Good morning!

Thanks for your suggestions, I will work my way through them.

Cheers,

Graham

(Please note that I own shares in IGG)

IG Group (LON:IGG)

- Share price: 671.25p (-8%)

- No. of shares: 367 million

- Market cap: £2,464 million

Response to FCA and ESMA announcements

It was a slightly unpleasant start to the day for me, as an unsettling RNS was released by one of my holdings, IG Group (LON:IGG).

Many of you will probably be clients of IG, perhaps for many years. It is the biggest spread betting operator in the UK.

The market cap is a lot bigger than we normally permit here, but I'm happy to make an exception.

IG's smaller rival, CMC Markets (LON:CMCX), also made an announcement. Its shares are down 12% for a market cap of £424 million. So I will discuss both in what follows.

Regulatory attack

It has been known for some time that new rules may be enforced on retail traders of leveraged products in Europe and the UK.

The FCA published a consultation paper a year ago, receiving an avalanche of feedback in response, which undoubtedly slowed its progress.

The German and French regulators have also been active. And the Paris-based European Securities and Markets Authority (ESMA) issued a statement on Friday (see here), which sounds ominous.

ESMA has been concerned about the provision of speculative products such as CFDs, including rolling spot forex, and binary options to retail clients for a considerable period of time and has conducted ongoing monitoring and supervisory convergence work in this area. Some competent authorities have also adopted national measures to limit the provision of these products to retail clients.

Notwithstanding these actions, ESMA remains concerned that the risks to investor protection are not sufficiently controlled or reduced.

The proposals are to ban binary options for retail clients, impose leverage limits of between 30:1 and 5:1 on CFDs, prevent bonus offers to incentivise trading, a guaranteed limit on client losses, etc.

The really major proposal is the leverage limit. This is because it's fundamental to the product offering in forex, indexes, etc., that you can trade with a nice big leverage ratio of 100x, for example.

Leverage

Personally, I don't need to use such a leverage ratio. But I can understand why someone might.

It's true that leverage is often a bad idea, because most people can't use it properly. But it can also be used responsibly and to the benefit of the trader.

For example, suppose I have a £1 million equity portfolio with a traditional stockbroker, but I need to sell it for one reason or another, and don't want to be exposed to any more market risk.

While I sell it down, I can remove my market risk by running a £1 million short on the FTSE (or other index).

Since the expected return on the FTSE is positive, my short hedge has a negative expected return. But I benefit from the risk management effects of shorting it.

With a 100:1 limit, I only need £10k to hedge my portfolio. A 10:1, I need £100k. But I probably don't have £100k lying around.

There are other investors who hedge the FTSE only when they think it is overvalued or due for a correction, and this enables them to hold more physical equities for longer.

So judging leveraged trading by a simple measure such as how many people win or lose isn't the right thing to do, to my eyes. The risk management effects of what people do might be a lot more nuanced than they appear at first glance.

Alternatively, if someone does simply want to make bets on the FTSE worth a few hundred pounds here or a few hundreds of pounds there, I don't know why that would be considered worse than losing money on any other form of gambling - but it may be prohibited in the near future, at these leverage limits.

I've just checked my own IG account, and the leverage available to me for a FTSE or EURUSD spreadbet is indeed 200:1.

Professional client

In practice, rules such as this would mean that large numbers of retail clients would need to reclassified as "professional clients" - individuals who by dint of their professional experience, trading activity or account size are deemed not to warrant these protections.

IG believes that clients representing well over half its current UK and EU revenue are eligible to be categorised as professional and will elect to be treated as such if the products that they can trade and the leverage they can utilise diverges from that available to retail clients.

As discussed before, IG has been steadfast in reducing its low-value client book, and focusing sales efforts on the larger and more sophisticated client. This puts it in a great position ahead of these potential rules.

CMC Markets (LON:CMCX) has copied the IG strategy to some extent, and includes the following comments in its statement today:

Proposed margin changes are likely to have an impact on how clients trade, although at this stage it is not possible to quantify the impact. ..

The Group has focused on higher value clients and has one of the highest revenue per clients in the industry.

Conclusion - I've not considered selling any IG shares today. Maybe that's just stubbornness, but at the back of my mind is the knowledge that IG is already the market leader in this business. If these rules are implemented, adding to the regulatory burden of the sector and removing many of the marginal opportunities available to companies, then its position as market leader will only be made that much stronger.

The overall market might be smaller, and earnings may take a hit a year or two down the line, but I expect that the earnings achieved by IG would eventually prove to be even more predictable than they are today.

In the conference call, IG said that the proposals would likely cause some consolidation in the sector, "in the short to medium term". So the smaller players would be forced to give up and merge with the likes of IG Group (LON:IGG) or perhaps CMC Markets (LON:CMCX).

Alternatively, if the UK were to leave the EU's regulatory framework at some point (I know this doesn't seem very likely at present), then it wouldn't need to worry about being harmonised with the EU and the FCA could adopt a somewhat more traditional approach to this sector.

Either way, I'll hang on to these shares.

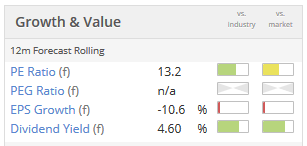

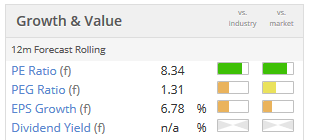

CMC Markets (LON:CMCX) shares are a bit cheaper but I'd want an even cheaper discount to tempt me, given the disparity in size between itself and IG. Both companies have strong balance sheets, so that's not an issue.

CMC stats are pasted below. It passes no less than four quantitative screens for value, growth etc. The screens can't analyse this regulatory threat, though - and it's pretty hard for humans, too.

Filtronic (LON:FTC)

- Share price: 10.25p (-7%)

- No. of shares: 207 million

- Market cap: £21 million

Trading Update and Notice of Results

We've only occasionally covered this share in recent years. It designs and manufactures components and subsystems used in wireless communication.

Performance has been patchy. So if the shares appear cheap, it's because investors haven't yet managed to suspend their disbelief that this company will at last string together a sustained period of good performance.

This disbelief appears to be justified, as the company reports today that the latest contract hasn't rolled out as quickly as expected.

By the way, I'm fairly certain there is an error in the statement, which I've corrected below:

The Company expects to report unaudited revenues for the first half of its financial year of approximately £12.8m (FY2017: £21.6m), comprising Filtronic Wireless at £11.0m (FY2017: £21.6m [gn note: this should be £18.7 million]) and Filtronic Broadband at £1.8m (£2.9m) generating an expected unaudited operating profit of approximately £0.9m (FY2017: £1.8m) and strong cash generation with a net cash balance at the period end of £2.9m (FY2017: £0.7m).

The share count is dramatically larger than it was a couple of years ago, as investors accepted dilution to bail out the company a couple of times.

Note the reduction in sales. A handful of customers have traditionally accounted for the majority of revenues for Filtronic, so the company is highly sensitive to variations in their demand for its products.

The results are "broadly in line" with expectations, which can be interpreted to mean a small miss. So it makes sense to mark the shares down today.

I'm afraid this share doesn't interest me. With such an extreme level of customer concentration risk as it has, it's beyond my risk tolerance. While it is attempting to broaden the customer base, that is much easier said than done.

Brokers have been forecasting net income of £2.4 million for the current financial year. The problem is that I don't think you can put a normal earnings multiple on this figure.

As the Chairman remarked in the last Annual Report:

"...the growth achieved has been with a concentrated number of customers and with relatively few products. Notwithstanding the growing opportunity and product pipeline we continue to remind shareholders that until there has been a further widening of the customer base, growth will continue to be lumpy and difficult to forecast in the short term..."

The top customer accounted for 71% of sales last year, while the second largest accounted for 11%.

I don't have the stomach to invest in a business with just one big client, or even just a small handful of big clients. If you do, you're braver than I am!

Sumo Group (new listing)

Pricing and details of admission to AIM

This is a great little RNS on a number of counts - and thank you for bringing my attention to it in the comments.

IPOs for interesting companies are definitely worth a watch. Even if we don't buy the shares this week, we'll have a better understanding of the company over the year or two. And perhaps if it has the "wobble" which we often expect from newly-listed companies, then we'll be ready to swoop!

Sumo Group includes the Sheffield-based game developer Sumo Digital (see here). It also has the digital art producer Atomhawk (see here), a smaller business but one whose content looks gorgeous to me!

Atomhawk was acquired earlier this year. Of course it makes good sense that a game developer would benefit from teaming up with a digital art producer.

To be clear about how this works, Sumo doesn't own the brand names for its games, e.g. Sumo makes a Sonic the Hedgehog game but it's Sega which publishes it. If I can make an analogy, Character (LON:CCT) doesn't own the brand names it works on either, but it's relied upon to design the corresponding toys. In the same way, Sumo is relied upon to design the video games.

The company has 450 employees now, and competitive advantage is described as follows:

The Directors believe the Group's competitive advantage lies in its scale, management systems, technology and creative solutions, which enable it to offer flexible co-development and full end-to-end solutions for publishers and other developers. The Company also operates a lower risk contracting model through long-term contracts, which generally have milestone payments.

The question of where risk lies is an important one. Is it with the developer or the publisher? While both do of course bear some of the risk, I think the developer payments are relatively fixed. So the developer does most of the heavy lifting in terms of actually creating the game, and then the success or failure of the title falls on Sega or whichever publisher has commissioned the work.

Reading through the announcement, I see that the company has this year released its first "own-brand" title, and did so profitably with 170,000 units sold. It's currently for sale at $20, so those 170,000 units would have generated a nice little chunk of revenues. It plans to release its own "indie games" on a selective basis.

The IPO has a fair mix of new money in and old money exiting. £38.5 million of new money is raised, while selling shareholders take out £40 million. The market cap will be £145 at the placing price.

Take note that the new money raised will at least partially be used to pay down debt and deleverage the balance sheet. So in a roundabout fashion, that money is also for the benefit of the selling shareholders (who might not have decapitalised the business without the expectation of subsequently being able to raise money on the stock market to pay off the debt).

Private equity - The PE outfit is the same name which brought us Accrol Group (LON:ACRL) and Ramsdens Holdings (LON:RFX), two companies discussed regularly on these pages.

One of those stocks is down over 60% since IPO, while the other has more than doubled. So I'm not sure if this is a green or red flag!

Audioboom (LON:BOOM)

- Share price: 2.8p (-16%)

- No. of shares: 931 million

- Market cap: £26 million

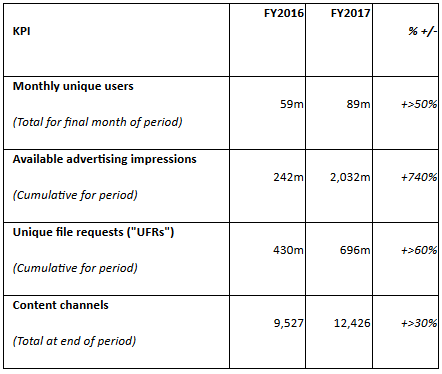

Great KPIs from this audio platform:

The problem is that it's running out of money.

After switching away from its free-to-use model, revenues have jumped to £4.8 million. But the loss on an adjusted EBITDA basis is £4.3 million. It has £1.45 million in cash and facilities.

It needs a lot of funds, because breakeven doesn't look like it's achievable any time soon. I'm surprised it's not already priced for heavy dilution!

That's all I have for today. Cheers.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.