Good morning,

Today's report is taking ages to get going, so timing will be a bit later than usual, but I'm on the case.

StockSlam

These events are great fun. Please note that the next StockSlam is scheduled for Wed 24 October, evening, in central London.

At this stage, 15 presenters are needed, to do quickfire 3 minute pitches on your favourite shares. Then pizza & beer afterwards, networking & shares chat. Why not have a go, and apply to do a quick spiel about your favourite share? Click on the header above for more details.

Warpaint London (LON: W7L)

Share price: 250p (up 5.3% today, at 12:04)

No. shares: 76.7m

Market cap: £191.8m

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to announce its unaudited interim results for the six months ended 30 June 2018.

- Revenues have grown strongly, up 38.7% to £18.4m

- This growth has mainly come from an acquisition on 30 Nov 2017, of "Retra"

- Today's statement is admirably clear, also showing the organic revenue growth of 7.3%

- Adjusted profit is down though, which is not good;

Adjusted Profit from Operations of £2.8 million* in the half year (before exceptional Items, depreciation and amortisation costs) (H1 2017 £3.1 million)

Outlook - this is the key bit, which reassures;

"The additional revenues in the second half, particularly from Christmas gifting, are expected to result in overall revenue being two thirds weighted to the second half of this financial year and with a fixed cost base that is evenly spread over the full year, we expect to deliver overall Group earnings in line with management's expectations.

It's good to have the seasonality clearly explained. Let's hope the company does manage to double H2 revenues over H1 - a steep increase.

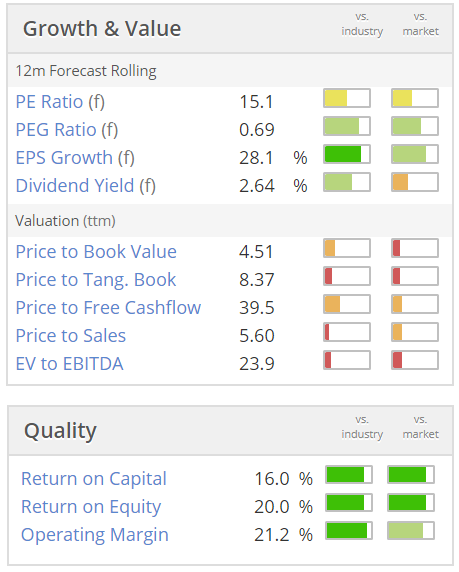

Valuation on a PER basis looks about right to me;

Note that the quality scores are high.

Balance sheet - looks excellent, with a very strong working capital position.

Although both inventories & receivables strike me as a little high - perhaps there are not tight enough controls over working capital?

Net cash of £4.6m is healthy.

My opinion - it looks quite interesting. It would be worth finding out more about the brands, how they are perceived by customers, their longevity, etc.

The figures strike me as a fairly good company, at a valuation that doesn't look stretched. So it could be worth a closer look perhaps?

Finsbury Food (LON:FIF)

Share price: 122p (down 1.6% today, at11:34)

No. shares: 130.4m

Market cap: £159.1m

Finsbury Food Group Plc (AIM: FIF), a leading UK speciality bakery manufacturer of cake, bread and morning goods for the retail and foodservice channels, is pleased to announce its preliminary results for the financial year ended 30 June 2018.

The key headline numbers look OK;

- Adjusted PBT up 4% to £17.2m

- Adjusted basic EPS up 4.1% to 10.2p (for a PER of 12)

However, I always check what the adjustments are, and how big they are. In this case, note 3 shows us some large adjustments, relating to site closures. This brings statutory PBT down to only £4.5m (down 66% year-on-year).

This scale of closure costs also reinforces that this is quite a capital-intensive business - generally something that I try to avoid.

Outlook comments flag up steady organic growth, and more acquisitions.

Balance sheet - looks OK, not strong. NTAV is only £21.3m

Net debt is £15.6m, ample headroom within a £45m facility. There is also scope to double the facility size (presumably for acquisitions, if needed). This looks a satisfactory gearing position, quite low actually versus EBITDA. The company points out that it owns 3 freehold sites, and has a blue chip receivables book. So no issues here to worry about.

My opinion - this seems a decent, well-managed group.

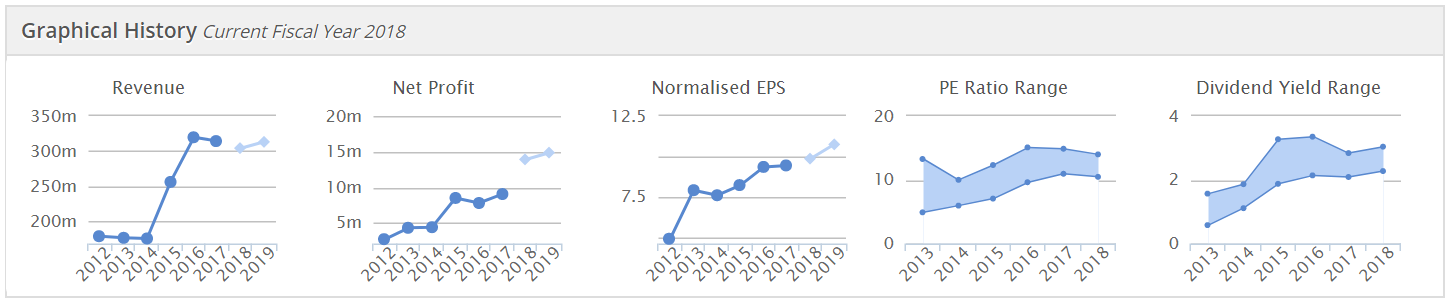

The track record is solid, as you can see;

So if I wanted to park some money in an investment that gives a 2.9% dividend yield, and might go up in price a little bit, if I'm lucky, then this one could be worth considering.

The 3-year chart below highlights the issue here - it's all a bit dull. The share price has just gone sideways, at a time when the stock market has presented numerous opportunities to make 100%+ gains on other shares. So that is an opportunity cost.

It seems a decent enough company, but personally I'm looking for shares which are a bit more exciting, and have more upside potential.

Christie (LON:CTG)

Share price: 136p (up 3.8% today, at 12:59)

No. shares: 26.5m

Market cap: £36.0m

Christie Group plc ('Christie' or the 'Group'), the leading provider of Professional Business Services and Stock & Inventory Systems & Services to the leisure, retail and care markets, is pleased to announce its Interim Results for the six months ended 30 June 2018.

I last reported on the impressive (big growth in profits) full year results from Christie here on 17 Apr 2018.

Interims published today show;

Outlook - the narrative mentions a solid pipeline, and;

In conclusion, the first half saw progress in performance while our services remain in demand from sophisticated commercial audiences. Looking at the second half we anticipate a more balanced year than 2017. With an increased pipeline of both current and ongoing projects we intend to deliver a solid set of results for the year.

I can't find any detailed forecasts, although Stockopedia has a figure of 13.3p EPS for 2018 - assuming that's correct, then the PER is 10.2, which strikes me as reasonable value.

Balance sheet - not great, which should be factored into the valuation.

NAV: £2,289k. Removing £1,843k in goodwill, and £1,370 other intangibles, gives;

NTAV: negative -£924k

Cash of £3,977k is more than offset by £692k + £6365k in borrowings, giving net debt of £3,080k

There's quite a large pension deficit of £12.0m

My opinion - it looks an OK company, although historically, results have been quite erratic. It seems to be humming along nicely now. Shareholders receive a modest dividend stream.

It's not clear to me why this share is listed on the stock market? It's very illiquid. Some time ago I tried to buy some, but there wasn't anything significant available.

I wonder if the stock-taking division might be affected by retailers moving to RFID tags in future?

There's nothing else of interest today, so I'll leave it there.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.