Good morning from Paul (early shift) & Graham (usual time)!

All done for today now!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Short Sections

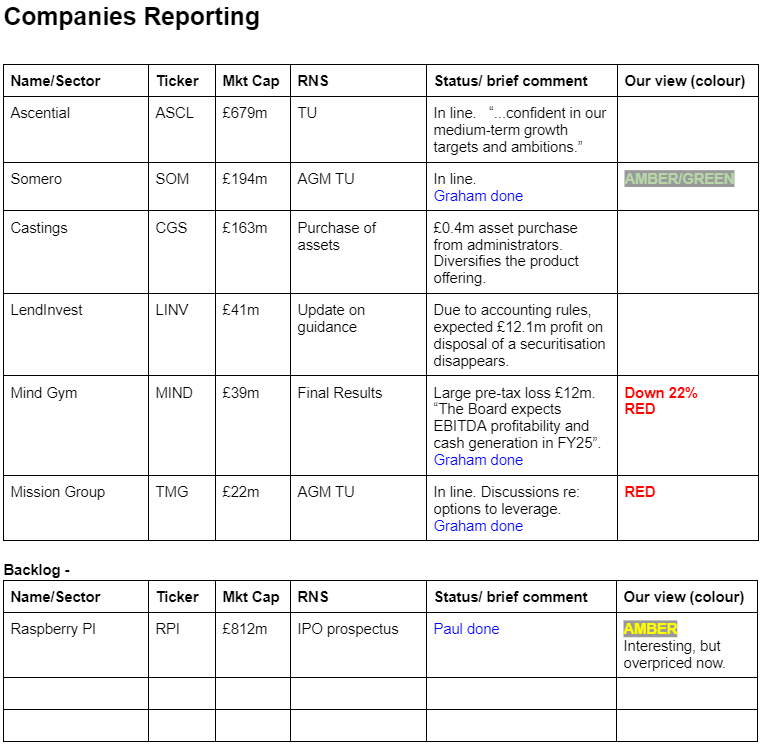

Somero Enterprises (LON:SOM) - down 2% to 346.1p (£192mm) - AGM statement - Graham - AMBER/GREEN

It’s a short update ahead of the company’s AGM in Florida tomorrow. Fortunately, “the health of the non-residential construction market remained consistent” and therefore all forecasts remain unchanged for this provider of screeding equipment. Broker Cavendish puts the shares on a PER of 10.4x for the current year (FY December 2024), with a dividend yield of over 6% and a free cash flow yield of 7%. At some point the comparatives will become very easy to beat (maybe next year?) and we should see positive year-on-year numbers again. For now, given the lack of growth and my lingering concerns around increased competition (e.g. see my comments in March) I continue to think that some caution is appropriate. However, I do agree with Paul that the “AMBER” stance I took was a little too unforgiving for a company with excellent financial results over many years. Therefore, in light of the in-line trading update, I will nudge up my stance slightly to AMBER/GREEN today (previous stance: AMBER at 382p in March). [no section below]

Mission (LON:TMG) - unch. at 23.3p (£22m) - AGM Trading Statement - Graham - RED

I’ve been negative on this group of marketing agencies, primarily due to their net debt balance (£19.5m as of February 2024). I thought the proposed merger with smaller rival Brave Bison (LON:BBSN), while perhaps opportunistic on the part of Brave Bison (LON:BBSN), would have been a reasonable way to solve the problem. But the Board of TMG insisted that they wanted to resolve it themselves, without a merger. So here we are with the latest AGM trading update from TMG. It’s in line with expectations and furthermore the company announces that it has achieved “the vast majority” of the £5m of annualised “profit improvements” it was seeking this year. There is £2m of headcount reduction and £3m of cost cuts and “efficiency gains”. It sounds like good news for shareholders but surely there are some knock-on effects on long-term growth expectations due to the headcount reduction?

A note on the debt reduction plans:

As previously announced, the Group continues to progress discussions regarding options to deleverage the Group's balance sheet, alongside the successful refinancing of the existing debt facility with long-standing lender NatWest, announced on 28 March 2024. A further update will be provided when appropriate.

Graham’s view - a great way to deleverage would be through generating free cash flow but checking the forecast financial statements published by Canaccord Genuity in early April, not much free cash flow was pencilled in for the current year. The company could wait until next year to deleverage using its own free cash flow (assuming that it improves its performance on that front in 2025), but the mention of “discussions” leads me to believe we could see an equity raise here before long. An equity raise is also mentioned as an option in Canaccord’s April research note. With equity fundraising clearly possible, I’ll leave my RED stance on TMG unchanged for now. [no section below]

Summaries

Raspberry PI Holdings (LON:RPI) - 420p (£812m) - Review of Prospectus - Paul - AMBER

I have a proper rummage through the IPO prospectus. It’s clearly an interesting company, but I do have some concerns, and overall think it’s looks significantly overvalued based on the numbers we currently have available. That might change in future of course, as always I'm not trying to predict the future.

Mind Gym (LON:MIND) - down 22% to 30p (£30m) - Final Results - Graham - RED

Maintaining the negative stance of my co-writers as I see little evidence of a quality or even a value investment here. The pace of cost cuts by Mind Gym is impressive and I'm sure that the company's founder-Chairman (who still owns the majority of the shares) is keen to ensure that the company survives and thrives after this difficult period. But the company's remaining cash balance (£1.4m) doesn't leave much margin for error.

Paul’s Section:

Raspberry PI Holdings (LON:RPI)

420p (£812m) - Review of Prospectus - Paul - AMBER

Brief product overview video is here.

What an interesting company! Let’s hope this is the starting bell for a renaissance in the badly damaged UK IPO market, which was ruined by a deluge of poor quality, opportunistic & over-priced floats in 2021 particularly, contributing towards poor performance and hence outflows from small cap funds. We’ve had many years where AIM in particular has seen numerous junk floats of tiny, speculative shares, where there is often little free float, hence no liquidity, and where nearly all the companies floated badly under-perform on fundamentals. No wonder the UK small caps market has had a 2-year bear market. It’s early days, but so far RPI has been a successful float, currently at a 50% premium to the 280p float price, and even spiking up last Friday intraday to a 78% premium at 500p, giving a lovely flipping opportunity.

Above all a healthy IPO market needs precisely this - the potential for quick profits will soon draw in eager buyers for new issues, and create some excitement and liquidity. It remains to be seen whether the excitement around RPI will be sustained, and whether the future performance will justify the hype, and a valuation that’s now over £800m.

RPI is a developer/designer of high-performance, low cost, single-board computers. C.60m units have been sold in total, and are used in education, and by developers, and in lots of industrial applications too. Rapid growth has been delivered in the last 3 years. The product is particularly interesting, and has a loyal community of millions of users, high brand awareness, with marketing often being community-led. The idea being that educational, early users then take that knowledge into their subsequent careers. The blurb in the prospectus is very interesting, but not within my skill set to assess the product or markets - that’s your job! My job is to assess the numbers, and to raise points about risk: reward, which is what I’ll cover here.

I’ve read the whole prospectus (takes about 2 hours, as you can skip or skim through some sections, eg detailed historical results, pages and pages of legal notices, definitions, etc.) and jotted down some key points, with my comments added. Here goes -

Raspberry Pi - IPO

Premium listing, main market in London. I wonder why they chose London, and not NASDAQ?

Brokers - Peel Hunt and Jeffries.

The offer was for 59,288,752 shares, priced at 280p, mostly selling existing shares by the major shareholder, Raspberry Pi Foundation, which has reduced its holding from 140.85m shares (77.3%) pre IPO, to 94.92m shares (49.1%) post IPO. There’s a 360 day lock up on it selling any more shares.

Selling shareholders dispose of 48.1m shares, newly issued shares are 11.2m, totalling the 59.3 offer shares noted above.

Hence the company received about $40m from the issue of new shares, and that seems to net down to $31m after costs (taken from the prospectus balance sheet reconciliation section of before & after IPO).

Total shares in issue post IPO is 193.4m so the IPO market cap (at 280p) was £542m.

Smallish free float, as total >3% shareholders shown in the prospectus is 73.3% (dominated by the Foundation at c.49%).

Notable existing investor is famous chip designer ARM, which increased its stake in the IPO, from 3.5% to 8.4%, giving a seal of approval effectively.

CEO is Dr Eben Upton CBE (owns 1.9%), CFO is Richard Boult (owns 0.3%).

Paul’s view - I’m not madly keen on IPOs that are mostly from selling shareholders. Although in this case the largest shareholder Raspberry Pi Foundation (website here) still holds almost 50%. Its laudable purpose is to promote computing amongst children. It’s now a cash-rich charity, so it would be interesting to look into what the foundation plans to do with the c. £129m cash (before costs) from its sale of shares in the IPO. I instinctively feel a lot more comfortable about a worthwhile charity reducing its stake in an IPO than say a cynical private equity float where you can almost guarantee they will be stuffing gullible fund managers with something over-priced, and often also over the hill, that has been carefully massaged to look good in a float.

The numbers

This key table shows highly impressive growth in revenues and profit - but remember RPI is now valued at £800m, so the figures need to be very good to support a now high valuation. Also note that RPI reports in in US dollars -

Taking the $31.6m PAT (profit after tax) above for FY 12/2023, divide this by 193.4m new share count (boosted in the IPO, so this is not strictly correct, but it does give us a conservative view to use as a base number for FY 12/2024 and beyond), gives EPS of 16.3 US cents, or 12.8p per share.

The actual number of shares in issue in 2023 (pre IPO) was 182.2m, so if you use that figure, EPS was higher at 17.3 cents, or 13.6p.

Hence at the current share price of 420p, I make the FY 12/2023 PER 30.9x on pre-IPO basis, and 32.8x post-IPO increased share count.

For an exciting growth company, that’s not an outrageous valuation at all, especially if the growth shown in the table above is likely to continue.

So the absolutely key areas to research in more depth, is what’s driving rapid growth, and is it likely to continue? Or will competition also spot this lucrative niche and squash RPI over time?

Dependence on key suppliers - this is an interesting area to ponder.

Manufacturing - RPI doesn’t actually make any products, it’s a designer.

Sony - production is outsourced to a single factory run by Sony in Wales. Section B3 of the prospectus reveals that there is no formal contract governing this, which seems a glaring omission, and considerable potential risk were that relationship to break down, or if Sony squeezes RPI on prices, since it seems to be in a very dominant negotiating position. I’m not comfortable with this arrangement. Although note that Sony is a shareholder, with 3.2m shares (1.66%) now worth £13.4m, which seems supportive - ie. would they try to grab more profit from production price rises, knowing that this could damage the value of their shareholding in RPI? No idea, you’d have to ask Sony!

Broadcom - supplies most of the “critical” components. So again, single supplier risk is flagged in the prospectus. Again, what’s to stop Broadcom hiking prices in future, knowing that it’s a vital single source supplier? Although the prospectus does point out that in their heyday, many PC companies such as Dell relied on sole supplier Intel for key components. Although I imagine there would have been watertight contracts determining continued supply at agreed prices.

Premier Farnell - is disclosed as a sole licensee to distribute RPI products. The contract is to 2026. It has been rapidly falling as % of total sales over the last 3 years from 57%, 27%, and most recently 18%. So this concentration risk is falling.

Put that lot together, and it strikes me that RPI has excessive single supplier risk in those 3 areas, making the business model not as robust as I would like. Having said that, these are latent risks, and reality might turn out absolutely fine.

Current Trading - this is a very important section, giving quite detailed guidance. I haven’t yet found any broker notes on RPI, so this is all I’ve got to go on. In part VIII it says that 2024 trading so far has been in line with expectations.

However, it also says that it has seen “expected volatility in demand” and higher inventories, which are “expected to normalise in 2024” with an H2 weighting to profits in 2024! That’s definitely not what I would want to see in an IPO document. There’s a risk this is already set up to disappoint with its H1 2024 results later this year.

I also wonder if the superb growth in 2023 might have been boosted by ramming through some big sales in late 2023? It looks like that could be the case, so I urge readers to scrutinise parts VIII and XI of the prospectus yourself.

Borrowing facility - it has a $40m RCF available. Note that the end-2023 cash figure was inflated by a large increase in trade creditors, due to a big intake of stock late in the year which was not paid for until early 2024. Window-dressing the cash figure. That might have been accidental, or deliberate, I don’t know.

Staff - there are only 103 staff, so a very lean operation (as production is outsourced). 50 are engineers, mostly with PhDs and MBAs. So a small team of very smart people. A key question is therefore how are they locked in? Share options in a listed company might well be a key advantage, to lock in key people. It also makes me wonder what’s to stop a competitor employing 50 similarly bright people, and creating a similar competing product, maybe manufactured at lower cost in the Far East? Which brings me back to the key question of how sustainable RPI’s competitive advantages are? I’ve got no idea, am purely putting the question out there for investors to ponder. History is after all littered with examples of promising British tech products that were overtaken by international competition. To pay £800m+ for RPI you need to be seriously comfortable that it’s on a strong upward trajectory that is sustainable.

Historical accounts

Dec 2023 balance sheet. NAV $159m, less $59m intangible assets = $100m NTAV. That looks OK, and will have recently been boosted by $30m from the net IPO proceeds.

Inventories are a stand-out at $108m, unusually high due to some big stock intake. The corresponding trade creditors were also high at $81m, multiples of the previous year’s figure. Cash of $42m is flattered by this unpaid-for inventories.

Part XII shows more recent cash at 31/3/2024 of only $6.2m, less $14.3m debt, so it looks as if the 31/3/2024 cash figure is actually net debt of $8.1m. Receipt of IPO proceeds would take that up to net cash of about $22m, which is not a lot for a c.£800m market cap company.

Large swings in inventories and trade creditors make me question how good the financial controls and planning are? I would have expected to see more gradual phasing of stock intake. So the question to ask is whether RPI has to commit to large, lumpy production orders?

Capitalised development spend - this is my main concern in the numbers. RPI doesn’t actually generate much cash. This is because its internal development costs are rapidly rising, and the amounts capitalised onto the balance sheet considerably exceed the amortisation charges. Capitalised development spend was $4.6m (2021), $8.6m (2022), and $19.2m (2023). In 2023 this was 5.7x larger than the amortisation charge, giving a large boost to profits. This is a perfectly acceptable accounting treatment, and there’s nothing wrong with it, just be aware that RPI is not a lucrative cash machine. It’s recycling a lot of its profits back into development spending, which could be a good thing, to expand & improve product ranges. This means that EBITDA is a nonsense number of course, which is dangerous given the current fashion for valuing tech companies on high EBITDA multiples.

Lack of cash generation means there won’t be much cash available for divis. Again, it’s entirely up to you how you view this, I’m just flagging the facts.

The 2023 cashflow looks poor to me (page 145), showing $16.5m operating cashflow, and then $14.4m capitalised development spending. So if you expense R&D fully as a cost, which is how I see it, then RPI didn’t actually generate any cash at all in 2023. The increase in cash came from $15.1m equity issuance in 2023.

Guidance - not very exciting is my conclusion. Let’s hope RPI can beat these figures, as I’d be surprised if it retains an £800m valuation once this slowdown in growth is reported.

Unit sales - expecting 10-12% growth pa.

Unit gross profit - expected to be lower in 2024 than 2023, due to Pi5 launch costs. 2025 guidance is unclear, as it references higher memory costs, but lower Broadcom costs, without giving figures. Medium term they “aim to grow unit gross profit” - that doesn’t sound too strong, does it?

Total gross profit - in 2024 only flat vs 2023. Medium term, expect “some uplift”.

Paul’s opinion - I’m delighted this IPO has gone so well, and RPI looks a very interesting company. Let’s hope this is the start of an IPO recovery in the UK. After all, we need some interesting, good quality new companies to join the market, to replace all the shares we’re losing to takeover bids.

Let’s also hope the broker community has learned some lessons, and will from now on only float high quality, interesting companies at sensible valuations.

It’s up to you to decide what the future holds, and I can see that if RPI produces stellar growth, especially from new products, then you could have a very good outcome here.

My problems are that the guidance and current trading seem lacklustre. Also RPI doesn’t generate any cash. Bulls need to hope the guidance is super-conservative and they thrash it. If they don’t then I could see the £800m market cap coming back down to earth with a bump.

So for me, it’s not something I would be interested in owning, since it would be little more than gambling on what the future holds.

My view is that at £800m it’s now significantly over-valued, based on the figures and outlook as of now. I have no idea what’s likely to happen in future. If it does well in future, then the valuation could keep rising, who knows? Just to be polite, I'll go with AMBER, and also because I don't know what the future will hold. But it needs a much more exciting outlook to justify that valuation in my view at this point in time.

Graham's Section

Mind Gym (LON:MIND)

Down 22% to 30p (£30m) - Final Results - Graham - RED

MindGym (AIM: MIND), the global provider of human capital and business improvement solutions, announces its audited results for the year ended 31 March 2024.

Paul and Roland who have been RED on this one. The bear thesis seems to be playing out: here is the summary results table.

It’s a year to forget: unprofitable even at the adjusted EBITDA level, a very large loss in statutory terms, and the cash balance drops to a pittance..

As previously discussed in this report, the “capex” figure here relates to software development spend. It’s perfectly legitimate to capitalise this spending, but it adds a greater urgency for the company to succeed as these are real cash flows exiting the company which are not fully reflected in the income statement.

And unlike physical capex (e.g. buying physical equipment), if capex on software doesn’t succeed in its goals then there is a strong likelihood that the balance sheet assets created in this way are worth nothing at all.

Today’s cash flow statement again shows that the amortisation charge was very small (£1.6m), much lower than the capex spend, and therefore the accounting treatment again served to reduce the size of the losses that would otherwise have been seen on the income statement.

At the same time, there was a £6.6m “digital asset impairment” for the year as plans to launch certain products were abandoned. The company says that the technology that was being developed for these products is still useful, but accounting rules still required this large impairment.

The company’s explanation of what happened in FY March 2024:

Macroeconomic headwinds affected confidence in key sectors, including tech (especially in US) and consumer/manufacturing companies who are dependent on global supply chains

Increased caution on HR budgets has affected the buying cycle, with more client stakeholders needed to sign off budgets: growing requirements for pilots to establish proof of concept first; fewer big-ticket requests for proposal

There has been increased competition for client budgets resulting from unprecedented investment in HR platforms and technology in recent years

The market has seen a material decline in client spend on DEI, a significant revenue stream for MindGym, particularly in the US; this contributed to the 32% US revenue decline vs prior year

For me, this creates a picture of a company simply being unable to compete - but can they turn it around?

Cash (£1.4m) - MIND reports that its cash balance was stable from December 2023 to March 2024, that they have significantly lower operating costs and capex in the current financial year, and that they have access to a £2m undrawn facility.

The CEO report states that annual costs (both opex and capex) were reduced by £11m.

New strategy - a new CEO, taking over from the founder (who becomes Executive Chair), has a strategy designed to evolve the company “from being a provider of individual behavioural change programmes to becoming a strategic behavioural change partner for CHROs [Chief Human Resources Officers]”.

Outlook:

FY25 will be a year of recalibration as we implement the new strategy which will return MindGym to its historic performance levels

Whilst it will take time before the full benefit of this new strategy is realised, the Board expects EBITDA profitability and cash generation in FY25

The opportunity for MindGym in a highly fragmented $80bn Human Capital Advisory market is as compelling as ever

In the medium-term, the Board is therefore confident that the business will deliver revenue growth in excess of 10% CAGR, with EBITDA margins between 15% and 20%

Graham’s view

There is little doubt in my mind that I need to maintain the RED stance of my co-writers.

Of course it’s perfectly possible that the company might turn things around. Please bear in mind that I’m not commenting on the quality or usefulness of its existing product set - I am merely observing that from a financial point of view, I see little evidence of a quality investment here.

And with such a low cash balance, it no longer has the flexibility to take risks. With £1.4m in the bank, and with profits hard to come by, it now has to count the pennies. That might not be such a bad thing, but I find it difficult to justify even a £30m market cap in these circumstances.

If you’re interested in this one, do remember that the founder still has a majority stake. Perhaps he will end up owning all of it again some day?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.