Good morning from Paul & Graham!

Today's report is now finished.

The Week Ahead series - today's article is from Mark.

Mello Monday is tonight - details here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

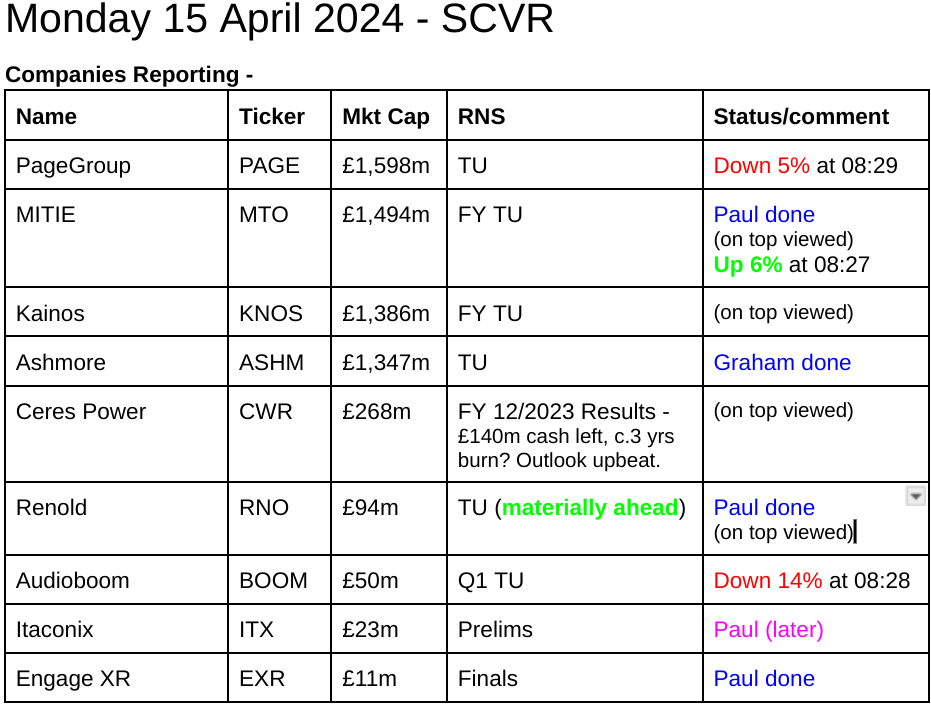

List of companies reporting - some of which we'll report on, focusing on over/under performers, and what we think are the better value/GARP shares. Also we prioritise your favourites, by looking at what readers are reading, on the top viewed list from the home page. Please remember that on busy days we cannot cover everything.

Other mid-morning movers (with news) -

KRM22 (LON:KRM) - up 24% to 23.5p (£8m) - New Customer Contract - Paul - RED

Niche risk management software minnow. Sounds like it’s making progress with growing ARR, and cost-cutting. However, its balance sheet is very weak c.£(6)m negative NTAV. Propped up with loan from major shareholder. Kestrel is second largest shareholder. I see high risk of this share de-listing, therefore I have to mark it red as currently structured. Pity, because if it had been properly funded with net cash, then it might have been an interesting punt here.

Invinity Energy Systems (LON:IES) - up 8% to 23.75p (£45m) - Update on Stretegic Investors - Paul - RED

Teases us by saying the negotiations with multiple large investors are going well, but nothing actually agreed as yet. I flagged here in Feb 2024 that it’s clearly running out of cash, and needs another refinancing. So personally I’ll wait to see if it successfully refinances, before being tempted to have a punt. Given the heavily cash burning history, I have to mark it as high risk for now, hence a continuing RED. The battery storage products do sound interesting though, and very much of the moment. I just need more proof, and more secure finances first.

Horizonte Minerals (LON:HZM) - down 82% to 0.425p (£1m) - Corporate Update -

Says it’s struggling to raise more cash, and that alternative options won’t leave any value for shareholders. That’s it then, looks like it’s a zero. Obviously we don’t cover the resources section here in the SCVRs, but an 82% share price drop today caught my eye and meant I had to do a spot of rubber-necking. It’s been around a long time, listed on AIM since 2006. Tried to develop nickel projects in Brazil.

Summaries of main sections

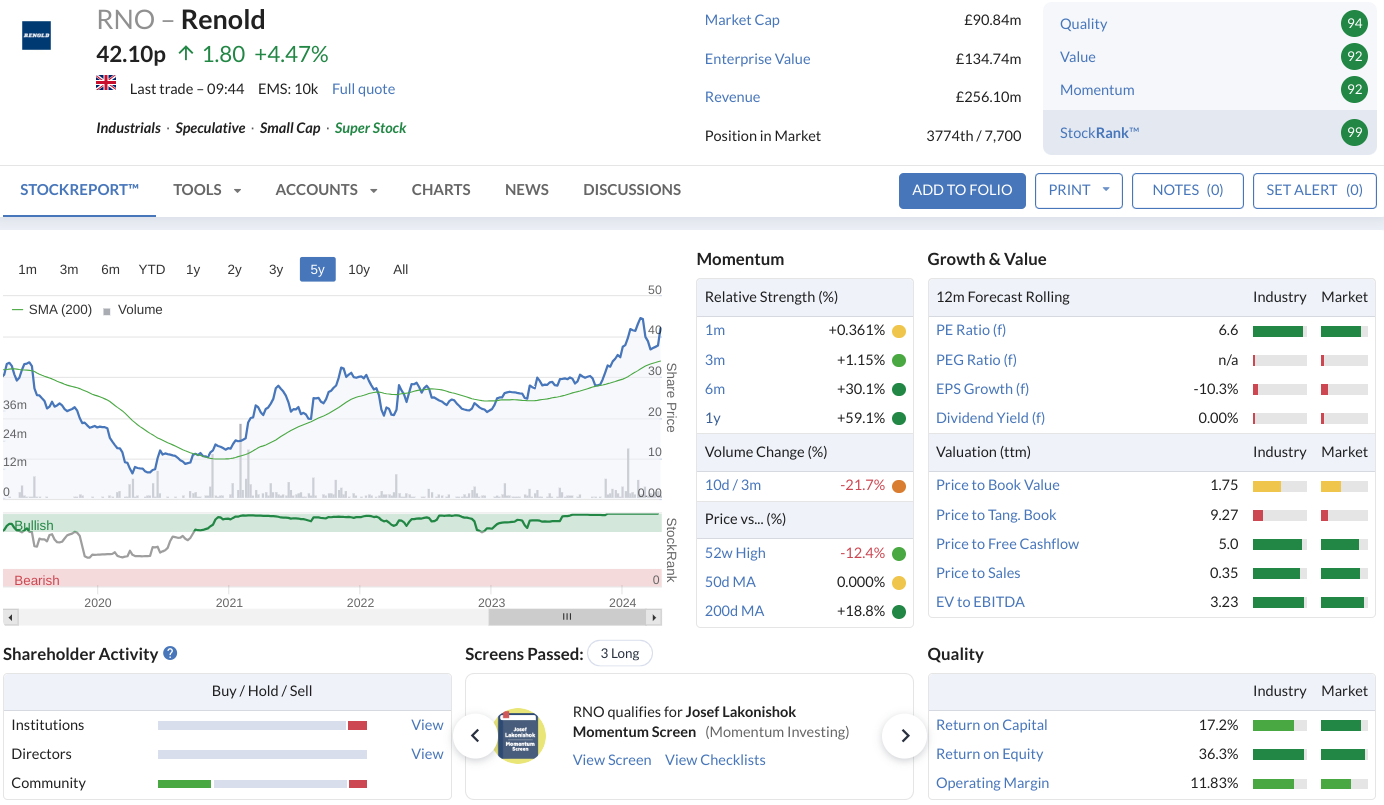

M&C Saatchi (LON:SAA) - 184p (£224m) - FY 12/2023 Results - Paul - AMBER

A 5-year turnaround still hasn't delivered convincing results. The famous PR agency has seen shares up 50% since last autumn. I'm underwhelmed by its complicated accounts, and poor cashflow, with legacy issues still cash-hungry. Hence why it pays negligible dividends. Weak balance sheet isn't good, but not a particular issue for a capital-light business. Maybe I'm missing a trick, but I can't see anything to get excited about here at the moment.

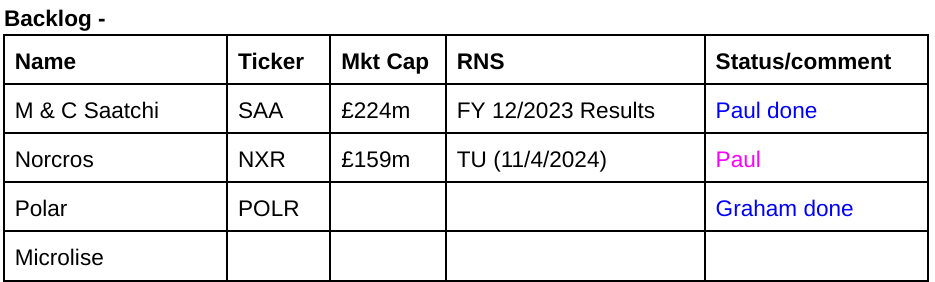

Renold (LON:RNO) - 40.3p (£91m) - Trading Update [ahead] - Paul - GREEN

"Materially ahead" of market expectations for FY 3/2024, with Cavendish raising adj PBT forecast by 13%. Also a larger increase in its FY 3/2025 (previously very cautious) forecast. The profit growth is coming from margin improvements. Net debt is quite modest, and more acquisitions are planned. I remain keen on this under-priced acquisitive group. Don't forget the pension deficit though, although this is waning in importance as the group grows.

Ashmore (LON:ASHM) - down 1.4% to 185.3p (£1.32b) - Trading Statement - Graham - GREEN

The Q3 update from this emerging markets asset manager describes a £2 billion outflow, blamed on institutional investor risk aversion. But I think the overall story here remains intact. If the dollar ever stops strengthening, Ashmore should see headwinds turn into tailwinds.

Polar Capital Holdings (LON:POLR) - 530.4p (£537m) - AuM Update - Graham - GREEN

An excellent update from Polar last week saw estimates getting revised higher and was warmly welcomed by investors. Small net inflows in Q4 interrupted the stream of outflows. This stock remains expensive relative to AuM but the earnings multiple is undemanding.

MITIE (LON:MTO) - up 8% to 120p (£1.60bn) - Trading Update (FY 3/2024) - Paul - AMBER

Shares up 8% on a decent-sounding FY 3/2024 trading update. I'm not sure how much more upside there is to be had here, after a very strong run of late. Facilities management companies tend to be ascribed quite low multiples by the market. This share has basically gone sideways for 20 years, so I'm not sure it's the best investment opportunity out there.

ENGAGE XR Holdings (LON:EXR) - unch 2.0p (£11m) - Final Results [FY 12/2023] - Paul - AMBER

Lousy numbers from this serial loss-maker. Why amber then? I've probably been too generous, but the main reason is that it has a 2-year cash runway after a fundraise in 2023, and has won a few impressive contracts. Losses are reducing too. As a fun money punt, I'd be tempted if the price came down a fair bit more. Risk:reward doesn't feel quite right yet. It probably should be amber/red actually. Let me have a think, I might edit this later.

M&C Saatchi (LON:SAA)

184p (£224m) - FY 12/2023 Results - Paul - AMBER

It’s getting a little late to be publishing 2023 results, and they’re not even audited.

Inevitably at a communications company, its results statements are going to be scrutinised carefully. The headlines don’t impress me, with the last two sounding too vague -

Material profit improvement in H2 and encouraging Q1 like-for-like momentum

Significant progress on transformation programme

Strengthened foundations for future growth

Going back a few years, SAA got itself into a big mess, and had various accounting problems, including some complicated options scheme that was used in acquisitions, that got into a tangle - see our archive where it’s all documented. It seems to have mostly sorted itself out now, but is still a big drain on cashflow.

More recently, the “Queen of tech” Vin Murria tried to take over SAA, but that didn’t work out. She’s still the biggest shareholder with 12.5%, and her listed tech acquisition business AdvancedAdvT (LON:ADVT) holds a further 9.8%.

SAA shares have risen c.50% from last autumn’s lows.

Note that the biggest drop in SAA shares happened in summer 2019, before the pandemic began in Feb 2020 -

The headlines section below raises some obvious questions - why is there a gulf between adjusted, and statutory profits, in both 2023 and 2022? Why is adjusted PBT down 10%, but adj EPS is up 3%? Why are dividends so mean, at little more than 10% of profit? -

New CEO is joining soon - I wonder why the old one left? -

"I am delighted that Zaid Al-Qassab joins as CEO in May to lead M&C Saatchi on its next phase of growth, building on a simplified operating model and supported by our exceptional leaders.

It’s an international group, with 40% of revenues UK, Asia and Americas being the next two largest markets.

Adjustments - here’s the reconciliation from small statutory profit, to large “headline” PBT. I see the dreaded put options still seem to be muddying the water -

What on earth is FVTPL above? It’s “fair value through profit & loss” - which means the change (downwards) in value of some unlisted investments in other companies that SAA has made. That sounds subjective valuations of investments. They’ve now written off just over half of the £15m total (not very good) investments, in the last two years. Maybe SAA should stick to its core activities in future, instead of trying to be an incubator investor in multiple startups?

Outlook - is it just me, or is this (below) mainly waffle? I would have expected something more concise, and impactful from a communications group -

“Over the last 12 months, there have been many changes at M&C Saatchi against a background of significant market volatility. The Board has materially changed, including the appointment of a new Chair and Chief Executive Officer designate while our markets have been challenging, particularly in the technology sector. As such, we have taken the decision to no longer provide long-term targets and will, instead, provide nearer-term guidance.

2024 has started with renewed energy and focus and encouraging first quarter momentum. While our end markets continue to be affected by macro-economic uncertainty, we expect Headline profit before tax for 2024 to be in line with expectations. We are confident that the structural changes we are making to our cost base alongside our new operating model are increasing our operational leverage potential which will help support future margin expansion.

We have evolved the senior leadership team increasing capabilities and alignment. Zaid Al-Qassab's arrival as our new Chief Executive Officer is at the core of this process and sets the scene for our delivery over the coming years.

We are well progressed on building a simplified operating model which places our regional focus and global specialist expertise at the heart of everything we do. This will ensure we can continue to be unashamedly bold, creative, entrepreneurial and fearless in the work we do with our clients.

Our focus is on growing returns for our shareholders by investing in capabilities and driving the Group forward with renewed purpose. We have a marked advantage in being able to operate at scale with the agility of a start-up, allowing us to move at pace.”

Balance sheet - isn’t great. NAV is £29.5m. Deduct £34.6m intangible assets, and NTAV is negative at £(5.1)m. So there’s no asset backing. However, a people business like this probably doesn’t need much in the way of tangible assets, so it’s not necessarily a problem, I’m just reporting the facts.

Lease liabilities exceed right of use lease assets by £15.7m, so that raises the question of whether it is committed to any onerous leases? I can imagine that a big name PR firm like this might have signed some expensive leases on fancy London offices in the past, that it might now find expensive, what with more people working from home, etc. Anyway it’s a question to ask management.

“Minority shareholder put option liabilities” have fallen a lot in 2023, but are still material, at £9.9m in current liabilities, plus £3.5m in non-current liabilities.

Ah! It’s coming back to me. I remember now - the plunging share price a few years ago meant that some payments it had to make in shares would have caused big dilution. So it renegotiated them, to pay out in cash instead. I see the share count seems to have stabilised at about 122m in issue. See note 26 for the details of equity related liabilities, which increase with the rising share price. This shows that £25-34m liabilities (total over the next 5 years) are payable between a share price of 200-300p. That’s a fairly hefty amount, and I suggest we should probably discount the valuation of this share by about 10% to allow for this.

Net cash was £8.3m at end 2023, down from £30.0m at end 2022.

Going concern note looks clean, saying it can operate within banking covenants even in a severe but plausible scenarios.

Cashflow statement - given that the P&L is full of adjustments, and the balance sheet is weakish, and complicated, then cashflow might give us a better idea of whether this business is any good or not.

Operating cashflow in 2023 was about £30m, but “Exercise of put options” saw a cash outflow of £14.6m - so half the cash generated was burned on this. There was also a £14m adverse working capital movement. Put those two things together, plus £4.2m cash paid out for corporation tax, and cash generation was actually negative £(3.6)m.

This is all before lease-related cash outflows too, of £(6.2)m. So about £(10)m cash outflows. Capex is modest at £1.8m.

Cash fell from £37m to £24m in the year, and it raised an additional £9m from increased bank borrowings.

Overall then, the cash generation is negative, and looks very poor to me in 2023 and 2022.

Paul’s opinion - as a value/GARP investor, I’m mainly looking for cash generative companies, that can pay out surplus cash in big dividends. SAA looks almost the opposite of that. Its accounts are far too complicated for a company of this size.

If you’re prepared to ignore a load of real world costs, then the adjusted numbers look OK. However, cashflow is reality, and it’s really poor, in both 2022 and 2023. That’s why SAA is only paying token dividends. The historic issues are not fully resolved, and are still a major burden on cashflows. Bulls might argue these are only temporary though, and they could be right, who knows what the future holds? The outlook does say that 2024 should see better cash generation.

SAA has been seemingly in permanent turnaround mode for about 5 years now. Admittedly we have had the pandemic in that time, but its problems pre-date that.

I was expecting to like this share, but rummaging through the accounts has put me off. It looks superficially cheap, on a forward PER of 9.9x, but the weak balance sheet, poor cashflows, and negligible dividend yield don’t suggest to me that this is a great opportunity. That’s just based on historical numbers though. Vin Murria seems to think it has great potential, and she’s a lot smarter than me, so maybe I’m missing a trick here? That said, we’re not trying to predict the future in the SCVRs, we’re just analysing the facts & figures as of now, and SAA doesn’t impress on that basis.

Renold (LON:RNO)

40.3p (£91m) - Trading Update [ahead] - Paul - GREEN

Renold, a leading international supplier of industrial chains and related power transmission products, is pleased to provide a trading update for the year ended 31 March 2024 ("FY24" or the "Year"), ahead of the announcement of the Company's preliminary results for the Year.

Trading is ahead of expectations -

The strong momentum in the Group's performance in the first half of the Year continued throughout the second half of FY24. The results for the full year are now expected to be materially ahead of current market expectations1, with adjusted operating profit approximately 20% higher than the prior year, driven by a further improvement in margin.

1 Company compiled analyst consensus for FY24 is for revenue of £244.3m, and for underlying operating profit of £26.5m.

Broker update - Cavendish helps us with updated numbers (many thanks) -

FY 3/2024: raises adj PBT forecast by 13% from £19.2m to £21.7m.

EPS is raised from 6.0p to 6.6p.

FY 3/2025: previously soft forecasts are raised a lot, with adj EPS up 28% from 5.3p to 6.8p (still only a slight increase on FY 3/2024 - are they leaving things cautious, to allow for further upgrades in future?)

Valuation - at 40.3p (like to rise today) the PER is only 6.1x revised forecast FY 3/2024.

Remember that the PER is low partly because of the cash-hungry pension deficit.

Profit growth is being driven by margin improvement, not top line growth.

Net debt is £24.9m, which looks fine to me relative to profitability.

Order book sounds fine -

Order intake in the second half increased over the first six months by 7.5%, or 8.2% at constant exchange rates. The closing order book at 31 March 2024 of £83.6m remains close to record levels and was in line with the half year position (30 September 2023: £83.6m).

Acquisitions - sounds like more are planned. Renold is proving adept at these, and it’s a good strategy because acquisitions are gradually diluting the pension deficit -

The Group continues to strengthen its financial position, which provides funding capacity to support its strategic growth objectives. These include both investment to further enhance operational capabilities as well as value-accretive acquisitions, from a developing pipeline of opportunities.

Paul’s opinion - very positive still, this is one of my favourite value/GARP shares, and has been for several years. I think the valuation is too low, and over-compensates for the pension deficit, which has proven a manageable and diminishing problem as the group grows.

At some stage, there’s possible scope for this share to re-rate, both from diluting the pension scheme in a larger group (enlarged via acquisitions), and eventual recognition that it is self-funding these acquisitions, and seems to be pretty good at it.

So it’s a thumbs up from me again, GREEN. Expect a rise in share price today (written just before 8am).

RNO shares are close to its recent 5-year high. Consistently high StockRank in recent years -

MITIE (LON:MTO)

Up 8% to 120p (£1.60bn) - Trading Update (FY 3/2024) - Paul - AMBER

Continuing our push into selected mid caps, I’m attracted to Mitie by the excellent 5-year chart, high StockRank, and positive market reaction (up 8%) to today’s news.

I last looked at MTO in 2020 and 2016, so we seem to be on a 4-year reporting cycle!

I would have preferred a clearer explanation of what the company does - this seems a bit vague -

Mitie Group plc ("Mitie" / "the Group") (LSE: MTO), the UK's leading facilities transformation company, today provides a trading update for the year ended 31 March 2024 ("FY24").

Going through the H1 results, this was the divisional breakdown, which gives a better idea as to what it does (half year figures remember!). It’s facilities management basically - with most profitable division at the top -

Business Services: £719m revs, £42m op profit, 84% of revenue is security & cleaning.

Central Govt & Defence: £406m revs, £35m op profit

Technical Services: £636m revs, £20m op profit, mostly maintenance & project work.

Local authorities, education, health, prisons, etc: £371m revs, £14m op profit.

The FY 3/2024 headlines today are -

Record revenue of at least £4,500m (11% increase yoy)

Operating profit increased to at least £200m (4.5% margin)

Share buybacks continue with next £50m programme launched

That suggests H2 improved on H1 (since operating profit was £85m in H1, it must be £115m in H2). I’m not sure if this is a usual seasonal pattern, or out-performance? There are no broker notes available to me, so I’ve had to estimate my own figures for FY 3/2024. I’ve come up with 10.6p adj EPS, which is a bit ahead of the broker consensus shown on the StockReport of 10.3p. So this looks like a beat against expectations, which is what an 8% share price rise today suggests too.

I don’t like the current trend for presenting operating profit as the main profit measure, we’re seeing this with more & more companies. We’re trying to wean the city off EBITDA, but they seem to have tried to dig in at operating profit, instead of presenting proper profits (adj PBT and adj EPS are the measures I need to see, to take into account all costs).

In this case though, adj operating profit was £85m in H1, and this became adj PBT of £80m, so that’s quite close together, since finance costs are not high for the size of business.

Note that profit adjustments are significant each year. Note 3 to the H1 results shows that it adjusted out £15m of acquisition-related costs, and £10m restructuring.

The highlights section below reads positively - and note the share buybacks at Mitie have been substantial, with issued shares peaking c.1,539m in 2022, now down to 1,335m. Another £50m share buyback is announced today, about 3% of the total in issue.

Note the significant increase in profit vs last year of 23% - impressive -

Broker consensus forecasts had been steadily rising -

So we’ve established that the group is performing well. What about its finances?

Balance sheet - excellent to see Mitie reporting average daily net debt, we need to keep the pressure on for all companies to report this key figure -

FY24 average daily net debt is expected to be c.£160m (FY23: £84m).

Overall, the balance sheet is loaded up with intangible assets, relating to the many acquisitions it has done. NAV is £412m, less intangibles of £606m, gives a weak overall NTAV of negative £(194)m.

Normally that would make me nervous, but in this case it actually looks OK. Why? Mainly because this is a services business, so it has negligible inventories. Not having to carry inventories which would be hundreds of millions, if this were selling physical goods, means the balance sheet can be negative overall without causing any problems.

There is some debt, but this is structured very well. It has £150m in private placement notes, with long maturities and low interest rate of 2.9%. So this looks an inspired move during the zero interest rate phase to lock in cheap debt.

An undrawn £250m bank facility is also available.

Both trade debtors and creditors are big numbers, at around £800m each. These would need careful scrutiny when the annual report comes out. In particular I’d be interested in what the c.£500m of accruals contains?

So even though it looks weak on paper, this balance sheet actually looks OK to me in practice.

Cashflow statement - going by the H1 figures, it seems to be spending more than it has coming in, with spending mostly on making acquisitions, paying divis, and doing buybacks. All of which seems to be depleting the cash pile.

Since I’m happy with the overall net debt position, which isn’t excessive at the moment, then it’s probably OK. It would be worth closely scrutinising the cashflow statement when the full year figures come out.

My opinion - it’s a fresh look for the first time in 4 years, so I’ve not looked at everything.

My impression is that this seems a well-run business, performing well. Facilities management is fairly low margin work, and Mitie makes about a 5% operating margin, and I imagine with little to scope to meaningfully raise that.

Obviously it had a rough time in the pandemic, but has now recovered. My main question mark from the graphs below, is whether all these acquisitions are really adding value? Revenue & profit growth look good, but it more than doubled the share count between 2019-2022. So EPS has essentially been static around 10p, and the PER is typically low - this makes me question how much more upside there is likely to be now that the shares have had a good run? I think MTO shares look OK, but there doesn’t seem to be exciting upside here. Whereas we’re finding numerous other shares that look obviously under-priced, and with cyclical upside in for free, whereas MTO shares look up with events, and probably don’t have much cyclical upside. So I would worry that tying up money here could have an opportunity cost.

Zooming out, and the 20-year chart has basically gone sideways (below). AMBER feels right to me.

ENGAGE XR Holdings (LON:EXR) - unch 2.0p (£11m) - Final Results [FY 12/2023] - Paul - AMBER

ENGAGE XR Holdings Plc (AIM: EXR), a leading spatial computing and metaverse technology company, is pleased to announce its audited results for the 12 months ended 31 December 2023.

I’ve previously been negative on this jam tomorrow cash burner. However, looking at today’s accounts, I’m happy with the cash position, and reduced cash burn, which gives it a 2-year cash runway not having to worry about any more dilution or a cash crunch.

It warned on profit last autumn, and 2023 revenues show no progress at E3.7m (down from E3.9m in 2022).

EBITDA loss reduced from E5.8m in 2022, to E4.0m in 2023. It’s an own goal quoting EBITDA, as there is no capitalisation of costs (nothing in intangibles on the balance sheet), so LBT is the same number, of E4.0m.

Net cash is the key number, which is healthy at E7.9m (EXR raised E9.9m fresh equity in Feb 2023).

Outlook - seems mixed. It says Q1 2024 was a record quarter, but then seems to quote revenue bookings, not actual revenue recognised, of E2m - it’s ambiguous. Mentions that some corporate clients have not renewed, or scaled down contracts, as workers come back into offices. That’s a concern for a growth company. Business seems to be focused on the educational & training sectors, globally, where EXR reckons it’s in “prime position” to become the global leader in this niche. It also expected many competitors to fail this year, an unusual statement! The worry is that they might be failing because it’s impossible to make any money from this area maybe?

Paul’s opinion - speculative, but EXR has won a few impressive contracts, and it has plenty of cash to give it a 2-year opportunity to crack this space. Shares look a long shot, but I’d be tempted to have a little punt if they drift down to 1.0p per share (half the current level).

Graham’s Section:

Ashmore (LON:ASHM)

Down 1.4% to 185.3p (£1.32b) - Trading Statement - Graham - GREEN

This is a Q3 update:

Ashmore Group plc ("Ashmore", "the Group"), the specialist Emerging Markets asset manager, announces the following update to its assets under management ("AuM") in respect of the quarter ended 31 March 2024.

Assets under management fell by 4%, including a 5% fall in the broad “Fixed Income” category that is Ashmore’s core business:

All told, it’s a $2.1 billion fall in AUM, made up of a $2.0 billion net outflow along with a small decline due to investment performance. Institutional clients were “continuing to reduce risk”.

Despite the overall sense of risk aversion, equities did see a small net inflow.

Performance was affected by the strong US dollar, which reduces the value of bonds denominated in other currencies (especially. the “local currency” theme in the table above).

Marc Coombs is the founder and largest shareholder, in addition to being the CEO:

"Emerging Markets delivered a mixed performance over the quarter as stronger than expected economic data pushed back expectations of rate cuts by the US Fed. Looking beyond the short-term, macroeconomic stability in emerging countries underpins superior GDP growth compared with the developed world, and many central banks continue to cut rates in response to lower inflation. An easing of US monetary policy will further boost hard currency bonds and, with the US dollar at or close to its cyclical peak, a weaker dollar will underpin returns from local currency bonds and equities. Ashmore remains well-positioned to benefit from the capital flows that should follow these positive market trends."

Graham’s view

While I do value Ashmore’s commentary, it’s worth repeating that in my experience, they will always argue that they are well-positioned, and they will always argue that investors are underweight emerging markets.

Long-term, I think they have a point that institutional investors will want more emerging markets exposure, and it’s a valuable niche in which to have specialist expertise, so I tend to view ASHM shares as attractive.

They’ve been getting cheaper in recent years:

As a result, they tend to offer a very generous yield:

The PE Ratio may seem expensive, but the company has a very strong balance sheet that includes a seed portfolio worth nearly £300m. So the PE Ratio is not the only factor to be considered here. See our comments in February.

Despite the outflows in Q3, I’ll continue to give this share the thumbs up.

Polar Capital Holdings (LON:POLR)

530.4p (£537m) - AuM Update - Graham - GREEN

News from Polar last week was a little better, and the market reacted positively to this update.

In the case of Polar, the quarter to March is its Q4. So the update published last week was its full-year update.

In great news, Q4 saw net inflows at Polar. They were very small inflows (£56m), but inflows nonetheless!

The underlying assets - e.g. healthcare and technology stocks - were a good place in which to be invested during the quarter, and so AuM rose by an impressive £2.3 billion, or 12%, to £21.9 billion.

It means that the financial year had a very positive result, in the end. The final result for FY March 2024 is:

Outflows £1.6 billion

Investment returns £4.3 billion

Total change in AuM: £2.7 billion, up 14%.

Of course it would be best if AuM growth was driven by inflows rather than by investment returns, but maybe the good result in Q4 is a sign that Polar has turned the corner?

Estimates: Paul Bryant at Equity Development upgraded his revenue forecast for FY March 2025 from £178.6m to £197.1m, and his EPS forecast from 35.3p to 43.4p.

Some snippets from the CEO comment:

Given the backdrop of challenging conditions for the asset management industry, and following a number of quarters of net outflows, it is pleasing to be able to report net inflows

With interest rates having potentially peaked, global equity markets continued to rise during the quarter…

While the outlook for fund flows remains uncertain, positive momentum has continued into April 2024…

Whilst global financial markets remain exposed to several headwinds, the potential of interest rates peaking and central banks beginning to consider the possibility of rate cuts bodes well for equities in general and investors will, we believe, continue to seek additional exposure to the asset class.

Graham’s view

This stock made it onto my best ideas list. There were many fund managers I could have chosen, and there are still many fund managers I am bullish on. However, I decided to go for one of them consider to be “best in class”, and that is Polar.

It’s a mainstream fund manager but I am betting that it can resist the flight to passives due to known specialisms in particular sectors.

Like Ashmore, this one also appears to offer good value, especially in terms of the dividend yield. As consensus estimates are upgraded, the PE Ratio should fall, too:

Of course, it’s not the cheapest fund manager. At the current valuation, it offers only £41 of AuM for every £1 invested in the stock.

By contrast, something like Jupiter Fund Management (LON:JUP) currently offers £107 of AuM for every £1 invested in the stock. I like the risk/reward there too (e.g. see our report in January), but that one has almost become a special situation due to the extremely long series of outflows.

For investors who are willing to pay a higher valuation to get a fund manager with a better chance of defeating the passives and retaining its independence, I think Polar is a great candidate.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.