Good morning, it's Paul here with the SCVR for Monday.

I hear from CNBC that the average American has put on 16ibs during lockdown. I can quite believe the same might be true here. Certainly, basking in the sun on Friday afternoon, I caught a glimpse of myself reflected in the window, and it reminded me of a documentary about a mudslide that had engulfed a whole village. Time to do some sit-ups, methinks!

There was some weak economic data in the US on Friday, with flash consumer confidence numbers coming in well below expectations, and importantly below June's numbers. That's not consistent with the V-shaped recovery that the stock market has priced-in. Combine that with a dearth of guidance from companies, and I remain cautious, and have shorted the US indices again, just as some downside protection. After all, if companies are not putting out guidance, then it doesn't suggest things are going well, does it?

On the upside, news on treatments/vaccines sounds promising, and the wall of money thrown at the markets is artificially propping up everything very well, for now. We'll see what happens with US earnings season this week, as that obviously sets the tone for UK markets too. Netflix results were interesting last week, as the stock dropped sharply - not on the numbers, but on soft expectations for Q3 and beyond. Are things priced to perfection? Some seem to be.

Whereas UK small caps generally seem quite cheap still. No sign of any euphoric bulls over here.

On to today's RNS. Not much news today in the samll caps world, so estimated timings - should be complete well before 1pm official finish time.

Update at 13:45 - today's report is now finished.

.

Hollywood Bowl (LON:BOWL)

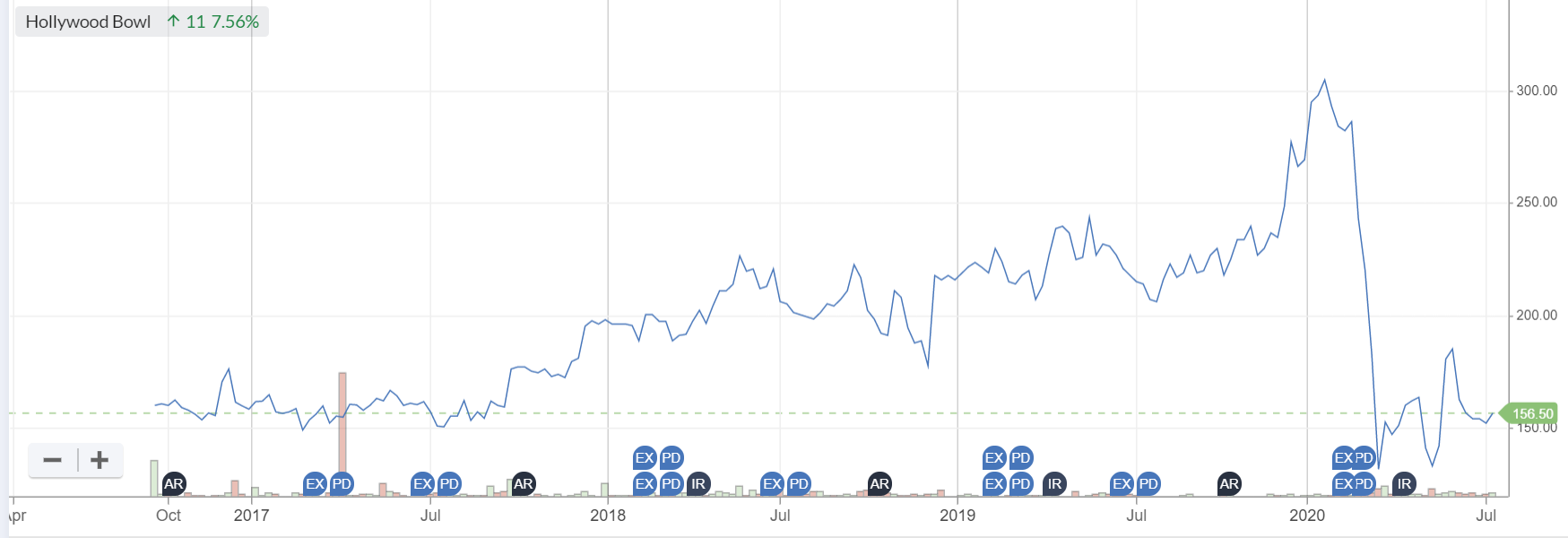

Share price: 158p

No. shares: 157.5m

Market cap: £248.9m

Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, announces that following the Government's announcement on 17 July 2020, it will reopen all of its English centres on 1 August 2020.

Pre-booking has started already, as you can see from its website here.

COVID-secure operating measures are being put in place. It will be interesting to see how this pans out. A number of members here left negative comments about the idea of going bowling, pointing out that putting your fingers into bowling balls that have been mauled by thousands of other people, repels you. I can understand that point of view, but isn't there a simple solution - just wear disposable latex gloves when you're handling the bowling balls. Then take them off to eat/drink. What's the problem with that? If combined with hand-washing stations, sanitiser, etc, I could see that working fine. Especially as bowling alleys are large spaces, where it's fairly easy to space people out.

My main concern (which applies to most of the hospitality sector) is that spacing people out, and measures to control them, could result in reduced revenues, combined with extra costs. Still, I suppose the aim is to get business moving again, and providing it can operate at above cash breakeven, then it's successfully treading water until covid is under control or eliminated. Then logically, the valuation should eventually return to pre-covid levels, giving a decent profit to people who buy now.

BOWL strengthened its balance sheet in April, with a fundraising of £10,5m after fees. That was only about 5% dilution, and was done at 145p.

My opinion - it depends on your view about how long covid is likely to be around, and the big risk of course is a second wave, and renewed lockdowns in the autumn/winter.

Annoyingly, I had to cut my position in BOWL because of a margin call, but want to buy back in when spare funds crop up. I've still got a long position in smaller rival Ten Entertainment (LON:TEG) .

My feeling is that for every person who's terrified by covid, there's another that is itching to get back to normal - which probably should be enough to get BOWL moving again at a sufficient level of trading to cover its costs. I'm guessing there, obviously. Time will tell. For anyone who can look beyond covid, the chart suggests there could be 50% upside here maybe? Plus in due course, divis could resume, which is increasingly important at a time when yield is hard to find. Overall then, I'm positive with a long-term view. Unsure with a short-term view.

.

.

Venture Life (LON:VLG)

Share price: 86p (up 19% today)

No. shares: 83.7m

Market cap: £72.0m

Venture Life Group plc (AIM: VLG), a leader in developing, manufacturing and commercialising products for the international self-care market, provides an update on its performance for the six months to 30 June 2020, after a period of strong trading.

I've only looked at this share once, here on 9 June 2020, where I came away with a very positive impression. Thanks to members here who flagged up the company.

Edited highlights;

· Revenues increased 80% to £16.9 million (H1 2019: £9.4 million)

· 65% from organic growth and 15% from acquired growth

Those are pretty stunning figures.

With our strong balance sheet we continue to explore additive M&A opportunities using our existing cash resources and available debt finance alone.

That's important, as it means management is not intending to issue new shares for acquisitions. As long as they don't over-cook it with debt, then that should reassure existing shareholders.

There's more detail on operational highlights, which all sounds impressive, albeit mostly reiterating previous announcements.

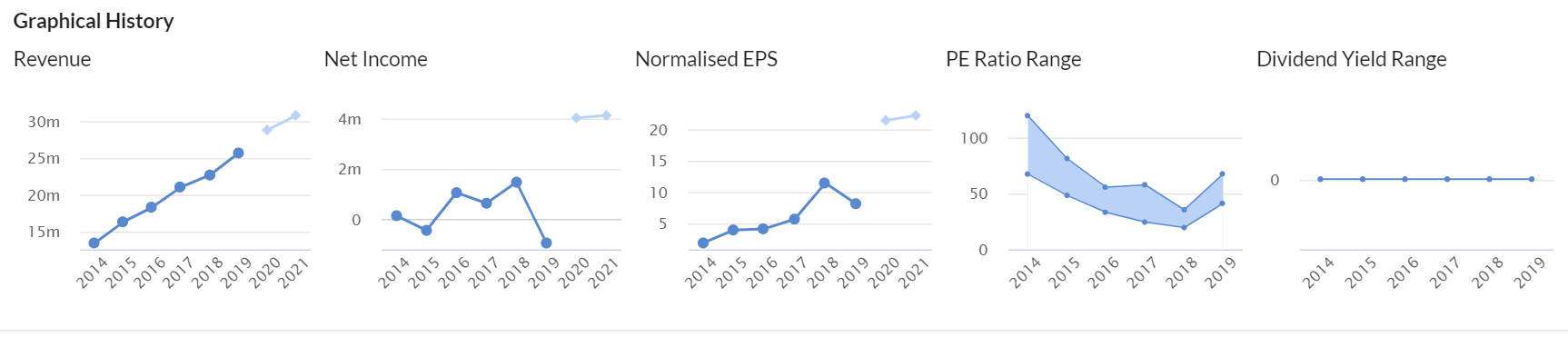

My opinion - this looks a terrific little company, that has achieved a stunning increase in business this year, after years of lacklustre performance.

I'd be really interested to hear from any subscribers here who know the company well, whether you spotted early signs of this major turnaround, and what were they? I don't know what the company's background is. Were new management brought in? Good acquisitions?

Today's update doesn't say anything about performance versus expectations, so we should assume it's in line.

There's an update note today, available on Research Tree. adj EPS for FY 12/2020 is 5.4p, which is said to be conservative - i.e. upside potential on that number. At 86p, the PER is 15.9, but that could be lower if the forecast is exceeded, which is hinted at.

Providing this great improvement in performance is sustainable, then this share still looks decent value to me. A very large contract with a Chinese customer is not ideal, given escalating tensions with China.

The chart below shows how 5 years of drift was rapidly recouped this year;

.

.

Instem (LON:INS)

Share price: 454p (unchanged)

No. shares: 16.67m

Market cap: £75.7m

Instem plc (AIM: INS), a leading provider of IT solutions to the global life sciences market, is pleased to announce a trading update for the six months to 30 June 2020 (the "Period").

Subscriber Michael Tee flagged this share in the comments section below, providing a nice summary of the share, which got me interested, so I'll take a look at its update today.

Refreshing my memory, my notes here on 13 Jan 2020, I liked the look of the company, which traded well in 2019. Although it had just shot up on a magazine tip to 490p. We're about 10% lower than that today, after covid of course.

This is all nice and clear, and sounds good;

The Company continued to perform well across all areas of the business despite the wider backdrop and macro impact of COVID-19.

Trading for the Period was in line with the Board's expectations.

H1 2020 revenues increased by approximately 20% with like-for-like revenue growth (excluding the Leadscope acquisition in November 2019) of approximately 12%.

Operational cash generation was strong, with a closing cash balance at 30 June 2020 of £9.1m (30 June 2019: £6.0m).

That all sounds excellent, especially considering that we're going through a massively disrupted economic & public health crisis.

Fundraising -

The oversubscribed £15.75m fundraise (£15m net of expenses), as approved by shareholders on 16 July 2020 and completed post period-end, provides significant capital to accelerate the Group's acquisition strategy, with a number of potential compelling opportunities for bolt on acquisitions and more substantial targets having been identified.

This recent equity raise was at 435p per share. Note also that Directors sold £3.0m of shares at the same time - not exactly a ringing endorsement, so that's an amber flag for me. If the future was wildly exciting, then surely Directors would be holding onto their shares for dear life?

This got me wondering, why did it raise fresh equity earlier this year, if the balance sheet was already loaded with cash?

Balance sheet - the reason is that its 31 Dec 2019 balance sheet wasn't very strong, it actually had negative NTAV of £(1.3m). The company's cash comes from a favourable working capital position, where customers pay up-front. However, given that the company has traded well this year, then the explanation of wanting cash for acquisitions does sound credible.

Outlook - sounds good;

The Company continues to trade in line with the Board's expectations and, given the continued strong organic and acquisitive growth potential, the Board is confident that the Company is well positioned to take advantage of opportunities that arise throughout the remainder of the year and beyond in existing and adjacent markets. With a scalable platform in place and broad portfolio of products and services, the aim is to further grow market share, margins and revenue visibility.

Note how performancce seems to have really shot up this year - so as always, it's key to understand how this has been achieved, and whether it is sustainable, or down to one-offs? That's a generic point, applicable to all shares;

Note also the lack of dividends. Not necessarily a problem, especially for a growth company that can better deploy the capital internally.

Market liquidity - market makers are quoting a ludicrously wide bid/offer spread of 434p/474p, a 40p spread. This deters people from trading the shares, undermining the point of having a listing. The real prices are 438p bid (in 5k shares), 468p offer (in 10 shares), a slightly less bad spread of 30p. Why not qjust publish the real prices, instead of misleading wider prices? I very much dislike this two-tier pricing system (keeping real prices hidden), which seems counter-productive, and rigs the system against private investors. We're forced to use intermediaries that should have disappeared a long time ago.

My opinion - it's rated at about 20 times earnings. Although remember that the cash pile, post fundraising, means it will be able to bolt on more earnings using the cash for acquisitions.

There was a contract dispute mentioned in the last full year results, which could be a fly in the ointment - that would need checking out before buying.

Overall, I think this share looks interesting, and could be worthy of readers taking a closer look. Generating decent organic growth in the current macro situation suggests this is a decent business that could perform better still once economies improve. Please remember that, because of the large number of companies I review here, my views should always be treated as just a quick review of the company. Much more detailed due diligence should always be done before buying anything, as it's quite possible that I might have missed something important.

.

.

Quick fire comments not, on things that don't interest me at all;

Tungsten (LON:TUNG)

42p (up 6%) - mkt cap £52.9m

Trading update for FY 04/2020 - lacklustre revenue growth of 2-3% - good that 93% of revenues are recurring/repeatable, which seems a solid base. Net cash of £3.2m - it looked as if it might go bust a while back, but seems to have stabilised. Adj EBITDA broadly in line with expectations. Profitable in May & June 2020, post year end. Details given of some new contracts/partnerships. Replaced some senior positions. Transaction run rates impacted by covid. Outlook;

We remain comfortable with external forecasts for FY21 on the basis that transaction run rates recover in line with our expectations.

My opinion - for me, this one is too tainted by massively over-promising in the past, and delivering very little. It would need much better growth to get interested again. The key point with this share used to be that it would create a network effect between companies and their suppliers, and finance the supply chain. The financing part seems to have been jettisoned. Therefore it just looks like one of many e-invoicing companies. It doesn't make any profits, so what's the point of it existing, other than to provide employment for staff & Directors?

On the upside, it has sticky revenues with an impressive client list. If it can win new business on top of that, then profits could (eventually) flow. My abiding memory of Tungsten is all the big talk of billions, and trillions, from founder Edi Truell,who wowed everyone with his big talk, and super-self-confident delivery. I was taken in by it, and so were many of the experienced investors I know. It turned out to be largely hot air. The lesson I learned is that "impressive sounding" Directors quite often turn out to be hype. Just because they did something good in the past, doesn't mean their next venture will be any good. Similar sort of things with the mobile phone company fronted by Jimmy Walkes of Wikipedia - that turned out to be hopeless. Give me a down-to-earth, hard-working CEO any day, rather than one that gets everyone hyped up with the vast future potential.

That said, today's update from TUNG does show that it's now viable, and who knows, if they can deliver accelerated sales growth, then it could be work a fresh look. But there's not enough in today's update to make me want to chase up the market cap just on the hope that things might get better in future. So it's not much more than a punt at this stage.

.

Optibiotix Health (LON:OPTI)

55p (up 5%) - mkt cap £48.5m

This follows on nicely from my earlier theme of jam tomorrow companies with promotional CEOs.

a life sciences business developing compounds to tackle obesity, cardiovascular disease and diabetes, provides the following unaudited preliminary revenue figures for the first six months of the financial year and a commercial update.

Revenues are still tiny, at £742k in H1, but the percentage increase look good, at +398% vs LY.

Profit - here's a cunning plan, let's cherry pick a few figures, to make things look good!

We are pleased that these preliminary figures show that each division is making progress against the aim of becoming profitable this year.

The functional fibres division led by Dr Fred Narbel reported a profit during this period,

the ProBiotix division was profitable in three of the six months, [Paul: which ones, what was the trend?]

and the consumer health division was profitable in one of the six months. [Paul: big deal, so it was loss-making in the other 5!]

Spinning off another loss-making part of the business, in order to generate cash from ramping & then selling its shares, is a clever strategy;

The Company also received £747,500 of investment income in this period from the disposal of shares in SkinBioTherapeutics plc which is not included in these figures.

My opinion - I don't care if this triggers the usual wave of abuse from bulls in this share, as always I speak as I find, and keep an open mind if things change. There's nothing in today's update to change my view that this is a jam tomorrow company based largely on hype. I've not seen any convincing evidence that it has any genuine science. From company presentations I've seen, it's generic science talk, and the products strike me as nothing more than hype. Of course people lose weight if they consume fewer calories by substituting one or two meals per day for low calorie shakes. Do the shakes make you feel full? No. So they're no better than drinking a glass of water and swallowing a multivitamin, and feeling hungry for a few hours.

Has there been extensive, and unique scientific research done? No, the company admitted in a videotaped presentation that it just gets university students to come up with the product formulations. Therefore the evidence suggests to me that its products should be seen mainly as marketing gimmicks, used by product manufacturers to appeal to end customers. That's not necessarily a bad thing - look at the yoghurt products with daft names, like Biffidus Activus, etc, which convince people of their magic powers. The trouble is, that needs a big marketing budget. Where's the evidence that any of OPTI's customers have backed its ingredients with big marketing bucks? IF that were to happen, then I could see the appeal of this share.

Cue now, some angry replies, telling me to stick to things I understand!

This share has been listed since Aug 2014, promising jam tomorrow for nearly 6 years now. Yet H1 revenues in 2020 are below £1m. It seems to me that the company is good at signing, and announcing lots of small deals, none of which to date have developed into bigger deals that actually generate material revenues. That does tend to support my scepticism over the company's shares. I suppose there's always a chance it could hit the jackpot, with a blockbuster deal, but 6 years of trying hasn't worked so far. The odds of success must surely be receding somewhat?

.

Pittards (LON:PTD)

39p (down 6%) - mkt cap £5.4m

I didn't realise the market cap had dropped so low, hence this is likely to be my last comment on this share, unless it stages a remarkable recovery in future.

Impact of covid;

This has been significant, with sales running at 45% of previous year's levels. As a consequence, the interim results will show a significant loss.

Debt looks too high;

The Group has however managed the impact on cash through strict cost control measures. At 30th June 2020 borrowings stood at £11.2 million (31 December 2019: £9.8 million).

It does own a freehold, which helps.

My opinion - looks too high risk. An equity fundraising looks inevitable at some stage, and given the poor track record, might have to be done at a big discount. Is it a viable business? Are the costs of maintaining a listing worthwhile? Both are valid questions. For me, it's a very obvious avoid.

All done for today, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.