Good morning!

The FTSE is down by "only" 25 points so far, meaning that this isn't yet the "Black Monday" I thought it might be. The low earlier this year was around the 6900 level (currently at 6975).

From Patisserie Holdings (LON:CAKE), we have heard of the existence of secret overdrafts propping up the company. The placing at 50p went ahead on Friday with 31.5 million new shares being issued - it could have been so much worse! The pre-existing shares will maintain ownership of 75% of the equity.

I've noted a couple of interesting comments over the weekend. Richard Bernstein from Crystal Amber - who wanted to be part of the rescue deal - has remarked that interest income was suspiciously low, given the cash balance the company was allegedly holding.

Elsewhere, Leon Boros has speculated that bills may have been credited to sales rather than creditors.

EBITDA forecasts for the current year have been slashed by c. 60%. Given that the earnings multiple attached to Pat Val's earnings will also be compressed, we can understand how a 90% discount might have been needed to ensure the success of the Placing.

The shares should come back from suspension by Thursday morning. Putting my optimistic hat on, I think 50p could prove to be a floor for the share price, assuming that the balance sheet is fixed and the chain is profitable (albeit at a lower level).

The problem is that the historic earnings numbers were probably a fantasy, making Patisserie Holdings (LON:CAKE) an inherently speculative proposition at this point. Financial analysis isn't possible with fake numbers!

Bring on the restatement of the accounts.

There are other companies with news apart from CAKE:

- Shoe Zone (LON:SHOE)

- Superdry (LON:SDRY)

- Cake Box Holdings (LON:CBOX)

- Purplebricks (LON:PURP)

- System1 (LON:SYS1)

Shoe Zone (LON:SHOE)

- Share price: 185p (+12.5%)

- No. of shares: 50 million

- Market cap: £92 million

Shoe Zone PLC (the "Group"), the UK's largest value footwear retailer, reports on trading for the 52 week period to 29 September 2018

An excellent update from this cheap shoe shop. Revenue will be c. £161 million (vs. forecast £159 million) and PBT greater than £11 million (vs. forecast £10 million).

The improvement is explained by "a stronger revenue and margin performance from the spring/summer ranges as well as benefiting from progress achieved through the further development of the Group's foreign exchange hedging policy".

It's a fine achievement and the shares are undoubtedly cheap but I think it's important to bear in mind why this has been cheap for most of its history on the stock market (i.e. since 2014):

It's a bargain bucket kind of place and that means the shares are going to be bargain bucket too - because it's difficult to imagine that there is any economic moat around cheap shoes.

The cheap rating doesn't cause any harm to shareholders though: it means a great big dividend yield (something like 5.5%) and a £4 million special dividend on top will be worth an extra 4%+ next year (subject to AGM approval).

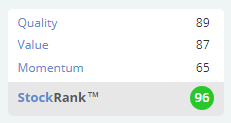

The algorithms love it:

I would be more measured in my own assessment, thinking that its real-life "Quality" is a good bit lower than the algorithms imply. I doubt that it has any brand value, for example (something that can be tricky to determine with a purely quantitative approach).,

All of that having been said, it is performing well and I expect that it will continue to produce a reasonable return for shareholders, especially when you take the generous dividends into account.

Superdry (LON:SDRY)

- Share price: 806p (-21%)

- No. of shares: 82 million

- Market cap: £660 million

Superdry updates on trading and financial impacts

What an ominous title for an RNS!

Superdry shares have more than halved in 2018 and are approaching the traditional SCVR market cap limits.

Before we get into the details of the profit warning, take note of the first sentence:

Superdry, the Global Digital Brand, updates the market on trading and financial impacts, against a backdrop of widely reported weaker consumer confidence across its key markets.

Global Digital Brand? That's more of an aspiration than a reality for now. Superdry still owns c. 250 stores, i.e. it has a very large physical presence. Online is a minority of total retail revenue.

Anyway, here's the explanation for the profit warning:

- Hot weather has hit the demand for heavy sweaters and jackets. I can well believe it, as those are the products I most associate with the Superdry brand. They are about 45% of annual sales. Hot weather has also affected Superdry's partners. Result: £10 million impact.

- FX hedging hasn't worked, so there's an extra £8 million in FX costs. It probably worked for the investment bank that sold it the product, I bet!

The expected H1 numbers are rather lukewarm. For example, there is "mid-single digit Ecommerce revenue growth" - not inspiring.

The company is heading into the critical H2 period on the back of a poor H1 - quite worrying.

EBIT was forecast at £111 million for FY 2019, prior to today's update. So it looks to me as if today's share price decline is roughly in line, on a percentage basis, with the £18 million reduction in profitability.

While I accept that momentum is against Superdry, I'm inclined to suspect that the market is punishing its share price a little too much, on the grounds that a) the heatwave is unlikely to be repeated long-term; and b) the FX costs shouldn't be repeated long-term, either.

I might be a little bit biased, however. This is a share that did a wonderful job for me when I bought it (on behalf of others) back around 2012. In more recent years, I've been thinking that it would be a nice share to add to my personal portfolio, if only the price was right.

It's beginning to look like value to me. At the current valuation, the EV/EBITDA ratio for next year might be something like 5x.

This valuation implies that the company's brand value has been ruined. Or that bricks-and-mortar shopping is dead and will be taking the company's store portfolio with it to the mortuary in due course. It feels very pessimistic to me.

While I'm not ready to pull the trigger on a purchase just yet, I do suspect that it has headed into undervalued territory.

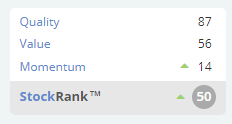

The StockRank is unconvinced for now:

Cake Box Holdings (LON:CBOX)

- Share price: 174.5p (+7%)

- No. of shares: 40 million

- Market cap: £70 million

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, today announces a trading update for the six months ended 30 September 2018.

This company provides egg-free cakes, a surprisingly popular choice. It runs a franchise model (great idea - let motivated managers on the ground do the heavy lifting!)

H1 revenue will be up 40% to c. £8.3 million. That's ahead of expectations.

Franchisees continue to sign up at a decent pace. It has 102 stores and reports "a strong pipeline" of new ones to open in H2.

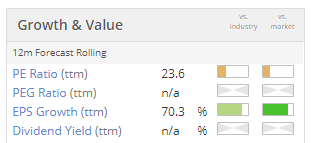

There's not much else to report from today's update but this recent listing seems worthy of additional research. Return on capital is recorded by Stocko at a mighty 54% (thanks to the capital-light franchise model, I expect).

On the other hand, I will understand if readers don't want to research any more cake shops at expensive ratings!

Purplebricks (LON:PURP)

- Share price: 212p (-3%)

- No. of shares: 302 million

- Market cap: £641 million

German joint venture and current trading update

This market cap is lower by some £300 million since I covered it in July.

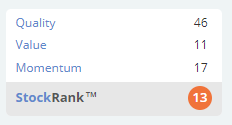

It was poorly ranked then, and it's poorly ranked now:

At least trading is in line with expectations for the current year.

Separately, it announces an £11 million investment in Homeday, "the leading German online estate agent".

Purplebricks will own 12.9% of Homeday, and its joint venture partner will also own 12.9%, so together they will own nearly 26% of the German company.

There are agreements in place enabling the JV to increase its stake in Homeday and ultimately buy the entire thing.

According to the numbers, Homeday is about three years behind Purplebricks in terms of the financial progress it has made so far. It is hoping to break even in 2021, having made sales of just €3.5 million last year.

My view - the valuation attached to Homeday is c. £85 million according to my maths and this seems absolutely bonkers to me. I still feel the same way about the Purplebricks valuation, even though its share price has now more than halved.

These are websites without any network effects to benefit from, performing a low-tech and labour-intensive job for customers. Valuing them on a multiple of sales makes no sense to me, but what do I know?

System1 (LON: SYS1)

- Share price: 205.8 (+4%)

- No. of shares: 12.6 million

- Market cap: £26 million

This market research company has never been the same since it changed its name from the quirky "Brainjuicer" (BJU) to the less interesting "System1". The share price is down by over 80% since the peak last year.

It's now in cost-cutting mode as it tries to recover performance.

Key points from this update:

- H1 gross profit to be 5% lower than last year. Slowly stabilizing.

- Operating costs down 14% excluding investment in a new service.

- H1 underlying and adjusted PBT to be £1.9 million (vs. £1.1 million last year).

My view - a fine example of why I no longer consider investing in this type of company any more (creative agencies / marketing consultancies).

It was performing brilliantly until competition sprang out of nowhere and ate its lunch (with cheaper and more highly automated products, apparently). The fixed labour cost base then hammered profitability.

Not tempted to bottom-fish here with this one which is a shame, as I used to think it was a really interesting little business (it had a fun website when it was called "Brainjuicer"!)

All done for today, thank you for dropping by as always.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.