Good morning, it's just Paul here with the SCVR for Monday. As it's a quiet day for news, Jack is doing other things today.

Timing - today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research) - don't blame us if you buy something that doesn't work out. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda -

Paul's Section:

Photo-me International (LON:PHTM) - another upgrade to guidance. Shares still look good value, although the long-term outlook for the business is opaque, hence a lowish PER is to be expected.

Dialight (LON:DIA) - interim results show a return to just above breakeven. Outlook comments point to an improving performance in H2. Difficult to value, so I'm neutral on this one.

Escape Hunt (LON:ESC) - positive sounding re-opening trading, but no meaningful numbers provided. Not much cash. Speculative, unproven business model. It's not for me.

Ricardo (LON:RCDO) (I hold) - a straggler left over from last week. Trading update is in line, with lots of detail provided. Seems to be recovering from the pandemic, and valuation looks cheap. I like it.

Getbusy (LON:GETB) - Brief thoughts on today's InvestorMeetCompany webinar.

Photo-me International (LON:PHTM)

75p (Friday’s close) - mkt cap £290m

Photo-Me International plc (PHTM.L), the instant-service equipment group, announces an update on the Group's trading position.

The company has a 31 October year end.

I’ve reported on this company 3 times so far this year, and have had a quick look back (our summaries at the top of each report are so useful for a snapshot view!), as follows:

11 March - guidance for £9.0m PBT in FY 10/2021

23 April - Surge in activity in Japan drives increase in guidance to £15-19m PBT

12 July - Good interim results, driven by restructuring rather than top line growth.

2 August - Q3 better than expected. Guidance raised to PBT £25-30m (previously £21-24m)

Today’s update - it’s more good news for shareholders.

Stronger-than-anticipated recovery of photobooth activity, mainly in Continental Europe.

New guidance - revenues £210m (old: £200m), profit before tax (PBT) £25-30m (old: £21-24m)

Outlook - generic comments tell us nothing really -

Nevertheless, economic uncertainty remains across many of the Group's operating markets due to the COVID-19 pandemic. The Board continues to closely monitor activity across all its end markets.

Valuation - an update from Finncap this morning (many thanks) shows 5.6p adj EPS for FY 10/2021, and 8.2p next year.

The big question is what PER should we apply, for an opaque business (it doesn’t disclose the split of profits between various activities), with a structurally challenged main activity (will photobooths be needed in the future?), which also seems to be geographically concentrated (most of the profit coming from mainland Europe, which I think is France mainly)?

It also doesn’t tell us what profit is being generated by the newer products (e.g. launderettes). So it’s impossible to value, as I’ve mentioned before.

As a guess, I think a PER of 10 looks about right, which would value the shares at 82p based on next year’s forecast EPS of 8.2p.

The current price is 75p (likely to rise today when the market opens, I’m writing this at 07:35), so the current valuation looks reasonable to me.

My opinion - a tremendous recovery in performance this year - it just shows the benefits of restructuring (unprofitable machines were withdrawn, and other costs cut). This is one of many businesses that have emerged stronger from the pandemic, which forced them to take an axe to poorly performing areas of the business, which might have been tolerated in the good times.

PHTM looks a good business, and reasonably priced, so I can see why some investors like it. The lack of visibility about what the future holds, and the opaque reporting of segmental profits, mean that it’s not something I would be able to value with any certainty, hence that rules it out for me. I like as little guesswork as possible when assessing shares.

However, people who anticipated a recovery in performance, have been well rewarded, and it looks like today should see a further rise, so well done to holders. Nothing is said about dividends today, but with this strong performance, it seems likely that divis might resume at some point.

Note the consistently high StockRank too.

.

Takeovers

There’s a bumper 800p agreed cash takeover bid today for Meggitt (LON:MGGT) - valuing it at £6.25bn. Not a small cap obviously, but it’s the latest in many takeover approaches for UK listed companies. The premium is an astonishing 70.5% on Friday’s close.

The buyer, Parker-Hannifin is a large American corporation. So many bids for UK companies seem to be coming from across the pond - suggesting that in places, the UK market looks cheap to Americans.

Wm Morrison Supermarkets P L C (LON:MRW) - Sunday papers suggested that there might be a bidding war for this property-rich supermarket, which is already in play. I wonder if other supermarkets might also receive bid approaches? I’ve taken positions in J Sainsbury (LON:SBRY) and Tesco (LON:TSCO) on that basis, but they also look good value on fundamentals. Although logistical problems are widely reported, with a particular shortage of HGV drivers at the moment, which is pushing up wages.

Let’s hope some bid approaches come through for small caps as well.

Dialight (LON:DIA)

327p (up c.4% at 09:!4) - mkt cap £109m

Board changes - don’t look particularly important - the Chairman steps down to a NED, and another NED steps up to become Chairman. A different NED leaves after 9 years.

Dialight plc (LSE: DIA.L), the global leader in sustainable LED lighting for industrial applications, announces its half year results for the period ended 30 June 2021.

This is a nice touch - a results video, including some pictures of its factories & staff, which I like, because it helps to visualise what the business is like in reality.

.

Key numbers -

Revenue H1 up 9% to £60.2m - prior year comps are not representative of normal performance, for all companies, since we’re comparing against the prior year period which was worst impacted by the pandemic, in the most stringent lockdown 1. So I’ve checked back to the 2019 interims, and this showed £76.1m revenues. Today’s reported revenues are 21% below the pre-pandemic level, so not very good.

Profit before tax - breakeven, at £0.1m profit in H1. The company identifies £0.7m of non underlying items (litigation costs) in note 3, so the adjusted PBT is £0.8m. I don’t like litigation, so would not buy this share without first fully investigating that issue.

Balance sheet - NAV of £56.8m, less intangible assets of £21.9m, gives NTAV of a healthy £34.9m.

Note the £1.1m pension scheme asset - which could indicate a liability, because of the crazy way pension scheme accounting works.

Inventories stand out as very high, at £36.0m. That strikes me as inefficient, because cost of sales for the half year is £39.0m, indicating that the company holds inventories of almost 6 months sales - way too high. There could be slow-moving stocks held there, or maybe the company has too wide a product range? It’s tying up capital unproductively, and raises the risk of a future exceptional item to write down stock, possibly.

Receivables look fine at £19.3m, so there doesn’t seem to be a problem collecting in the cash from customers.

Net debt of £12.0m doesn’t look problematic.

Overall, the balance sheet looks OK to me. I’m not worried about solvency, or dilution risk, which are the key things to look for.

Cashflow statement - the stand out item is £1.6m development spending capitalised in H1. So that renders EBITDA meaningless.

Note also the £1.2m repayment of lease liabilities in H1, near the bottom of the cashflow statement, that should be manually moved up, in my opinion.

Overall there is slightly negative free cashflow.

Outlook - the H1 results are nothing to write home about - a company that’s nowhere near to recovering in full to pre-pandemic revenues. Operating around breakeven, in profit and cashflow terms. Therefore, the key question is what does the future hold? Can it improve on these numbers, I would hope so!

H2 2021 has started well with substantial order book

· Expectations for full year currently unchanged

The first half of 2021 has been encouraging with a significant improvement in order intake, revenue and a return to profit combined with ongoing cash flow discipline. We expect our markets to continue to recover at varying rates, while acknowledging that there are potential headwinds including currency, inflation, and supply chain constraints. We have made good progress in the first half with order intake ahead of revenue and a good pipeline of projects for the second half of the year. Our expectations remain unchanged at this stage.

Longer term the sales pipeline, product development, team strengthening, and operational actions will help ensure we are strongly positioned to sustain significant growth as end market conditions normalise. We are also seeing the increasing requirement of our customers for more environmentally friendly products that help them to meet their net zero commitments and as market leader we are at the forefront of supporting this.

That’s not very helpful - saying expectations are unchanged, but no indication provided of what those expectations are! How ridiculous. I can’t find any broker research to help either, so we’re left in the dark. Hence I won’t be buying any shares, due to inadequate information.

My opinion - it sounds as if the company is expecting an improvement in trading in H2.

As mentioned above, I don’t have enough information to form a view on this company. Who are its competitors? How do Dialight products compare with them re price & quality? I’ve got no idea on that, do any readers have experience of the company? We love “scuttlebutt” from readers if you’ve worked for, or dealt with any company, then do post anything you can to share your experiences.

With the order book growing, it sounds like Dialight is set up to report better H2 figures, so that’s positive. The balance sheet looks OK. How to value it? I don’t really know, as it depends on how strong the future recovery is. I can’t see any serious negatives in the numbers. Therefore overall I’m neutral on Dialight.

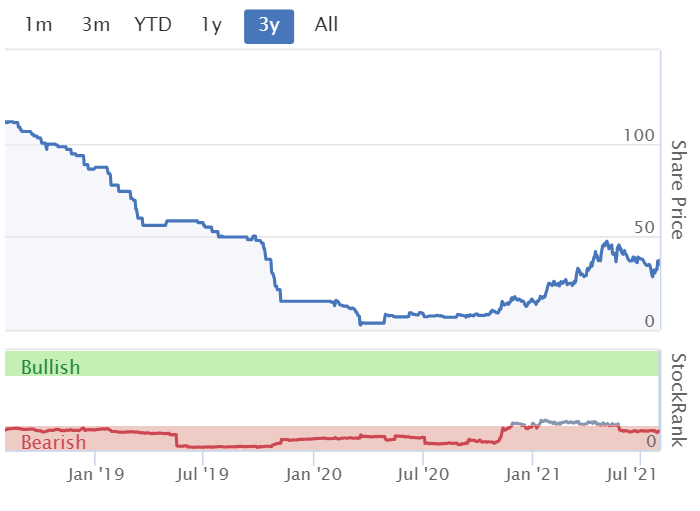

Middling StockRank. The chart looks interesting, that shape tends to attract charting/momentum traders, so there could be a short term trade here maybe?

.

.

Escape Hunt (LON:ESC)

38.5p (up 10%, at 10:53) - mkt cap £36.0m

Escape Hunt, a leading international operator of escape rooms in the fast-growing experiential leisure sector, is pleased to provide an update on trading since the re-opening of its UK sites and for the six months to June 2021 ahead of the release of its unaudited interim results due to be announced in September 2021.

Main points -

- Uk sites re-opened on 17 May 2021

- Trading in 10 weeks to 25 July 2021 “ahead of management’s expectations”

- Total revenue (NB not LFL revenue) up 58% on 2019 pre-pandemic comp

- Like-for-like (LFL) revenues (8 sites) down 5% on 2019

- LFL has improved, and turned positive (+2%) in the last 5 weeks

- EBITDA at site level up 185%, or 83% on a LFL basis - good percentage increases, but with no base numbers provided, that doesn’t tell me much

- Cash balance of £2.4m at 30 June 2021, plus an undrawn £1m convertible loan note facility - seems low for a £36m market cap company with an unproven business model.

- Revenue only £1.1m in H1, due to sites being closed until 17 May 2021. That’s 6 weeks and 3 days of trading, or 45 days. That annualises to a run rate of £8.9m

- New sites - 18th and 19th UK sites are in the pipeline

- “Property market conditions will continue to be favourable, in short & medium term”

- Demand expected to improve in the autumn, as office workers return

Forecasts - thanks to Zeus for putting out a short note today. This shows an unusual, but useful approach to forecasting - giving a run rate, at end 2022, with 3 cases (optimistic, base case, and pessimistic). That’s by far the best way to forecast, in my view, and it’s what a lot of companies do internally. Let's hope other brokers switch to doing 3 scenario forecasts.

The 3 figures for ESC are EBITDA of £2.3m, £1.2m, and £0.6m. as that's the Q4 run rate, it's effectively forecasts for calendar 2023.

My opinion - there’s not enough information in this update for me to form a view.

In my view it’s far too early to decide whether ESC has a viable (long-term) business model or not.

I can see how escape rooms might be a fun, albeit niche, experience, but the trouble is that the sites would have to be changed frequently, requiring continuous capex, to refresh them. Hence I imagine a surge of initial demand is likely when they open, then a long tail of declining sales, or at least increasing marketing costs to drum up business from a declining group of people that have not experienced it yet.

The valuation of £36m, for what is really a speculative concept, that’s very easy to copy, strikes me as highly optimistic. So it’s not for me, as risk:reward looks unfavourable at this stage, and I’m trying to get out of the habit of speculative buying of unproven business models, as they rarely work out as planned. So it's really a complete punt, in my view. Maybe the re-opening trade has overshot on the upside?

It floated in 2016, and was a dismal performer well before covid hit. The initial placing was at 135p, when it reversed into a shell called Dorcaster. Looking at the Admission Document the initial share count was 10m. It's now 88.6m, which tells me everything I need to know about this share! I'd say the recent big surge in share price could be providing a favourable exit point.

.

.

Ricardo (LON:RCDO)

(I hold)

390p - mkt cap £245m

Ricardo plc ("Ricardo") is a world class global engineering, technical, environmental and strategic consultancy business, which also manufactures and assembles niche, high-quality and high-performance products.

Ricardo is today providing a trading update ahead of its full year results in respect of the year ended 30 June 2021. Ricardo plans to announce its full year results in September 2021. The results in this trading update are subject to audit.

This somehow slipped through the net, in last week’s deluge of reports. There’s lots of information in the update, here is my summary of the highlights (I’ve omitted the detail on divisional performance, for brevity) -

- FY 06/2021 - Ricardo continued to recover from the pandemic

- Sequential half year improvements in revenue & operating profit

- All division improved “activity” and “revenue” (what about profit?!)

- Order intake for the year of £350m, down on £369m in prior year

- Revenue of £350m, same as last year

- Net debt - £47m at June 2021, £50m at Dec 2020, and £74m at June 2020

- Placing of £28.2m main reason for drop in net debt

- Liquidity looks ample, with a £200m bank RCF available

- CEO leaving, previously announced 25 Jan 2021, but he’s still in situ as heis named in the trading update as CEO

Most important bit - underlying profit before tax (PBT) is in line with market consensus forecast. Yes there’s a footnote, thankyou!

[1] Based on company compiled analysts' consensus of £18.0m, with a range of £15.1m to £19.6m

Valuation - grateful thanks to Liberum for crunching the numbers - analyst Daniel Cunliffe has converted the trading update into 28.3p EPS for FY 06/2021, 31.8p the following year, and 40.4p after that.

At 390p per share, the PERs are: 13.8 (historic), 12.3 (current year just started), and 9.7 the following year. Looks cheap to me, even after we adjust for net debt (not excessive).

My opinion - I opened a standard size starter position in this share recently at a rather ill-timed 441p. That broke my usual rule of only buying after a recent reassuring trading update or results, to eliminate the short-term guesswork. Sometimes you have to break your own rules, to be reminded of why you have them, and get back on track!

I’ve always had a positive impression of Ricardo, but it’s been too expensive in the past.

It’s now looking decent value, so it’s moving into my “need to buy more when funds permit” tray.

To be completely open, I’m not that au fait with the various parts of the business, it seems quite diversified. What do subscribers think?

This is an unusual chart, the share price is not that much above pandemic lows. Surprising, considering performance is recovering. An opportunity maybe? Or is there something nasty lurking that I haven't spotted?

.

.

Getbusy (LON:GETB)

82.5p - market cap £41m

Brief thoughts on results webinar today

I tuned in to this at 11am, and thought management presented well - the CFO seems a much more confident presenter than the CEO, just as an aside.

I'm reasonably familiar with the company, and quite like it, so there wasn't really anything new in the presentation. A few points I did jot down though -

- Well-used niche product - 30% of UK's top 100 firms of accountants use Virtual Cabinet - so it must be a very good product

- Very sticky recurring revenues, and low customer churn

- Talked us through the productivity benefits of using their software, which sounds convincing (e.g. eliminating lost files, confusion over which version of file is latest, etc)

- Annual recurring revenues: Virtual Cabinet 56%, Smart Vault 44%

- Strong visibility, as reliable recurring revenues

- Development spend fully expensed

- My view the £1.1m corporate/shared overheads seems a lot, and arguably could be unrealistically boosting the Virtual Cabinet profit line of £2.1m (mentioned before in SCVRs)

Overall - lots of other things were mentioned. My main worry is that the main products could be mature, and hence post-growth? (even though markets are very large). New products haven't gained enough traction yet to be exciting. On balance then, I remain neutral, although leaning slightly towards positive.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.