Good morning, it's Paul & Graham here today.

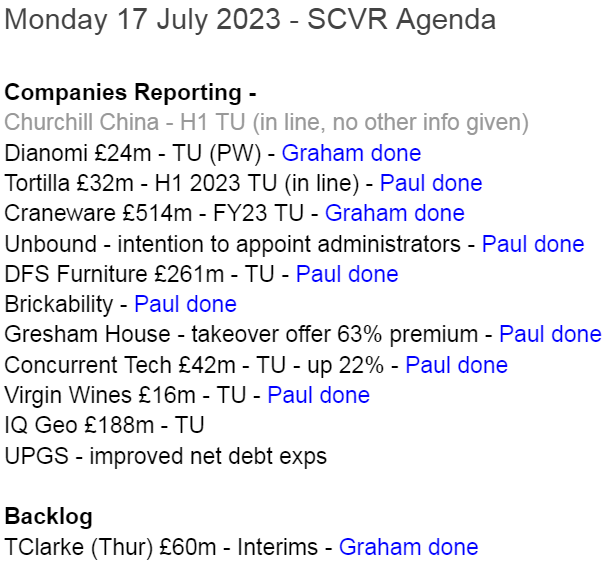

Today's report is now finished. 10 companies today, whoop whoop we're on fire!!

Podcasts - there was only 1 from me this weekend, as I was busy on Sunday watching the exciting tennis final and cooking a roast for Mum, on her 86th birthday! So no macro podcast, but I didn't have much material this week anyway. My main point was going to be the very positive news on rapidly falling inflation in the USA, which I think augurs well for the direction of travel here in the UK too.

So my overall macro/market view remains: nervous short-term, but bullish medium-term, and excited by all the great value shares that the UK small caps market is currently offering us. This seems to me the time to be holding our nerve, and embracing the value in UK small caps, not getting despondent and selling (probably at or near the low).

Also, the main theme we're hearing from individual companies at the moment seem to be -

- Supply chains improving, and

- Inflation easing.

So despite question marks over demand, and the possibility of a recession triggered by large, and (too) rapid increases in interest rates, there are also nice tailwinds which could offset the negatives for some companies.

Mello Monday - starts at 5pm online this evening. Renowned fund manager Christopher Mills will be doing a presentation, and I'll be on the BASH twilight session (when most people have probably nodded off!) at the end, giving an update on strong performance from Renold (LON:RNO) (I hold), which we covered in the SCVR last week here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections below

Tclarke (LON:CTO) - up 4% on Friday to 136p (£60m) - Half-year Report - Graham - AMBER

A solid set of interim numbers from this diversified construction and engineering firm with particular expertise in data centres. Expectations are for a big H2 and a record £500m of total revenues. I am happier being neutral on the sidelines after recent fundraising plans.

Tortilla Mexican Grill (LON:MEX) - 81.5p (pre market) £32m - H1 2023 Trading Update - Paul - AMBER/GREEN

An in line trading update for H1. I take issue with the company quoting adj EBITDA as a measure of profitability, when actually the lease and depreciation charges wipe out almost all of it! I run through the bull & bear points, and wonder if this might be getting into buying range for a contrarian/recovery situation once macro improves?

Craneware (LON:CRW) - up 2% to £14.85 (£503m) - FY23 Trading Update - Graham - AMBER

This US-focused software business, serving the healthcare industry, provides a nice update to its shareholders; revenue is at the upper end of expectations at c. $174m. If you value this through UK eyes, it’s expensive, but it’s probably cheap through an American lens.

Dianomi (LON:DNM) - down 40% to 47p (£14m) - Trading Statement - Graham - AMBER

H1 revenues are down 18% at this digital advertising company, which seems partly due to macro issues but probably also some company-specific failings. The stock IPO’d at 273p and perhaps shareholders have suffered enough. There’s still c. £8m in the bank balance.

Unbound (LON:UBG) - shares suspended at 0.75p - Paul - RED

As expected, this unsuccessful project has reached the end. It's bust basically, and the operating company is being placed into administration. There's nothing in the group holding company either, where liabilities exceed likely asset realisations. So that's a zero for UBG shareholders I'm afraid.

I ponder the lessons to be learned below, and what I can learn from my misplaced initial (moderate) enthusiasm for this project. Apologies again for initially getting this one wrong. Although to be fair, we did turn negative on it quite a long time ago, once it became clear that things were going wrong.

DFS Furniture (LON:DFS) - Up 1% to 115p (£269m) - Trading Statement - Paul - RED

Year end trading update says this market leading furniture retailer is trading in line with (greatly lowered) forecasts, making around £30m aPBT for FY 6/2023, and expecting only slightly more for FY 6/2024. No mention of the sizeable net debt it recently ran up, to recklessly pay divis & fund buybacks. Precarious balance sheet means I have to maintain my high risk, RED opinion. But, as a recovery trade, it might have some merits for risk-takers, once macro worries have eased?

Gresham House (LON:GHE) - Up 55% to 1056p (£404m) - Recommended Final Cash Offer - Paul - N/A

Well done to holders of this fast-growing alternative asset manager, which announces an agreed cash bid at a lovely 63% premium. Could the whole sector now be too cheap maybe? A few general thoughts from me below, although I'm not at all familiar with Gresham House.

Brickability (LON:BRCK) - Up 2% to 56.5p (£169m) - FY 3/2023 Results (audited) - Paul - GREEN

Good, in line results for FY 3/2023, plus an in line current trading/outlook section too. Balance sheet & cashflow statement both look fine. Looks astonishingly cheap on a PER of c.5x, but the market must be pricing in a sharp slowdown. Tempting to start nibbling at this, taking a longer-term view, but I'm nervous shorter-term. EDIT: I've upped my view from AMBER/GREEN to GREEN, because a subsequent webinar with mgt was excellent, and addressed my macro concerns. They're already forecasting for a 20% drop in demand re private housebuilding, saying that's in the forecasts.

Virgin Wines UK (LON:VINO) - Unch 29p (£16m) - Trading Update - Paul - AMBER

In line with previously lowered expectations for FY 6/2023 is today's message from this wine subscription service. It was an opportunistic IPO in the pandemic, which has since unravelled, as most of them have. Only £0.5m profit now expected, but with plenty of cash in the bank, the downside risk seems quite low. Could be a recovery/turnaround, but not one I can muster a lot of enthusiasm for.

Concurrent Technologies (LON:CNC) - Up 22% to 70p (£51m) - Trading Update - Paul - GREEN

A cracking trading update today, with Cenkos raising forecast profit by 29%. Supply chain easing, and the customer orders are piling up. So this is now looking very interesting! Recent problems over accounting adjustments can probably now be disregarded. I'm happy to go GREEN on Concurrent, thumbs up!

Paul’s Section:

Tortilla Mexican Grill (LON:MEX)

81.5p (pre market) £32m - H1 2023 Trading Update - Paul - AMBER/GREEN

Tortilla Mexican Grill plc ("Tortilla"), the largest and most successful fast-casual Mexican restaurant group in the UK, provides a Trading Update for the half year ended 2 July 2023 ("H1 2023", the "Period").

Overall trading is in line -

The Board remains confident in the Group's ability to deliver FY 2023 results in line with market expectations1.

1 Company-compiled consensus: FY23: revenue £69.8m, Adjusted EBITDA £5.0m (Adjusted EBITDA defined as statutory operating profit before interest, tax, depreciation and amortisation (before application of IFRS 16 and excluding exceptional costs) and reflects the underlying trading performance of the Group)

I disagree that adj EBITDA reflects the underlying performance of the group. Looking at the FY 12/2022 Results, adj EBITDA was £4.0m, but that became a loss before tax of £(0.9)m. So EBITDA looks to me an unrealistic measure of financial performance. There are large entries for depreciation of the fixed assets (shop fits), and big IFRS 16 lease entries, which render the cashflow statement completely useless, even gibberish really - not the company’s fault, but rather the geniuses at the accounting standards organisations, who came up with this deeply flawed way of accounting for leases.

However, what we can probably all agree, is that were MEX to operate in a steady state, not opening any new sites, then it would be nicely cash generative.

Other points today -

H1 revenue up 22% to £32.7m (helped by new store openings in H2 LY, and H1 TY).

LFL (same stores) revenue up 8.4% - that’s pretty good in the current conditions I think, and means it should be absorbing inflationary increases in wages, in a labour-intensive business.

Franchised stores “performed very well”, further expansion planned.

3 new sites opened in H1 (2 company operated, 1 franchised), total now 85 sites - so there should be plenty more suitable sites to expand into, in the UK.

Net bank debt is minimal, at £1.6m - as expected, it says.

Efficiency & cost-saving measures have helped.

“Some easing of cost inflation in relation to certain key food ingredients” - I think this relates primarily to meat prices, which shot up last year.

Paul’s opinion - I’ve been sniffing around this share since it listed, as something I’d like to possibly take a small stake in personally, when the time is right.

The bull case being -

It’s an appealing format with attractive shops, serving tasty, fairly healthy, affordable, filling meals (it’s one of my personal favourites).

Repeat business from customers once they discover it.

Roll-out of new sites on attractive lease terms, with a lot of the capex being funded by landlord contributions, so it’s a good time to be expanding, and more sites dilutes central costs.

Has coped with multiple macro shocks, particularly food price inflation (very high for meat), and energy costs (now being hedged).

Management seem sensible & competent (subjectively) - I've met the CFO, but not the CEO.

Potential to increase margins, as inflationary pressures ease/reverse?

Holding its own, with decent LFL sales growth of 8.4% in H1.

Bear points -

Not really making any money! Although that’s in a tough macro environment.

Incredibly tough, competitive sector - so why invest in anything here?

Weakish balance sheet, with negligible NTAV, which limits expansion plans.

Lots of competition - esp in London, where Mexican-style food is growing in popularity (although competitors are mostly not very good, in my opinion).

Illiquid shares, with only 25% free float, with 4 big holders owning over half - delisting risk?

Overall - looking forward say 3-5 years, I think this share has the potential to be a much bigger, and more profitable group. Although at this stage, it’s a bit of a leap of faith, but not that much really - because we’re probably over the worst in terms of cost pressures.

LFL sales growth of 8.4% in H1 is a solid performance in a tough market, which makes me feel this brand/concept is now proven in all market conditions.

I’m not ready to go GREEN on Tortilla just yet, but think I’ll ease in that direction with AMBER/GREEN.

Too expensive when it floated (like nearly all IPOs!) but given a solid update today, this looks overdue a bounce. Trouble is, there could be unwilling institutions selling the background, so price could remain depressed for some time, who knows?

Unbound (LON:UBG)

Shares suspended at 0.75p

A sad postscript for this share, which was the remnants of Electra Private Equity, after all the other assets had been sold off, or in the case of Hostmore (LON:MORE) split off into a separate listing (which has also been a disaster).

Anyway, Unbound (Hotter Shoes), is where naive (and dishonest, as I’ve mentioned before - they denied to me that a fundraising was being done, when they were in the process of doing one!), prolific buzzword-wielding management have completely failed to execute their plan. It was also floated with too much debt.

The main part of Electra was Hostmore, so the shares we got in Unbound were always a bit of a bonus if it worked, but not particularly material overall. Sadly it just hasn’t worked.

Here at the SCVR, my initially quite positive thoughts about the potential (based on forecasts at the time), turned to negative comments quite a while ago, once it became clear the project wasn’t working as planned, and management failed to achieve the forecast profitability. Mind you, most of the shareholder value had already disappeared by the time it became obvious that the shares were not worth holding.

This is par for the course with micro cap investing I’m afraid - lots of them do go wrong.

Sceptics were right to dismiss UBG shares.

Rather than try to blame other people for our investing mistakes, I find it’s better to look for the signs of what went wrong, and avoid similar situations in future. Hence, with hindsight, these strike me as things I should have put more emphasis on at UnBound -

- Relying too much on broker forecasts, when there wasn’t a proven track record.

- The physical stores business of Hotter Shoes had failed, so why would it work online?

- Naive, inexperienced management, spouting trendy buzzwords all the time (this infuriated a lot of us at one of their online presentations, I remember the discussions afterwards here)

- UBG retained too much bank debt, and this wasn’t obvious until its first standalone accounts were published - so I must check more rigorously what debt new floats have, if any.

- Several zooms with apparently credible Electra management, allowing them to pull the wool over my eyes.

For speculative shares, I think using an informal stop loss might be a good idea.

Averaging down on shares which are failing, is a disastrous strategy (thankfully I didn’t, as I ditched them) - as emphasised by both Paul Hill recently, and the Naked Trader interview with our Megan (I started listening over the weekend, the recording is here) -

I’m sure ACounsell will post his usual post on UBG, blaming me for an investment that went wrong. So I thought I’d get that in first! As we always say though, all we can do is review the facts, figures, and forecasts at any specific point in time. When the facts change, we change our mind, which is what happened on UBG. But on reflection, I should have been a lot more sceptical initially, so please accept my apologies again for that. Lots of speculative micro caps go wrong, which is why we’re sceptical on nearly all of them here. But I probably need to raise the bar even higher, so that another UBG doesn’t slip through the net.

DFS Furniture (LON:DFS)

Up 1% to 115p (£269m) - Trading Statement - Paul - RED

DFS, ("DFS" and "the Group"), the market leading retailer of living room and upholstered furniture in the United Kingdom, announces the following update for the 52 week period to 25 June 2023 ("FY23").

FY23 profit within previously guided range

Group achieves record market share

However, profit has halved from last year -

Underlying profit before tax and brand amortisation for FY23 in line with previous guidance at slightly above £30m despite the market being significantly worse than expected

To put that £30m aPBT figure in context, it was £60m last year FY 6/2022, and £109m in FY 6/2021.

Look at how much market forecasts had already been lowered, so meeting these low targets is not good news, it’s just not any worse than expected -

Other points -

Impressive market share claimed of 38%

Gross margins improved as freight costs reduced.

Consumer demand is soft, “market volumes down by c.15-20% across FY 23” - it’s unclear whether this is company-specific, or the market generally?

Current trading - “consistent with the Board’s expectations”.

Outlook - only a slight recovery expected -

Expect to continue to outperform a declining market in FY24 and grow market share delivering low single digit £m profit growth…

We currently expect market volumes to decline by mid-single digits for the full year, however, the economic outlook remains uncertain. To that end the business has been prudent in its planning, is taking actions to maximise operating cashflow through continuous margin improvement, delivering cost savings and reducing capital expenditure. Despite the ongoing pressure on market volumes, we expect underlying profit in FY24 to be slightly above FY23 levels, supported by the Group's leading brands, scale and well invested integrated retail proposition.

When the market recovers, given our increased market share, the operating leverage within the business and our negative working capital cycle, we are well positioned and remain confident in delivering our long-term targets of £1.4bn of revenue, an 8% profit before tax margin and 75% post tax free cash conversion driving strong returns for our shareholders.

Nothing is said about cash or debt. That’s a key (deliberate) omission, because the main risk with DFS is that management launched a reckless debt-fuelled dividend and buyback programme, at a time when profit was heavily falling. What on earth were they thinking?

Net bank debt was £135.6m at Dec 2022. That sounds a lot for a company that’s only made a profit of about £30m in FY 6/2023, and only expects a little more for FY 6/2024.

Balance sheet - is a big problem. NAV was £230m at Dec 2022, but included £535m of worthless intangible assets. So NTAV is negative £(305)m!

Where has all the customers cash gone? They’ve spent it, and run up bank debt on top, to pay for divis & buybacks.

Hence the whole business is financed by bank debt and supplier credit - very high risk I’d say. Smaller SCS (LON:SCS) is the opposite, prudently sitting on piles of customers & its own cash.

Paul’s opinion - this is a good business I think, but run by reckless financial engineers, who’ve plundered the balance sheet in order to pay unjustified & unaffordable shareholder returns.

That just makes it too high risk for me, as any further downturn in trading could put the whole rickety structure in danger of collapse (if bank, and/or trade credit insurers, get cold feet and pull cover - the sort of thing they do in economic downturns).

The strange thing is, DFS sailed close to the wind in the pandemic, but managed to get a rescue equity raise away on quite good terms, I remember. You would have thought such a close shave would have made management more prudent, but the opposite seems to have happened - instead of hunkering down, they instead decided to max out the overdraft to pay divis & do buybacks more recently.

Looking for positives, for balance, DFS shares could do well in a cyclical recovery, and there’s no doubt DFS is fundamentally a decent business. But investors also need to be aware that its extremely weak financial structure means you’re taking a big risk here.

There was chatter about the intentions of a Polish furniture manufacturer which has a c.10% position in DFS. A possible takeover maybe? Or any deep-pocketed overseas buyer might see merit in buying DFS to get an instant 38% market share of the UK market. So I can see strategic value in the company, and debt might not worry such a buyer.

DFS cannot afford to pay any more divis, so I would treat the yield as being irrelevant.

On the upside, the stock market has ignored balance sheet risk at DFS before, so looking at the chart below, a soft landing might see a repeat of the 2021 rally perhaps? So it might be an interesting share to trade, for risk-takers.

The balance sheet position is so awful, that I am compelled to maintain a RED opinion on this one. Why take the risk, when the macro situation is so uncertain right now?

Gresham House (LON:GHE)

Up 55% to 1056p (£404m) - Recommended Final Cash Offer - Paul - N/A

This is not the usual bid talks in progress type of announcement (which often fall through). This is a proper, agreed takeover bid at 1105p, by Searchlight Capital Partners LP. - whose website says it has $11.6bn assets under management, and has made 40 private equity investments. I’m assuming it’s US-based, with the contacts page showing 3 North American offices, and one in London.

Gresham House calls itself

“A leading specialist alternative asset manager focused on sustainable investments across a range of strategies, with expertise covering forestry, real estate, sustainable infrastructure, renewable energy, battery storage….”,

with c.£8bn assets under management.

The offer is a very good premium of 63%, which I’m sure shareholders will be secretly delighted with (after having made the customary public complaints about how disappointed they are!)

I’ve skimmed a bit of the announcement, and it’s basically saying that the public market hasn’t rewarded Gresham House with a valuation it believes it merits, having grown very strongly from almost nothing about 9 years ago. Clearly the bidder agrees.

Gresham House’s growth track record does indeed look really impressive, as you can see below. Although it can be tricky to ascertain whether profit growth like this is sustainable, when they come from nothing, and grow very fast -

Paul’s opinion - this looks a generous premium, but that’s about as far as my view on it goes, as it’s not a company we’ve covered here before I’m afraid.

Although as others have said, it does add credence to the idea that the whole sector might now be cheap.

We’re given one clue on valuation, which could be useful to searching for other possible takeover targets in the sector -

The Acquisition implies an enterprise value multiple of approximately 15.9 times Gresham House's EBITDA for the 12-month period ending on 31 December 2022.

Graham’s finished for today, but as our resident sector expert, maybe he could flag up any other promising potential bid candidates? He was right about Numis, for example. Although it’s often very difficult to predict bids, because bidders often see something quite intangible, usually structural growth opportunities, rather than just focusing on price.

Anyway, congratulations to GHE holders, it’s a lovely feeling when a takeover bid comes through at a decent price. The more bids we see coming through at big premiums, the more it should help rebuild market confidence I think, and of course gives the existing institutional holders a liquidity event, which provides the firepower to buy other shares.

The agreed bid looks to be an all-time high too -

Brickability (LON:BRCK)

Up 2% to 56.5p (£169m) - FY 3/2023 Results (audited) - Paul - GREEN

Brickability Group PLC (AIM: BRCK), the leading construction materials distributor, is pleased to announce its audited final results for the twelve-month period ended 31 March 2023.

Good performance across all divisions

Impressive revenue growth +31% to £681m, nearly all from acquisitions.

Very low gross margin of only 16.6% (very slightly down on LY)

Adj Profit Before Tax (aPBT) up 29% to an impressive £44.6m.

Adj EPS up 19% to 11.9p (LY: 10.1p)

PER only 4.7x

Net debt modest at £8.0m.

Total divis up 5% to 3.16p - yield of 5.6%

What’s the catch then, why are these shares so cheap?

Outlook - there doesn’t seem to be any sign of a slowdown as yet -

As previously announced, and whilst remaining conscious of the challenges in some of our segments in the short-term, the Group believes that the underlying long-term demand for UK housing remains robust as does the demand for quality materials for the construction sector generally. The Board remains confident that the Group is well placed to continue delivering on its strategic objectives and the underlying organic growth of the business and, notwithstanding a number of industry participants publicly communicating their own expectations of volume reductions in the near term, trading in the current financial year to date has remained in line with Board expectations.

Note that BRCK achieved broker consensus earnings for FY 3/2023, despite those forecasts actually being raised - completely the opposite of what I would have expected. The raises were probably due to acquisitions though -

As you can see for the lighter line, the new financial year is currently forecast to show a fall in EPS from 11.9p actual for FY 3/2023, to 10.5p for FY 3/2024 - that’s not a bad starting point, with an assumption that earnings might dip. Although in my experience, when earnings do drop in cyclical sectors like this, they tend to drop a lot, not just a little! That’s what the low share price is telling us too.

I also wonder whether the tight supply, and hence rising prices, of building materials might turn into a glut, and falling prices, which often happens after supply disruption in many areas? The danger is, we could be valuing this share on peak, unsustainable earnings.

Balance sheet - is it shot to bits? Actually no. NAV of £175m is mainly intangibles (relating to acquisitions) of £152m, so I’ll deduct that, but also the (usually acquisition-related) £18.2m deferred tax liability. That gives me NTAV of £41m, which is OK I think.

Note that inventories are unusually low at £33m, which is because a lot of the products are drop-shipped direct from the manufacturers. Hence why BRCK doesn’t actually need a lot of capital, so overall it looks fine to me.

Cashflow statement - it looks a genuinely cash generative business this year and last year. That cash was spent on divis of £9.1m, capex of £7.2m, acquisitions £16.7m, with a £53m equity raise last year also helped boost cash.

There are a lot of moving parts here, but I don’t see anything of concern.

Paul’s opinion - in normal macro conditions, I would say this share looks very cheap indeed - a current year PER of just over 5x, and an in line current trading statement. Solid enough balance sheet, with only a little net debt. Generous divis too. It looks really good actually.

However, clearly the market is anticipating a profit warning, otherwise it wouldn’t be this cheap.

I’ve toyed with the idea of buying a few BRCK shares myself, but just imagined what a numpty I’d feel as the (seemingly almost inevitable) downturn in demand might come through, and forecasts get slashed, taking the share price down further. So cheap shares can often get cheaper, as I know only too well from previous mistakes!

I don’t understand why a (primarily) brick distributor can remain impervious to slowing conditions that we’re hearing from housebuilders. Is there a time lag effect maybe? I don’t know enough (well, anything!) about how demand for bricks works.

So this might be cheap for a good reason, or it could be oversold. I’m not sure which it is I’m afraid, so will have to stay neutral-ish, but leaning towards a positive view as the valuation is now so cheap. Let’s go with AMBER/GREEN.

This chart is since it floated -

Virgin Wines UK (LON:VINO)

Unch 29p (£16m) - Trading Update - Paul - AMBER

Virgin Wines UK plc (AIM: VINO), one of the UK's largest direct-to-consumer online wine retailers, today provides an update on trading for the year ended 30 June 2023 (the "Period").

FY23 financial performance in line with market expectations; making progress with strategic initiatives

Performance during the Period was in line with expectations, with total revenue for the year of £59 million and adjusted PBT of no less than £0.5 million.

Virgin Wines maintains a strong balance sheet with net cash of £5.5m and no debt.

Given the plummeting share price, I think no more bad news is actually good news!

Quite a few things have gone wrong this year, including a warehouse IT system installation, causing disruption.

I last looked at VINO here in early May 2023, when it warned on profits. Surprisingly, I seemed to think it was looking tempting as a possible value/recovery punt “if it drops further”. It’s since dropped from 39p to 29p, but I’m finding it more difficult to see much upside potential, other than if someone bids for it. Gresham House (41%) and the CEO (8%) effectively control it, so there’s a risk they might take it private without paying a proper bid premium perhaps?

There might be recovery potential here, and the balance sheet is very good. The big question is whether the business is actually any good, or just an opportunistic float during the pandemic? I’m not keen on wine subscription services as investments. But as a value, special situation, VINO shares could have some potential upside from £16m mkt cap?

Its strategic growth plans are set to be revealed with results in Oct 2024, which could be a catalyst if the market views that positively.

I can’t decide, so will just go AMBER on this.

Concurrent Technologies (LON:CNC)

Up 22% to 70p (£51m) - Trading Update - Paul - GREEN

Concurrent Technologies Plc (AIM: CNC), a world-leading specialist in the design and manufacture of high-end embedded computer systems and boards for critical applications, is pleased to announce a trading update for the six months to 30 June 2023 ("H1 FY23").

The 22% rise in share price today caught my eye. Although the 1-year chart shows this move to be a reversal of a recent sharp fall over accounting delays & gremlins -

This sounds really good actually - especially that order backlog of £29m -

Based on its unaudited management accounts for H1 FY23, the Company expects to report revenue of approximately £12M (H1 FY22: £7.4M) and profit before tax of approximately £1M (H1 FY22: £0.1M). This represents record first half revenues for the business and an increase of 60 per cent compared to the equivalent prior year period. The business is now operationally geared for a higher revenue outturn and is well positioned for future growth.

Order intake remains strong with H1 FY23 intake of £14.5M and an order backlog, as at 30 June 2023, of approximately £29M.

Supply chains “much more favourable and continue to improve”, but not yet back to normal.

Full year outlook - very nice -

The Board believes that the Company is in line to deliver revenues slightly ahead of current market expectations and profit before tax materially ahead of market expectations…

We are at an inflection point. Now that components are becoming more readily available, we will enter a period of growth. H1 FY23 revenue was a record first half for us, and I believe H2 FY23 will be better still.

**Consensus profit before tax expectations for 2023 are £2.7m

Broker updates - many thanks to Cenkos for an update note. It’s substantially increased FY 12/2023 forecasts, with new forecast PBT up 29% to £3.5m.

That’s 4.7p adj EPS, for a PER of 14.9x, which doesn’t seem excessive.

Paul’s opinion - I recall looking at this last month, when the news was negative, with accounts being delayed due to auditors questioning the capitalisation treatment, and prior year adjustments, which damaged the share price. Although as I said at the time, the positive outlook comments meant I was going to give CNC the benefit of the doubt.

I think today’s update will consign any concerns to history, with a smashing ahead of exps update, and that order book really impresses me. Clearly whatever CNC makes, is in high demand, and it’s making very good margins on it too.

Given this excellent update, I’m happy to shift from AMBER to GREEN. There’s something interesting going on here!

Graham’s Section:

Tclarke (LON:CTO)

Share price: 136p (+4% on Friday)

Market cap: £60m

Earlier this month, I switched back to neutral positioning on this stock due to a proposed £10m placing that I felt should have been unnecessary.

The headline reason for the fundraising made sense - a mammoth order book of around £800m that needed more cash to support it. But take a step back and you see that the company has been paying £2m in dividends every year. Due to the apparently low market cap (PER of 6.5x!), a £10m fundraise means 20% dilution. If management are shareholder-oriented, I think they should be highly reluctant to issue shares at this level. It just didn’t add up for me, so I abandoned my bullish view on the stock.

On Thursday, we had a double-whammy of news from the company.

Firstly, we had an RNS outlining how the CEO, MD, and FD were collecting nearly 1.3 million nil-cost shares (pre-tax) or 0.7m shares (after-tax) related to a 2020 share scheme. Based on the current share count, 1.3 million shares amount to nearly 3% of the company’s entire equity. This level of dilution to pay management isn’t unusual but in the context of the proposed dilution from the placing, it’s another reason for me to feel safer with a “neutral” stance on the stock.

We also had the company’s half-year results. Here’s the table at the top of the report:

As you can see, the order book (bottom row) is surging, although there is a delay in terms of improvement to the other metrics.

Trading is in line with expectations and the company reassures that “significant revenue growth is forecast for H2 2023”. They expect to hit their £500m revenue target (revenue in 2022: £426m).

They also argue for the planned fundraising:

The net proceeds of the Placing will further strengthen the Group's balance sheet and will provide additional resources with which to capture and deliver additional identified short to medium term attractive contract opportunities in the London business - in doing so driving further growth and margin expansion.

Operational review

There is no denying that business at TClarke is strong with the company very busy and likely to get busier in the months ahead. They are increasingly active outside London and the most interesting sector they work on is Data Centres, described as “our largest operational sector, with the expectation for further rapid growth in the second half of the year”.

Graham’s view

I’m much more comfortable with a neutral stance on this one now. Construction and engineering services is a sector I treat cautiously and I feel like it was important to change tack when I saw the dilution coming down the tracks here. The dilution disclosed from share options makes me feel more confident in this view.

The stock does remain “cheap” and will still be cheap after all of the new shares are issued. For this low price, investors can get one of the better businesses in this low-margin industry. The algorithms love it and it does enjoy a StockRank of 98. As always, you pays your money and you takes your choice.

Craneware (LON:CRW)

Share price: £14.85 (+2%)

Market cap: £503m / $658m

This is not one that we review very regularly but let’s take a quick look at this morning’s trading update. The company provides software to US healthcare providers. It seems to me that much of their work revolves around compliance with the US government’s rules for Medicaid drug pricing.

Their financial year has just ended (FY June 2023) and they saw “a positive close to the year”:

…revenue for the year is expected to be towards the upper end of current market expectations at approximately $174m, a 5% increase over the prior year. This has delivered an adjusted EBITDA increase of approximately 5% to over $54m which represents an EBITDA margin of 31% (FY22: 31%).

Annual recurring revenue improves to $169m, from $166m as of December 2022.

Bank debt is reduced to $83m and is offset by a healthy cash balance.

By my calculations, the company is trading at an EV/ARR multiple of 4.1x (enterprise value divided by annual recurring revenue). This would be considered very cheap in the US, but in a UK context I don’t think it stands out. The discount on UK companies versus US companies is something we are used to now; it’s about as interesting as rain in April. In other words, it’s a fact of life.

Buybacks: the company plans to continue buying its own shares, under previously announced plans to spend £5m on buybacks.

Outlook: there is “further sales momentum” helping to deliver a positive start to the new financial year (FY June 2024):

The Group's balance sheet strength, high levels of ARR and early signs of increasing customer confidence, leave the Group well positioned for FY24 and beyond.

Graham’s view

I’m tempted to go green on this one. The buyback (announced in May) is a nice sign of confidence, and hopefully we will see further debt reduction go hand in hand with this.

Maybe it comes down to your view on whether it is US or UK valuations that make sense.

If we look purely at earnings, this is on the expensive end of the spectrum

If, on the other hand, we treat it as a sexy “SaaS” business, then the ARR multiple is probably too low compared with its US peers.

I don’t have a strong view on this; I think that US valuations often look silly, but we can’t argue against the strong long-term performance of US equities. So I’ll continue to sit on the fence here.

Dianomi (LON:DNM)

Share price: 47p (-40%)

Market cap: £14m

Dianomi, a leading provider of native digital advertising services to premium clients in the Business, Finance and Lifestyle sectors, announces the following trading update for the year to 31 December 2023.

Commiserations to anyone holding this overnight. Dianomi is approaching levels where even lovers of micro-caps such as ourselves start to wonder if it is worth looking at!

It’s another 2021 IPO that has gone sour:

It has never made much money:

Roland took a look in April (share price then: 90p) and noted that the company reported net cash of nearly £12m. That’s pretty much the entire market cap now!

Here is today’s profit warning:

As has been widely reported, the decline in traffic volumes has been a key challenge for publishers in 2023. This trend is clear across Dianomi's direct publisher inventory with traffic levels across key publishers down by between 10-30% in the six months to 30 June 2023 vs the same period in 2022. As a consequence, while demand from Dianomi's 400+ premium financial and lifestyle advertisers has remained consistent with the backdrop announced at full year 2022 results, the reduced traffic across its publishers naturally impacts Dianomi's ability to generate revenue from the adverts it places on their digital properties. Furthermore, certain new publisher partnerships did not materialise in the expected timeframe to offset the decline in traffic across existing publishers, though they remain future opportunities.

So this is not just about declining traffic; it’s also about Dianomi failing to get deals that it was hoping for. That sounds like it may be a company-specific failing, not a macro issue.

The company also says: “Readership levels are also perhaps finding a new 'normal' level post pandemic.” How fortuitous that the company floated in 2021, before this new normal materialised!

Revenues in H1 are down c. 18% and new revenue guidance for the year is £30.5m - £32.5m (Stockopedia shows that the prior consensus estimate was £36.9m).

Cash has reduced all the way to £7m. The company does say that it expects improved cash generation in H2, and the cost base has been reduced by £1m.

Graham’s view

H1 revenues last year were £18m so I guess we are looking at c. £14.8m in H1 this year. If the situation has now stabilised (a big if!), the company’s new revenue guidance does look reasonable.

I would often give a stock like this the thumbs down but the fact that it does still have some cash to support it, and the derisory market capitalisation, make me think that shareholders might have suffered enough. If it falls much further it will be trading at its new cash balance (£1m was received by debtors at the beginning of H2, so it should have £8m now).

Therefore I am going to stay neutral for the third time today. These splinters are beginning to hurt!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.