Good morning, it's Paul here.

Estimated timing today - I'll be writing here mainly from mid-morning, to mid-afternoon.

EDIT at 12:38 - today's report is now complete. There's hardly anything of interest in the trading updates & results category of the RNS today.

Twitter - a couple of friends have queried what has happened to my Twitter account? After another temporary suspension by Twitter, I just told them to stick it & permanently delete my account. Social media is killing society in my view. For me it's become a colossal waste of time, and a source of unrelenting yet unnecessary stress. Hence it had to go. I'm already feeling a lot more calm, and can spend my time & energy doing more constructive things.

Maintel Holdings (LON:MAI)

Share price: 425p (down c.4% today, at 10:20)

No. shares: 14.3m

Market cap: £60.8m

Maintel Holdings Plc, a leading provider of communications cloud and managed services, announces its interim results for the six months to 30 June 2019.

Reading through my previous notes here, the weak balance sheet has put me off considering any investment in Maintel. The main attraction of this share looks to be the high dividend yield - a key question being whether this is sustainable?

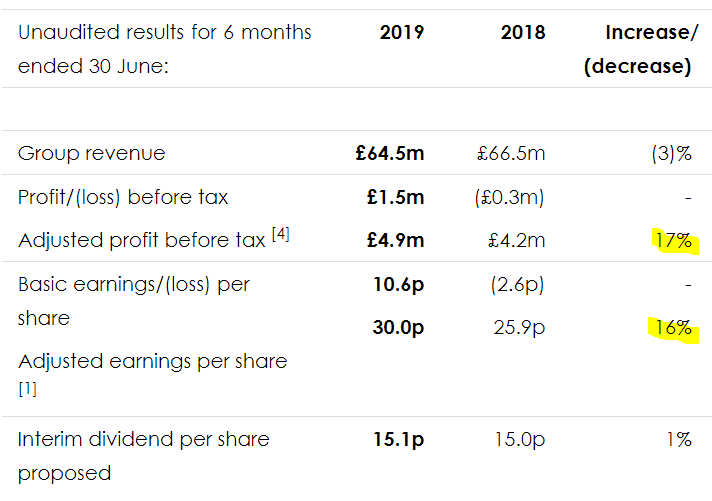

The numbers highlighted from the P&L show decent growth (remember this is just for 6 months trading);

Outlook - the narrative with today's interim results sounds rather downbeat in tone in parts, and upbeat in others. Overall, it strikes me as confusing!

The all-important outlook section says;

The 28% growth in adjusted EBITDA, which includes a positive IFRS 16 adjustment of £0.5m in the period is pleasing, as we continue the transformation of our business, carefully managing our revenue mix and gross margin. We have seen cloud customers grow to represent 20% of our total revenue, up from 15% in 2018, and this is expected to continue to grow in H2 supported by our recently launched ICON Now and Insight Secure propositions.

Underlying demand for our services remains high and our new business pipeline remains strong with some significant project opportunities,however, we are seeing more customers expressing their concerns about the economy and the uncertainty around the prospect of a disorderly exit from the EU. This economic uncertainty is causing some contract close dates to move out, as organisations give more scrutiny to their larger investment decisions, resulting in longer sales cycles.

As such, whilst 2019 adjusted EBITDA is expected to show year on year growth versus 2018's level on a like for like basis, the Board now expects to deliver full year FY 2019 adjusted EBITDA (excluding IFRS 16 adjustments) in the range of £13-14 million.

Revised forecasts - it's a profit warning, because a broker update today (available on Research Tree) lowers 2019 & 2020 adjusted profit by 17% & 14% respectively.

2019 EPS is now forecast at 66.6p - giving a PER of only 6.4

Balance sheet - this remains weak.

NAV: £21.6m, less intangible assets of £66.3m, gives NTAV negative at -£44.7m.

Cash generation is good, so the weak balance sheet doesn't necessarily present an immediate problem. However, it does mean that investors have little downside protection, were something serious to go wrong.

Dividends - a total of 35p is forecast for 2019, a yield of 8.2% - unsustainably high maybe?

My opinion - I like the low PER & high dividend yield, but not when combined with a weak balance sheet that has quite a bit of debt on it.

Also, the hesitant-sounding outlook comments are a bit worrying.

Note also the wide spread & lack of liquidity in this share. Only 4,350 shares have traded today at the time of writing. Market liquidity in small caps is extremely poor at the moment, as many people are waiting to see what happens with Brexit. Plus the usual summer seasonal low. Published market prices may show a 50p spread between the bid price of 400p and the offer price of 450p, but this is often meaningless, as the real prices are often much closer together. The real prices can be ascertained by calling your full service broker, or putting in a dummy buy & sell into an online dealing platform. Hence wide published spreads are not necessarily a problem in reality.

CentralNic (LON:CNIC)

Share price: 55p (up c.2% today, at 12:09)

No. shares: 181.8m

Market cap: £100.0m

CentralNic Group Plc (AIM: CNIC),the global internet platform that derives revenue from the subscription sales of domain names and web servicesis pleased toannounce its half year results for the six months ended 30 June 2019.

This caught my eye today, because of stellar growth in revenues (up 225% to $49.7m), and adjusted EBITDA up 203% to $9.2m.

Revenues are nearly all subscription-based, so recurring in nature.

Less exciting, is that the growth has almost all come from acquisitions, with just 6% organic growth.

The balance sheet has been restructured, with a bond being issued, and several acquisitions post period end, hence there's not a lot of point in trying to analyse the interim numbers. We would be better off finding some broker research that models how the figures are likely to look in future, including recent acquisitions.

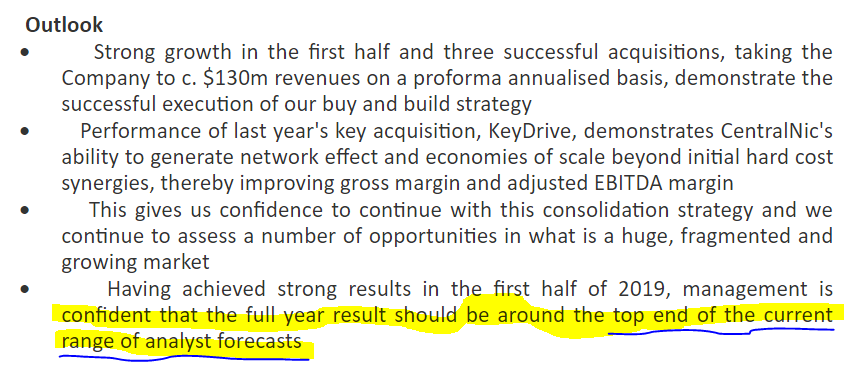

Outlook comments sound positive;

My opinion - neutral, as it's not a sector I've looked at before.

This announcement in June 2019 set out the terms of the bond issuance. This is crucial information for anyone thinking about buying the shares. It's a 4 year bond (more secure than bank debt), but fairly costly, at 7% + EURIBOR - which seems to be negative at the moment, but this bond deal has a floor of 0%. Therefore it's costing the company 7% p.a., payable quarterly. On E50m, that's about E3.5m p.a. in interest cost - quite a hefty funding cost.

The crux is whether management is adding value through acquisitions funded by fairly expensive debt, or not? That's for investors to decide, I don't have a view on it.

That's it for today, given that there's nothing else of interest on the RNS for me to cover.

See you tomorrow, and as always, many thanks for the interesting subscriber comments below.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.