Good morning, it’s Paul here with the SCVR for Monday.

Timing - I'm hoping to be finished by the official end time of 1pm today. There's not much in the way of small cap news. Today's report is now finished.

Lockdown restrictions

Weekend press reports suggest that the Government is aiming to start lifting restrictions in a phased manner as early as March. Dominic Raab is quoted as saying that we’ll probably be heading back to a tiered system, with partial releasing of restrictions in regions which are seeing covid subside, and vaccinations progress well.

Another vaccine is apparently in the pipeline, from Johnson & Johnson, which is a single shot apparently, rather than two. Good news.

Overall then, the news seems supportive of my current portfolio view, that retail/leisure/hospitality/travel could be getting somewhere near back to normal in April/May. After that, my view is the “roaring twenties” view, that I think we could see a big surge in consumer spending, especially amongst the middle class, who have hoarded cash in 2020, being unable to spend on the usual things like eating out, holidays, etc. Which brings me on to…

Inflation & interest rates

We all probably think we’re brilliant stock pickers at the moment, because so many shares have gone up. However, if you look more closely, “multiple expansion” is a major factor behind that - i.e. shares which used to be valued on a PER of say 13 are now quite routinely valued on a PER of 20-30. That’s a one-off gain, and it could easily reverse (mean reversion). Hence why I’m so wary of high valuations at the moment, a lot of which look very risky to me, and investors seem complacent about this risk.

I think the key driver for current high valuations is the expectation of low interest rates forever. As for inflation, people under 35 barely know what it is, because they’ve never experienced it. People under 30 think that interest rates will always be zero, because that’s all they’ve ever experienced in their lives when they become aware of financial matters (from aged mid-teens perhaps).

All this could be in for a rude awakening, if inflation rears its ugly head again. The conditions are perfect - there’s been massive money-printing in all major economies, and Governments are running huge deficits, pouring money into the pockets of households & companies, both of which are hoarding some of that cash, for now.

We have a catalyst for a spending binge imminently - the gradual ending of covid lockdown restrictions. I think many households are likely to want to spend freely, on the basis that we survived this awful thing, you only live once, and let’s live for today. After all, that’s the attitude which fuelled the roaring 1920s - people wanted to live a little, having just experienced both WWI, and Spanish Flu (many times worse than covid-19, yet little more than a footnote in history now).

People spending freely, even recklessly, later this year, together with household bank accounts groaning with cash in many cases, are perfect conditions for businesses to raise their prices. Holidays, and flights especially, have variable pricing, based on demand. So I imagine it could be expensive to get away on holiday in 2021, and maybe 2022 also, as demand outstrips supply, possibly?

Plus some Govt support measures (e.g. lower VAT on leisure) unwind, therefore boosting inflation. I read an article (sorry cannot find the link) saying that Germany and the USA both have pent-up inflation about to appear, because of annualising of factors which had previously pushed down inflation a year earlier. Higher commodity prices were also mentioned as a factor behind looming higher inflation.

The big question is whether central banks would raise interest rates in response to rising inflation, or just leave rates near zero, and print enough money to buy up their own Govt’s bond issuance? As MMT points out, Government bonds don't actually need to exist at all. The whole lot could be bought back & cancelled, using newly created money. Then Govts could be directly funded by central banks printing the money needed to fund future deficits. It is astonishing to think that the national debt is actually an optional policy choice. It could be extinguished instantly, if the Govt wished to. After all, it's already effectively extinguished £895bn of the £2+ trn national debt. So this is real, not a pipe dream.

There are worrying articles appearing about the USA possibly raising interest rates sooner than expected. Even talk of 5-10% inflation in the USA occurring if the economy overheats from all this stimulus & infrastructure spending. Similar factors would be at play here in the UK too.

I’m worried about this. Inflation would kill off the QE wheeze. MMT supporters say that QE cannot be used to infinity. The limiting factor on QE is inflation remaining benign. If inflation takes off, then QE has to be stopped. Easier said than done! Once a Government is relying on money printing to fund a deficit, then it’s almost impossible to stop, as history shows. Inflationary pay rises for public sector staff, mean that inflation fuels greater Govt spending deficits. Just look at Thatcher, Howe & Lawson’s memoirs for vivid accounts of how difficult it was to tame Govt spending & inflation in the early 1980s. As fast as they cut spending, inflationary pressures pushed it back up again. Then tax receipts dropped as recession took hold. Money printing & reckless deficit spending wasn’t an option back then, as interest rates were so high.

All in all, I think conditions are looking ripe for a sharp correction in expensive US markets, so I’ve added to my index short positions there. I remember about 3-5 years ago, the Fed tried to start raising interest rates, and it triggered a big sell-off in equity markets. They had to reverse track, and put interest rates back down again. That demonstrated how sensitive expensive equity markets are to interest rate rises. Hence why I’m keeping a close eye on this issue.

Maybe it could be time to be a bit more cautious, and bank some profits on things that are looking extended in valuation? After all, to buy a future dip, we need to have some cash on hand. If we're 100% invested, then we can't buy the dip.

.

Begbies Traynor (LON:BEG)

(I hold)

Acquisition - this is noteworthy, as it's bigger than the usual smallish bolt on acquisitions that BEG has been doing in recent years, to supplement growth.

Begbies Traynor Group plc (the "group"), the business recovery, financial advisory and property services consultancy, today announces that it has completed the acquisition of CVR Global LLP ("CVR").

"A significant expansion of the group's scale and specialisms in business recovery and financial advisory"

CVR is a firm of insolvency practitioners.

Price paid: £12.0m initial cash, financed through existing borrowing facilities. Additional £4.0m maximum of contingent consideration, based on 3-year profit targets being met. Earn-out of up to £4.8m based on successful fee realisations on existing cases (so self-funding).

Valuation - CVR made profit normalised PBT of £1.2m, so the acquisition price of 10x PBT doesn't look a particular bargain. However, when you factor in the £0.75m of cost synergies, it makes more sense, at a multiple of 6.2x PBT. I make that a PER of about 7.6, for the acquisition, which does look good value.

My opinion - BEG has a good track record of making sensible acquisitions. This looks a good deal, and by my calculations should raise the next full year profitability by about 15-20%, once synergies are achieved. All funded with no new shares being issued. Expect brokers to raise forecasts, to take this deal into account. The shares look good value to me, so I might add to my existing small position at some stage.

.

Warpaint London (LON:W7L)

90p (up 8% at 08:05) - mkt cap £70m

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to announce an update on trading for the year ended 31 December 2020.

It’s good news -

Strong H2 trading and results expected to be ahead of previously stated guidance

Background - here are my notes from 25 Sept 2020, where I concluded with a “mildly positive” view of the shares. It traded around breakeven in H1, has a good balance sheet, continued paying divis, and the H2 outlook showed improvement.

Today’s update -

- Raises FY 12/2020 revenue guidance from £37m to be not less than £40m.

- Adjusted operating profit guidance raised from £2m to £2.6m (we have to be wary of operating profit, as it can overstate profitability due to IFRS 16 shifting some property rental costs further down, into finance costs).

- Non-cash charge of £0.4m relating to forex hedging, takes operating profit to £2.2m, 10% ahead of previous guidance

- Net cash £4.9m sounds healthy, and as previously mentioned, W7L has a good strong balance sheet - very necessary in these uncertain times

- Tesco trials have gone well, and being extended to more stores

- Fy 12/2020 results date vague - “in April 2021”

My opinion - all sounds good. I’m impressed with how well W7L has navigated such a difficult year in 2020.

I’m not really sure how to value this share, because it depends on how well future profits recover. Performance wasn’t great in 2018 & 2019, pre-covid, so given its patchy track record, I don’t see a compelling reason to buy this share. Therefore I’m neutral.

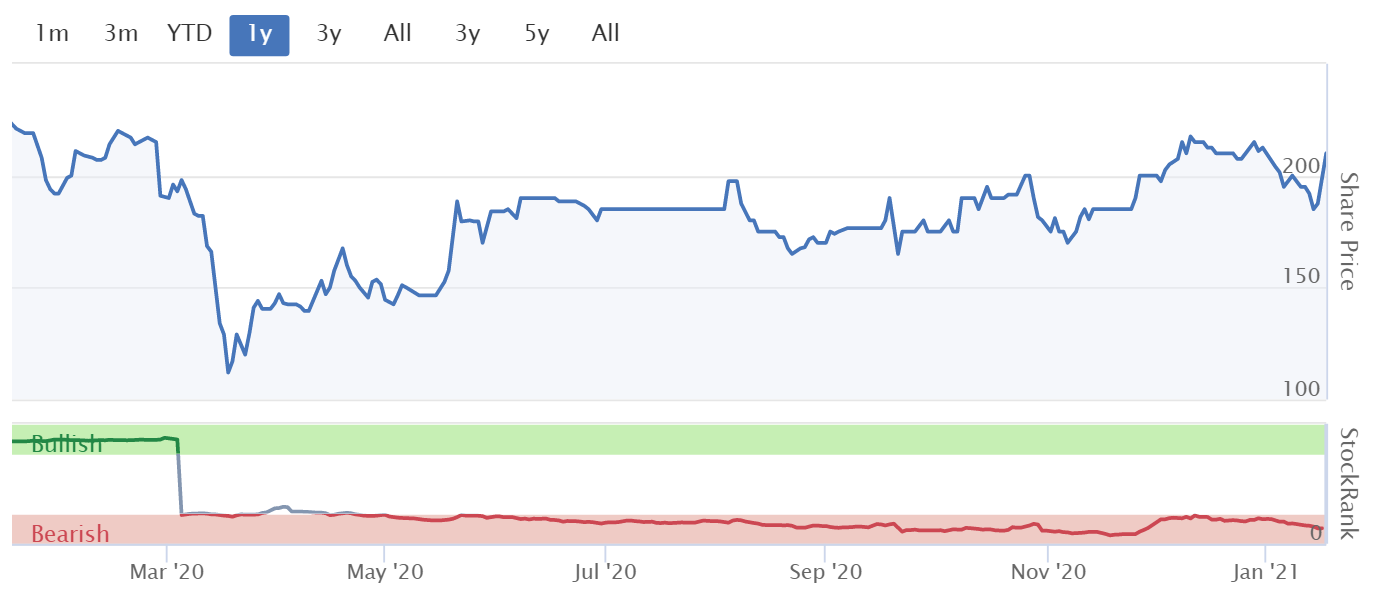

Note below that the share price seems to have formed a base, and the StockRank is high. Although the 2021 broker consensus forecasts look challenging, which might cause the value score to reduce in future, if they are lowered?

.

.

Augean (LON:AUG)

205p (up 9% at 09:14) - mkt cap £215m

This hazardous waste recycling company has been on my radar for a while, I reported on it here 6 times in 2020.

It looks a very good business, but has a large ongoing dispute with HMRC, £40.4m disputed landfill tax (paid in full by Augena). That’s equivalent to 19% of the market cap, so it’s a material issue.

Trading Update today -

Augean plc ("Augean") one of the UK's leading specialist waste management businesses, announces that trading has recovered strongly through the second half of the year and the Group expects, subject to audit, to report adjusted PBT for the year ended 31 December 2020 at least in line with the prior year despite the impact of Covid-19 and the resultant decline in the North Sea business.

To put that into context, at the half year stage, Augean was trading below LY -

Adjusted profit1 before taxation decreased 11% to £8.5m (2019: £9.6m)

[from 2020 interim results]

Looking back to FY 12/2019, it reported this -

Adjusted profit2 before taxation increased 68% to £19.2m (2018: £11.4m)

[from 2019 preliminary results]

Note the big rise in profit in 2019. So matching that result in 2020 (a turbulent year) strikes me as pretty good.

North Sea business - costs cut, to reflect forward trading conditions. £3m exceptional item will be included in 2020 results.

New contracts for £6m annualised revenue won, energy from waste.

R code - a completely unintelligible section on this, no idea what it means, but presumably positive, or they wouldn’t have mentioned it!

Net cash of £6.4m (excluding lease liabilities), which includes benefit of £3.5m VAT deferred until March 2021. Thank you for disclosing the creditor stretch. All companies should be doing this, as it’s vital information that investors need to know.

Diary date - preliminary results due “in early March 2021”

Dividends - Augean says these should resume in 2021, a good sign.

My opinion - I don’t feel confident in my ability to analyse this company, being so unfamiliar with the sector. There’s a really helpful update note out today from N+1 Singer, many thanks to them for this.

We’re looking at 15.0p forecast EPS for 2020, expected to rise further in subsequent years.

At 205p/share this means the PER looks modest, at only 13.7 on FY 12/2020 earnings (confirmed today, so no guesswork there), and that PER could fall further in future, if earnings rise.

The big dispute with HMRC has been paid in advance by Augean, so it doesn't look ruinous, even if they lose. If they win, then it's time to hang out the bunting.

Augean shares do look good, to my untrained eye. Investors probably need some sector knowledge to properly understand this one. So bear in mind that I might have missed something in my reviews.

It's strange that the StockRank is so consistently low, am not sure why that is.

.

.

Cppgroup (LON:CPP)

A very quick comment on this micro cap, which is up 54% today on a positive trading update.

It says this today -

As a result, the Board expects revenue for the year to 31 December 2020 to be circa £140 million compared to the current *market consensus of £133 million.

In light of the solid trading performance and a proactive focus on cost management across the Group, the Board now expects to report EBITDA in the range of £7.1 million to £7.3 million, which is more than 10% ahead of the market consensus of £6.4 million.

I've gone through the numbers, and want to flag up that last year, £4m of the EBITDA isn't what I would regard as real profit. That's because the company capitalised around £2m of intangible assets, which looks like development spend. Plus there was c.£2m in rents which go through finance charges (IFRS 16).

Cash -

As a result the Group's financial position remains robust with a cash balance as at 31 December 2020 of £21.9 million.

If you check out the balance sheet, then most of the cash is offset by creditors. So overall, the balance sheet isn't particularly good, or not as good as the gross cash figure suggests.

My opinion - this company has a bit of a chequered past, it came very close to going bust a few years ago, and I think there might have been some regulatory issues too, possibly? Therefore, it needs careful scrutiny before getting carried away with a positive update today.

That said, the update sounds good, and it might be worth doing a bit more digging on this one.

.

I'll leave it there for today. Thanks for the interesting reader comments, some good stuff there, especially the podcast recommendation, which I found fascinating. Good book & podcast recommendations on shares/markets/economics are particularly welcome.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.