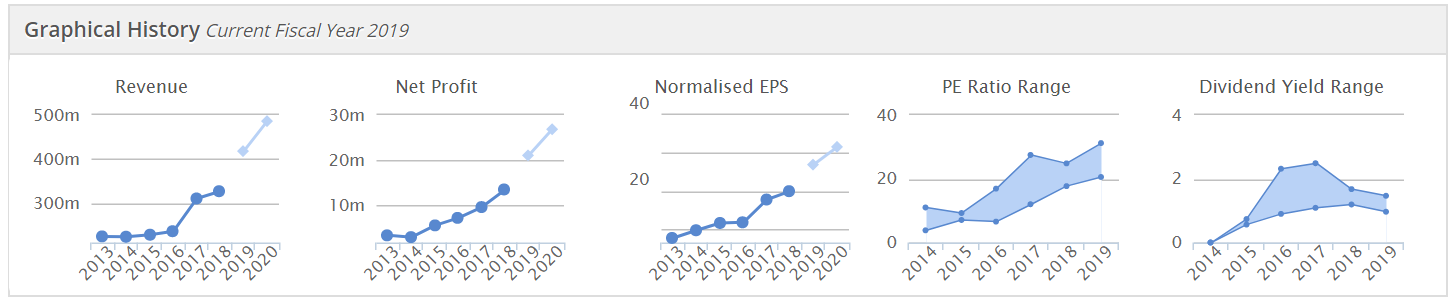

Reviewing the StockReport page here, there's a very nice progression in broker forecasts, although some of this may be due to acquisitions possibly?

Checking back through our archive, Graham commented here in Nov 2018 that most of the growth came from a recent large acquisition in the USA.

Balance sheet - the last (interim) balance sheet looks a little stretched. However, at 30 Sept each year, working capital is at a peak, in readiness for peak Christmas trading. So historically, a lot of the working capital unwinds by year end at 31 March. Therefore I don't have any particular concerns over its balance sheet - it's generally OK for highly seasonal businesses to use bank borrowings to support inventories & receivables at seasonal peaks, in my view.

My updated view - having dug a little deeper, I'm happy to reiterate my positive view above.

This share originally came to my attention a few years ago, when I enjoyed chatting to Gervais Williams of Miton, at an investment dinner. He was raving about how good the management at IGR were. I'm sure I've mentioned that here before (several times!), and the share price has done really well since then. It's interesting to note that Miton has recently reduced its stake here from 9.7% to 4.8%. I wonder what the rationale for this is? Conversely, someone else has bought the shares, so it's not necessarily a bearish sign.

(this section written at 11:25)

Sanderson (LON:SND)

Sanderson Group plc ('Sanderson' or 'the Group'), the specialist provider of digital technology solutions, innovative software and managed services for the retail, wholesale, supply chain logistics, food and drink processing and manufacturing market sectors, issues the following trading update ahead of the announcement of its interim results for the six months ended 31 March 2019, which are scheduled to be released on 15 May 2019.

This looks good, so I'll take a closer look later today;

The Group's trading results for the six month period ending 31 March 2019, stated under the new IFRS 15 accounting standard, are ahead of management's expectations with revenue growing to approximately £17.0 million (H1 2018: £14.6 million) and operating profit (stated before the amortisation of acquisition-related intangibles, share-based payment charges and 'one-off' non-recurring items) increasing by over 30% to £2.8 million (H1 2018: £2.1 million).

- Stockopedia shows EPS forecast for this year FY 09/2019 rising 36.4%, so it's not clear to me why a lower 30% increase in interim operating profit would be ahead of expectations? I'll need to look into that more carefully.

- On a comparable basis under IFRS15, operating profit was up a lower amount of 20%. Still good though.

- Order book up, and cash also up.

Outlook - sounds positive, but they've been careful not to say anything too specific!

The Board continues to be cautious in its approach, sensitive to both market conditions as well as to monitoring the general economic environment carefully.

However, following the strong trading momentum built in the first half of the year, a healthy order book, high recurring revenues and a strong, cash backed balance sheet, the Board has confidence that the Group is well positioned to make further progress in the rest of the full financial year ending 30 September 2019.

This will enable the Board to maintain its progressive dividend policy and continue to build shareholder value.

My view - I've reported favourably on this group before. It looks good value.

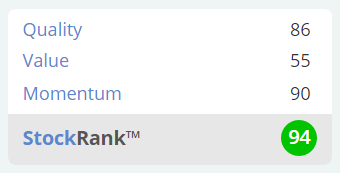

StockRank of 94, "Super Stock" - so worth a closer look.

(above written at 07:39)

UPDATE: This section is to add more detail, once I've had time to take a closer look.

There's a house broker update note available on Research Tree. This shows no change to forecasts. That may seem surprising, but the broker has decided to take heed of Sanderson's outlook comment, noting management caution (due to macro factors). This is my favourite type of situation - i.e. a strong update, saying ahead of expectations, but forecasts are left unchanged. This means investors now have a lovely tailwind, with the risk of a profit warning being low.

Sanderson achieved 7.9p adj EPS in FY 09/2018.

Broker forecast is for only a small increase to 8.1p this year FY 09/2019. It looks to me as if the company is likely to beat this figure.

At the time of writing this, at 10:45, the market has responded positively to today's trading update;

Sanderson (LON:SND)

Share price: 101p. (up 8% today, at 10:45)

No. shares: 60.0m

Market cap: £60.6m

Valuation - based on the (probably soft target) of 8.1p EPS this year, the PER is 12.5 - which looks good value, for a software group with decent recurring revenues, performing well.

Forecast EPS for next year, 09/2020 is 9.0p, for a forward PER of 11.2 - good value.

Balance sheet - conducting my customary review of the last balance sheet, I'm not terribly happy with it.

NAV is £34.4m, but once you take off the £43.3m intangible assets, then NTAV is negative at -£8.9m. I really don't like investing in companies with negative NTAV. However, software companies tend to have favourable cashflow, since customers pay up-front (represented on the balance sheet within creditors, as deferred income).

There is a £3.8m pension deficit. Not a huge amount, at only 6.3% of the market cap. However, in cashflow terms it's more significant - last year payments of £586k were made into the pension scheme. That's cash which could otherwise be paid out in divis. So it needs to be allowed for in the valuation.

My updated view - taking into account the cash-consuming pension deficit, and the weak balance sheet, it's maybe not quite as good bargain as it initially looked? I think on balance, the valuation is still quite attractive, but not enough to make me want to rush out and buy this share.

For existing holders though, today's update should be seen an reassuring.

Note that Sanderson qualifies for the "Best dividends screen" - which might seem surprising, but I've just had a look at this screen, and it has performed very well. It has also picked up some nice value/growth companies like Somero Enterprises Inc (LON:SOM) Zytronic (LON:ZYT) and Headlam (LON:HEAD) , plus housebuilders & car dealers - all interesting potential value situations. So if you have a value leaning, you might like to check out this screen here.

(above written at 11:00 & 12:34)

System1 Group

System1, the marketing services group, today releases the following Trading Update for its financial year ended 31 March 2019 (2018/19).

This share has fallen 80% since peaking in May 2017.

Pre-tax profits up strongly;

As a result, System 1 has generated underlying Pre-tax profits for the year, excluding Ad Ratings, share based payments and a one-off business rates rebate, of around £3.7m, approximately 80% higher than in 2017/18.

That's good, but note that Stockopedia shows consensus forecast EPS up 103%. So I'll need to dig deeper to see how actual compares with forecast.

Very heavy expenditure of £3.1m on a new "Ad Ratings" subscription service (not yet launched). Some expensed, some capitalised. This looks to be very important for future performance, so understanding this new product is key to the investment case.

Balance sheet is strong (I've just checked);

Despite this high level of investment, System1's financial position remains strong. At the year end the Company had a cash balance of £4.3m (31 March 2018: £5.7m), and no debt.

My view - erratic historical performance, but looks potentially interesting. Market cap is low, at £25m, so could be good upside if new product takes off.

StockRank is high, at 77. Style neutral.

(written at 07:50)

UPDATE: I can't find any more information, as there's nothing new on Research Tree.

Just to reiterate then, I think the "Ad Ratings" new product looks absolutely key to the future potential of this company. I'd certainly be interested in hearing more about that. Here is the website for this new product. It went completely over my head, so perhaps any subscribers here with industry knowledge might like to review it & let me know what you think? At £1k per month, subscriptions look ambitious.

This share looks extremely illiquid. It's up 11% today, but on only 7,358 shares traded (although there might be other traded in the background, not yet reported). With a very wide spread too, it's probably safest for me to avoid it.

Carr's (LON:CARR)

A rather dull agriculture & engineering group.

Interim results, 26 weeks to 2/3/2019.

- Adjusted profit before tax is up 4.5%

- Full year expectations unchanged

- Forward PER of 10.7 looks about right, for a low-growth, lowish margin group

- Dividend yield of 3.1%

- Share price has gone sideways in a 125-150p range for the last 5 years

My view - Why would anyone want to own this share, in preference to the many more interesting & better performing shares?

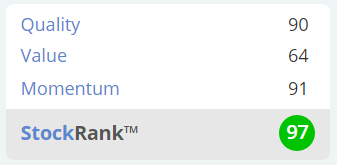

Why is the StockRank so high, at 97?

(written at 08:00)

No updates for this one, as it doesn't interest me.

XP Power (LON:XPP)

XP Power, one of the world's leading developers and manufacturers of critical power control components for industrial, healthcare, semiconductor and technology markets, is today issuing a trading update for the first quarter ended 31 March 2019.

This share bounced nicely on publication of decent 2018 results, on 5 Mar 2019.

- Today's update looks a bit mixed

- Q1 performance doesn't look great, with LFL revenues down 12%

Outlook - the company sounds upbeat about its order book;

We are encouraged by the continued strength of order intake experienced across the industrial, healthcare and technology sectors, and the book to bill level gives us confidence for the future.

We continue to expect further revenue growth in 2019 which will be weighted to the second half of the year.

The Board’s expectations for the Company’s full year performance remain unchanged.

My view - on an initial view, I'm struggling to reconcile the company's upbeat commentary today, with lacklustre organic growth figures. We don't like H2 weightings here at SCVR, which increase the risk of a profit warning later in the year.

There's nothing in this update which would make me want to rush out and buy this share. I normally only buy anything after a strong trading update, not a mixed one like this.

Although XPP does look good value, and has a strong track record, as you can see;

StockRank of 60. Style neutral.

(written at 08:18)

UPDATE: Just to flag up that there's an update note today from Edison, which maintains existing forecasts.

Redcentric (LON:RCN)

Share price: 77.5p (unchanged today, at 11:58)

No. shares: 149.1m

Market cap: £115.6m

All this is self-explanatory;

Redcentric plc (AIM: RCN), a leading UK IT managed services provider, is today issuing a trading update for the year ended 31 March 2019.

The Company's trading results for the year were in line with the Board's expectations.

Net debt at 31 March 2019 was £17.6m which was ahead of the Board's expectations and is a reduction of £10.1m since this time last year.

Having a quick review of the StockReport, I don't see anything of interest here, so won't look any deeper.

Filta Group (LON:FLTA)

Share price: 217p (down 5.7% today, at 12:03)

No. shares: 29.05m

Market cap: £63.0m

For calendar year 2018. This is a franchise business, mainly for (taken from the StockReport);

Filta Group Holdings plc is a provider of various services to national and independent commercial kitchen operators and owners. The Company's principle service is FiltaFry, which is the micro-filtration of cooking oil, the vacuum-based cleaning of deep fryers and full Fryer Management...

It looks a potentially interesting niche - recurring revenues, doing something difficult & unpleasant - so the shares could be of interest on the, "Where there's muck, there's brass!" concept, maybe?

- Revenue up 23% to £14.2m

- Adjusted EBITDA up 25% to £2.6m

I find franchise businesses very difficult to analyse, as it can be difficult to work out where the profit is actually coming from? i.e. from trading profit, or from selling new franchises? If it's the latter, then profits can dry up quickly in an economic slowdown.

Mindful of that, this comment today concerns me a bit;

"Whilst we anticipate a slowdown in new franchise sales as our territory coverage gets closer to maturity in the US, our European operation has picked up the mantle and we are encouraged both by the strength of the new business pipeline and the opportunities that will come from a broader geographic base.

Broker update - there's an interesting update from the house broker, on Research Tree. This suggests that today's figures are an earnings beat at 9.2p vs 7.8p forecast.

Attractive margins, & recurring revenues are highlighted by the house broker.

FY 12/2019 forecast adj EPS is lowered 11%, but this is blamed on increased amortisation of intangibles. I'm confused by that, because such amortisation charges are usually excluded from adjusted earnings.

My opinion - there are some positive features of this company, but overall I don't feel particularly motivated to investigate it any further. That's on account of the £63m market cap looking up with events, or a little ahead, in my view. Plus I find franchise business models difficult to analyse.

I'll leave it there for today, and hope that subscribers like the new format. Seeing as these reports are now part of the subscription, thought I'd better up my game a bit!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.