Good morning, it's Paul here with Monday's SCVR.

Estimated timings - most of today's report is already up (at 11:24), but I'll carry on adding bits & bobs until about 2pm. Today's report is now finished.

Covid preamble

There's been lots of fascinating media coverage over the weekend, and it feels to me as if the tide might be starting to turn in a more favourable direction. Accordingly, I have now closed my index shorts.

I'm obviously not claiming to be in any way knowledgeable on the medical side of things. Instead, I'm a layman trying to diligently gather as much information & informed views as I can, then process it all to settle on an overall view. This is exactly the approach suggested in Super Forecasting (by Tetlock & Gardner), my latest favourite book. Over the weekend, I started typing up my notes, which is a very time-consuming process. Here's a link to my notes, for the early part of the book, which you might like to take a look at, to see if the book looks interesting to you, or not. When time permits, I'll carry on updating my notes.

So far, this approach has served me very well, in anticipating both the market plunge, and the market bottom, and positioning my portfolio reasonably well in advance of both. We can never get the timing exactly right, and I've made plenty of mistakes along the way, but getting the broad direction right works well enough. A vital factor in this is a willingness to change our minds when the facts change.

Key recent news includes;

Several newspapers are reporting that Doctors at Royal Brompton Hospital have discovered, using CT scans, that blood clotting around the lungs could be a significant factor. Therefore blood thinning drugs seem to help. This was also found in a study at Mount Sinai Health System in New York, with apparently striking results. Anything like this which makes the virus less deadly, could enable it to be more of a treatable condition, than a death sentence for the elderly & those with pre-existing conditions. That would enable us to move towards a herd immunity approach, very bullish for the retail & hospitality sectors of course, as they could open up again with few (if any) restrictions, if we get to a point where hardly anyone is actually dying from covid.

Although as I've been pointing out all along, the statistics show amazingly clearly, that healthy people below about 65, with no existing medical conditions and of normal weight, only have a tiny risk of death. Hence why the lockdown policy has been so wrong. We should have just locked down the vulnerable, and people coming into contact with the vulnerable, not the healthy who are at minimal risk. Instead we did the opposite - leaving the vulnerable badly exposed (e.g. in care homes), whilst wrecking the economy by terrifying healthy people into staying at home through horrifyingly misleading media coverage & Govt briefings.

The expert view seems to be that a vaccine is a long way off, if it happens at all. Therefore, the only alternative is to get herd immunity, whilst locking down the vulnerable. Why does R matter, if we lock down the vulnerable, so the only people exposed are healthy people who just recover at home? Millions of people have probably already had it, but we don't know because of the delays in getting tests up & running on a large scale.

Recent reports suggest the Imperial College model which seems to have so influenced the Govt into implementing lockdown, is apparently riddled with errors. This begs the question, why did the Govt take such drastic action, apparently on the basis of one report? This is a classic error, as pointed out in Super-Forecasting - never place too much reliance on one forecast. Instead, a number of credible sources should be consulted (but not too many). See interesting reader comments about this point, below.

This seems to be dawning on policymakers, hence another reason why I'm feeling more bullish that lockdown easing could happen faster than we think. There's increasing pressure from the public too. I see Jeremy Corbyn's brother was arrested at a protest against lockdown. My initial reaction was to mutter "silly old fool!", but on reflection I agree with him. (See reader comments below, clarifying this). Our civil liberties are incredibly valuable, but fragile. It's alarming how we acquiesced at their suspension, fully co-operating with largely unnecessary lockdown measures. There's a clear blueprint for anyone plotting to destroy democracy - first create a huge panic over a virus, tell people to stay at home, whilst democracy is dismantled. Scary stuff.

Latest news from the OBR is that it's rowing back on its previous, unrealistic suggestion that the economy is likely to have a V-shaped recovery. CityAM says this;

Last week, there was talk among some economists that the government’s furlough scheme was hiding how many businesses had really gone bust over the past two months and that mass lay offs will ensue when the scheme ends.

Chote said the prospect of permanent damage to the economy is a very real one and that it was unlikely for many sectors, such as hospitality, to go back to trading as they were pre-crisis.

As a former retailing FD myself, I can tell you that shops probably won't be re-opening en masse just yet, even when they are allowed to. It simply won't be economic to open many/most shops whilst the furlough scheme is underway. If you combine reinstating staff (so them dropping off the furlough scheme), with probably greatly reduced customer footfall, with a low gross margin due to having to sell off surplus stock cheaply, that combination would make shops much more heavily loss-making than keeping them shut! I'll crunch some numbers on this later, to illustrate the point. Without continuing massive Govt support, there will undoubtedly be millions of unemployed from failing retailers & hospitality sector companies.

Conclusion - putting this all together, I think we might be at the early stages of getting on top of "controlling the virus". That's bullish for the longer term. Even if a second wave does recur in the autumn/winter, by then we should hopefully be better placed to deal with it, once ubiquitous testing is available, tracing, and better treatments.

On the other hand, I don't think the market has yet fully appreciated just how serious, and permanent, the economic damage is likely to be. Govt finances are being shattered as we speak, and I think many companies are likely to be reporting horrendous numbers from July onwards. Therefore, I am very cautious about the picture for the rest of this year.

I like the potential for hospitality sector shares, if (as seems likely) we could be looking at many being able to re-open from July. Therefore, I think there's money to be made from the lockdown easing in the coming months. Although later this year, I think we could be looking at many shares selling off again, as the full extent of losses incurred in Q2 becomes apparent. What reinforced my view about this, was the recent 17% daily plunge in Countryside Properties (LON:CSP) on disappointing numbers. This erased much of the c.57% gain made in April, from the lows hit in late March. Could the recent rally just be a dead cat bounce? I don't know, answers on a postcard please!

I'm expecting to see a similar pattern with many other shares, as very poor numbers are released in the coming months. In my experience, even if bad numbers are expected, share prices still tend to sell off, especially in small caps, when the numbers are actually published. This factor is worsened by the fact that we have so few reliable forecasts available at the moment. Research departments at brokers seem to have collectively given up trying to forecast - right at the time when we need their forecasts the most.

Overall, most small caps look far too expensive to me, given the dreadful macro economic outlook for the next year or two. Hence more than ever, caveat emptor!

Another factor to consider is that many small caps will need to repair balance sheets with fundraisings. I'm worried that the market's appetite for refinancings could wane, especially if markets wither over the summer, which they often do. I read somewhere that about £3bn was raised in fresh equity in April. I imagine far more than that has been raised in fresh debt, using the Govt schemes. That's great for propping up businesses in a crisis, but debt has to be repaid at some point.

As always, the above are just my personal opinions. You don't have to agree with it. Some will turn out to be right, and some wrong.

US Indices

I did some digging over the weekend, to try to understand why US markets in particular have proven so resilient. It's essentially because we have two separate markets operating side by side, namely (1) multi-year boom (bubble, maybe) in technology shares, many of which are now priced for perfection, but are seen as beneficiaries of the current crisis, and (2) a sell-off in smaller caps, and vulnerable sectors such as travel & tourism.

Note the striking divergence in the US indices below, over the last 12 months;

Nasdaq has performed amazingly well, and is 17% up against a year ago. Note its V-shaped recovery from the covid crisis.

S&P 500 - up just under 1% in the last year. It seems to be stabilising in the short term, having recouped about half the Covid sell-off.

S&P 600 Small Caps Index - down 23% in the last year, greatly lagging the larger caps. Note also how it has recently given back about half the April bounce.

.

This does make me wonder how long tech stocks can continue to out-perform, given that many are now so expensive? That said, this is a continuation of a long-term trend. If we expand the one year chart above, to 10 years, we can see that tech stocks (the top line) started to outperform in about 2017, with a remarkable acceleration starting in 2019. Valuations on the biggest US tech stocks are actually not particularly excessive, given the outstanding quality and dominance of businesses like Microsoft, Amazon, Google, Apple, Facebook. That said, Google & Facebook are basically advertising businesses, so they're not likely to be immune from the economic slowdown.

Note also from the chart below that small caps did well from 2010 to late 2018, but have since under-performed. The red line is the S&P 500, which crossed over & overtook small caps recently.

Last time we had a tech shares boom, in 1998-2000, it ended in disaster. That said, I think the tech shares of today are vastly better businesses than the more speculative tech stocks of the previous era. Sooner or later though, it all comes down to valuation. Therefore, some tech (and healthcare) stocks are looking very stretched in valuation right now, and could be vulnerable to a correction.

Maybe the small caps space is the place to look, for good value? Although last time we had a tech share boom, many punters sold off their small caps, in order to chase tech stocks ever higher, then the bubble burst in March 2000. Will we get reversion to the mean again this time, I wonder? Or will tech stocks be pricey forever more? Who can say?!

.

.

Stockopedia is very good for rummaging around indices, and their constituent parts. This is how you do it - Browse, then Indices (see screenshot below). Then you can sort in any way you want, and click through to the individual company StockReports, etc. I often have a play at the weekends, and sometimes come up with interesting ideas.

.

.

UK Indices

Running the same charts for UK Indices shows a very different picture.

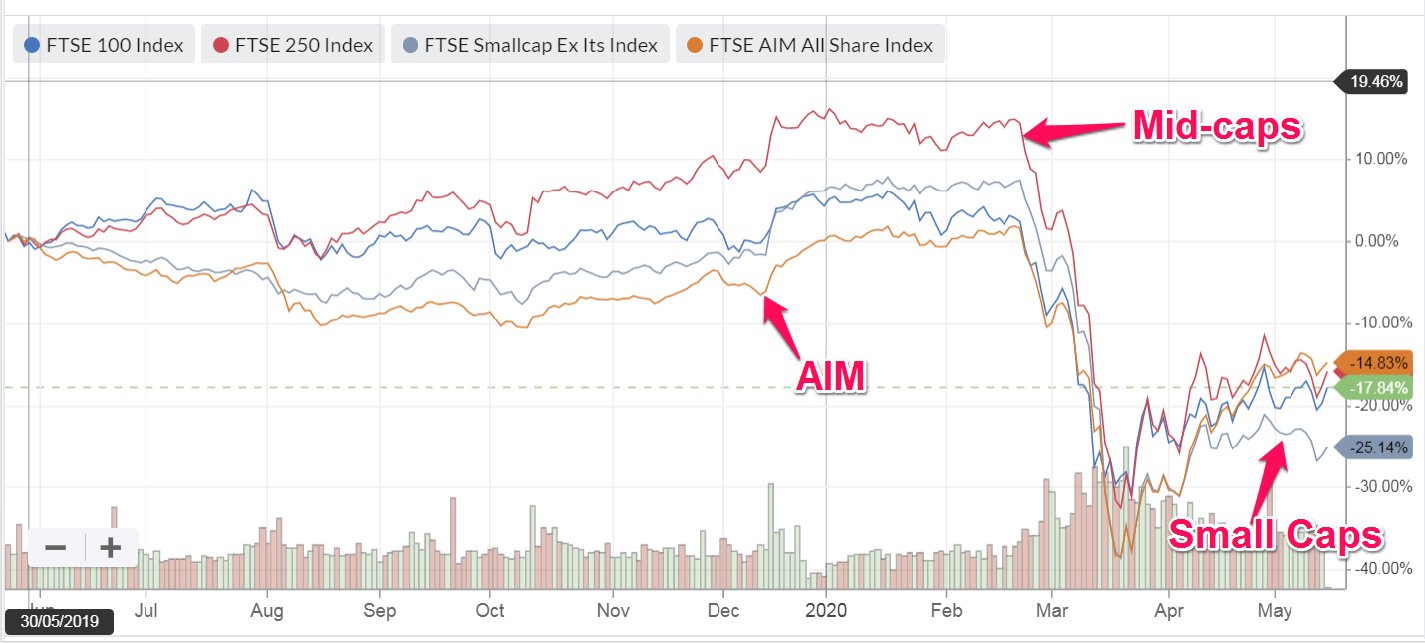

Here you can see (below) that over the last year, mid caps were out-performing from last August, but gave it all back once the covid crisis began this year. The current position is that Mid caps, FTSE 100, and AIM all share are bunched closely together between about -15 and -17% over the last 12 months. Small caps have performed the worst, down -25% in the last year.

Why have US markets done so much better? I think it's because there's such a heavy tech weighting. Also, US markets contain much better companies than the UK market, to be brutally honest. The FTSE 100 has a heavy weighting in banks and oil, both of which are troubled sectors right now, for obvious reasons. Small caps can be hit the hardest in recessions, and so many UK listed small caps are just rubbish (especially some of the speculative junk on AIM). Although one Boohoo (LON:BOO) can offset the poor share price performance of many junk shares, in AIM.

.

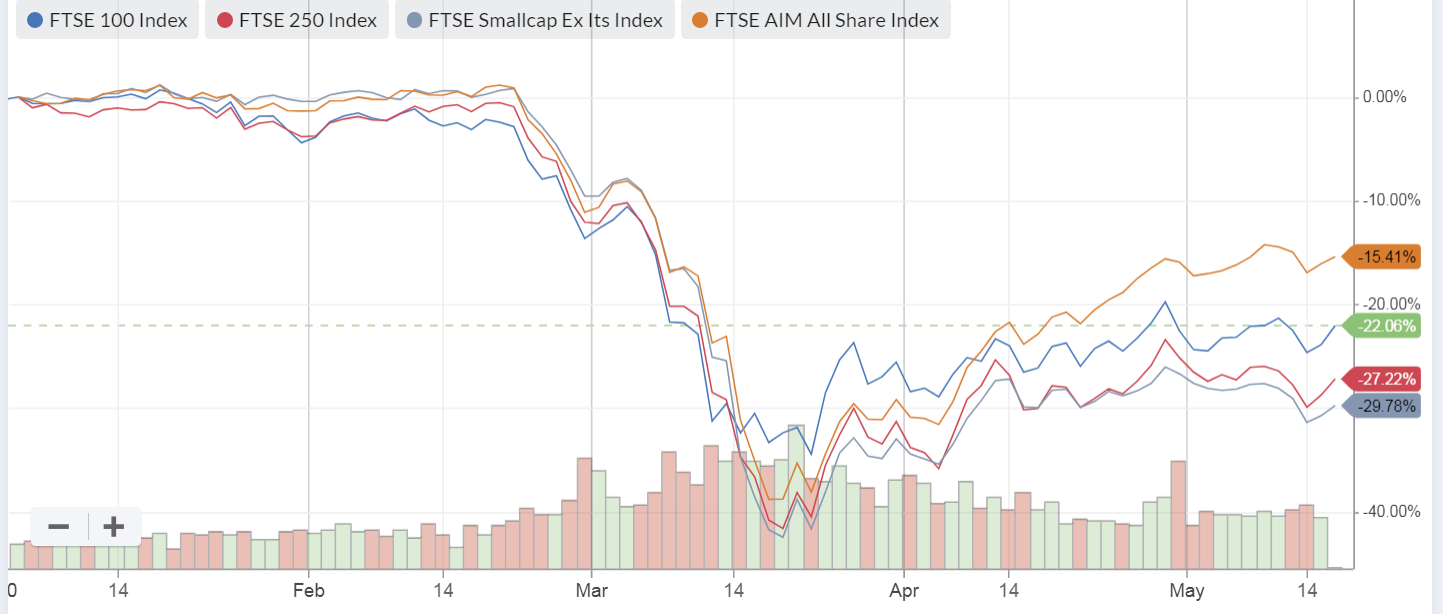

Looking below, at what has happened this year, to narrow it down to the covid impact, the best performer has been AIM All Share, down -15.4%, but this is so skewed by one or two large stocks like BOO, that I'm disregarding this. We really need a new AIM Index that excludes the handful of mid caps on AIM.

Following on, the FTSE 100 is down -22%, and mid & small caps are bunched together, at -27% and -30% for 2020 YTD.

Therefore, it's still worth looking at small to mid caps, as there could still be some bargains around, possibly?

.

.

Scapa (LON:SCPA)

Share price: 105.6p

No. shares: 155.7m before placing + 30.76m new placing shares = 186.5m

Market cap: £196.9m

(at the time of writing, I'm long)

Trading update, financing, and placing

This is left over from last week. I've picked up a small, starter sized position, to motivate & remind me to research it properly. That may be the wrong way around, but there we go.

Scapa Group plc (AIM: SCPA), the diversified Healthcare and Industrial company focused on bringing best-in-class innovation, design and manufacturing solutions to its customers, today issues an update on trading and management actions during a period of unprecedented disruption as a result of the COVID-19 pandemic.

Placing - this was successfully done last week - key details are;

- 105p placing price, modest 1.9% discount to previous day's price

- 30.76m new shares issued

- Gross proceeds £32.6m

- Directors/Mgt subscribed for 319k shares

- Numis & Berenberg were joint bookrunners - who clearly did a good job

Financing - this refers to banking arrangements;

- New £15m short term borrowing facility, plus existing £80m RCF (seems a lot)

- Temporary relaxation of bank covenants

I think it's perfectly reasonable for banks to require an equity fundraising, where possible, in return for increased borrowing facilities. Although that depends on whether they're making use of Govt guarantees or not.

Trading update - the above seems to have straightened out the finances, so how is it trading, and what's the outlook like?

Revenues FY 03/2020 - record revenues, despite loss of lucrative ConvaTec contract (disputed) of £320.6m. Flat against last year on LFL basis

Trading profit for FY 03/2020 is expected to be approximately £28 million, as announced in the trading update on 12 February 2020.

Adjusted net debt at 31 Mar 2020: £54.4m - recent placing should have reduced this considerably, as follows;

Taking together the impact of the management cost reduction initiatives, the Placing, the Subscription and the Additional Debt Facility, the Group is expecting adjusted net debt of approximately £34 million at the end of FY 2021. Consequently, the Company projects that, following the Placing and the Subscription, the Company's FY 2021 Net Debt / EBITDA ratio will be approximately 1.4x, compared to approximately 2.6x without the Placing and the Subscription.

Very clear guidance there, and after the placing, its debt position looks much more comfortable.

Covid - key points;

- Conserving cash - usual stuff, cutting capex, and costs, 20% mgt pay cuts (temporary), no pay rise or bonuses, divi & pension payments suspended, deferring tax payments

- Grant of $5m received under US PPP scheme - loan that is forgiven if US headcount is not reduced for 8 weeks - nice!

- Revenues substantially impacted in Q1 (Apr-Jun) and early Q2, before returning to more normal levels, per previous budget, from Q3 onwards (Oct-Dec 2020)

- Efficiency savings being implemented over next 6 months

Guidance - this clear, specific guidance is very useful, why can't all companies do this?

Under the COVID-19 scenario, the Group is expecting to generate FY 2021 revenue of around £272 million, being approximately 80% of the previously budgeted revenues for the year, generating approximately half of the trading profit that was originally forecast in management's FY 2021 pre-COVID-19 budget....

The Board therefore believe that revenue and profits will recover in FY 2022. It is expected that Group revenue will grow by between 5 and 10 per cent. from the FY 2021 level in FY 2022.

Trading profit is also expected to grow significantly from FY 2021 with a return to double digit margins, driven predominantly by volume recovery in both businesses, underpinned by the operational leverage and cost reductions across the Group and on-going restructuring in Healthcare.

The Board believe that, should revenue recover more slowly than anticipated, the Company has the necessary levers to protect and drive earnings through further cost optimisation in both businesses, a clear contingency plan that can be implemented and further restructuring, margin improvement and footprint consolidation.

I can't find any updated broker forecasts. Looking back a few months, pre-covid, consensus forecast seemed to be about 17.3p EPS for FY 03/2021. Halve that, and we're around 8.6p - for a PER of 12.3 - that looks great value, assuming I've understood this correctly, considering it's for the year which includes the covid impact. i.e. future years could see that PER drop significantly, as profits recover.

Outlook comments - some good stuff in here -

Healthcare sector;

- Healthcare spending should return to normal, as postponed elective surgery resumes

- Customers reviewing extended supply chains, especially from Asia - should benefit Scapa from re-shoring back to USA/Europe

- Possible benefit from customers streamlining product portfolios & do more outsourcing

- M&A opportunities at more attractive valuations

Industrial sector;

- Well diversified, non-cyclical products

- Covid having minimal impact on its cable segment

- Also could benefit from re-shoring

- Increased eCommerce, and re-opening of retail sector

My opinion - I need to do more research on this, in particular on the pension scheme.

The other query is on Scapa's legal action against ConvaTec, I wonder where that has got to?

In other respects though this share looks interesting, and worth a closer look.

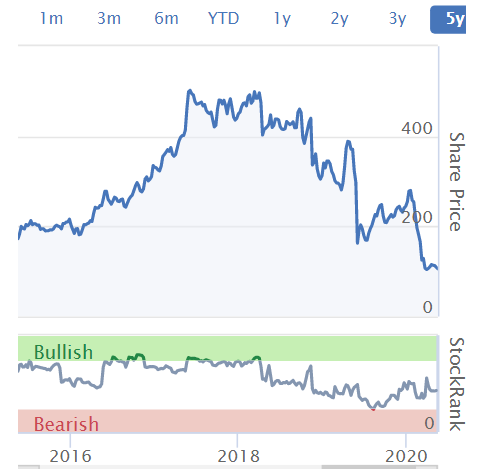

As you can see from the 5-year chart, it used to be over 4 times the current share price. It looks as if at least some of that could possibly be recouped, if trading improves later this year as indicated.

.

.

Augean (LON:AUG)

Share price: 146.5p (unchanged today, at 13:01)

No. shares: 104.1m

Market cap: £152.5m

Claim for repayment of landfill tax

Quite an interesting announcement today from this waste management company.

It's lodged a claim with HMRC for £11.1m repayment of landfill tax that it says is overpaid.

I'm not going into all the detail, but it sounds as if the case might have moved in a positive direction for Augean possibly;

This protects the Augean position in the light of legal challenges brought by other waste site operators that have successfully argued before the Upper Tax Tribunal that they can reclaim LFT accounted for on the 'Fluff layer'. HMRC has challenged the Upper Tribunal decision and it is expected the matter will be heard in the Court of Appeal at a yet to be determined date. The outcome of that appeal will have a direct bearing on the claim filed by Augean...

Augean has decided to reclaim the relevant LFT at this point given the success of other operators in the Upper Tax Tribunal. If the Group succeeds in its endeavours to reclaim the LFT the final quantum remains uncertain and the value quoted above excludes legal fees and other costs associated with the claim.

My opinion - potentially interesting.

There's nothing else of interest today, and I'm tired, so will leave it there for today.

Thanks for all the really interesting reader comments, keep 'em coming!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.